The Bottom Line Upfront 💡

Verizon Communications Inc. $VZ ( ▼ 1.68% ) is America's premium wireless carrier, generating massive cash flows (~$19B annually) while navigating a mature, hyper-competitive market. Trading at ~$40 per share, our DCF analysis suggests significant undervaluation with fair value ranging from $118-$217 per share (197%-445% upside potential). The company operates like a digital toll road system - customers pay monthly fees to access their premium network infrastructure. With 115 million wireless connections, a 7% dividend yield, and aggressive 5G deployment, VZ offers income investors steady returns while betting on 5G monetization for future growth. Key risks include $172.6B in net debt and intense competition, but strong free cash flow generation and network quality advantages provide defensive characteristics. This is a "steady Eddie" play - not a growth rocket, but a reliable dividend aristocrat with potential upside if 5G investments pay off.

Sponsorship

Peak Rates on the Products You Need

Peak Bank was designed for those who want to bank boldly, providing a 100 percent digital platform that combines convenience and powerful money management tools. Our high-yield savings accounts offer rates as high as 4.35% APY* while remaining accessible and flexible, ensuring you stay in control at all times. Apply online to start your ascent.

Member FDIC

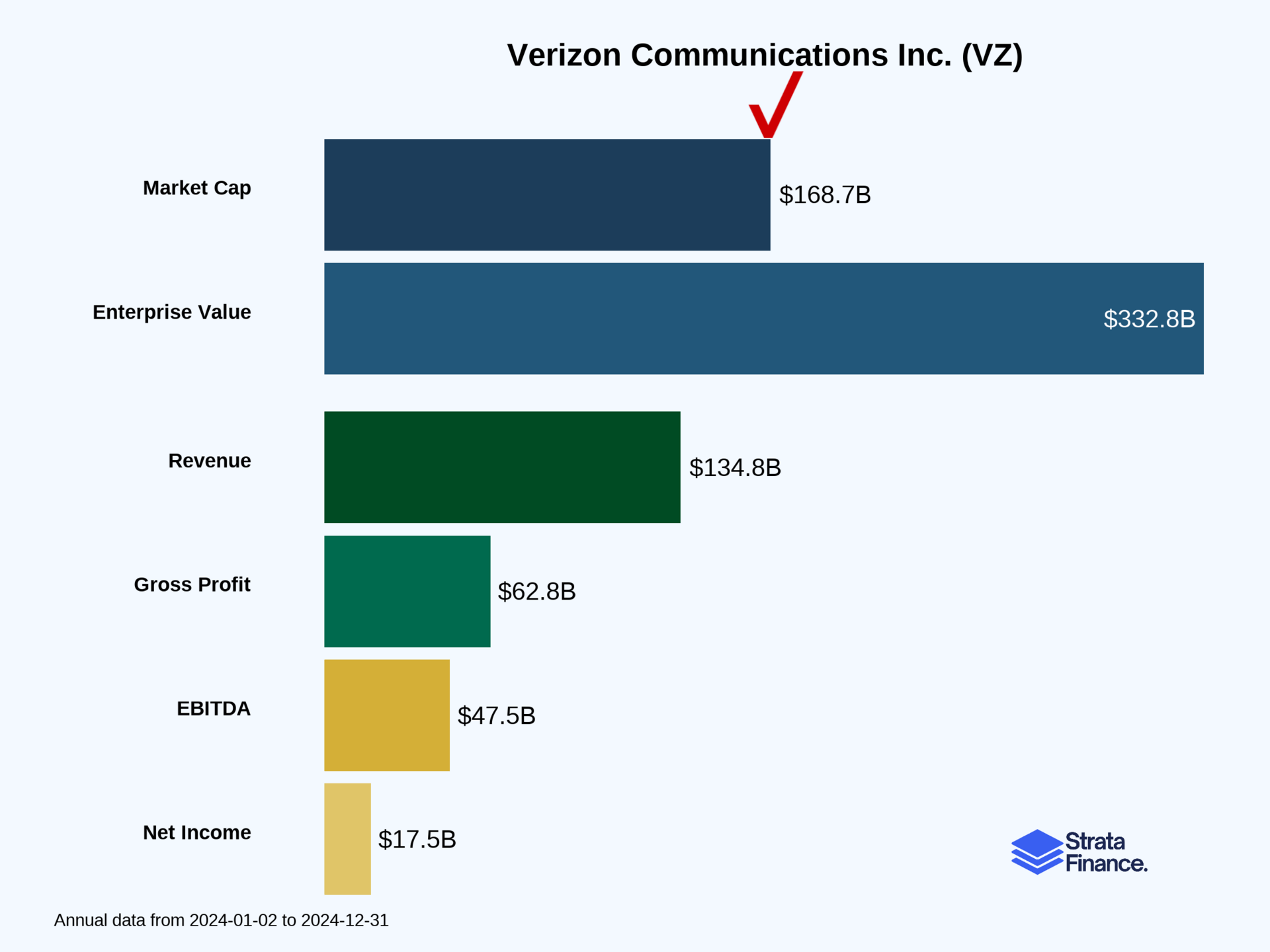

Strata Layers Chart

Layer 1: The Business Model 🏛️

Think of Verizon as the digital equivalent of a massive highway system - they've built the roads (networks), and everyone pays tolls to use them. But unlike actual highways, these digital roads require constant upgrades, and customers expect them to get faster every year while somehow costing less. Fun times!

What They Actually Do

Verizon operates two main businesses that are basically like running two different stores under the same massive roof:

Consumer Group (76% of revenue - $102.9B ↗️): This is the "regular people" business. They provide wireless service to 115 million connections ↗️, which includes your typical smartphone plans, home internet through their Fios fiber network, and Fixed Wireless Access (FWA) - think of FWA as turning cell towers into home internet providers. About 83% of their wireless customers are postpaid (the valuable ones who pay monthly bills), while 17% are prepaid (pay-as-you-go customers).

Business Group (22% of revenue - $29.5B ↘️): This serves companies, government agencies, and other carriers. They provide everything from basic connectivity to advanced solutions like cybersecurity, private networks, and Internet of Things (IoT) services. It's like being the IT department for half of corporate America.

The Money Machine

Verizon's revenue model is refreshingly straightforward for such a complex operation:

Monthly Service Fees: The bread and butter - customers pay monthly for network access

Equipment Sales: Phones, tablets, and other devices (often financed through installment plans)

Add-on Services: Device protection, premium content, international roaming, business solutions

