The Bottom Line Upfront 💡

Procter & Gamble $PG ( ▲ 0.35% ) is the ultimate "boring but brilliant" business—a 187-year-old empire built on products you use every day without thinking twice. With $84B in annual revenue across five segments (Fabric & Home Care, Baby/Feminine/Family Care, Beauty, Health Care, and Grooming), P&G dominates categories from Tide laundry detergent to Gillette razors. The company's genius lies in creating premium products for daily necessities, building unshakeable brand loyalty, and generating massive cash flows (105% free cash flow productivity). Recent results show remarkable resilience: 4% organic growth, expanding market share while raising prices, and 68 consecutive years of dividend increases. While facing headwinds from private label competition and mature markets, P&G's competitive moats, operational excellence, and global scale make it a steady wealth compounder for patient investors seeking predictable returns over explosive growth.

Partnership

Tackle your credit card debt by paying 0% interest until nearly 2027

If you have outstanding credit card debt, getting a new 0% intro APR credit card could help ease the pressure while you pay down your balances. Our credit card experts identified top credit cards that are perfect for anyone looking to pay down debt and not add to it! Click through to see what all the hype is about.

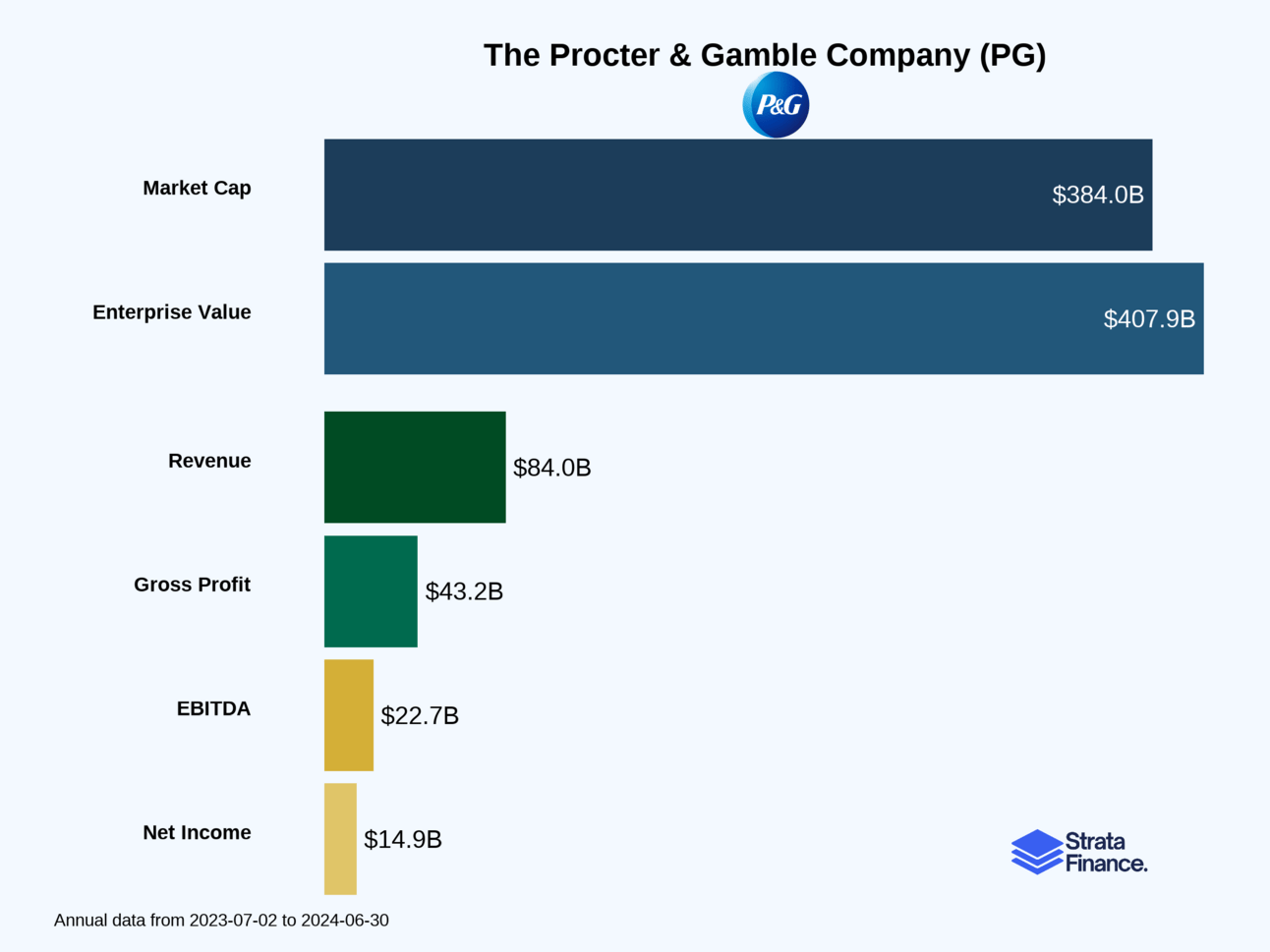

Strata Layers Chart

Layer 1: The Business Model 🏛️

Think of Procter & Gamble as the ultimate "boring but brilliant" business. While tech companies chase the next shiny object, P&G has spent 187 years perfecting the art of making stuff you use every day and somehow convincing you to pay a premium for it. And honestly? They're really, really good at it.

What They Actually Do 🧼

P&G operates what I like to call the "daily necessity empire." They make products that solve problems you didn't even know you had until you tried their version. Need to wash your hair? They've got Pantene and Head & Shoulders. Want your clothes to smell like a spring meadow? Tide's got you covered. Tired of your razor feeling like it was forged in medieval times? Gillette to the rescue.

The genius of their business model is deceptively simple: create products people use repeatedly, build brands they trust implicitly, then watch the cash register ring for decades. It's like owning a toll booth on the highway of human hygiene and household maintenance.

