The Bottom Line Upfront 💡

TransDigm Group $TDG ( ▲ 1.76% ) has built one of the most impressive business models in industrial America - a specialized aerospace parts empire with 90% proprietary products, 55% aftermarket revenue, and nearly 60% gross margins. With products on 100,000+ aircraft and 50-year product lifecycles, they've created the ultimate recurring revenue machine. However, our DCF analysis reveals a sobering reality: at ~$1,266 per share, TDG appears significantly overvalued with a fair value range of $33-$597. The culprit? A staggering $31.2 billion debt load that essentially turns this into a leveraged buyout masquerading as a public company. While the business model is brilliant and deserves a premium valuation, the current price requires believing in miracles.

Sponsorship

Outdated tax tools drain time, increase audit risk, and limit strategy. In this on-demand webinar, see how Longview Tax helps you cut manual work, boost accuracy, and get back to what matters most.

Strata Layers Chart

Layer 1: The Business Model 🏛️

What Does TransDigm Actually Do?

Think of TransDigm as the ultimate aerospace parts dealer – but not the kind that sells generic components. They're more like the specialized shop that makes the one weird bolt that holds your airplane's engine together, and they're the only shop that makes it. Founded in 1993, TDG has built an empire around a simple but brilliant concept: create highly specialized, mission-critical aircraft parts that are so essential and proprietary that customers have no choice but to pay premium prices.

Here's the beautiful part of their business model: it's like the ultimate subscription service. When TransDigm designs a component for a new aircraft, they're not just making a one-time sale – they're locking in revenue for the next 50+ years. Aircraft platforms get produced for 20-30 years, then those planes stay in service for another 25-30 years. Every time a part needs replacement or maintenance, ka-ching! 💰

The Three-Headed Monster

TransDigm operates through three main segments:

Power & Control (49.6% of revenue, $3.94B ↗️): These are the components that make planes go vroom. Think ignition systems, specialized pumps, electric motors, and all the electronic wizardry that keeps aircraft powered and controlled. If it involves making or controlling power on an aircraft, they probably make it.

Airframe (48.0% of revenue, $3.81B ↗️): Everything else that keeps passengers alive and comfortable. Seatbelts, cockpit security systems, latching devices, interior surfaces, and even parachutes. Basically, if it's attached to the airplane but doesn't make it go, it's probably in this segment.

Non-aviation (2.4% of revenue, $190M ↗️): The "other stuff" – seatbelts for cars, space applications, and industrial equipment. It's tiny but growing.

The Secret Sauce: Aftermarket Dominance

Here's where TransDigm gets really clever. About 55% of their revenue comes from the aftermarket – meaning replacement parts and maintenance. This is the golden goose because:

Higher margins: Aftermarket sales are more profitable than original equipment

Predictable revenue: Planes need maintenance whether the economy is good or bad

Captive customers: Once their part is certified on an aircraft, switching suppliers is expensive and time-consuming

Key Metrics They Watch

TransDigm measures success using EBITDA As Defined (earnings before interest, taxes, depreciation, and amortization, plus some adjustments). In fiscal 2024, this hit $4.17 billion ↗️, up 22.9% from the prior year. They also obsess over:

Proprietary product percentage: Currently 90% (the higher, the better for pricing power)

Aftermarket mix: 55% and stable

Acquisition integration: They've bought 93 businesses since 1993

Manufacturing & Operations

With approximately 120 manufacturing facilities worldwide and 16,600 employees, TransDigm operates a decentralized model where each business unit focuses on specific product lines. They're not trying to be everything to everyone – instead, they dominate narrow niches where they can command premium pricing.

Layer 2: Category Position 🏆

The Niche Domination Strategy

TransDigm doesn't compete in the broad aerospace market – they've carved out dozens of specialized niches where they can be the dominant (often only) supplier. It's like being the only company that makes left-handed smoke shifters for Boeing 737s. Good luck finding an alternative!

The aerospace components industry is highly fragmented, which works perfectly for TransDigm's strategy. Their competitors range from divisions of massive corporations like Honeywell, Collins Aerospace, and Safran to tiny private companies with just one or two products. But here's the kicker: TransDigm doesn't really compete on price. They compete on being irreplaceable.

Competitive Advantages That Actually Matter

Regulatory Moats: The aerospace industry has some of the most stringent certification requirements on Earth. Once a component is certified and installed on an aircraft, switching to a different supplier requires extensive (and expensive) re-certification. Customers have a strong incentive to stick with what works.

Installed Base Lock-in: TransDigm estimates their products are on over 100,000 aircraft worldwide. Each installation represents decades of future aftermarket revenue. It's like having a money printer that runs for 50 years.

Engineering Expertise: They don't make commodity parts – they make highly engineered solutions to specific problems. This technical expertise creates switching costs and pricing power.

