The Bottom Line Upfront 💡

Starbucks $SBUX ( ▲ 3.52% ) is the undisputed king of premium coffee, operating 40,000+ locations globally and generating $36 billion in annual revenue. But the empire is showing cracks: customer traffic is declining, margins are compressing, and competition is intensifying. New CEO Brian Niccol (fresh from his Chipotle turnaround) faces the challenge of reigniting growth while maintaining profitability. The bull case hinges on international expansion, digital platform advantages, and enduring brand power. The bear case warns of market saturation, permanent behavioral shifts, and structural margin pressure. This is no longer a high-growth story—it's a mature company that needs to prove it can evolve with changing consumer habits while defending its premium positioning.

Partnership

Finance Headlines, Translated for Humans

Every week, 1440 zooms in on one timely business or finance theme—whether it’s a sudden Fed pivot, an IPO frenzy, or the hidden economics behind AI chips—and unpacks it with crystal-clear analysis. Expect a swift read grounded in hard data: straightforward charts, context that connects the dots, and zero partisan spin. We cut through industry jargon so you gain real insight, not marketing fluff, leaving you informed, confident, and ready to talk markets like a pro—all in one concise email.

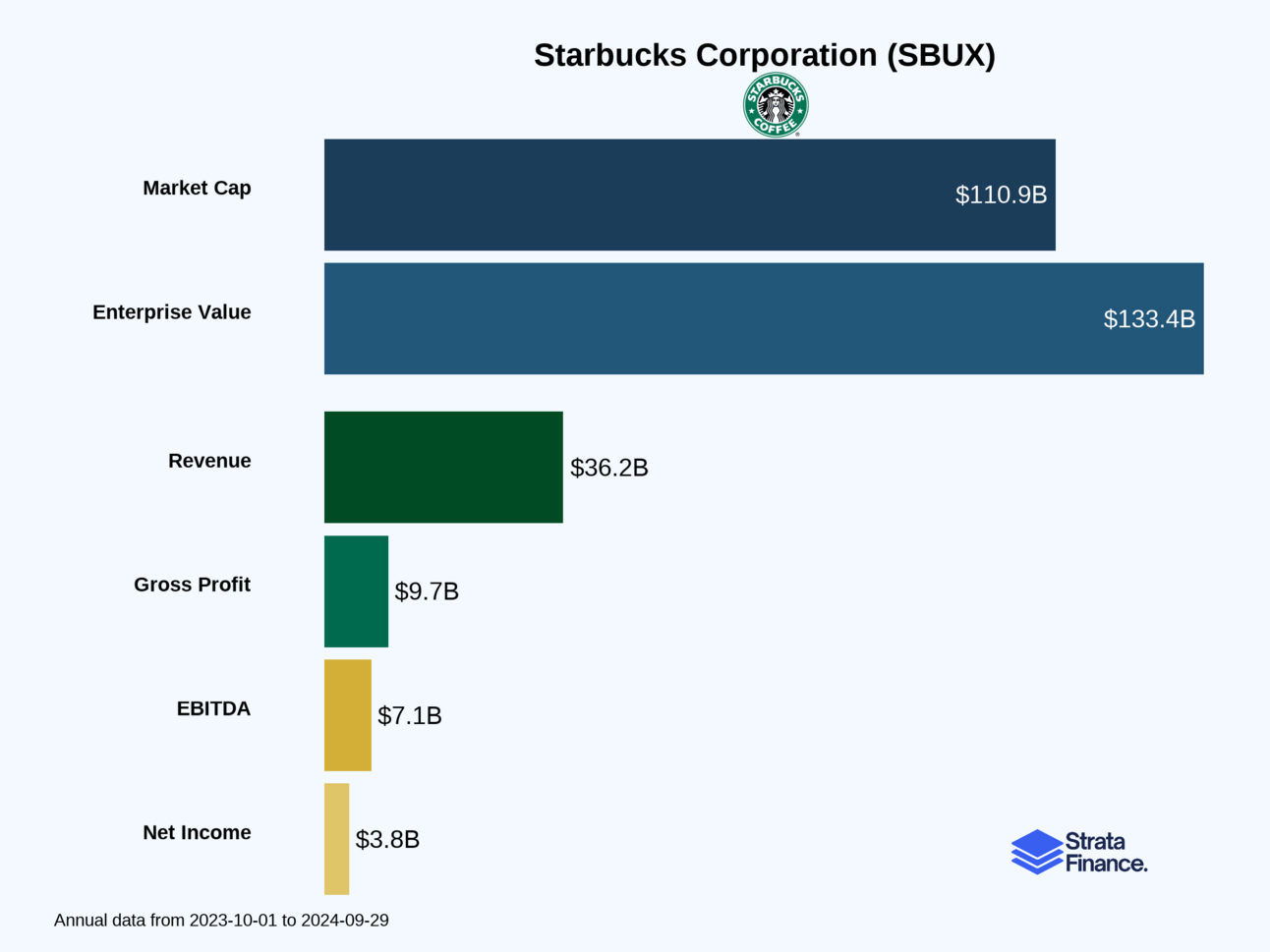

Strata Layers Chart

Layer 1: The Business Model 🏛️

Think of Starbucks as the McDonald's of coffee, but with better vibes and higher prices. Since 1985, they've transformed from a Seattle coffee roaster into a global caffeine empire operating in 87 countries. But here's the thing—Starbucks doesn't just sell coffee; they sell an experience. They call it the "third place" between home and work, which is fancy marketing speak for "a place where you can spend $6 on a latte and feel good about it."

