The Bottom Line Upfront 💡

Salesforce $CRM ( ▲ 1.9% ) remains the undisputed CRM leader with strong fundamentals, but faces a critical inflection point as AI and intensifying competition from Microsoft could either propel them to new heights or force margin compression. The stock appears fairly valued at current levels, with success hinging on Agentforce adoption and platform expansion.

Sponsorship

Still searching for the right CRM?

Attio is the AI CRM that builds itself and adapts to how you work. With powerful AI automations and research agents, Attio transforms your GTM motion into a data-driven engine, from intelligent pipeline tracking to product-led growth.

Instead of clicking through records and reports manually, simply ask questions in natural language. Powered by Universal Context—a unified intelligence layer native to Attio—Ask Attio searches, updates, and creates with AI across your entire customer ecosystem.

Teams like Granola, Taskrabbit, and Snackpass didn't realize how much they needed a new CRM. Until they tried Attio.

Strata Layers Chart

Layer 1: The Business Model 🏛️

Think of Salesforce as the digital backbone for how companies manage their relationships with customers. Instead of juggling spreadsheets, sticky notes, and prayer to track sales leads, customer service tickets, and marketing campaigns, businesses use Salesforce's cloud-based platform to organize everything in one place.

Here's the genius of their model: Salesforce operates like a massive digital apartment complex where each customer gets their own secure unit, but everyone shares the same underlying infrastructure (elevators, plumbing, security). This "multi-tenant" approach lets them spread costs across thousands of customers while keeping everyone's data separate and secure.