Their device payment program is particularly clever. Instead of the old "free phone with 2-year contract" model, customers now finance devices separately while paying lower monthly service fees. It's like separating your car payment from your insurance - more transparent, more flexible, and it gives Verizon steady revenue streams from both service and equipment financing.

Key Metrics They Watch

ARPA (Average Revenue Per Account): $138.25 ↗️ for postpaid customers - this measures how much they squeeze from each customer relationship

Churn Rate: 1.62% ↘️ - the percentage of customers who leave each month (lower is better)

Connection Growth: Total retail connections grew modestly to 115.3M ↗️

Broadband Connections: 10.0M total ↗️, with FWA growing 45% to 2.7M connections

The Infrastructure Reality

Here's where it gets expensive: Verizon spent $17.1 billion on capital expenditures in 2024. That's not a typo - billion with a B. This money goes toward acquiring wireless spectrum (the invisible highways), deploying 5G networks, maintaining fiber infrastructure, and constantly upgrading technology. It's like being a utility company that has to rebuild the power grid every few years because customers demand faster electricity.

Layer 2: Category Position 🏆

Verizon operates in what they diplomatically call a "highly competitive" industry, which is corporate speak for "it's a gladiator arena out there." The U.S. wireless market has reached smartphone saturation, meaning the days of explosive customer growth are over. Now it's musical chairs - companies fight over existing customers rather than finding new ones.

The Big Three Showdown

Verizon vs. AT&T vs. T-Mobile: This is essentially a three-way battle for wireless supremacy. Verizon has traditionally been the "premium" option - they cost more but claim superior network quality. AT&T is the "we're everywhere" player, while T-Mobile has positioned itself as the "un-carrier" disruptor with aggressive pricing.

Verizon's competitive advantage has been network quality and coverage. They were early leaders in 4G LTE and have continued this with 5G deployment. Their network covers over 146 million wireless retail connections, and they've been aggressively deploying C-Band spectrum to enhance 5G capabilities.

The Cable Company Invasion

Plot twist: Cable companies like Comcast and Charter have entered wireless by becoming MVNOs (Mobile Virtual Network Operators) - essentially reselling Verizon's own network capacity back to customers at lower prices. Awkward.

Broadband Battlefield

In the home internet space, Verizon's Fios fiber service competes with cable companies, while their FWA service provides an alternative using wireless technology. They're also facing new competition from low Earth orbit satellite companies (hello, Starlink) that can reach areas traditional providers can't.

Recent Competitive Moves

The company completed a $2.8 billion tower monetization deal with Vertical Bridge in December 2024, similar to their 2015 American Tower transaction. They're also acquiring Frontier Communications to expand their fiber footprint - a clear signal they're doubling down on broadband competition.

