The Bottom Line Upfront 💡

The pharmaceutical industry represents one of the most research-intensive, high-risk, high-reward sectors in the global economy. Based on our analysis of three major players—Vertex Pharmaceuticals $VRTX ( ▲ 4.17% ) , Eli Lilly $LLY ( ▲ 3.66% ) , and AbbVie $ABBV ( ▲ 2.01% ) —several key themes emerge:

Innovation drives everything: Companies investing 20-33% of revenue in R&D are creating transformative medicines that address previously untreatable conditions.

Blockbuster economics dominate: A single successful drug can generate $10+ billion in annual revenue with 80%+ gross margins, but patent expirations create inevitable "cliff" events.

Specialization vs. diversification strategies: Companies balance between dominating specific therapeutic areas (Vertex in cystic fibrosis) or building diversified portfolios (AbbVie across immunology, oncology, neuroscience).

Regulatory and pricing pressures intensifying: Government price negotiations through the Inflation Reduction Act represent a significant new challenge to the industry's pricing power.

Weight loss/diabetes drugs creating a new mega-market: GLP-1 medications for diabetes and obesity (like Lilly's Mounjaro/Zepbound) are driving extraordinary growth and could become a $100 billion market by 2030.

For investors, the pharmaceutical sector offers a unique combination of growth potential, income (through dividends), and defensive characteristics. However, success requires careful analysis of pipeline assets, patent timelines, and each company's ability to replace blockbuster drugs as they lose exclusivity.

Industry Overview 🏭

Structure and Value Chain

The pharmaceutical industry follows a complex, lengthy, and expensive path from laboratory to patient:

Research & Discovery: Companies identify disease targets and develop molecules that might address them. This phase typically takes 3-6 years and has a high failure rate.

Preclinical Testing: Promising compounds undergo laboratory and animal testing to assess safety and efficacy before human trials. This adds another 1-3 years.

Clinical Trials: Human testing occurs in three phases:

Phase I: Safety testing in healthy volunteers (dozens of participants)

Phase II: Initial efficacy testing in patients (hundreds of participants)

Phase III: Large-scale efficacy and safety testing (thousands of participants) This process typically takes 6-7 years and costs hundreds of millions to billions of dollars.

Regulatory Review: The FDA (U.S.) or similar agencies review clinical data and decide whether to approve the drug. This takes 1-2 years.

Manufacturing: Production occurs in highly regulated facilities with strict quality controls.

Distribution: Products flow primarily through wholesale distributors to pharmacies, hospitals, and clinics. Three major distributors—McKesson, Cardinal Health, and Cencora (formerly AmerisourceBergen)—dominate U.S. distribution.

Marketing and Sales: Companies employ sales representatives to educate physicians about their products and invest in direct-to-consumer advertising in some markets.

Post-Marketing Surveillance: Ongoing monitoring for safety issues after approval.

The entire process from discovery to market typically takes 10-15 years and costs $1-3 billion per successful drug. For every drug that reaches the market, thousands of compounds fail during development.

Key Industry Trends and Drivers

Shift to specialty and rare disease treatments: Companies increasingly focus on high-value medications for serious conditions rather than primary care drugs facing generic competition. Vertex exemplifies this with its focus on cystic fibrosis.

Biologics and complex therapies dominating: Large-molecule biologics (like antibodies) and advanced therapies (gene editing, cell therapies) are replacing traditional small-molecule drugs. Vertex's CASGEVY gene-editing therapy represents the cutting edge of this trend.

Weight loss/diabetes revolution: GLP-1 receptor agonists like Eli Lilly's Mounjaro/Zepbound are creating an entirely new mega-market for obesity treatment, potentially reaching $100 billion globally by 2030.

Increasing pricing pressure: Government initiatives to control drug costs, particularly the Inflation Reduction Act's Medicare price negotiation provisions, are challenging the industry's traditional pricing power.

Digital transformation: Companies are incorporating AI, machine learning, and digital health tools throughout the value chain, from drug discovery to patient engagement.

Direct-to-consumer channels emerging: Companies like Eli Lilly are experimenting with direct patient engagement through platforms like LillyDirect.

