The Bottom Line Upfront 💡

Royal Caribbean $RCL ( ▲ 6.72% ) has built an impressive floating hospitality empire with strong competitive advantages and delivered exceptional 2024 results. However, the stock appears significantly overvalued at current levels, trading at a massive premium that prices in years of perfect execution with little room for error.

Sponsorship

AI in HR? It’s happening now.

Deel's free 2026 trends report cuts through all the hype and lays out what HR teams can really expect in 2026. You’ll learn about the shifts happening now, the skill gaps you can't ignore, and resilience strategies that aren't just buzzwords. Plus you’ll get a practical toolkit that helps you implement it all without another costly and time-consuming transformation project.

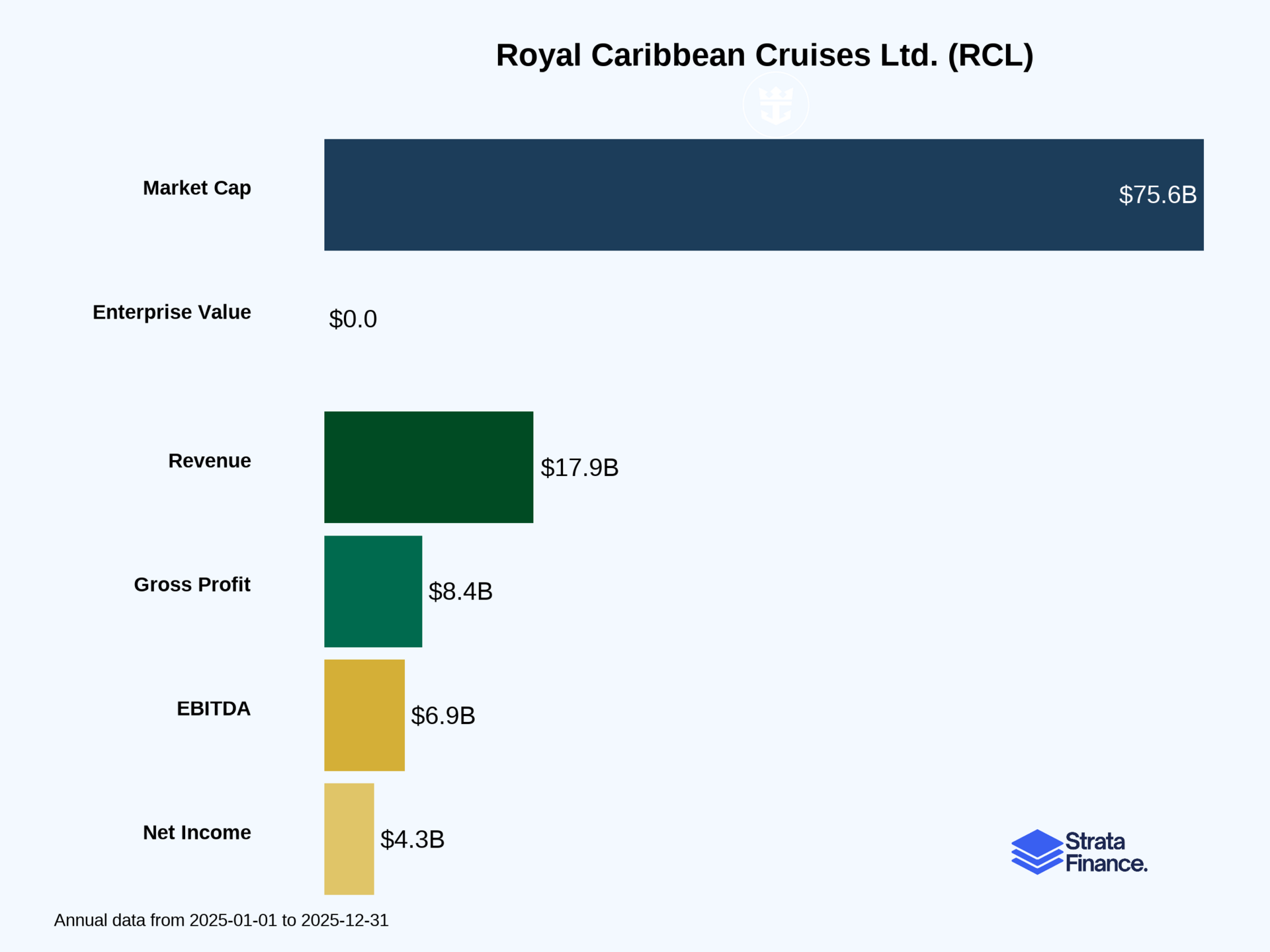

Strata Layers Chart

Layer 1: The Business Model 🏛️

Think of Royal Caribbean as the Disney World of the seas, but with a twist – their theme parks float and can relocate based on weather, demand, and where the money is. Founded in 1968, RCL has evolved into a floating hospitality empire that operates 68 ships across three main brands: Royal Caribbean (the mass-market crowd-pleaser), Celebrity Cruises (for folks who want to feel fancy), and Silversea Cruises (where champagne flows like water and your butler has a butler).

