The Bottom Line Upfront 💡

PepsiCo $PEP ( ▲ 1.53% ) dominates global snacks but plays second fiddle to Coke in beverages, generating massive cash flows while navigating the shift toward healthier consumption. At $141, shares offer defensive dividend income with modest upside potential as the company executes a $6.15B productivity plan to maintain relevance in changing markets.

Sponsorship

A big 2026 starts now

Most people treat this stretch of the year as dead time. But builders like you know it’s actually prime time. And with beehiiv powering your content, world domination is truly in sight.

On beehiiv, you can launch your website in minutes with the AI Web Builder, publish a professional newsletter with ease, and even tap into huge earnings with the beehiiv Ad Network. It’s everything you need to create, grow, and monetize in one place.

In fact, we’re so hyped about what you’ll create, we’re giving you 30% off your first three months with code BIG30. So forget about taking a break. It’s time for a break-through.

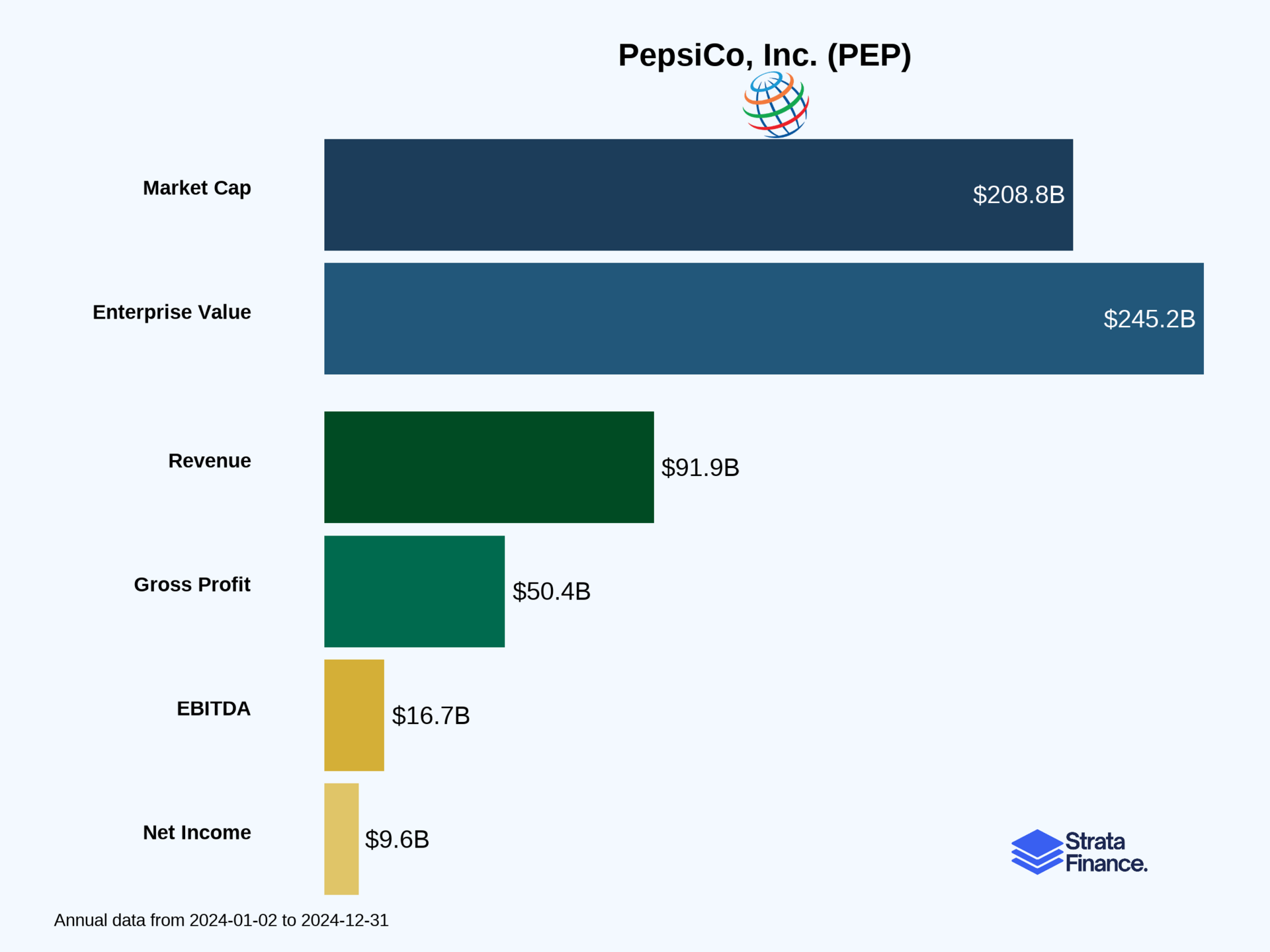

Strata Layers Chart

Layer 1: The Business Model 🏛️

Think of PepsiCo as the ultimate convenience store empire - except instead of owning the stores, they own the brands that fill the shelves. From the Doritos you grab during a Netflix binge to the Gatorade that saves you after a questionable workout decision, PEP has mastered the art of being everywhere you are when you need them most.

