AI-written, human-approved. Read responsibly.

The Bottom Line Upfront

Texas Roadhouse $TXRH ( ▼ 0.83% ) has mastered the casual dining steakhouse category by delivering exceptional value through high-quality, made-from-scratch food at reasonable prices. Their unique managing partner model creates an ownership mentality that drives operational excellence. With strong unit economics ($8.5M average unit volume), zero debt, and consistent growth in both traffic and check size, TXRH continues to outperform the restaurant industry. Their expansion of Bubba's 33 and Jaggers concepts provides additional growth runways beyond their core steakhouse business.

Table of Contents

Layer 1: The Business Model 🏛️

What the Heck is Texas Roadhouse?

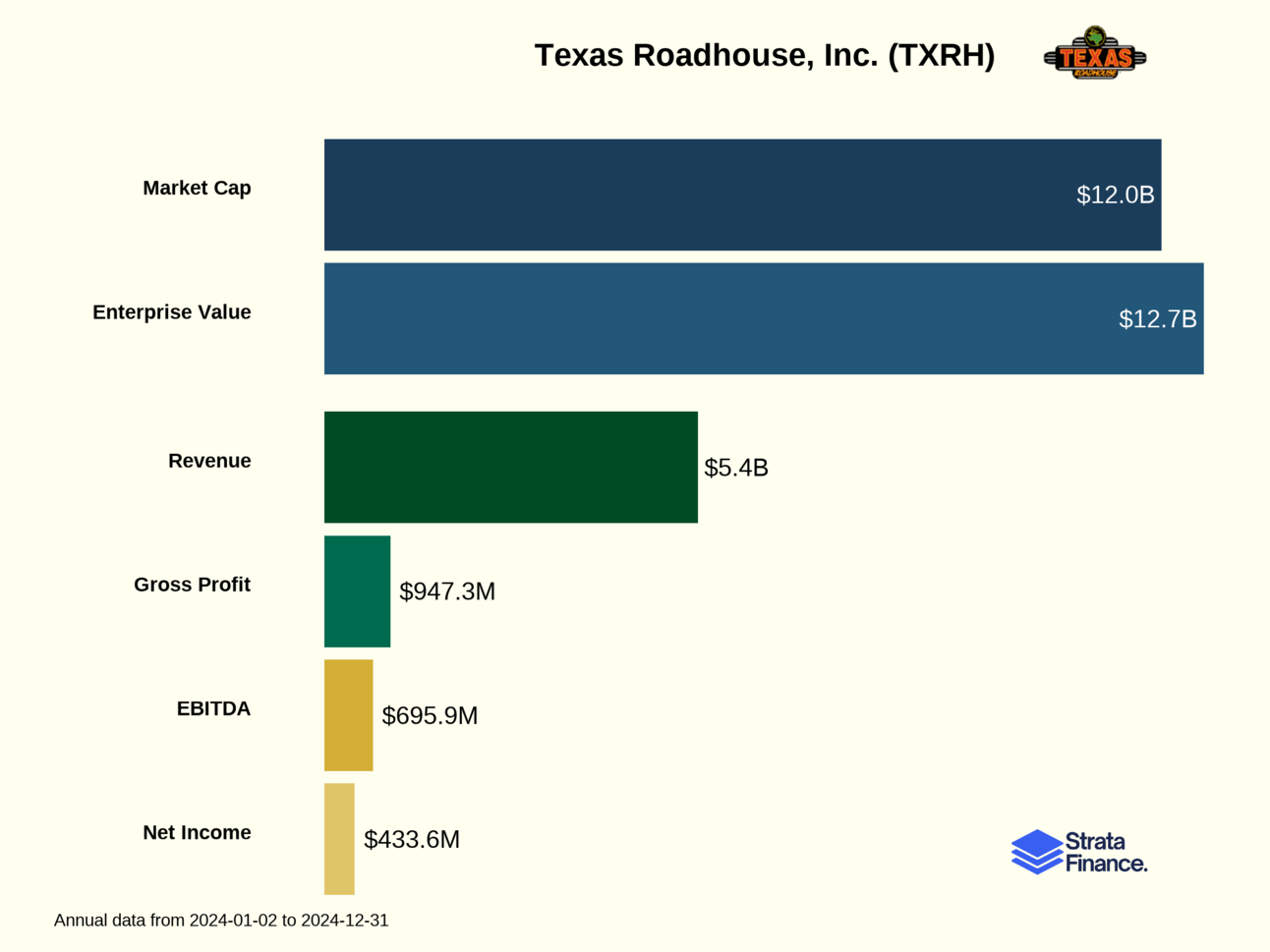

Texas Roadhouse is basically that friend who throws the best backyard BBQs but somehow turned it into a $5.4 billion business. Founded in 1993 by Kent Taylor in Clarksville, Indiana (plot twist: not Texas!), this casual dining powerhouse has grown to 784 restaurants across 49 states and 10 countries.

