The Bottom Line Upfront 💡

Progressive Corporation $PGR ( ▼ 2.54% ) has built America's #2 auto insurance business by embracing the customers others reject and pricing risk better than anyone else. Through decades of collecting driving behavior data via their Snapshot program, they've created a competitive moat that generates $74.4 billion in annual premiums while maintaining superior profitability. Their "Destination Era" strategy aims to become a one-stop insurance shop, expanding beyond auto into property insurance. While climate risks and potential autonomous vehicle disruption pose long-term challenges, Progressive's data analytics advantage and operational excellence make them a formidable player in the evolving insurance landscape.

Partnership

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

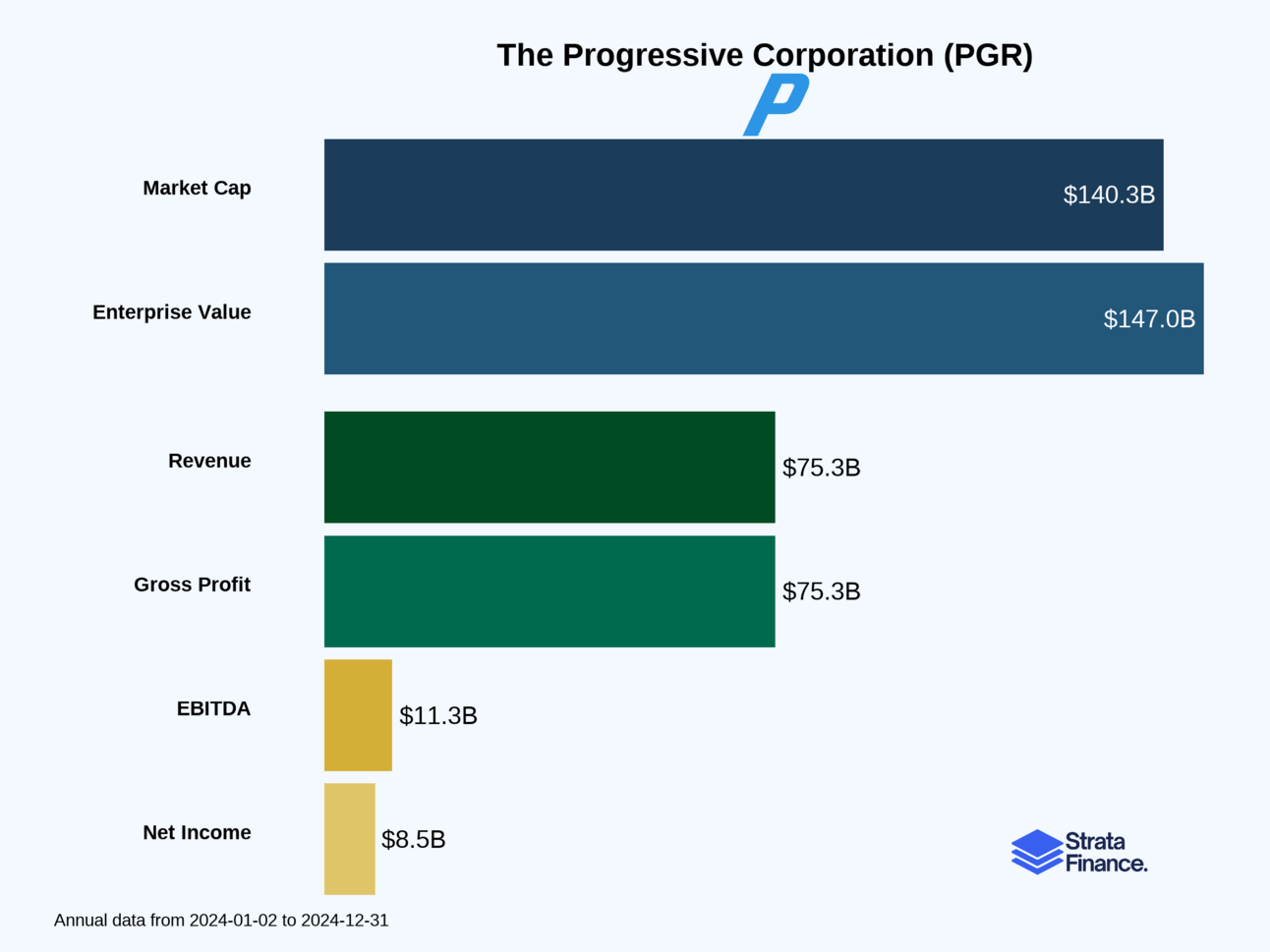

Strata Layers Chart

Layer 1: The Business Model 🏛️

Think of Progressive as the insurance company that figured out how to make money from the drivers everyone else runs away from. While other insurers are busy rejecting customers who have a few dings on their record, Progressive says "Hold my beer" and writes them a policy – but at the right price.