Market Position by the Numbers

TransDigm serves a diversified customer base:

Commercial aftermarket: 31% of sales (airlines, distributors)

Defense: 40% of sales (U.S. military, foreign governments)

Other: 2% of sales

No single customer accounts for more than 10% of revenue, which provides nice diversification. About 37% of revenue comes from international customers, primarily in Western Europe, Canada, and Asia.

Layer 3: Show Me The Money! 📈

Revenue Breakdown: The Beautiful Diversification

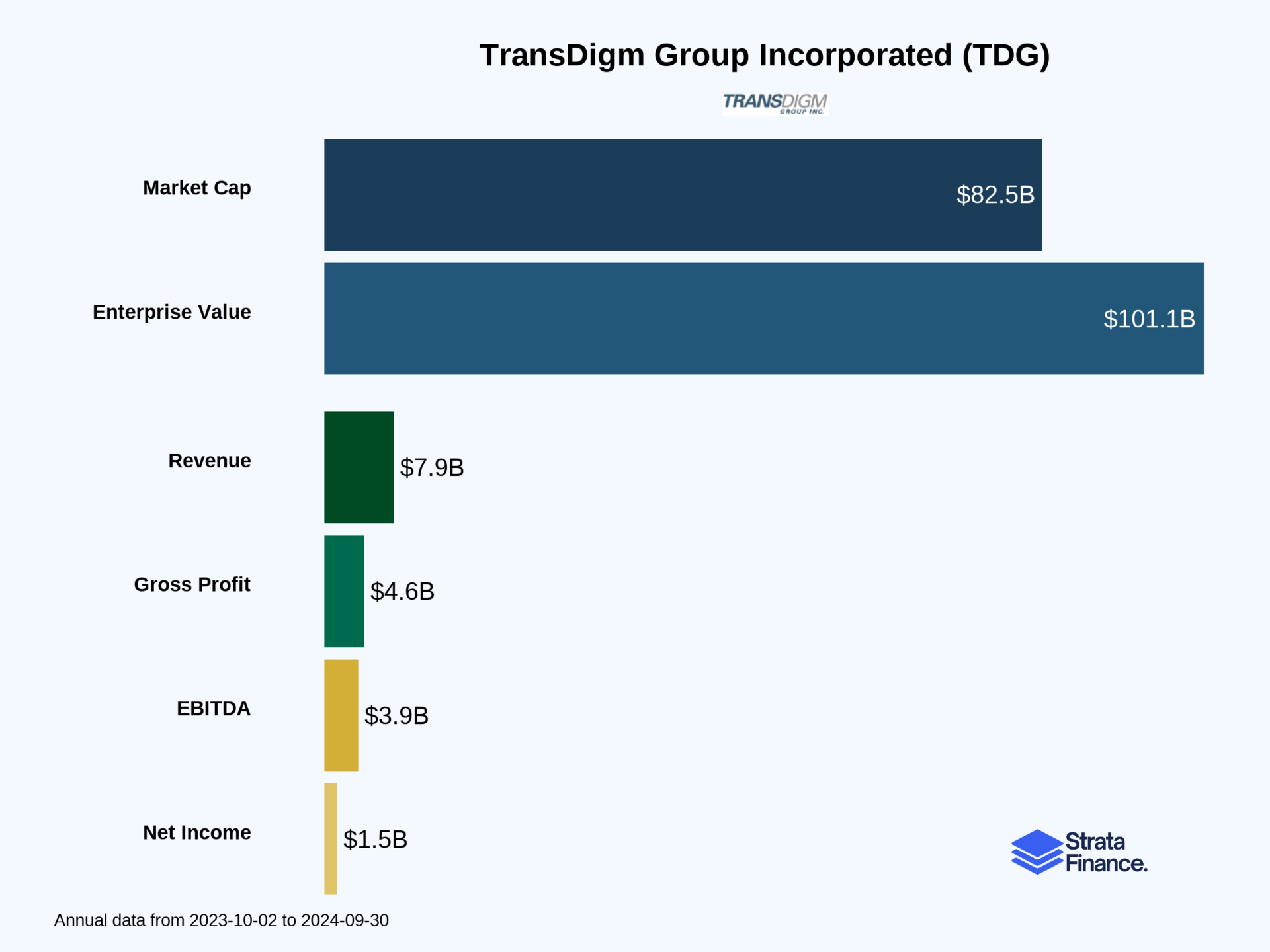

Total Revenue: $7.94 billion ↗️ (up 20.6% from $6.59B in fiscal 2023)

The revenue growth story is firing on all cylinders:

Power & Control: $3.94B ↗️ (+18.8%)

Airframe: $3.81B ↗️ (+23.1%)

Non-aviation: $190M ↗️ (+8.6%)

Geographic Split

United States: $5.03B (63.4%)

International: $2.91B (36.6%)

The international exposure provides nice diversification and growth opportunities, especially as global air travel continues recovering from the pandemic.