At its core, Texas Roadhouse is selling you a night out with hand-cut steaks, unlimited peanuts, and country music at a price that won't make your wallet cry. Their business model is refreshingly straightforward: serve high-quality, made-from-scratch food in generous portions at reasonable prices, all while making you feel like you're at your local hometown favorite rather than a faceless chain.

The Three-Headed Restaurant Monster

The company operates three distinct concepts:

Texas Roadhouse - The OG moneymaker with 608 company-owned and 113 franchised locations. Picture this: rustic southwestern decor, country music, free peanuts where you can throw the shells on the floor (seriously), and servers who occasionally break into line dances. Their specialty? Hand-cut steaks that are aged and seasoned in-house, plus those addictive fresh-baked rolls with cinnamon butter that could probably qualify as a controlled substance.

Bubba's 33 - The sports bar younger sibling (49 locations) launched in 2013. Think burgers, pizza, wings, and walls lined with TVs showing sports. It's where you go when you want to watch the game but also eat something better than microwaved bar food.

Jaggers - The baby of the family (14 locations) and their entry into the fast-casual space. Offering drive-thru, carry-out, and dine-in service with a focused menu of burgers, chicken sandwiches, and milkshakes. It's like if Texas Roadhouse and Shake Shack had a baby.

The Secret Sauce: Owner-Operators

Here's where Texas Roadhouse gets interesting. Rather than just hiring managers, they create "managing partners" who:

Sign multi-year employment agreements

Make refundable deposits (they have skin in the game!)

Earn base salary PLUS a percentage of their restaurant's pre-tax profits

This creates an ownership mentality that's rare in chain restaurants. These partners are incentivized to run their restaurants like they own them because, in a way, they do! This model has been crucial to maintaining quality and service standards as they've expanded.

How They Measure Success

Texas Roadhouse obsesses over a few key metrics:

Average Unit Volume (AUV): $8.5 million ↗️ for Texas Roadhouse restaurants in 2024 (up from $7.6 million)

Comparable restaurant sales: 8.5% growth ↗️ in 2024

Guest traffic: 4.4% increase ↗️ in 2024

Restaurant margin: 17.1% ↗️ (up from 15.4%)

To-go sales: 12.8% of total sales ↗️ (slightly up from 12.6%)

When your average restaurant is pulling in $8.5 million annually and both traffic and check sizes are growing, you're clearly doing something right in an industry where many competitors struggle to maintain traffic.

Layer 2: Category Position 🏆

The Steakhouse Showdown

In the gladiatorial arena of casual dining, Texas Roadhouse has carved out a unique position. They're not trying to be the fanciest steakhouse (looking at you, Ruth's Chris), nor are they aiming to be the cheapest option. Instead, they've planted their flag firmly in the "best value for your dollar" territory.

Their main competitors include:

Outback Steakhouse: The Australian-themed rival with similar price points

LongHorn Steakhouse: Darden's entry in the casual steakhouse category

Applebee's and Chili's: General casual dining competitors

Local independent steakhouses: The hometown heroes Texas Roadhouse aims to outperform

What makes Texas Roadhouse stand out is that they've managed to create a national chain that feels local. While Applebee's awkwardly calls itself "your neighborhood grill & bar" despite being exactly the same in every neighborhood across America, Texas Roadhouse actually empowers local managing partners to engage with their communities.

Winning the Value War

The company has been consistently gaining market share, with comparable restaurant sales growth of 8.5% ↗️ in 2024, driven by both increased traffic (4.4% ↗️) and higher average checks (4.1% ↗️). This is particularly impressive in an industry where many competitors are seeing flat or declining traffic.

