The Bottom Line Upfront 💡

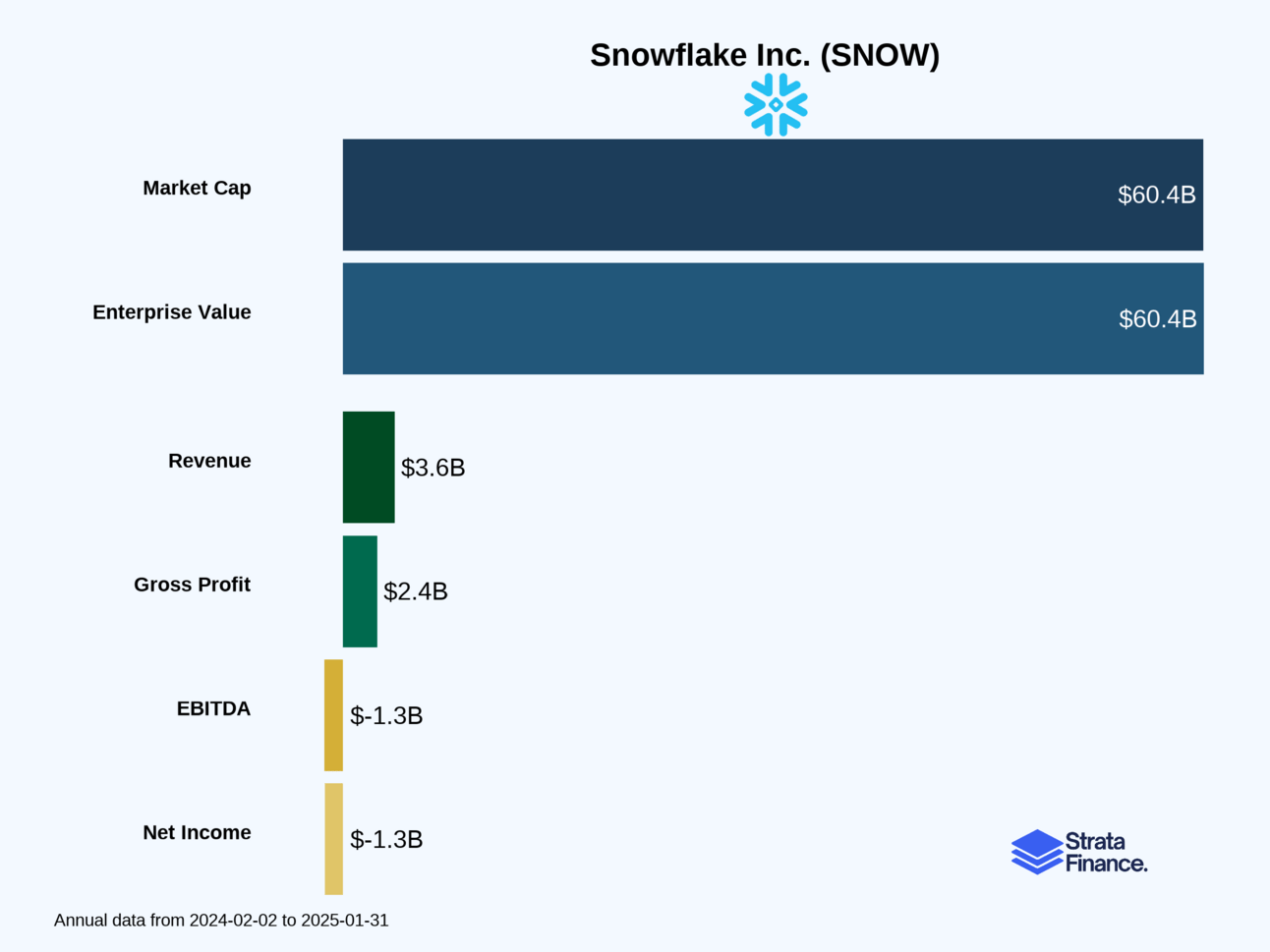

Snowflake $SNOW ( ▲ 7.48% ) has built a compelling data cloud platform that helps enterprises manage and analyze data across multiple cloud providers. With $3.7B in revenue growing at 29% and 580 customers spending over $1M annually, they've achieved strong product-market fit. However, they're burning $1.3B annually while competing against cloud giants Amazon, Microsoft, and Google who are both competitors and landlords. The slowing net revenue retention rate (126% vs 131%) suggests customers are optimizing usage amid economic uncertainty. This is a high-quality growth company with legitimate competitive advantages, but success depends on maintaining technological leadership while achieving profitability in an increasingly competitive market.