The business model is beautifully simple: get people on boats, sail them to pretty places, and make money both from the ticket and everything they buy once they're trapped... er, enjoying their vacation at sea. It's like running a city that moves – complete with restaurants, shops, casinos, spas, and entertainment venues – except your customers can't easily leave to spend money elsewhere.

Here's where it gets clever: RCL operates what's essentially a two-part revenue machine. First, they sell you the cruise ticket (69.8% of revenue in 2024 ↗️), which covers your floating hotel room, meals, and transportation between tropical destinations. Then comes the real profit magic – onboard spending (30.2% of revenue ↗️). Once you're on the ship, they've got you for 7-14 days with nowhere else to spend your vacation budget. Specialty dining, drinks, spa treatments, shore excursions, casino games, photos, and that irresistible duty-free shopping – it all adds up.

The company measures success through metrics like Available Passenger Cruise Days (APCD – basically how many bed-nights they can sell), occupancy rates (108.5% in 2024, meaning some cabins had three people ↗️), and Net Yields (revenue per APCD, which grew 11.5% in 2024 ↗️). They also obsess over "load factors" and onboard spending per passenger – because a full ship of big spenders is the holy grail.

What makes this model particularly smart is the asset flexibility. Unlike Disney, which can't move Magic Kingdom to Florida when California gets expensive, RCL can redeploy ships based on seasonal demand, political situations, or economic conditions. Caribbean in winter, Mediterranean in summer, and Alaska when it's not frozen solid.

Key Takeaway: RCL runs floating cities that generate revenue from both tickets and captive-audience spending, with the flexibility to chase demand around the globe.

Layer 2: Category Position 🏆

Royal Caribbean sits pretty as the innovation king in a cruise industry that's surprisingly concentrated. The big players are Carnival Corporation (the Walmart of cruising with multiple brands), Norwegian Cruise Line Holdings, MSC Cruises, Disney Cruise Line, and Viking. Together, these companies control most of the world's 432 cruise ships and the 36 million passengers who sailed in 2024.

RCL's secret sauce? They're the industry's tech nerds and experience innovators. While competitors focus on price or luxury, Royal Caribbean builds ships with rock-climbing walls, surf simulators, skydiving simulators, and even bumper cars at sea. Their newest Icon-class ships are basically floating amusement parks with the largest waterparks at sea. It's like they asked, "What would happen if we crossed a cruise ship with a theme park and added some engineering magic?"

The competitive moat gets deeper with their private destinations strategy. Perfect Day at CocoCay in the Bahamas isn't just a beach – it's a private island playground that only Royal Caribbean guests can access. Try copying that, competitors! They're expanding this concept with Perfect Day Mexico (opening 2027) and Royal Beach Club locations in Nassau and Cozumel. It's vertical integration at its finest.

Market share-wise, RCL's combined fleet represents about 163,200 berths out of the industry's 706,000 total capacity. That's roughly 23% market share, making them a major player but not dominant. The industry still has massive growth potential – cruise penetration rates are only 6% in North America, 1.7% in Europe, and a tiny 0.09% in Asia-Pacific. Translation: lots of people haven't discovered the joy (or horror, depending on your perspective) of being on a floating city for a week.

Recent wins include achieving their ambitious "Trifecta" financial goals 18 months early and successfully refinancing $6.1 billion in high-cost debt. They've also eliminated all secured debt and achieved investment-grade metrics – basically graduating from financial summer school.

Key Takeaway: RCL leads through innovation and unique experiences in a concentrated industry with massive untapped global growth potential.

Layer 3: Show Me The Money! 📈

Royal Caribbean's financial performance in 2024 was nothing short of spectacular – the kind of numbers that make CFOs do happy dances in boardrooms. Revenue jumped 18.6% to $16.5 billion ↗️, with both ticket sales ($11.5B ↗️) and onboard spending ($5.0B ↗️) firing on all cylinders.

The revenue mix tells an interesting story. Passenger tickets (69.8% of revenue) are essentially the cover charge to get into their floating entertainment complex. But the real profit party happens with onboard revenue (30.2%), where margins are juicier than a perfectly grilled steak. Think about it – once you're on the ship, where else are you going to buy a cocktail or get a massage?

