The Bottom Line Upfront 💡

The Travelers Companies $TRV ( ▲ 1.98% ) is America's insurance fortress—a 170-year-old company that turns life's "what ifs" into steady profits. With $43.9B in annual premiums across business, personal, and specialty insurance, Travelers operates like a sophisticated betting house where everyone wins when nothing bad happens, and they step in when disaster strikes.

The investment thesis is compelling: a 92.5% combined ratio shows they're making money on underwriting, while their $94.2B investment portfolio generates rising income (3.7% yield and climbing) as interest rates increase. Management returned $2.1B to shareholders in 2024 through dividends and buybacks, demonstrating confidence in their cash-generating machine.

Key risks include accelerating climate change (they've already disclosed $1.7B in preliminary losses from 2025 California wildfires), regulatory constraints on pricing, and potential technology disruption. However, their disciplined underwriting approach, strong financial position ($27.9B shareholders' equity), and superior risk assessment capabilities position them well for long-term success.

This isn't a growth stock—it's a steady dividend-grower for investors who appreciate consistent profitability, shareholder-friendly management, and a business model that has survived every crisis since before the Civil War. The red umbrella keeps working. ☂️

Partnership

Get Matched With the Best HRIS/ATS Software, for Free!

Does researching HR Systems feel like a second job?

The old way meant hours of demos, irrelevant product suggestions, getting bombarded with cold emails and sales calls.

But there’s a better way.

With SelectSoftware Reviews, spend 15 minutes with an HR software expert and get 2–3 vendor recommendations tailored to your unique needs—no sales pitches, no demos.

SSR’s free HR software matching service helps you cut through the noise and focus only on solutions that truly fit your team’s needs. No guesswork. No fluff. Just insights from real HR experts.

Why HR teams trust SSR:

✅ 100% free service with no sales pressure

✅ 2–3 tailored recommendations from 1,000+ vetted options

✅ Rated 4.9/5 by HR teams and trusted by 15,000+ companies

Skip the old way—find your right HRIS/ATS in a new way, for free!