Market Size and Growth Projections

The global pharmaceutical market reached approximately $1.5 trillion in 2023 and is projected to grow at a CAGR of 5-6% through 2028, reaching around $2 trillion. Key growth segments include:

Obesity/diabetes treatments: Potentially a $100 billion market by 2030, growing at 20%+ annually

Oncology: Projected to reach $375 billion globally by 2030

Immunology: Expected to exceed $150 billion by 2028

Rare diseases: Growing at 12-14% annually, reaching $350 billion by 2030

Gene and cell therapies: Projected to grow at 30%+ annually from a smaller base

The U.S. remains the largest pharmaceutical market, accounting for approximately 45% of global sales, followed by China, Japan, and Europe.

Business Models Comparison 🏛️

Common Elements

All three companies share certain fundamental business model elements:

R&D-driven innovation: All invest heavily in research and development (20-33% of revenue) to discover and develop new medicines.

Patent-protected pricing: They rely on intellectual property protection to maintain premium pricing during the exclusivity period (typically 10-15 years from launch).

Physician-directed sales: Products require prescriptions from healthcare providers, making physician education and engagement critical.

Regulatory navigation expertise: Success requires effectively managing complex regulatory processes across multiple countries.

Distribution through intermediaries: All primarily sell through wholesale distributors rather than directly to patients.

Business Model Comparison Table

Element | Vertex | Eli Lilly | AbbVie |

|---|---|---|---|

Primary Revenue Driver | Cystic fibrosis treatments (90%+ of revenue) | Diabetes/obesity drugs (30%+ of revenue) | Immunology (47% of revenue) |

R&D Investment (% of Revenue) | 33% | 24.4% | 23% |

Geographic Focus | U.S. (61%), International (39%) | U.S. (67.4%), International (32.6%) | U.S. (76%), International (24%) |

Business Diversification | Low (CF dominance, emerging areas) | Medium (diabetes/obesity core with other areas) | High (balanced across multiple therapeutic areas) |

Manufacturing Strategy | Outsources some production | Heavy internal manufacturing investment | Mix of internal and external manufacturing |

Acquisition Approach | Selective, smaller acquisitions | Moderate M&A activity | Aggressive, large-scale acquisitions |

Direct-to-Consumer Engagement | Limited | Growing (LillyDirect) | Significant in aesthetics business |

Dividend Strategy | No dividend | Modest dividend | Substantial dividend (3.5% yield) |

Competitive Landscape 🥊

Market Position Analysis

The pharmaceutical industry is highly fragmented by therapeutic area, with companies typically competing in specific disease categories rather than across the entire market. Based on the companies analyzed:

Immunology/Autoimmune Diseases:

AbbVie remains a leader despite Humira biosimilar competition, with Skyrizi and Rinvoq growing rapidly

Johnson & Johnson, Novartis, and Pfizer are major competitors

Estimated market size: $150+ billion globally

Diabetes/Obesity:

Eli Lilly and Novo Nordisk dominate the GLP-1 market in a virtual duopoly

Lilly's Mounjaro/Zepbound and Novo's Ozempic/Wegovy are the leading products

Estimated market size: $50+ billion currently, potentially growing to $100 billion by 2030

Cystic Fibrosis:

Vertex holds a near-monopoly position with approximately 75% of eligible patients

Limited competition from companies like Sionna Therapeutics and Fair Therapeutics

Estimated market size: $10-15 billion globally

Oncology:

Highly fragmented market with AbbVie competing in blood cancers (Imbruvica, Venclexta)

Major competitors include Merck, Bristol Myers Squibb, Roche, and Pfizer

Estimated market size: $200+ billion globally

Aesthetics:

AbbVie (through Allergan acquisition) leads with Botox and Juvederm

Estimated market size: $15+ billion globally for medical aesthetics

Other Significant Players

Beyond the three companies analyzed, several other major players shape the pharmaceutical landscape:

Johnson & Johnson: Diversified healthcare giant with pharmaceutical, medical device, and consumer health divisions (though spinning off consumer health). Strong in immunology, oncology, and neuroscience.

Pfizer: Major player across multiple therapeutic areas, with significant COVID-19 vaccine and treatment revenue. Strong in vaccines, oncology, and rare diseases.