What They Actually Do 💼

Progressive is essentially a sophisticated risk-pricing machine wrapped in an insurance company. They've built their entire business around one core insight: instead of avoiding risky customers, use better data and analytics to price risk more accurately than anyone else. It's like being the bookie who actually knows which horse is going to win.

Their business breaks down into two main chunks:

Personal Lines (85% of premiums ↗️): This is your everyday car insurance, plus some fun stuff like motorcycle, RV, and boat coverage. They also recently jumped into home and renters insurance because, apparently, insuring your car wasn't exciting enough. Personal auto insurance alone represents 95% of their personal vehicle business, making them the #2 auto insurer in America.

Commercial Lines (15% of premiums): Think business vehicles, from the plumber's van to the trucker's 18-wheeler. They're actually #1 in commercial auto insurance, which is pretty impressive considering they compete against about 60 other large companies who all think they know what they're doing.

The Secret Sauce 🔬

Progressive's real magic happens in their data analytics. They've been collecting driving behavior data through their Snapshot program for years – we're talking billions of miles worth of data. They know if you brake hard, speed, or use your phone while driving. It's like having a helicopter parent, but one that gives you discounts for good behavior.

Their latest personal auto product model (catchily named "8.9") is rolling out across states and includes something called "Progressive vehicle protection" – basically mechanical breakdown coverage for when your car decides to have an existential crisis.

How They Make Money 💰

The insurance business model is beautifully simple: collect premiums, pay claims, invest the float, and pray that math works in your favor. Progressive collected $74.4 billion in net premiums in 2024 ↗️ (up from $61.6 billion in 2023), which is a pretty solid year by anyone's standards.

But here's where it gets interesting – they also have an $80.3 billion investment portfolio ↗️ that generated $3.1 billion in investment income in 2024 ↗️. That's like having a really successful side hustle while your main job is already printing money.

Distribution Strategy 📱

Progressive plays both sides of the fence brilliantly. About 45% of their personal vehicle business comes through their network of 40,000+ independent agents (because some people still like talking to humans), while 55% comes directly through their website and phone sales (for those of us who prefer to buy insurance in our pajamas).

They've also got this "Destination Era" strategy where they're trying to become your one-stop shop for all things insurance. It's like Amazon, but for protecting your stuff instead of selling you stuff you don't need at 2 AM.

Layer 2: Category Position 🏆

The Competitive Landscape 🥊

The auto insurance market is basically a gladiator arena with 240 competitors, but Progressive and the top 15 players control about 85% of the action. It's like a battle royale where most of the small players are just trying not to get eliminated.

Progressive sits pretty at #2 in personal auto insurance, which is impressive when you consider they built their reputation on insuring the drivers that State Farm and Allstate would cross the street to avoid. They've turned "high-risk" into "high-profit" through superior pricing models.

In commercial auto, they're the undisputed champion 🥇, holding the #1 spot since 2015. When you're competing against 60 other large companies and still coming out on top, you're clearly doing something right.

Recent Wins and Challenges 📊

The Good News: Progressive's growth has been impressive, with net premiums written jumping from $61.6 billion to $74.4 billion in 2024 ↗️. Their expansion into personal property insurance (homeowners and renters) is gaining traction, and they're now the 11th largest homeowners carrier in the U.S.

The Reality Check: The property insurance market is brutal right now. Climate change isn't just an abstract concept when you're paying hurricane and wildfire claims. Progressive has sophisticated reinsurance programs (up to $2.1 billion coverage for Florida events), but Mother Nature doesn't always read the fine print.

The competitive environment is also intensifying. With comparative rating services making it easier for customers to shop around, everyone's fighting for the same eyeballs. Progressive's response? Double down on technology and data analytics, because if you can't beat them with price alone, beat them with precision.