How They Actually Make Money 💰

Starbucks operates three distinct money-making machines:

Company-Operated Stores (82% of revenue) 📍 These are the 21,018 stores where Starbucks calls all the shots. They own the real estate (or lease it), hire the baristas (sorry, "partners"), and keep all the profits. It's like owning your own restaurant versus franchising—more control, more risk, but way more upside when things go well.

Licensed Stores (12% of revenue) 🤝 Here's where Starbucks gets clever. They let other companies run Starbucks-branded stores (think airport locations or grocery store kiosks) while collecting royalties and selling them products. It's like being a landlord who also sells furniture—you get paid twice with minimal effort.

Channel Development (5% of revenue) 🛒 This is Starbucks playing the long game. They sell packaged coffee, bottled Frappuccinos, and other branded products through grocery stores and gas stations. The crown jewel here is their $7 billion partnership with Nestlé, which basically gave Nestlé the rights to sell Starbucks products globally in exchange for a massive upfront payment.

What's Actually in Your Cup ☕

The revenue breakdown from company stores tells the real story:

Beverages: 74% (Your daily caffeine fix)

Food: 23% (Those overpriced breakfast sandwiches)

Other: 3% (Mugs, beans, and impulse purchases)

Key Metrics That Matter 📊

Starbucks obsesses over these numbers, and so should you:

Comparable Store Sales (Comps) - This measures whether existing stores are selling more or less than last year. It's the retail equivalent of a report card. Currently showing ↘️ -2% in North America and ↘️ -4% internationally. Ouch.

Store Count Growth - They opened 2,161 new stores in fiscal 2024, because apparently the world needs more places to buy $5 coffee.

Digital Engagement - Their Starbucks Rewards program and mobile ordering platform are secret weapons. When customers prepay through their app, Starbucks essentially gets an interest-free loan.

Operating Margin - Currently at 15.0% ↘️ (down from 16.3%), which means they're spending more to make each dollar of revenue.

Layer 2: Category Position 🏆

Starbucks is basically the Apple of coffee—premium pricing, cult-like customer loyalty, and everyone else trying to copy them. But the coffee game has gotten a lot more competitive lately.

The Competition Landscape ⚔️

Direct Competitors:

Dunkin' - The scrappy underdog focused on speed and value ("America runs on Dunkin'")

Local Coffee Shops - The hipster threat with artisanal everything

McDonald's McCafé - Fast food giant trying to steal market share with cheaper options

Indirect Threats:

Market Position Reality Check 📈

Starbucks dominates through sheer scale and brand power. With over 40,000 locations worldwide, they're everywhere you need caffeine. Their competitive moats include:

Brand Recognition - That green mermaid logo is more recognizable than most country flags

Supply Chain Mastery - They control coffee sourcing from farm to cup

Digital Platform - Their app and loyalty program create sticky customers

Real Estate - Prime locations in high-traffic areas

But here's where it gets interesting (and concerning): fiscal 2024 showed cracks in the armor. Customer traffic declined significantly, forcing increased promotional activity. Translation: people are buying less coffee, so Starbucks had to offer more deals to get them in the door.

Recent Wins and Losses 🎯

Wins:

Still opening stores globally (2,161 new locations)

Strong brand loyalty in core markets

Digital platform continues growing

Challenges:

↘️ Traffic declines across key markets

Increased competition from value players

China market facing economic headwinds

Had to bring in a new CEO (Brian Niccol from Chipotle) to fix things

Layer 3: Show Me The Money! 📈

Let's break down how Starbucks turns coffee beans into shareholder beans.

Revenue Breakdown by Geography 🌍

North America (75% of revenue - $27.0B) 🇺🇸🇨🇦 This is Starbucks' cash cow, generating three-quarters of total revenue. Growth of ↗️ 2% in fiscal 2024, but that's mainly from new stores, not existing ones performing better. The market is getting saturated—there's probably a Starbucks within walking distance of wherever you're reading this.

International (20% of revenue - $7.3B) 🌏 The growth story that's currently more like a cautionary tale. Revenue declined ↘️ 2% in fiscal 2024, with China being particularly challenging. This segment has huge potential but faces economic volatility and local competition.

