The Bottom Line Upfront 💡

Wells Fargo $WFC ( ▼ 3.16% ) is America's fourth-largest bank with $1.9 trillion in assets, which serves everyone from college students to Fortune 500 companies. The bank makes money through the classic spread model—borrowing low from depositors and lending high to borrowers—while diversifying into fee-based services across consumer banking, commercial lending, investment banking, and wealth management. Currently working through regulatory challenges from past scandals, WFC represents a value play on traditional banking's ability to compete with fintech disruptors through scale, customer relationships, and digital transformation. Success depends on regulatory restrictions lifting, maintaining credit quality, and proving that one-stop financial shopping still matters in an increasingly digital world.

Partnership

Quick, hard-hitting business news.

Morning Brew was built on a simple idea: business news doesn’t have to be boring.

Today, it’s the fastest-growing newsletter in the country with over 4.2 million readers—thanks to a format that makes staying informed both easy and enjoyable.

Each morning, Morning Brew delivers the day’s biggest stories—from Wall Street to Silicon Valley and beyond—in bite-sized reads packed with facts, not fluff, and just enough wit to keep things interesting.

Try the newsletter for free and see why busy professionals are ditching jargon-heavy, traditional business media for a smarter, faster way to stay in the loop.

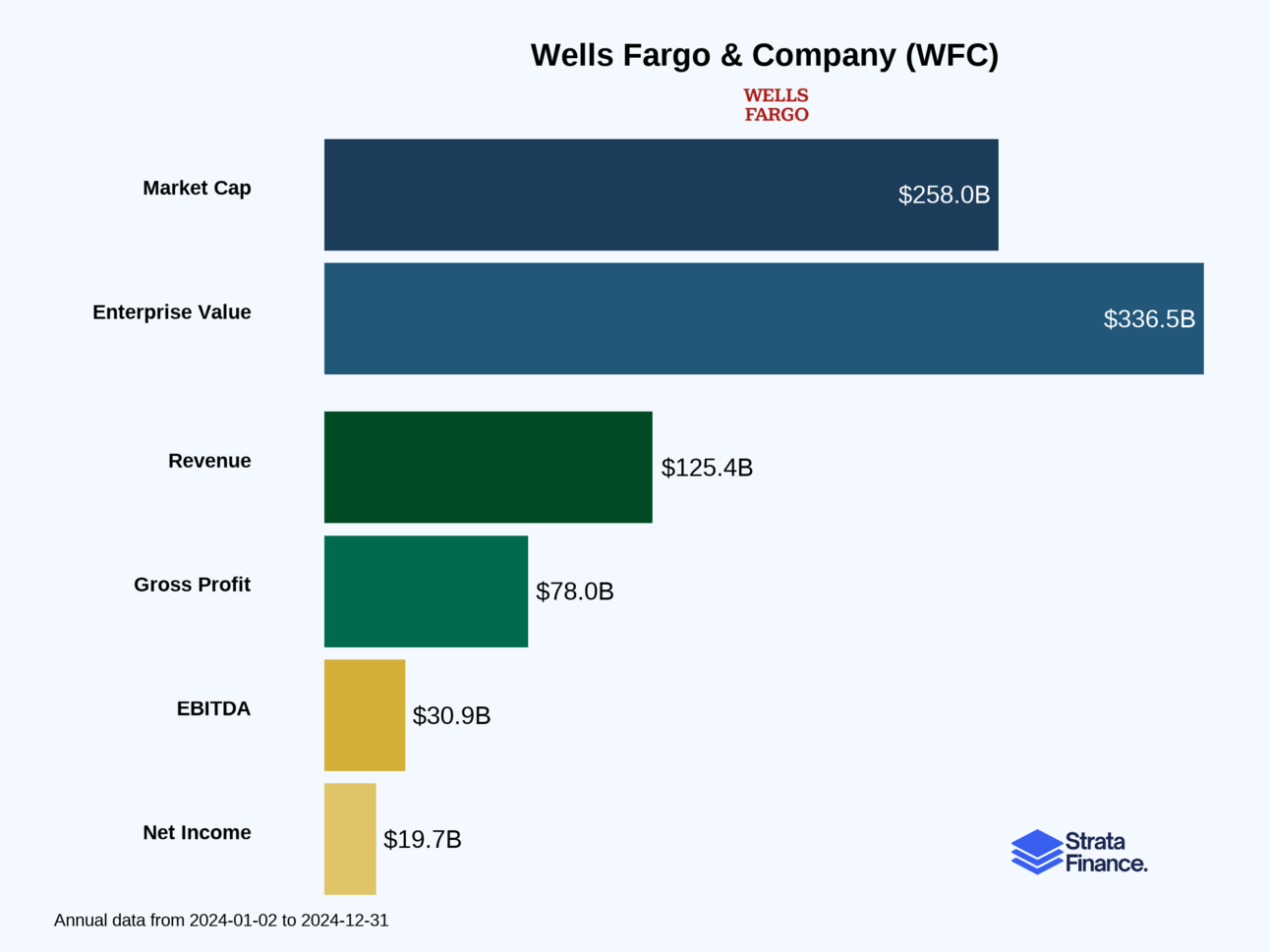

Strata Layers Chart

Layer 1: The Business Model 🏛️

Wells Fargo has a tool for pretty much every money-related problem you might have. With $1.9 trillion in assets (that's trillion with a T! 💰), WFC is the fourth-largest bank in the US, which is like being the fourth-tallest person in a room full of giants.

What They Actually Do

Wells Fargo makes money the old-fashioned way: they borrow money from you (deposits) at low rates and lend it to others at higher rates. It's basically the world's most profitable middleman operation. But they've evolved way beyond your grandpa's corner bank.

The Four Pillars of Wells Fargo:

Consumer Banking and Lending 🏠 - This is your bread-and-butter banking: checking accounts, savings, credit cards, mortgages, and auto loans. Think of it as the "retail store" of banking where regular folks like us do our financial shopping.

Commercial Banking 🏢 - Here's where they play with the big kids, offering loans and services to medium and large businesses. Need $50 million to expand your widget factory? These are your people.

Corporate and Investment Banking 💼 - The fancy suit division that helps massive corporations raise money, merge with other companies, or navigate complex financial deals. This is where the real money gets made (and the biggest risks live).