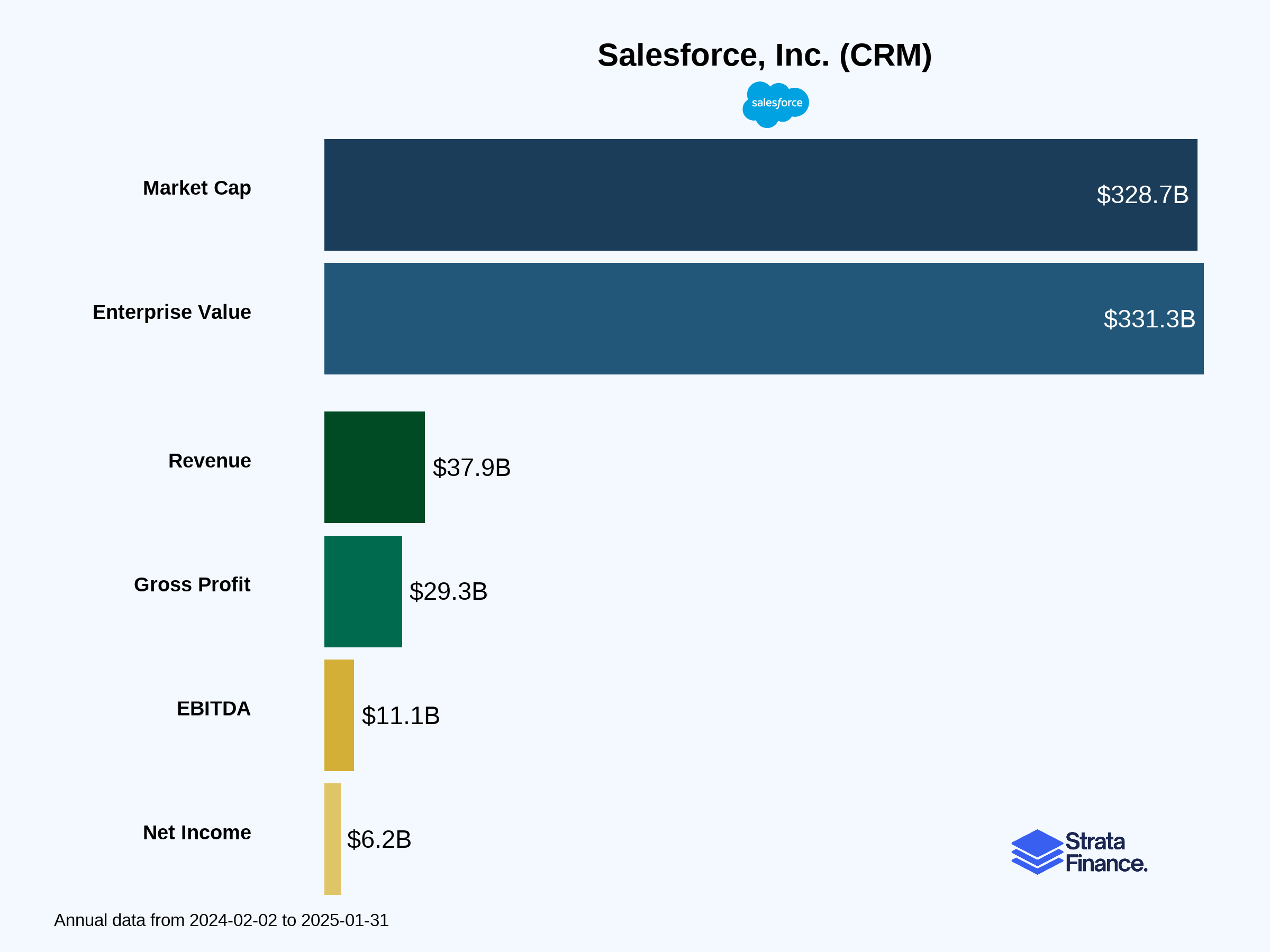

The Money Machine: Salesforce makes 94% of their $37.9B revenue from subscriptions – think Netflix, but for business software. Companies pay monthly or annual fees to access their platform, creating that beautiful recurring revenue that makes CFOs sleep better at night. The remaining 6% comes from professional services (basically, consultants who help implement the software for complex enterprise deployments).

The Product Portfolio: Salesforce has evolved from a simple CRM into what they call a "unified platform" with several key offerings:

Sales (23% of revenue): Helps sales teams track leads and close deals

Service (25% of revenue): Customer support and field service management

Platform & Other (21% of revenue): The underlying infrastructure and development tools

Marketing & Commerce (15% of revenue): Email campaigns, e-commerce, and customer journeys

Integration & Analytics (16% of revenue): Includes Tableau for data visualization and MuleSoft for connecting different systems

The New Hotness: In late 2024, they launched Agentforce – AI agents that can handle customer inquiries and business tasks autonomously. Think of it as having a digital workforce that never calls in sick and works 24/7.

Key Internal Metrics: Salesforce obsesses over their customer attrition rate (currently 8%, excluding Slack self-service), remaining performance obligation ($63.4B in contracted future revenue), and their ability to expand within existing accounts through cross-selling.

Key Takeaway: Salesforce has built a subscription-based platform that becomes more valuable as customers use more of its integrated services, creating strong recurring revenue and customer stickiness.

Layer 2: Category Position 🏆

Salesforce sits atop the CRM mountain, but the view isn't as peaceful as it used to be. They're the undisputed leader in cloud-based CRM, but competition is heating up from multiple directions.

The Heavyweight Bout: Microsoft is their biggest threat with Dynamics 365, leveraging their Office 365 dominance to bundle CRM capabilities. Oracle and SAP remain formidable in the enterprise space, while Adobe has carved out a strong position in marketing automation. Then there are the scrappy upstarts like HubSpot targeting small and medium businesses with simpler, cheaper solutions.

Salesforce's Competitive Moats:

First-mover advantage: They pioneered cloud CRM when competitors were still selling CD-ROMs

Platform ecosystem: Their AppExchange marketplace has thousands of third-party apps, creating network effects

Data integration: Their Data Cloud unifies customer information across systems, making switching painful

AI leadership: Agentforce represents a significant leap ahead of competitors in autonomous business processes

Recent Battlefield Updates: The AI arms race is real. While everyone's adding AI features, Salesforce has built AI deep into their platform architecture. Their recent acquisitions (Own Company for $2.1B, plus smaller deals) show they're not sitting still. However, Microsoft's bundling strategy and Google's enterprise push are forcing Salesforce to fight harder for new customers.

Market Share Reality Check: Salesforce dominates cloud CRM but faces pressure in adjacent markets. Their challenge isn't losing existing customers (8% attrition is quite good) – it's winning new ones as the market matures and competition intensifies.

Key Takeaway: Salesforce remains the CRM king, but they're fighting a multi-front war against tech giants with deeper pockets and different competitive strategies.

Layer 3: Show Me The Money! 📈

Salesforce's financial story is one of a maturing growth company learning to balance expansion with profitability – and they're finally nailing it.

Revenue Breakdown by Geography:

Americas: $25.1B (66% of total) ↗️

Europe: $8.9B (24% of total) ↗️

Asia Pacific: $3.9B (10% of total) ↗️

All regions are growing, with Asia Pacific leading at 12% growth, showing their international expansion is working.