Layer 3: Show Me The Money! 📈

Revenue Breakdown 💵

Progressive's revenue story is pretty straightforward, but the details are where it gets interesting:

Personal Lines: $63.5 billion ↗️ (85% of total)

Personal auto dominates at 95% of personal vehicle business

Special lines (motorcycles, RVs, boats) for the weekend warriors

Personal property (homeowners/renters) at 5% but growing

Commercial Lines: $11.0 billion ↗️ (15% of total)

Commercial auto is the bread and butter

Business owners' policies for small businesses

The Investment Side Hustle 💰

Here's where Progressive gets really interesting. That $80.3 billion investment portfolio isn't just sitting there looking pretty – it generated $3.1 billion in investment income in 2024 ↗️, up from $2.3 billion in 2023. That's like having a really successful hedge fund attached to your insurance company.

They focus on investment-grade fixed-income securities, which is the financial equivalent of wearing a seatbelt – not exciting, but it keeps you safe when things get bumpy.

Seasonality and Cycles 🌊

Insurance has its rhythms. Personal property claims spike during "warmer weather months" (insurance speak for "hurricane and tornado season"). Special lines products like boats and RVs also follow seasonal patterns – apparently, people don't buy boat insurance in January in Minnesota.

The beauty of Progressive's diversified model is that these seasonal variations tend to balance out across their portfolio.

Cost Structure and Margins 📊

Progressive's expense management is where their operational excellence really shines. They've got about 66,300 employees (up from previous years) but maintain strong efficiency metrics. Their employee retention rate of 89% ↗️ is impressive – happy employees generally mean better customer service and lower training costs.

Their claims handling is mostly done in-house with nearly 3,700 third-party repair shops in their network. This gives them control over the customer experience and helps manage costs.

Layer 4: What Do We Have to Believe? 📚

The Bull Case 🐂

Belief #1: Data is the New Oil Progressive's decades of collecting driving behavior data through Snapshot creates a competitive moat that's hard to replicate. If you believe that better data leads to better pricing, and better pricing leads to market share gains, then Progressive is sitting pretty.

Belief #2: Bundling is the Future The "Destination Era" strategy assumes customers want one-stop shopping for insurance. Early signs are promising – bundled customers stay longer and have lower claims costs. If this trend continues, Progressive's multi-product approach could drive significant growth.

Belief #3: Technology Wins Progressive has been a tech innovator in insurance for decades. Their digital platforms, mobile apps, and automated systems give them operational advantages. If technology continues to disrupt traditional insurance models, Progressive is well-positioned to benefit.

Belief #4: Market Share Gains Continue As the #2 auto insurer, there's still room to grow. If they can maintain their pricing discipline while gaining share from less sophisticated competitors, the growth story continues.

The Bear Case 🐻

Risk #1: Climate Change is Expensive Progressive's expansion into property insurance comes just as climate-related losses are exploding. Even with sophisticated reinsurance, a few bad hurricane seasons could seriously dent profitability.

Risk #2: Autonomous Vehicles If self-driving cars actually happen (big if), the auto insurance market could shrink dramatically. Progressive's entire business model is built on human drivers making human mistakes.

Risk #3: Regulatory Pressure Insurance regulation is getting more complex, with new rules around AI, pricing algorithms, and data usage. Progressive's data advantage could become a regulatory liability if politicians decide algorithms are unfair.

Risk #4: Competition from Big Tech Google, Amazon, and others have deeper pockets and more data than Progressive. If they decide to seriously enter insurance, it could get ugly fast.

The Bottom Line 📝

Progressive has built an impressive business by being smarter about risk than their competitors. Their data analytics, technology infrastructure, and operational excellence create real competitive advantages. The expansion into property insurance and commercial lines diversifies their revenue streams and reduces dependence on personal auto.

However, they're not immune to industry headwinds. Climate change, regulatory pressure, and potential disruption from autonomous vehicles are real risks that could reshape the entire industry.

The key question for investors: Do you believe Progressive's data and technology advantages are sustainable, and can they successfully execute their "Destination Era" strategy while managing the risks of an increasingly volatile world?

Given their track record of innovation and adaptation, betting against Progressive seems unwise. But like any insurance company, they're essentially making educated guesses about the future – and sometimes the future has other plans. 🎲

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.