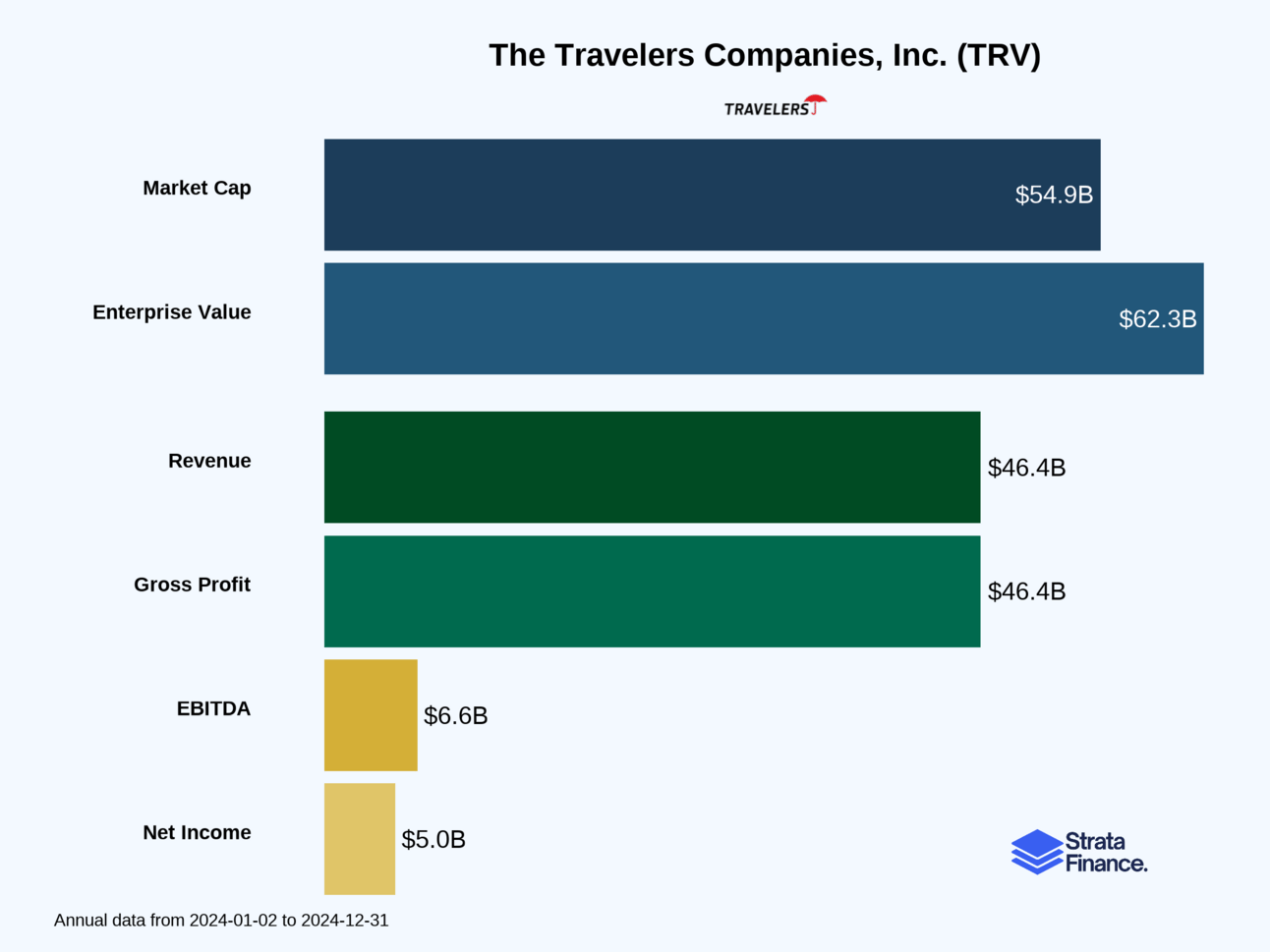

Strata Layers Chart

Layer 1: The Business Model 🏛️

What Does Travelers Actually Do? 🤔

Think of Travelers as the ultimate "what if" company. What if your house burns down? What if you crash your car? What if your business gets sued? What if a hurricane destroys your factory? Travelers has been in the business of turning life's "what ifs" into manageable monthly payments since 1853—making them older than the telephone, the light bulb, and probably your great-great-grandmother's sourdough starter.

At its core, Travelers operates like a sophisticated betting house, but instead of gambling on sports, they're betting on whether bad things will happen to their customers. The beautiful part? Everyone wins when nothing bad happens, and when something does go wrong, Travelers steps in to make it right. It's capitalism with a safety net, wrapped in a red umbrella. 🏮

The Three-Ring Circus 🎪

Travelers runs three distinct businesses under one roof, each targeting different types of customers:

Business Insurance ($22.1B in premiums ↗️) - The heavyweight champion, serving everyone from mom-and-pop shops to Fortune 500 giants. This segment is like running four different restaurants:

Select Accounts: The fast-casual spot for small businesses (under 50 employees)

Middle Market: The full-service restaurant for mid-sized companies (50-1,000 employees)

National Accounts: The white-tablecloth establishment for large corporations

National Property: The specialty cuisine for unique commercial property needs

Personal Insurance ($17.2B in premiums ↗️) - Your everyday auto and homeowners coverage for regular folks. With 8.8 million active policies, this is Travelers' steady Eddie—the reliable friend who always shows up with pizza when you're moving. Not the most exciting business, but it pays the bills consistently.

Bond & Specialty Insurance ($4.1B in premiums ↗️) - The boutique operation offering specialized coverage like surety bonds and cyber insurance. Think of this as the artisanal cheese shop of insurance—smaller scale, higher margins, serving customers with unique tastes (and risks).

How They Actually Make Money 💰

Travelers has a beautifully simple revenue model with three main streams:

Insurance Premiums ($41.9B in 2024 ↗️) - The monthly or annual payments customers make for coverage

Investment Income ($3.6B in 2024 ↗️) - Returns from their massive $94.2B investment portfolio (more on this magic trick later)

Fee Income ($473M in 2024 ↗️) - Charges for specialized services like claims administration and risk management

Here's where it gets interesting: Insurance companies are essentially investment managers funded by customer premiums. When you pay Travelers $1,200 for car insurance, they don't just stick that money in a checking account. They invest it in bonds, stocks, and other securities, earning returns while they wait to pay claims. It's like getting an interest-free loan from millions of customers—not a bad gig if you can get it!