Geographically, North America still drives the bus with $10.6B in revenue (64% of total), but Asia/Pacific is the growth story, jumping from $372M in 2022 to $1.4B in 2024 ↗️. Europe contributed $2.7B, staying relatively stable. The company sources 75% of passengers from the U.S., with the remaining 25% coming from international markets – plenty of room to grow globally.

The operational metrics are impressive: they carried 8.6 million passengers in 2024 ↗️ (up from 7.6M in 2023), with occupancy hitting 108.5% ↗️. That's right – more than 100% occupancy because some cabins fit three people. Net yields (revenue per available passenger cruise day) grew 11.5% ↗️, showing strong pricing power.

On the cost side, cruise operating expenses hit $8.7B ↗️, but the company maintained discipline with net cruise costs excluding fuel growing only 6.8% per available passenger cruise day. The big expense categories include payroll ($1.3B), fuel ($1.2B), and "other operating" costs ($2.1B) – basically everything it takes to run floating cities.

Margins expanded beautifully: operating margin hit 24.9% ↗️ (up from 20.7% in 2023), and net income margin reached 17.5% ↗️. The company generated $2.9B in net income ↗️, or $10.94 per share – a massive improvement from $6.31 per share in 2023.

Seasonality is real but manageable. The business peaks during summer months when families vacation, and they cleverly redeploy ships to warmer climates during Northern Hemisphere winters. It's like running a migratory business that follows good weather and tourist dollars.

Key Takeaway: RCL delivered exceptional 2024 results with strong revenue growth, expanding margins, and impressive pricing power across both ticket sales and onboard spending.

Layer 4: Long-Term Valuation (DCF Model) 💰

The Verdict: SIGNIFICANTLY OVERVALUED 🚨

Scenario | Fair Value | vs Current Price ($325) |

|---|---|---|

Conservative | $68 | -79% overvalued |

Optimistic | $117 | -64% overvalued |

Yikes. Even in our most optimistic scenario, RCL appears to be trading at a massive premium to intrinsic value. The DCF analysis suggests the stock is priced for absolute perfection – and then some.

Key assumptions driving this valuation:

High discount rate: RCL's beta of 1.94 reflects the cyclical, capital-intensive nature of the cruise business

Capital intensity reality check: Unlike tech companies, cruise lines need massive ongoing investments in ships that depreciate over 30+ years

Cyclical headwinds: The business is highly sensitive to economic downturns and discretionary spending cuts

Investment recommendation: AVOID – The current price appears disconnected from fundamental value, suggesting significant downside risk when reality sets in.

Layer 5: What Do We Have to Believe? 📚

Bull Case 🚀

Global cruise penetration explosion: Believe that cruise adoption will accelerate dramatically in underserved markets like Asia-Pacific (currently 0.09% penetration) and that RCL will capture disproportionate share

Pricing power permanence: Trust that RCL's innovation leadership and private destinations create sustainable competitive advantages that allow continued premium pricing

Perfect execution: Have faith that management will flawlessly execute their expansion plans, maintain operational excellence, and successfully navigate economic cycles

Bear Case 🐻

Economic sensitivity reality: Cruises are pure discretionary spending that gets cut first during recessions, and the highly leveraged model amplifies downturns

Capital allocation concerns: The massive capital requirements for new ships and destinations may not generate adequate returns, especially if competition intensifies

Valuation gravity: Current prices assume everything goes right for years – any stumble could trigger significant multiple compression

The Bottom Line: RCL has built an impressive business with strong competitive advantages and delivered exceptional recent results. However, the stock price appears to have sailed far ahead of fundamental value, pricing in a perfect storm of growth, margin expansion, and flawless execution. Smart investors might want to wait for calmer seas and a more reasonable entry point.

What to Watch 👀

Key Metrics to Monitor:

Net Yields growth: If this drops below 5% annually, it signals pricing pressure or demand weakness

Occupancy rates: Watch for sustained drops below 100% – it means they're struggling to fill ships

Debt-to-capital ratio: Currently improving, but any reversal above 60% could signal financial stress

Upcoming Catalysts:

New ship deliveries: Star of the Seas (Q3 2025) and Celebrity Xcel (Q4 2025) – watch booking trends and yield premiums

Private destination openings: Royal Beach Club Nassau (2025) and Perfect Day Mexico (2027) – monitor guest satisfaction and incremental revenue

Competitive Developments:

Industry capacity additions: Track if competitors are adding ships faster than demand growth

Economic indicators: Watch consumer confidence, unemployment rates, and discretionary spending trends – cruises get cut when wallets tighten

Fuel costs and environmental regulations: Both can significantly impact operating costs and capital requirements

The cruise industry is cyclical, capital-intensive, and sensitive to economic conditions. RCL has proven they can execute well in good times, but the current valuation leaves little room for error. Proceed with caution! ⚠️

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.