The Five Kingdoms 👑

P&G organizes their empire into five major segments, each ruling over different aspects of your daily routine:

Beauty ($15.2B in revenue) - The vanity kingdom featuring hair care (Pantene, Head & Shoulders) and skin/personal care (Olay, Old Spice, the trendy Native brand). This segment is all about making you look and feel good, which never goes out of style.

Grooming ($6.7B) - Dominated by the Gillette empire, this is where P&G flexes their pricing power. With over 60% global market share in blades and razors, they've basically turned shaving into a subscription service before subscriptions were cool.

Health Care ($11.8B) - Your medicine cabinet's best friend, featuring Crest toothpaste, Oral-B brushes, Vicks cold remedies, and Pepto-Bismol for when you make questionable food choices.

Fabric & Home Care ($29.5B) - The heavyweight champion and largest segment. This is where Tide, Dawn, Febreze, and other household heroes live. If it cleans something in your house, P&G probably makes a version of it.

Baby, Feminine & Family Care ($20.3B) - Life's necessities from cradle to... well, bathroom. Pampers diapers, Always feminine products, and Charmin toilet paper. Not glamorous, but absolutely essential.

Key Success Metrics 📊

P&G obsesses over several key metrics that tell the real story:

Organic Sales Growth: Revenue growth excluding acquisitions and currency effects (4% ↗️ in 2024)

Market Share: They track this religiously across all categories and geographies

Core EPS Growth: Earnings per share excluding one-time items (12% ↗️ in 2024)

Free Cash Flow Productivity: How much cash they generate relative to earnings (105% in 2024)

Gross Margin: Currently at 51.4% ↗️, showing strong pricing power

Layer 2: Category Position 🏆

P&G doesn't just compete—they dominate. In virtually every category where they play, they're either #1 or a strong #2. This isn't luck; it's the result of decades of strategic focus and relentless execution.

The Competitive Landscape 🥊

Grooming: The Crown Jewel - With over 45% global market share, P&G absolutely owns this space. Gillette's 60%+ share in blades and razors is the kind of market dominance that would make monopoly regulators nervous if it weren't earned through genuine innovation and consumer preference.