Wealth and Investment Management 💎 - For folks who have more money than they know what to do with, WFC offers investment advice, portfolio management, and financial planning services.

How They Keep Score

Banks have their own special way of measuring success, and it's not just about how much money they have in the vault:

Net Interest Margin: The spread between what they pay depositors and what they earn on loans

Efficiency Ratio: How much it costs to generate each dollar of revenue (lower is better)

Return on Equity: How well they're using shareholders' money to generate profits

Credit Loss Provisions: How much they're setting aside for loans that might go bad

The Money Machine in Action

With $1.4 trillion in deposits, Wells Fargo has built what's essentially a massive money collection system. Every time you deposit your paycheck, you're giving them cheap funding to lend out at higher rates. It's like running a hotel where guests pay you to stay, and then you rent out their rooms to other people at a premium while they're out sightseeing.

The bank employs 217,000 people globally (77% in the US), making it one of the largest employers in the financial sector. That's a lot of people whose job it is to help other people with their money – or at least that's the theory! 😏

Layer 2: Category Position 🏆

Wells Fargo sits in the exclusive "Too Big to Fail" club alongside JPMorgan Chase, Bank of America, and Citigroup. But being big doesn't automatically mean being the best – just ask any dinosaur.

The Heavyweight Division

In the banking world, size matters because it brings efficiency, regulatory compliance capabilities, and the ability to serve massive corporate clients. Wells Fargo's $1.9 trillion in assets puts them in fourth place, which sounds less impressive until you realize they're still bigger than the GDP of most countries.

The Competition Landscape:

JPMorgan Chase: The undisputed heavyweight champion

Bank of America: The scrappy challenger always nipping at JPM's heels

Citigroup: The international player with global reach

Wells Fargo: The "steady Eddie" with a strong domestic presence

Fighting on Multiple Fronts

But here's where it gets interesting (and scary for traditional banks): Wells Fargo isn't just competing with other banks anymore. They're also battling:

Online Lenders: Platforms that can approve loans in minutes instead of weeks

Credit Unions: Non-profit competitors that can offer better rates

The Regulatory Handicap

Wells Fargo has been playing with one hand tied behind its back due to various regulatory issues from past scandals. While competitors have been free to pursue aggressive growth strategies, WFC has been focused on compliance and rebuilding trust. It's like trying to win a race while carrying a backpack full of regulatory requirements.

The good news? They're working through these issues, and the regulatory cloud is slowly lifting. The bad news? Their competitors haven't been standing still.