Key Success Metrics 📊

Travelers obsesses over several critical metrics that determine whether they're winning or losing:

Combined Ratio (92.5% in 2024 ↘️) - The holy grail of insurance metrics. This measures claims and expenses as a percentage of premiums. Under 100% means they're making money on underwriting; over 100% means they're losing money and relying on investment income to stay profitable. At 92.5%, Travelers is crushing it.

Catastrophe Losses ($3.3B in 2024 ↗️) - Mother Nature's invoice. These are the big-ticket items like hurricanes, wildfires, and hailstorms that can make or break an insurance company's year.

Prior Year Reserve Development ($709M favorable in 2024 ↗️) - This measures whether their previous estimates for claims were too high or too low. Favorable development means they over-reserved (good news), while unfavorable means they under-reserved (oops).

Investment Yield (3.7% in 2024 ↗️) - How much their investment portfolio is earning. With rising interest rates, this has been a nice tailwind recently.

The Underwriting Discipline Philosophy 🎯

Unlike some competitors who chase market share like it's Black Friday at Best Buy, Travelers follows a "disciplined underwriting" approach. Translation: they'd rather walk away from unprofitable business than write policies that will lose money just to boost their top line. It's like being the bouncer at an exclusive club—not everyone gets in, but those who do are quality customers.

This philosophy requires sophisticated risk modeling and data analytics. Travelers uses both proprietary and third-party models to assess everything from hurricane paths to cyber attack probabilities. When you're betting billions on whether bad things will happen, having better data than the competition isn't just helpful—it's existential.

Layer 2: Category Position 🏆

The Insurance Industry Landscape 🗺️

The property and casualty insurance industry is massive but surprisingly concentrated. While there are about 1,100 insurance groups comprising roughly 2,600 companies in the U.S., the top 150 groups control 94% of the market's total premiums. It's like the restaurant industry—lots of players, but McDonald's, Burger King, and a few others dominate the landscape.

Travelers sits comfortably in the elite tier, competing primarily on financial strength, technology capabilities, and relationships rather than pure price. This isn't a race to the bottom on pricing—customers actually care about whether their insurer will be around to pay claims 20 years from now.

The Competition Lineup 🥊

The Heavy Hitters:

Chubb Limited - The luxury brand of commercial insurance, focusing on high-net-worth individuals and complex commercial risks

The Progressive Corporation - The direct-to-consumer champion, especially strong in auto insurance with their "Flo" marketing machine

The Allstate Corporation - Another household name in personal lines, famous for "You're in good hands"

Cincinnati Financial - Regional powerhouse with strong agent relationships

Travelers' Competitive Advantages:

Distribution Network - Thousands of independent agents and brokers who value working with stable, reliable insurers

Technology Edge - Superior catastrophe modeling and risk assessment tools that help them price risks others might miss

Brand Recognition - That red umbrella isn't just pretty—it represents 170+ years of trust and reliability

Layer 3: Show Me The Money! 📈

Revenue Breakdown: The Three-Legged Stool 💺

By Business Segment (2024):

Business Insurance: $22.1B (51% of total) ↗️

Personal Insurance: $17.2B (40% of total) ↗️

Bond & Specialty: $4.1B (9% of total) ↗️

This diversification is beautiful—if one segment hits a rough patch, the others can pick up the slack. Business Insurance is the workhorse, Personal Insurance provides stability, and Bond & Specialty adds high-margin specialty coverage.

Geographic Split:

Domestic: $43.9B (94.6%)

International: $2.5B (5.4%)

Travelers is overwhelmingly a U.S. story, with international operations providing modest diversification through Canada, UK, Ireland, and Lloyd's of London.

The Investment Income Magic Trick 🎩

Here's where insurance gets really interesting: Travelers earned $3.6B in investment income in 2024 ↗️, up 23% from 2023. This isn't just nice-to-have income—it's a massive profit center funded by customer premiums.