Their secret? They've positioned themselves as the value leader in the steakhouse category. When inflation hit and consumers became more price-conscious, Texas Roadhouse benefited from being the affordable option for a steak dinner. They've managed to increase prices modestly without driving customers away - a delicate balance many restaurants fail to achieve.

The To-Go Pivot

When the pandemic hit and dining rooms closed, many casual dining chains struggled to adapt. Texas Roadhouse, despite being known for its dine-in experience, successfully pivoted to to-go service. They've maintained that momentum, with to-go sales now representing 12.8% ↗️ of total sales, averaging nearly $20,000 per restaurant per week.

This ability to adapt while maintaining their core identity has helped them weather industry challenges better than many competitors. While some casual dining chains are closing locations, Texas Roadhouse opened 31 new company restaurants in 2024 alone.

Layer 3: Show Me The Money! 📈

Revenue Breakdown: It's Mostly Steaks

Texas Roadhouse generated a whopping $5.4 billion in total revenue in 2024, up 16.0% ↗️ from 2023. Let's break down where that money comes from:

Restaurant sales (99.4% of revenue): $5.34 billion ↗️

Texas Roadhouse: $5.01 billion ↗️ (93.3% of total)

Bubba's 33: $297.6 million ↗️ (5.5% of total)

Jaggers: Making up the remainder, but still small

Franchise royalties and fees (0.6% of revenue): $31.5 million ↗️

This includes royalties from 118 franchised restaurants and retail product royalties

Within restaurant sales, there are some interesting patterns:

Alcoholic beverages: 9.6% of restaurant sales (people love a beer with their steak)

To-go sales: 12.8% of restaurant sales ↗️ (averaging $19,940 weekly per restaurant)

Customer Demographics: Everyone Loves Steak

Texas Roadhouse appeals to a broad demographic swath - families, couples, groups of friends, and business diners. Their price point (average check around $20-25 per person) makes them accessible to middle-income consumers while still being perceived as a "treat" rather than an everyday dining option.

The company doesn't explicitly break down customer demographics, but their value proposition and locations (often in suburban areas and smaller cities) suggest they're particularly strong with:

Middle-income families looking for an affordable night out

Value-conscious diners who want quality food without fine dining prices

Suburban and rural customers (they're not concentrated in major urban centers)

Growth Drivers: More Stores, More Sales

Texas Roadhouse's growth comes from three main sources:

New restaurant openings: They added 31 company-owned restaurants in 2024, driving a 7.5% ↗️ increase in store weeks.

Comparable restaurant sales growth: Existing restaurants grew sales by 8.5% ↗️, driven by both:

Traffic growth: 4.4% ↗️ more customers

Check growth: 4.1% ↗️ higher average spending per customer

Concept expansion: While Texas Roadhouse remains the cash cow, they're investing in Bubba's 33 and Jaggers as future growth vehicles.

The company also benefits from strong seasonal patterns, with Q4 typically being their strongest quarter due to holiday dining and gift card sales. However, they're less seasonal than many restaurants, maintaining relatively consistent performance throughout the year.

Layer 4: Cash Rules Everything Around Me 💰

Margins: Getting Beefier

Texas Roadhouse has been impressively expanding margins in a challenging cost environment:

Restaurant margin: 17.1% ↗️ in 2024 (up from 15.4% in 2023)

Operating margin: 9.6% ↗️ in 2024 (up from 7.6% in 2023)

Net income margin: 8.1% ↗️ in 2024 (up from 6.6% in 2023)

This margin expansion is particularly impressive given the inflationary pressures on both food and labor costs. The company has managed this through:

Modest menu price increases (part of the 4.1% check growth)

Improved labor productivity

Higher sales volumes spreading fixed costs over more revenue

Cost Structure: Beef and People

The major cost categories as a percentage of restaurant sales:

Food and beverage: 33.4% ↘️ (down from 34.6%)

About half of this is beef costs (when your business is steaks, cattle prices matter!)

Labor: 33.1% ↘️ (down from 33.4%)

Despite wage inflation of 4.6% ↗️, they've improved productivity

Rent: 1.5% ↘️ (down from 1.6%)

Other operating expenses: 14.9% ↘️ (slightly down from 15.0%)

Includes utilities, repairs, marketing, etc.