Novo Nordisk: Eli Lilly's primary competitor in diabetes/obesity, with Ozempic and Wegovy competing directly with Mounjaro and Zepbound.

Merck: Oncology powerhouse with Keytruda (pembrolizumab), one of the world's top-selling drugs. Also strong in vaccines and antivirals.

Bristol Myers Squibb: Major player in oncology and immunology following its acquisition of Celgene.

Roche: Leader in oncology and diagnostics with a strong biologics portfolio.

Novartis: Diversified pharmaceutical company with strength in oncology, immunology, and neuroscience.

Amgen: Pioneer in biologics with strength in inflammation, oncology, and bone health.

Gilead Sciences: Leader in antivirals (HIV, hepatitis) and expanding in oncology.

Biogen: Focused on neuroscience, including multiple sclerosis and Alzheimer's disease.

Financial Metrics Comparison 📊

Key Financial Metrics Table

Metric | Vertex | Eli Lilly | AbbVie | Industry Benchmark |

|---|---|---|---|---|

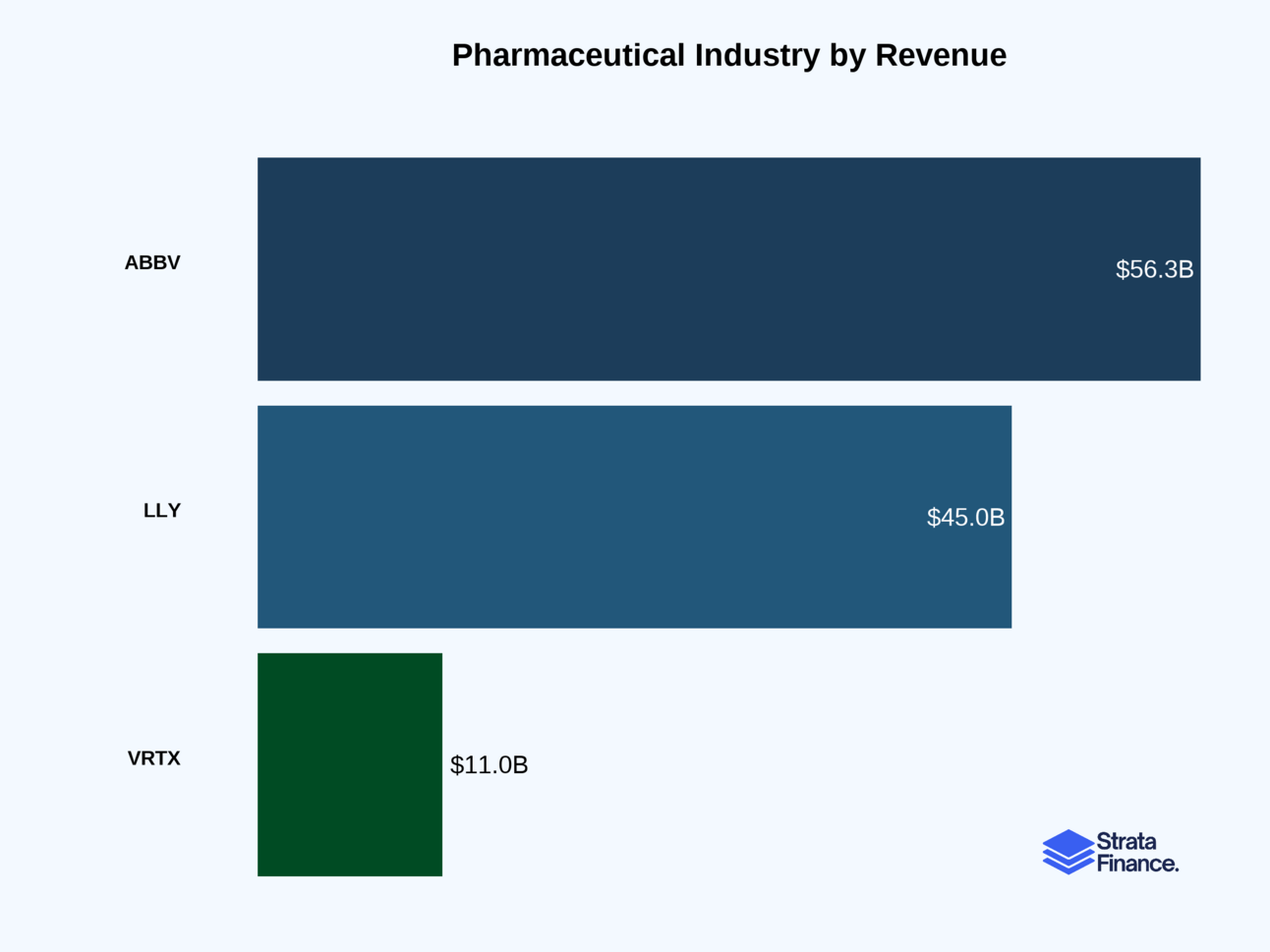

Annual Revenue (2024) | $11.0 billion | $45.04 billion | $56.3 billion | Varies by size |

Revenue Growth (YoY) | 12% | 32% | 3.7% | 5-7% |

Gross Margin | Not explicitly stated | 81.3% | 70% | 70-80% |

R&D Spending (% of Revenue) | 33% | 24.4% | 23% | 15-25% |

Operating Margin | Not explicitly stated | Not explicitly stated | 16.2% | 25-35% |

Net Profit Margin | Not explicitly stated | Not explicitly stated | 7.6% | 15-25% |

Cash Position | $11.2 billion | Not explicitly stated | Not explicitly stated | Varies by size |

Dividend Yield | None | ~1% | ~3.5% | 2-4% |

Industry Benchmarks Explained

Revenue Growth: The pharmaceutical industry typically grows at 5-7% annually, making Eli Lilly's 32% growth exceptional and Vertex's 12% growth strong. AbbVie's 3.7% growth reflects the Humira patent cliff offset by growth in other products.

Gross Margins: Pharmaceutical companies typically enjoy gross margins of 70-80% due to high pricing power and relatively low manufacturing costs compared to R&D investments. Eli Lilly's 81.3% margin is at the high end of the range, reflecting the premium pricing of its GLP-1 products.

R&D Investment: Traditional pharmaceutical companies invest 15-20% of revenue in R&D, while more innovation-focused biotechs may invest 20-30%. All three companies exceed traditional benchmarks, with Vertex's 33% being particularly aggressive.