Partnership

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Strata Layers Chart

Layer 1: The Business Model 🏛️

What Does Snowflake Actually Do? 🤔

Imagine you're running a massive library where all the books are scattered across different buildings, written in different languages, and locked behind incompatible security systems. You know there's incredible knowledge in there, but good luck finding what you need when you need it. That's essentially the data problem Snowflake solves for businesses.

Snowflake operates what they call the "AI Data Cloud" – think of it as the ultimate data translator and organizer that sits on top of major cloud providers (AWS, Microsoft Azure, and Google Cloud). Instead of forcing companies to choose one cloud provider and get locked in, Snowflake lets them work across all three while keeping their data unified and accessible.

The Money Machine 💰

Here's where Snowflake gets clever with their business model. Unlike traditional software companies that force you into rigid subscription tiers (looking at you, Adobe), Snowflake operates like a utility company. You pay for what you actually use:

Compute resources: Based on the type of processing power used and how long you use it

Storage: Charged by average terabytes per month of data stored

Data transfer: Based on how much data you move around and between which regions

Most customers (about 97% of revenue) sign capacity agreements lasting 1-4 years where they commit to spending a certain amount, but here's the beautiful part for Snowflake – customers almost always exceed their initial commitments as they discover new ways to use the platform. It's like signing up for a gym membership and actually going every day instead of just January.

The Platform's Five Superpowers 🦸♂️

Analytics 📊: Traditional business intelligence and reporting, but faster and more flexible

Data Engineering 🔧: Building and managing data pipelines (the plumbing that moves data around)

AI 🤖: The hot new category where they help companies build AI applications and process unstructured data

Applications 📱: Letting customers build data-powered apps or embed Snowflake into existing software

Collaboration 🤝: The secret sauce – letting companies securely share data with partners, customers, and suppliers

Key Metrics That Matter 📏

Snowflake tracks several metrics that tell the real story:

Net Revenue Retention Rate: Currently 126% ↘️ (down from 131%), meaning existing customers are still growing their usage, just not as aggressively as before

Customers spending $1M+: 580 ↗️ (up from 455), showing they're landing bigger fish

Forbes Global 2000 customers: 745 ↗️ (up from 710), proving they can compete for enterprise deals

Remaining Performance Obligations (RPO): $6.9B ↗️, representing contracted future revenue

The slight decline in net revenue retention is worth watching – it suggests customers are being more careful with their spending, which makes sense given the economic environment.

Layer 2: Category Position 🏆

David vs. The Goliaths 🪨

Snowflake faces some intimidating competition. Their primary rivals are the cloud computing giants themselves:

Amazon Web Services (AWS): The 800-pound gorilla with Redshift and other data services

Microsoft Azure: Pushing hard with Synapse Analytics and their integrated Office ecosystem

Google Cloud Platform: Leveraging BigQuery and their AI/ML expertise

These aren't just competitors – they're also Snowflake's landlords, since Snowflake runs on their infrastructure. It's like opening a restaurant inside a mall owned by McDonald's, Burger King, and KFC. Awkward? Absolutely. Impossible? Not necessarily.

Snowflake's Secret Weapons 🗡️

What keeps Snowflake competitive against these behemoths?

Cloud Agnostic Architecture: While AWS wants you locked into AWS and Microsoft wants you married to Azure, Snowflake lets you play the field. You can run workloads across all three clouds seamlessly.

Purpose-Built for Cloud: Unlike legacy database companies trying to retrofit old technology, Snowflake was born in the cloud. Their architecture separates compute from storage, allowing instant scaling that traditional databases can't match.

The Network Effect: The more customers use Snowflake, the more valuable their data marketplace becomes. It's like eBay – the platform gets better as more people join.

Market Position Reality Check 📊

Snowflake is definitely the scrappy underdog here. While they're growing fast (29% revenue growth ↗️), they're still burning cash ($1.3B net loss) while investing heavily in R&D (49% of revenue) and sales & marketing (46% of revenue). They're essentially in an arms race with companies that have much deeper pockets.