Channel Development (5% of revenue - $1.8B) 📦 The smallest but potentially most profitable segment. Revenue dropped ↘️ 7% after selling the Seattle's Best Coffee brand to Nestlé. Think of this as Starbucks' licensing empire—lower effort, higher margins.

Customer Behavior Patterns 👥

Here's what's really happening with Starbucks customers:

Transaction Trends: ↘️ Down 4% globally People are visiting less frequently. Whether it's economic pressure, work-from-home trends, or just coffee fatigue, fewer customers are walking through the door.

Average Ticket: ↗️ Up 2% globally When people do visit, they're spending more per trip. This is partly due to price increases (because inflation) and partly because of premium product mix.

Digital Adoption: Growing but not disclosed The Starbucks Rewards program and mobile ordering are increasingly important, but the company doesn't break out specific metrics. What we know: customers who use the app tend to visit more frequently and spend more.

Margin Analysis: The Profit Picture 💰

Operating Margin Pressure: 15.0% ↘️ (down 130 basis points) This is where things get spicy. Starbucks is spending more to generate each dollar of revenue due to:

Partner Investments - Higher wages and benefits (good for employees, tough on margins)

Promotional Activity - More deals to attract customers (necessary but margin-crushing)

Operational Deleverage - Fixed costs spread over fewer transactions

Cost Structure Breakdown:

Product & Distribution: 30.9% of revenue (down from 31.7% - actually improving!)

Store Operating: 42.3% of revenue (up from 40.9% - the problem area)

General & Administrative: 7.0% of revenue (steady)

Seasonality and Cyclicality 📅

Starbucks experiences moderate seasonal fluctuations:

Q2 (Winter) typically shows lower revenues

Q1 (Holiday season) benefits from gift card sales and seasonal drinks

Summer brings Frappuccino season and cold beverage sales

The stored value card program (gift cards) creates interesting cash flow dynamics. Customers essentially give Starbucks interest-free loans when they buy gift cards, improving working capital.

Layer 4: What Do We Have to Believe? 📚

Investing in Starbucks means betting on the future of premium coffee culture. Here's what bulls and bears are arguing about:

The Bull Case: ☕ Optimists Unite

For Starbucks to succeed long-term, you need to believe:

The Premium Coffee Market Will Keep Growing 📈 People will continue paying $5+ for coffee experiences versus making it at home. The "third place" concept remains relevant even in a work-from-home world.

International Expansion Has Legs 🌏 Despite current China challenges, emerging markets will eventually embrace Starbucks culture. The company has barely scratched the surface in many countries.

Digital Platform Creates Sustainable Advantages 📱 The Starbucks app, loyalty program, and mobile ordering create customer stickiness that competitors can't easily replicate. Data insights drive personalization and operational efficiency.

New CEO Brian Niccol Can Work His Magic 🎯 His track record transforming Chipotle suggests he can fix Starbucks' operational issues and reignite growth. The "Back to Starbucks" strategy focuses on core strengths.

Brand Power Endures 💪 Starbucks has built something special—a global lifestyle brand that transcends coffee. That green logo carries pricing power and customer loyalty that's hard to destroy.

The Bear Case: 🐻 Skeptics Speak Up

Here's what could go wrong:

Market Saturation is Real 🚫 North America might be tapped out. How many Starbucks does one city need? Growth will require taking share from competitors or expanding internationally, both challenging.

Consumer Behavior Has Permanently Shifted 🏠 Work-from-home trends, economic pressure, and changing habits could mean fewer daily coffee runs. The $6 latte might become a luxury, not a necessity.

Competition is Intensifying ⚔️ Everyone from McDonald's to local coffee shops is improving their game. Starbucks' premium positioning becomes harder to justify if alternatives get good enough.

China Risk is Underappreciated 🇨🇳 Their second-largest market faces economic headwinds, geopolitical tensions, and fierce local competition. If China doesn't work out, international growth plans crumble.

Margin Pressure is Structural 📉 Rising labor costs, increased competition, and promotional activity might permanently compress margins. The days of easy profitability growth could be over.

The Realistic Assessment 🎯

Starbucks is a mature company facing the classic innovator's dilemma. They built an incredible global brand and distribution network, but now they're struggling with the challenges of scale and market saturation.

The good news: They have massive competitive advantages, strong cash generation, and a new CEO with a proven turnaround track record. The brand remains powerful, and the international opportunity is real.

The concerning news: Customer traffic declines suggest fundamental challenges beyond just economic cycles. The company is spending heavily on promotions and wage increases while seeing fewer customers—that's not a sustainable combination.

Bottom Line: Starbucks isn't going anywhere, but the days of explosive growth are probably behind them. This is now a dividend-paying, mature company that needs to prove it can reignite customer enthusiasm while maintaining profitability. The next few quarters under CEO Niccol will be telling.

If you believe premium coffee culture is here to stay and that Starbucks can execute its "Back to Starbucks" strategy, there's probably value here. If you think the company's best days are behind it and competition will continue intensifying, you might want to get your caffeine fix elsewhere.

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.