Operating Margins: Mature pharmaceutical companies typically achieve 25-35% operating margins. AbbVie's 16.2% is below industry norms, partly due to one-time charges and increased R&D investment.

Net Profit Margins: The industry typically delivers 15-25% net margins. AbbVie's 7.6% is below normal, reflecting transition challenges and one-time charges.

Dividend Yields: Large pharmaceutical companies typically offer dividends in the 2-4% range. AbbVie's 3.5% yield is attractive for income investors, while Vertex offers no dividend, reinvesting all cash flow into growth.

Key Success Factors 🔑

What Separates Winners from Losers

In the pharmaceutical industry, long-term success depends on several critical factors:

R&D Productivity: The ability to consistently discover and develop successful drugs from research investments. Vertex's dominance in CF and Lilly's success with GLP-1s demonstrate superior R&D productivity.

Pipeline Management: Maintaining a balanced pipeline across development stages and therapeutic areas to ensure continuous product flow. AbbVie's successful transition from Humira to Skyrizi/Rinvoq exemplifies effective pipeline management.

Patent Cliff Navigation: Developing strategies to offset revenue losses when blockbuster drugs lose exclusivity. This includes developing next-generation products, expanding indications, and diversifying the portfolio.

Manufacturing Excellence: Particularly critical for biologics and complex therapies with challenging production requirements. Lilly's massive investment in manufacturing capacity for GLP-1 drugs highlights this factor's importance.

Regulatory Expertise: Successfully navigating increasingly complex approval processes across global markets.

Market Access Capabilities: Securing favorable reimbursement from insurers and government payers in an environment of increasing price sensitivity.

Geographic Expansion: Effectively entering and growing in international markets, particularly emerging economies.

Technological Disruption Potential

Several technological developments could significantly impact the pharmaceutical industry:

AI in Drug Discovery: Machine learning and artificial intelligence are accelerating target identification and lead optimization, potentially improving R&D productivity.