Layer 3: Show Me The Money! 📈

Revenue Breakdown: The Tale of Two Businesses

Consumer Segment Performance:

Total Revenue: $102.9B ↗️ (+1.3%)

Service Revenue: $76.9B ↗️ (+2.7%) - the recurring monthly payments

Equipment Revenue: $19.6B ↘️ (-5.1%) - fewer device upgrades hurt here

Other Revenue: $6.4B ↗️ (+5.2%) - regulatory fees and device protection

Business Segment Struggles:

Total Revenue: $29.5B ↘️ (-2.0%)

Enterprise and Public Sector: $14.2B ↘️ (-5.7%) - big corporate clients cutting back

Business Markets: $13.1B ↗️ (+3.0%) - smaller businesses still growing

Wholesale: $2.2B ↘️ (-5.0%) - other carriers buying less capacity

Customer Economics

The average postpaid customer generates $138.25 ↗️ per month, up from $132.36. That's solid pricing power in a competitive market. With 95.1 million postpaid connections ↗️, that's roughly $157 billion in annual postpaid service revenue potential.

Churn rates improved to 1.62% ↘️ from 1.67%, meaning they're getting better at keeping customers. In the wireless business, customer acquisition costs are brutal, so retention is everything.

Layer 4: Long-Term Valuation (DCF Model) 💰

DCF Analysis: The Numbers Don't Lie

Based on our detailed discounted cash flow analysis, Verizon appears significantly undervalued at current levels:

Fair Value Range: $118.49 - $217.25 per share

Current Price: ~$39.85 (as of 10.13.2025)

Potential Upside: 197% - 445%

Conservative Scenario ($118.49 target)

WACC: 5.07%

Terminal Growth: 2.5%

Assumptions: Gradual margin decline, modest growth, mature market dynamics

Key Drivers: Stable FCF generation of ~$19B annually, maintained dividend payments

What's Driving the Valuation

Positive Factors:

Massive free cash flow generation (~$19B annually) 💰

Dividend aristocrat status with reliable payments

5G network leadership and infrastructure advantage

Stable customer base with improving churn (1.62% ↘️)

Operating margin expansion (21.3% ↗️ vs 17.1% prior year)

Risk Factors:

High debt burden ($172.6B net debt) 📊

Mature market with limited organic growth opportunities

Intense competition pressuring margins

Heavy ongoing capex requirements for 5G deployment

Layer 5: What Do We Have to Believe? 📚

The Bull Case: Digital Infrastructure King 👑

For Verizon to succeed long-term, you need to believe:

5G Will Actually Matter: Beyond faster Netflix, 5G needs to enable new revenue streams - autonomous vehicles, IoT applications, edge computing.

Network Quality Commands Premium Pricing: In a world of aggressive competition, customers will continue paying more for superior network reliability.

FWA Can Disrupt Home Broadband: Fixed Wireless Access could be their secret weapon against cable companies. With 2.7 million connections growing 45% ↗️, early signs are promising.

Debt Is Manageable: With $172.6B in net debt, they need to maintain strong cash flows (~$19B annually) to service obligations while investing in growth.

Operational Efficiency Gains: The $1.7B in severance charges should translate to ongoing cost savings.

The Bear Case: Mature Market Blues 📉

The pessimistic view requires believing:

Wireless Is a Utility: If customers view wireless service as a commodity, pricing power evaporates. T-Mobile's "un-carrier" strategy suggests this might be happening.

5G Overhype: What if 5G doesn't generate meaningful new revenue streams?

Debt Burden Becomes Problematic: Interest rates remain elevated, and refinancing $172.6B becomes expensive.

Competition Intensifies: Cable companies, satellite providers, and aggressive wireless competitors could pressure both wireless and broadband markets.

Business Segment Decline Continues: Enterprise customers cutting telecom spending could accelerate the -2.0% ↘️ revenue decline in their business division.

The Verdict: Steady Eddie with Upside Potential 🎯

Verizon is like that reliable friend who always shows up but isn't the life of the party. They generate massive cash flows, pay a solid dividend, and have built impressive infrastructure. The question is whether they can monetize their 5G investments and grow beyond their mature wireless base.

The investment thesis boils down to:

Income investors get a ~7% dividend yield backed by strong cash flows

Value investors see potential upside if 5G monetization succeeds

Growth investors might want to look elsewhere - this isn't a rocket ship

The DCF analysis suggests significant undervaluation, but markets might be pricing in execution risks around 5G monetization and competitive pressures. At current levels, you're essentially betting that one of America's largest telecom companies can maintain its dividend while finding new growth avenues.

Bottom line: Verizon won't make you rich overnight, but it probably won't go bankrupt either. In a world of meme stocks and crypto volatility, sometimes boring reliability has its place. Just don't expect fireworks - expect steady cash flows and hopefully some pleasant surprises from their 5G investments.

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.