Layer 4: Long-Term Valuation (DCF Model) 💰

The Sobering Reality Check

Current Stock Price: ~$1,266 (as of 10.24.2025) DCF Fair Value Range: $33 - $597 per share Verdict: Significantly overvalued 📉

Hold onto your hats, folks, because this valuation analysis is going to be a wild ride. Our DCF model suggests TransDigm is trading at a massive premium to its intrinsic value, and the culprit is hiding in plain sight: $31.2 billion in net debt.

Conservative Scenario: $33 Per Share

Using conservative assumptions:

WACC: 10.5% (reflecting high leverage and risk)

Terminal Growth: 2.5%

Revenue Growth: Moderating from 15% to 4.6% over 5 years

This scenario assumes TransDigm continues growing but faces headwinds from high debt service costs and maturing markets. The massive debt burden essentially wipes out most equity value.

Optimistic Scenario: $597 Per Share

Even with rosy assumptions:

WACC: 8.5% (assuming operational excellence)

Terminal Growth: 3.5% (premium for quality franchise)

Revenue Growth: Strong 20% initially, moderating to 5%

We still get a fair value well below the current trading price. The math is unforgiving when you're carrying $31 billion in debt.

Key Valuation Drivers

The Debt Elephant: With $31.2B in net debt, TransDigm is essentially a leveraged buyout that went public. Every dollar of enterprise value has to service this debt before equity holders see anything.

WACC Sensitivity: Small changes in the discount rate dramatically impact valuation:

At 8.5% WACC: $597/share

At 10.5% WACC: $33/share

Growth Assumptions: The market appears to be pricing in perpetual high growth, which seems unrealistic for a mature aerospace supplier.

What's the Market Thinking?

At $1,266 per share, the market is essentially betting that TransDigm will:

Continue growing revenue at high rates indefinitely

Maintain or expand margins despite competition

Successfully manage their massive debt load

Execute flawless capital allocation

That's a lot of things that have to go right.

Investment Recommendation

The current price appears to discount extremely optimistic scenarios that may be difficult to achieve. While TransDigm has an excellent business model with real competitive advantages, the combination of high debt and current valuation creates significant downside risk.

Layer 5: What Do We Have to Believe? 📚

The Bull Case: Aerospace Royalty 👑

To justify buying TransDigm at current prices, you need to believe:

The Aftermarket Annuity is Unbreakable: With products on 100,000+ aircraft and 50-year product life cycles, TransDigm has built the ultimate recurring revenue machine. As global air travel grows, this installed base becomes increasingly valuable.

Pricing Power is Permanent: The regulatory moats and switching costs in aerospace are so high that TransDigm can continue raising prices faster than inflation indefinitely. When safety is paramount, customers pay whatever it takes.

Acquisition Machine Keeps Rolling: Management has successfully integrated 93 acquisitions since 1993. The aerospace industry remains fragmented, providing endless opportunities to buy specialized component businesses and apply the TransDigm playbook.

Debt is Manageable: Despite $31B in debt, the stable cash flows from aftermarket sales can service this debt while funding growth. Interest rates won't spike dramatically, and refinancing will remain available.

Defense Spending Stays Strong: Geopolitical tensions and military modernization will keep defense budgets growing, supporting 40% of TransDigm's revenue.

The Bear Case: Icarus Flying Too High 🔥

The skeptical view requires believing:

Debt Load is Unsustainable: $31B in debt on a $7.9B revenue company is simply too much leverage. Rising interest rates or economic downturns could create a liquidity crisis.

Growth is Maturing: After 30+ years and 93 acquisitions, the easy targets are gone. Future growth will be harder to achieve and more expensive to finance.

Regulatory Risk is Real: Government scrutiny of defense contractors is increasing. Price controls or margin caps could devastate profitability.

Cyclical Downturn Coming: Commercial aerospace is notoriously cyclical. When the next downturn hits, high fixed costs and debt service could create serious problems.

Valuation is Insane: At current prices, TransDigm trades like a high-growth tech company, not a mature aerospace supplier. Mean reversion is inevitable.

The Verdict: Respect the Business, Fear the Price 🎯

TransDigm has built one of the most impressive business models in industrial America. The combination of proprietary products, aftermarket dominance, and regulatory moats creates genuine competitive advantages that should persist for decades.

But – and this is a big but – the current valuation appears to price in perfection. With $31 billion in debt and a stock price that implies flawless execution forever, there's little margin for error.

This is a classic case of a great business at a terrible price. TransDigm deserves to trade at a premium to typical industrial companies, but the current premium seems excessive. Patient investors might want to wait for a better entry point, perhaps during the next aerospace downturn or debt-driven selloff.

Bottom Line: TransDigm is aerospace royalty, but even kings can be overpriced. The business model is brilliant, but the current valuation requires believing in miracles. Proceed with caution. 🚨

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.