G&A expenses: 4.2% ↘️ of total revenue (down from 4.3%)

The company's ability to reduce these costs as a percentage of sales while facing inflation is a testament to their operational discipline and the benefits of their managing partner model.

Cash Position: Loaded Baked Potato

Texas Roadhouse is sitting pretty with:

Cash and equivalents: $245.2 million as of December 31, 2024

Debt: Zero. Nada. Zilch. (They have a $300 million credit facility but no borrowings)

This strong balance sheet gives them tremendous flexibility to:

Fund new restaurant development (they expect to spend about $400 million on capital expenditures in 2025)

Return capital to shareholders through dividends and buybacks

Make strategic acquisitions (they just bought 13 franchise restaurants for $78 million)

Weather any economic storms that might come their way

Capital Allocation: Spreading the Wealth

The company balances growth investments with shareholder returns:

New restaurant development: Primary focus, with 31 new company restaurants in 2024

Dividends: $162.9 million paid in 2024, with an 11% ↗️ increase to $0.68 per share announced for 2025

Share repurchases: $79.8 million in 2024, with a new $500 million authorization

Acquisitions: Strategic purchases of franchise restaurants

Restaurant maintenance: Ongoing investments to keep existing locations fresh

This balanced approach has served shareholders well, with the stock significantly outperforming both the broader market and restaurant industry peers over the past several years.

Layer 5: What Do We Have to Believe? 📚

The Bull Case: Roadhouse Rules

To believe in Texas Roadhouse as a long-term investment, you need to believe:

The value proposition remains compelling: Their ability to offer high-quality food at moderate prices will continue to attract customers even as competitors try to copy their playbook.

The managing partner model is sustainable: This unique approach creates operational excellence that's hard for competitors to replicate. As long as they can keep finding and developing talented partners, they should maintain their edge.

Unit economics support continued expansion: With average unit volumes of $8.5 million ↗️ and restaurant margins of 17.1% ↗️, new restaurants generate strong returns on investment, justifying continued expansion.

Bubba's 33 and Jaggers can become meaningful growth drivers: While still small, these concepts could provide additional growth avenues as the Texas Roadhouse concept approaches saturation in the U.S.

They can navigate inflation without breaking their value promise: So far, they've managed modest price increases without losing customers, but this balancing act must continue.

The Bear Case: Potential Roadkill

The risks and challenges investors should consider:

Commodity price volatility: With beef representing about half of food costs, a significant spike in cattle prices could squeeze margins if they can't pass costs to consumers.

Labor cost pressures: The restaurant industry faces ongoing wage inflation and staffing challenges. While they've managed well so far, this remains a persistent headwind.

Concept saturation: With over 700 Texas Roadhouse locations, finding prime new locations becomes increasingly challenging.

Economic sensitivity: As a discretionary purchase, restaurant spending is vulnerable during economic downturns. Their value positioning helps, but they're not recession-proof.

Geographic concentration: 21% of company restaurants are in just two states (Texas and Florida), creating some regional risk.

Key Metrics to Watch

If you're invested or considering investing in TXRH, keep an eye on:

Comparable restaurant sales: Particularly the traffic component - are people still coming in greater numbers?

Restaurant-level margins: Can they maintain or expand margins despite cost pressures?

New unit performance: Are newly opened restaurants hitting target volumes?

Bubba's 33 and Jaggers metrics: Watch for increasing disclosure and improving economics as these concepts scale.

Beef prices: As a major input cost, significant movements can impact profitability.

The Bottom Line: Well-Done Business

Texas Roadhouse has built something special in the notoriously difficult restaurant industry. Their focus on operational excellence, value, and creating local connections has produced consistent results that few restaurant chains can match.

The managing partner model creates alignment throughout the organization that drives performance, while their disciplined approach to growth and capital allocation has rewarded shareholders. They've demonstrated resilience through various challenges, from the pandemic to inflation, emerging stronger each time.

For investors, Texas Roadhouse offers a rare combination in the restaurant space: growth, profitability, and a proven model with room to expand. While not without risks, the company's track record suggests they know how to navigate industry challenges while staying true to their core identity.

In a world of increasingly homogenized dining experiences, Texas Roadhouse has found success by focusing on the fundamentals: good food, good service, good value. Sometimes the simplest recipes are the most successful. Just like their steaks, this business is well-done indeed.

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.