Fabric & Home Care: The Cash Cow - Over 35% global market share in fabric care, led by Tide and Ariel. In home care, they hold about 25% market share. When your biggest worry is whether Dawn dish soap is too effective at cutting grease, you know you're winning.

Health Care: The Steady Performer - Number two globally with about 20% market share in oral care behind Crest and Oral-B. In personal health care categories, they're often the market leader with brands like Vicks and Pepto-Bismol.

Beauty: The Growth Engine - About 20% global market share in retail hair care, with Olay holding roughly 5% of the global facial skin care market. This segment faces more fragmentation and new entrant pressure, but P&G's scale advantages still matter.

Baby, Feminine & Family Care: The Necessity Play - Over 20% global market share in baby care, over 20% in feminine care, and dominant positions in North American family care (40%+ for Bounty, 25%+ for Charmin).

Major Competitors 🎯

P&G faces different competitive dynamics in each segment:

Unilever: The eternal rival, particularly strong in personal care and home care

Colgate-Palmolive: Direct competitor in oral care and some personal care categories

Kimberly-Clark: Major competitor in baby care and family care

Private Label Brands: Growing threat as retailers push their own brands

Startup Brands: Nimble competitors targeting specific niches, especially in beauty

Layer 3: Show Me The Money! 📈

Let's talk numbers, because P&G's financial performance tells a story of remarkable consistency in an increasingly chaotic world.

Revenue Breakdown: The Empire's Territories 🗺️

By Segment (Fiscal 2024):

Fabric & Home Care: $29.5B (35% of total) - The workhorse

Baby, Feminine & Family Care: $20.3B (24%) - The necessity play

Beauty: $15.2B (18%) - The growth engine

Health Care: $11.8B (14%) - The steady performer

Grooming: $6.7B (8%) - The profit machine

By Geography:

United States: $40.5B (48%) - Home sweet home

International: $43.5B (52%) - The growth frontier

Layer 4: What Do We Have to Believe? 📚

The Bull Case: Why P&G Could Thrive 🚀

Belief #1: Brand Moats Remain Unbreachable You have to believe that in an age of infinite choice and Amazon reviews, consumers will still pay premiums for trusted brands.

Belief #2: Innovation Drives Sustainable Growth P&G must continue developing products that genuinely perform better than alternatives.

Belief #3: Emerging Markets Will Drive Long-term Growth As middle classes expand globally, demand for branded consumer goods should increase.

Belief #4: Operational Excellence Continues The company's ability to generate 105% free cash flow productivity while investing in growth is impressive.

Belief #5: Digital Transformation Succeeds P&G is investing heavily in e-commerce, data analytics, and direct-to-consumer capabilities.

The Bear Case: What Could Go Wrong 🐻

Risk #1: Private Label Apocalypse If consumers become permanently price-sensitive and retailers aggressively push private label alternatives, P&G's premium positioning could crumble.

Risk #2: Innovation Stagnation Consumer goods categories are mature.

Risk #3: Emerging Market Disappointment Currency devaluations, political instability, and economic volatility in developing markets could derail growth plans.

Risk #4: Generational Shift Younger consumers might prioritize different values (sustainability, authenticity, local brands) over traditional brand attributes.

Risk #5: Margin Compression Rising labor costs, commodity inflation, and competitive pressure could squeeze margins.

The Verdict: A Boring Winner 🏅

P&G represents what I call "boring excellence"—they're not going to 10x your money, but they're unlikely to lose it either. The company has demonstrated remarkable resilience over nearly two centuries, adapting to changing consumer preferences while maintaining market leadership.

The recent financial results show a company executing well despite challenging conditions. Growing market share while raising prices is the holy grail of consumer goods, and P&G is achieving it across most segments.

Bottom Line: P&G is a high-quality business trading at a fair price. It's perfect for investors who want steady, predictable returns with the bonus of a growing dividend. Just don't expect fireworks—this is a tortoise, not a hare, and it's been winning races for 187 years.

If you're looking for the next Tesla, keep looking. If you want to own a piece of a business that will probably still be making money when your grandchildren are buying toothpaste, P&G deserves serious consideration. Sometimes boring is beautiful. 🌟

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.