Gene Editing Technologies: CRISPR and other gene-editing approaches (like Vertex's CASGEVY) are enabling entirely new treatment modalities for genetic diseases.

mRNA Platform Expansion: Following COVID-19 vaccine success, mRNA technology is being applied to other therapeutic areas, potentially disrupting traditional approaches.

Digital Therapeutics: Software-based interventions are emerging as complements or alternatives to pharmaceutical treatments for certain conditions.

Real-World Data Utilization: Advanced analytics applied to healthcare databases are changing how drugs are developed, approved, and commercialized.

Precision Medicine Advances: Increasingly targeted therapies based on genetic and biomarker profiles are fragmenting traditional disease markets into smaller, more specific segments.

Alternative Payment Models: Value-based contracts and outcomes-based pricing are challenging traditional pharmaceutical business models.

Future Outlook 🔮

Industry Growth Prospects

The pharmaceutical industry faces a complex but generally positive growth outlook:

Overall Market Growth: Expected to maintain 5-6% CAGR through 2028, reaching approximately $2 trillion globally.

Therapeutic Area Divergence: Growth will vary significantly by disease area:

Obesity/diabetes treatments: 20%+ annual growth

Oncology: 8-10% annual growth

Immunology: 6-8% annual growth

Neuroscience: 5-7% annual growth

Primary care/cardiovascular: 2-3% annual growth

Geographic Shifts: Emerging markets will grow faster than developed markets, with China, India, and Brazil becoming increasingly important.

Specialty Product Dominance: Specialty and rare disease medications will continue to account for an increasing share of industry revenue and profits.

Biosimilar Impact: Increasing biosimilar adoption will create pricing pressure for biologics but also expand overall patient access.

Potential Disruptions

Several factors could significantly disrupt the industry's trajectory:

Expanded Price Controls: More aggressive government intervention in drug pricing could substantially impact industry economics, particularly in the U.S. market.

Breakthrough Treatment Modalities: Gene therapy, cell therapy, and RNA-based approaches could disrupt traditional pharmaceutical markets by offering functional cures rather than chronic treatments.

Tech Company Entry: Major technology companies (Apple, Amazon, Google) are increasingly interested in healthcare and could disrupt traditional pharmaceutical business models.

Vertical Integration: Consolidation among payers, providers, and pharmacies (e.g., CVS-Aetna, Amazon-One Medical) could shift negotiating power away from pharmaceutical manufacturers.

Direct-to-Consumer Models: New distribution channels bypassing traditional intermediaries could change how medications reach patients, as suggested by Lilly's LillyDirect initiative.

Global Supply Chain Restructuring: Pandemic-driven recognition of supply chain vulnerabilities is leading to reshoring and redundancy initiatives that could increase manufacturing costs.

Potential Winners and Losers

Based on current trends and company positioning:

Likely Winners:

Innovation Leaders: Companies with productive R&D engines and breakthrough therapies addressing high unmet needs (Vertex, Lilly)

GLP-1 Dominators: Eli Lilly and Novo Nordisk are positioned to benefit from the explosive growth in the obesity/diabetes market

Diversified Players with Strong Pipelines: Companies that have successfully diversified beyond single blockbusters (AbbVie)

Cell and Gene Therapy Pioneers: Companies at the forefront of these transformative technologies (including Vertex with CASGEVY)

Efficient Operators: Companies that can maintain productivity while controlling costs in an increasingly price-sensitive environment

Potential Challengers:

Single-Product Dependents: Companies relying heavily on one or two products without clear succession plans

Primary Care Focused Companies: Those concentrated in therapeutic areas facing generic competition and limited innovation

Slow Adapters to Pricing Pressure: Companies without strategies to address increasing government and payer price controls

Manufacturing Laggards: Those unable to scale production of complex biologics and advanced therapies

R&D Underinvestors: Companies prioritizing short-term profits over long-term innovation

Remember, in this industry more than most, past performance doesn't guarantee future results. Today's blockbuster can become tomorrow's patent cliff, while an overlooked pipeline candidate might become the next multi-billion-dollar franchise. The key is understanding both the science and the business behind these medicine-making machines.

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.