The good news? They're winning meaningful enterprise customers and those customers are expanding their usage over time. The concerning news? The expansion rate is slowing, suggesting customers are becoming more price-conscious.

Layer 3: Show Me The Money! 📈

Revenue Breakdown 💵

Snowflake's revenue story is refreshingly simple:

Product Revenue: $3.5B (95% of total) ↗️ +30% growth

Professional Services: $164M (5% of total) ↗️ +17% growth

The vast majority comes from their core platform, which is exactly what you want to see. Professional services are typically lower-margin add-ons that help with implementation.

Geographic Mix 🌍

United States: $2.8B (76% of revenue)

EMEA: $575M (16% of revenue)

Asia-Pacific: $188M (5% of revenue)

Other Americas: $102M (3% of revenue)

They're still heavily dependent on the US market, which presents both risk (concentration) and opportunity (international expansion).

Customer Economics 💰

Here's where things get interesting. Snowflake has built a beautiful customer acquisition and expansion machine:

580 customers spending over $1M annually ↗️ (up from 455)

110 customers spending over $5M annually

39 customers spending over $10M annually

These big customers represent about 67% of total product revenue, showing Snowflake's ability to land and expand within large enterprises.

Layer 4: What Do We Have to Believe? 📚

The Bull Case: Why Snowflake Could Soar 🚀

For Snowflake to justify its valuation and continue growing, you need to believe:

The Data Explosion Continues: Every business is becoming a data business, and the amount of data companies generate will keep growing exponentially. If this trend continues, Snowflake's addressable market expands dramatically.

Multi-Cloud Wins: Companies will increasingly want to avoid vendor lock-in and use multiple cloud providers. Snowflake's cloud-agnostic approach becomes more valuable over time, not less.

AI Drives Consumption: As companies build more AI applications, they'll need platforms like Snowflake to manage and process the massive datasets required. Their Cortex AI features could become a major growth driver.

Network Effects Accelerate: The Snowflake Marketplace and data sharing capabilities create a flywheel where more customers attract more data providers, making the platform more valuable for everyone.

International Expansion: With 76% of revenue still coming from the US, there's massive room for growth in Europe, Asia, and other markets.

Path to Profitability: The company can eventually moderate their growth investments and achieve profitability while maintaining healthy growth rates.

The Bear Case: Why This Could Go Sideways 📉

The skeptical view requires believing:

The Big Clouds Fight Back: AWS, Microsoft, and Google have unlimited resources and could decide to make Snowflake's life very difficult through pricing, feature competition, or even restricting access to their infrastructure.

Economic Sensitivity: The declining net revenue retention rate (126% vs 131%) suggests customers are already optimizing their usage. In a prolonged economic downturn, this trend could accelerate.

Profitability Mirage: With $1.3B in losses and massive ongoing investments required to stay competitive, the path to profitability might be longer and more expensive than investors expect.

AI Disruption: While AI could drive growth, it could also disrupt Snowflake's business model. New AI-native platforms might emerge that make Snowflake's architecture look outdated.

Customer Concentration: Heavy dependence on large enterprise customers means losing a few big accounts could significantly impact growth.

Valuation Reality: At current levels, the stock might already price in a lot of future success, leaving little room for error.

The Bottom Line Assessment 🎯

Snowflake has built something genuinely valuable – a platform that solves real problems for large enterprises in an elegant way. Their customer metrics show strong product-market fit, and their technology architecture provides legitimate competitive advantages.

However, they're fighting an uphill battle against competitors with vastly superior resources, while burning significant cash in an uncertain economic environment. The slowing net revenue retention rate is a yellow flag that bears watching.

This is a classic "growth at a reasonable price" decision. If you believe in the long-term data and AI trends, and you think Snowflake can maintain their technological edge while eventually achieving profitability, the investment case is compelling. If you're worried about competition from the cloud giants or think the current valuation already assumes too much future success, you might want to wait for a better entry point.

The company is definitely not going anywhere – they've built a position that is too strong with too many large customers. The question is whether they can grow into their valuation while fending off increasingly aggressive competition. That's the bet you're making with SNOW. 🎲

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.