The Subscription Goldmine: That 94% subscription revenue ($35.7B) is the holy grail of business models. It's predictable, recurring, and grows as customers add more users and services. The remaining $2.2B from professional services actually declined 4% ↘️ as customers increasingly handle implementations themselves or through partners.

Margin Magic: Here's where the story gets exciting. Operating margin jumped from 14% to 19% ↗️ in fiscal 2025, showing they can grow efficiently. This improvement came from:

Sales & Marketing: 35% of revenue (down from 37%) – they're getting more efficient at customer acquisition

R&D: 15% of revenue (steady) – continued innovation investment

General & Administrative: 7% of revenue (flat) – good cost control

The Cash Generation Machine: Free cash flow margin hit 32.8% ↗️, up from 27.3% the prior year. They generated $13.1B in operating cash flow, which funded $7.8B in share buybacks and $1.5B in dividends. That's returning serious cash to shareholders while still investing in growth.

Customer Economics: With 8% attrition rate, they're retaining 92% of customers annually. More importantly, they're expanding within existing accounts through cross-selling additional products. This "land and expand" strategy is why their remaining performance obligation (contracted future revenue) grew 11% to $63.4B ↗️.

Seasonality Quirks: Q4 is their strongest quarter for new business and renewals (enterprise buying patterns), which makes Q1 their biggest cash collection quarter. Q3 is typically their weakest for cash flow.

Key Takeaway: Salesforce has cracked the code on profitable growth, generating massive cash flows while maintaining strong customer retention and expanding their platform reach.

Layer 4: Long-Term Valuation (DCF Model) 💰

The Verdict: Fairly Valued (with a wide range of outcomes)

Scenario | Fair Value | vs Current Price ($184) |

|---|---|---|

Conservative | $128 | -32.5% ↘️ |

Optimistic | $227 | +19.5% ↗️ |

Key Valuation Drivers:

AI monetization success: The optimistic case assumes Agentforce drives significant margin expansion and customer growth

Competitive pressure: Conservative case factors in market share erosion to Microsoft and other rivals

Free cash flow trajectory: Current 32.8% FCF margins could expand to 41%+ with AI automation or contract under competitive pressure

Recommendation: HOLD with a target range of $128-$227. The current price sits right in the middle, suggesting the market is pricing in moderate success with AI initiatives while acknowledging competitive risks.

Layer 5: What Do We Have to Believe? 📚

Bull Case 🚀

AI Revolution Pays Off: Agentforce becomes a game-changer that justifies premium pricing and drives massive productivity gains for customers

Platform Dominance: Their unified approach wins against point solutions, and customers increasingly consolidate on Salesforce for all customer-facing operations

International Expansion: Significant growth runway in underserved global markets, especially as businesses worldwide digitize

Bear Case 🐻

Microsoft Steamroller: Bundling Dynamics 365 with Office 365 makes it too convenient and cheap for customers to switch

Economic Sensitivity: Enterprise software spending gets cut during downturns, and Salesforce's premium pricing becomes a target

AI Commoditization: AI features become table stakes rather than differentiators, eroding their competitive moats

The Bottom Line: Salesforce has built an impressive business with strong fundamentals, but they're at an inflection point. Success with AI and maintaining platform leadership will determine whether they continue growing at premium valuations or face margin compression from increased competition. The wide valuation range reflects this uncertainty – they could be worth significantly more or less depending on execution over the next few years.

What to Watch 👀

Critical Metrics to Monitor:

Free Cash Flow Margin: Currently 32.8% – watch for expansion toward 35%+ as AI drives efficiency, or contraction below 30% if competition intensifies

Customer Attrition Rate: Holding steady at 8% – any increase above 10% would signal competitive pressure

Remaining Performance Obligation Growth: Currently 11% – sustained double-digit growth indicates healthy demand

Upcoming Catalysts:

Agentforce Adoption Metrics: Look for customer count, usage statistics, and pricing power in quarterly earnings

Microsoft Dynamics Market Share: Watch for enterprise deal wins/losses in head-to-head competitions

International Revenue Acceleration: Asia Pacific growth above 15% would validate global expansion strategy

Competitive Developments:

AI Feature Parity: Monitor how quickly competitors match Agentforce capabilities

Pricing Pressure: Watch for discounting or bundling strategies that could impact margins

Large Enterprise Renewals: Track retention rates among Fortune 500 customers as contracts come up for renewal

The next 12-18 months will be crucial for determining whether Salesforce can maintain its premium valuation through AI innovation or if competitive pressures force a more modest growth trajectory.

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.