Layer 3: Show Me The Money! 📈

Wells Fargo's revenue story is fundamentally about the spread – the difference between what they pay for money and what they charge for it. But like any good financial institution, they've diversified their income streams to reduce dependence on interest rates.

Revenue Breakdown: The Wells Fargo Money Tree

Net Interest Income (The Big Kahuna): This is the core banking business – borrowing low, lending high. With $912.7 billion in loans outstanding, even small changes in interest rates can have massive impacts on profitability.

Fee-Based Revenue: This includes:

Credit card fees and interchange income

Investment management fees from their wealth division

Transaction fees from commercial banking

Investment banking fees from deal-making

The Interest Rate Roller Coaster 🎢

Wells Fargo's profitability is heavily influenced by interest rates, which have been on quite the journey lately. When rates rise, banks typically benefit because they can charge more for loans faster than they have to pay more for deposits. When rates fall... well, it's the opposite.

The Federal Reserve's monetary policy decisions basically determine whether Wells Fargo has a good quarter or a great quarter. It's like being a farmer whose crops depend entirely on weather patterns you can't control.

Geographic and Customer Mix

Wells Fargo has a strong presence across the United States, with particularly heavy concentrations in:

California: Their home base and a wealthy market

Texas: Growing population and business-friendly environment

North Carolina: Legacy Wachovia territory

Minnesota: Historical Wells Fargo stronghold

Their customer base ranges from college students opening their first checking account to Fortune 500 companies needing billion-dollar credit facilities. This diversification helps smooth out economic cycles – when consumers are struggling, businesses might be thriving, and vice versa.

Layer 4: What Do We Have to Believe? 📚

Investing in Wells Fargo is essentially a bet on the future of traditional banking in America. Here's what you need to believe for each scenario:

The Bull Case 🐂: "Banking's Not Dead Yet"

For Wells Fargo to succeed, you need to believe:

The Regulatory Cloud Will Lift: WFC has been operating under various consent orders and regulatory restrictions. Bulls believe these will eventually be resolved, freeing up the bank to pursue growth opportunities and return more capital to shareholders.

Scale Still Matters: Despite fintech disruption, there's still value in being a one-stop financial shop. When you need a mortgage, business loan, and investment advice, having it all under one roof with established relationships matters.

Digital Transformation Will Work: Wells Fargo is investing heavily in technology to compete with digital-first competitors. Success here could combine the best of both worlds – digital convenience with traditional banking stability.

Interest Rates Will Stabilize: After years of volatility, a more predictable interest rate environment would allow WFC to optimize their lending and deposit strategies.

Credit Quality Will Remain Strong: The bank's conservative lending practices will pay off during economic downturns, giving them a competitive advantage over more aggressive lenders.

The Bear Case 🐻: "Disruption is Real"

The risks that could derail Wells Fargo:

Regulatory Purgatory: What if the regulatory issues never fully resolve? Continued restrictions could permanently handicap WFC's ability to compete and grow.

Fintech Disruption Accelerates: Digital-first competitors could capture the most profitable customers, leaving traditional banks with the expensive-to-serve remainder.

Net Interest Margin Compression: If deposit costs rise faster than loan yields, or if competition forces down lending rates, profitability could suffer significantly.

Economic Recession: A severe downturn could trigger massive loan losses, especially in commercial real estate and business lending where WFC has significant exposure.

Technology Disruption: What if blockchain, digital currencies, or other innovations make traditional banking obsolete faster than expected?

The Verdict: A Steady Ship in Choppy Waters ⚖️

Wells Fargo represents a classic "value" investment in the financial sector. They're not the flashiest or fastest-growing bank, but they have:

Massive scale advantages that are hard to replicate

Diversified revenue streams across multiple business lines

Strong deposit franchise providing cheap funding

Experienced management working through regulatory challenges

The company is essentially betting that reports of traditional banking's death have been greatly exaggerated. They're investing heavily in digital capabilities while leveraging their existing customer relationships and regulatory expertise.

The Bottom Line: Wells Fargo isn't going to be the next Tesla, but it doesn't need to be. If they can successfully navigate their regulatory challenges, compete effectively with fintech disruptors, and maintain their market position, shareholders should do reasonably well. Just don't expect fireworks – this is more like investing in a reliable utility that happens to deal with money instead of electricity.

The key question isn't whether Wells Fargo will survive (they will), but whether they can thrive in a rapidly changing financial landscape. That's the bet you're making when you buy WFC stock. 🎯

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.