Think about it: When you pay your insurance premium, Travelers doesn't just sit on that cash. They invest it in a $94.2B portfolio (94% in fixed income securities), earning returns while they wait to pay claims. It's like getting an interest-free loan from millions of customers—not a bad gig if you can get it!

The Investment Portfolio Breakdown:

Fixed Maturities: $83.7B (89% of total)

Short-term Securities: $4.8B

Equity Securities: $687M

Real Estate: $902M

Other Investments: $4.2B

This conservative approach makes sense—you don't want to be gambling with money you might need to pay hurricane claims next month.

Layer 4: What Do We Have to Believe? 📚

The Bull Case: Why Travelers Could Thrive 🚀

Belief #1: Climate Change Creates More Value Than It Destroys Yes, climate change is increasing catastrophe losses, but it's also driving massive demand for sophisticated risk assessment and management. Travelers has invested heavily in catastrophe modeling, climate science, and risk management expertise.

Belief #2: Technology Enhances Rather Than Disrupts Their Model While insurtech startups grab headlines, Travelers is using technology to strengthen their traditional advantages. Their AI-powered underwriting, automated claims processing, and superior data analytics are making them more efficient and profitable. The Corvus acquisition shows they're willing to buy rather than build cutting-edge capabilities, which could be faster and more effective than trying to develop everything in-house.

Belief #3: Rising Interest Rates Provide a Multi-Year Tailwind With $94.2B in investments, every percentage point increase in yields translates to massive income gains. Management expects after-tax investment income from fixed income to grow from ~$710M in Q1 2025 to ~$790M in Q4 2025 as their portfolio matures and gets reinvested at higher rates. This is a beautiful, predictable tailwind that could last for years.

Belief #4: Disciplined Underwriting Wins Long-Term Their "we'd rather walk away than lose money" philosophy might seem boring, but it's what separates great insurers from mediocre ones. The 92.5% combined ratio in 2024 shows this discipline is paying off. In an industry where one bad underwriting cycle can destroy decades of profits, boring discipline is actually exciting.

The Bear Case: What Could Go Wrong 🐻

Risk #1: Climate Change Accelerates Faster Than Expected If weather events become more frequent and severe than current models predict, even Travelers' sophisticated risk assessment might not be enough. The $1.7B preliminary loss from the 2025 California wildfires shows how quickly things can go sideways. If climate change outpaces their ability to model and price risks, catastrophe losses could spiral out of control.

Risk #2: Regulatory Backlash Limits Pricing Power State insurance regulators sometimes prevent insurers from raising rates or reducing exposure in high-risk areas for political reasons. If regulators increasingly tie insurers' hands while climate risks increase, Travelers could get caught in a profit squeeze. Florida's property insurance market is already showing signs of this dynamic.

Risk #3: Technology Disruption Happens Faster Than Adaptation While Travelers is investing in technology, they're still fundamentally a traditional insurer with legacy systems and processes. If AI-powered insurtech companies can underwrite risks more accurately and efficiently, Travelers' agent network and traditional approach could become obsolete faster than expected.

Risk #4: Economic Recession Hits Multiple Fronts A severe recession could hurt Travelers in several ways: reduced business activity (lower commercial premiums), increased personal lines cancellations, higher investment losses, and potentially higher claim frequencies as people become more litigious. Their diversified model helps, but they're not recession-proof.

Risk #5: Interest Rate Reversal If interest rates fall significantly, their investment income tailwind becomes a headwind. With such a large investment portfolio, they're highly sensitive to rate changes. A return to zero interest rate policies would be painful.

The Verdict: A Steady Eddie with Upside Potential ⚖️

Travelers is fundamentally a high-quality, well-managed insurance company trading in a challenging but profitable industry. They're not going to be the next Tesla, but they don't need to be.

The key question isn't whether Travelers will survive and prosper—they almost certainly will. The question is whether their steady, dividend-growing, share-buyback-heavy approach will satisfy investors in a world obsessed with growth stocks and meme investments.

For investors who appreciate the beauty of a well-run, profitable business that gets paid to take calculated risks and has been doing it successfully since before your great-great-grandfather was born, Travelers offers a compelling combination of stability, income, and modest growth potential. Just don't expect fireworks—expect steady, reliable performance with the occasional weather-related hiccup.

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.