What They Actually Do: PepsiCo operates a dual-engine business model spanning beverages and "convenient foods" (fancy corporate speak for snacks). They don't just make products and hope someone buys them - they've built an intricate distribution network that gets their products into your hands through multiple channels:

Direct-Store-Delivery (DSD): Those Frito-Lay trucks you see at gas stations? That's their army of merchandisers ensuring prime shelf placement

Customer Warehouses: Bulk distribution to major retailers

E-commerce: Because apparently we now order Cheetos online 📦

Independent Bottlers: Partners who manufacture and distribute beverages using PEP's concentrates

The Brand Portfolio: PEP's secret sauce is diversification. They've got:

Beverages: Pepsi, Mountain Dew, Gatorade, Aquafina

Salty Snacks: Lay's, Doritos, Cheetos, Tostitos

Breakfast/Pantry: Quaker Oats, Cap'n Crunch, Rice-A-Roni

How They Measure Success:

Volume metrics: Both concentrate shipments and bottler case sales for beverages

Market share: Especially in key categories like salty snacks

Operating margins: Currently at 14%, which they're working to expand

Return on Invested Capital (ROIC): 17% in 2024, showing efficient capital deployment

The Geographic Spread: Seven reportable segments spanning 200+ countries, with North America generating about 56% of revenue. Think of it as a global convenience empire with local flavor preferences.

Key Takeaway: PEP is essentially a diversified portfolio of consumer staples with unmatched distribution reach - they've positioned themselves to win whether you're thirsty, hungry, or both.

Layer 2: Category Position 🏆

PepsiCo lives in a fascinating competitive paradox: they're simultaneously the king of snacks and the eternal runner-up in beverages. It's like being the valedictorian in math class while getting a B+ in English.

The Snack Kingdom 👑 In North American convenient foods, PEP is basically the Death Star - they control the galaxy. Frito-Lay dominates with brands that have become verbs (seriously, when did "Doritos" become synonymous with "tortilla chips"?). Their competitive moats here are deep:

Premium shelf space control

Unmatched distribution efficiency

Marketing muscle that smaller brands can't match

Scale advantages in procurement and manufacturing

The Beverage Battle ⚔️ Here's where things get spicy. In the U.S. liquid refreshment category, PEP holds about 18% market share versus Coca-Cola's 21%. Globally, Coke's carbonated soft drink advantage is even more pronounced. PEP's response? Diversification into sports drinks (Gatorade dominance), water, and energy drinks - essentially saying "fine, you can have cola, we'll own everything else."

The Competitive Landscape:

Emerging Threats: Health-focused startups, private label expansion, direct-to-consumer brands

Regional Champions: Local players with cultural advantages in international markets

Recent Competitive Moves: The 2025 acquisition of Siete (Mexican-American foods) for $1.2B signals their strategy: buy brands that align with health trends and cultural authenticity rather than trying to out-Coke Coca-Cola.

Market Share Trends:

Snacks: Maintaining dominance but facing pressure from better-for-you alternatives

Beverages: Holding steady in total liquid refreshment while losing ground in traditional sodas

International: Mixed bag depending on local competitive dynamics

Key Takeaway: PEP dominates snacks globally but plays second fiddle to Coke in beverages - their winning strategy is diversification across categories and geographies rather than head-to-head combat.

Layer 3: Show Me The Money! 📈

PepsiCo's financial engine is like a well-diversified investment portfolio - when one part struggles, another usually picks up the slack. Let's break down where the $91.9B in revenue actually comes from.

Revenue Mix by Segment:

Frito-Lay North America: $24.8B (27%) - The cash cow 🐮

PepsiCo Beverages North America: $27.8B (30%) - The volume leader

Quaker Foods North America: $2.7B (3%) - The troubled child (thanks, recall!)

International Segments: $36.5B (40%) - The growth engine

Geographic Revenue Breakdown:

United States: $51.7B (56%) - Home base advantage

Mexico: $7.1B (8%) - Solid growth market

Russia: $3.9B (4%) - Geopolitical complexity

Other International: $29.2B (32%) - Diversified exposure

The Customer Base: PEP doesn't just sell to consumers - they navigate a complex web of relationships:

Walmart & Affiliates: 14% of total revenue (yes, one customer!)

Independent Bottlers: Buy concentrates, manufacture finished beverages

Retailers: From corner stores to supermarket chains

Foodservice: Restaurants, stadiums, schools

Margin Story: Operating margins have been under pressure but are recovering:

2024: 14.0% (up from 13.1% in 2023) ↗️

Cost pressures: Commodity inflation, transportation, labor

Margin expansion drivers: Productivity initiatives, pricing actions, mix improvements

Major Cost Categories:

Cost of Sales: $41.7B (45% of revenue) - Raw materials, manufacturing, packaging

SG&A: $37.2B (41% of revenue) - Marketing, distribution, overhead

R&D: $813M - Innovation and product development

Key Takeaway: PEP generates massive, diversified cash flows but faces margin pressure from inflation and changing consumer preferences - their success depends on balancing growth investments with operational efficiency.

Layer 4: Long-Term Valuation (DCF Model) 💰

The Verdict: Fairly Valued to Slightly Undervalued

Scenario | Fair Value | vs Current Price ($141 as 1.13.2026) |

|---|---|---|

Conservative | $102 | -28% ↘️ |

Optimistic | $199 | +41% ↗️ |

Key Valuation Drivers:

Cash Flow Sustainability: PEP's $7.5B free cash flow provides a solid foundation, but growth is modest

Terminal Growth Assumptions: Conservative 2.5% vs optimistic 3.5% creates massive valuation differences

Operational Efficiency: Success of their $6.15B productivity plan through 2030 is critical

Investment Recommendation: HOLD with modest upside potential. At $141, PEP trades near the midpoint of our valuation range, offering defensive characteristics with dividend income while you wait for operational improvements to drive returns.

Layer 5: What Do We Have to Believe? 📚

Bull Case 🚀

Brand Portfolio Power: PEP's diverse, globally recognized brands can maintain pricing power and market share despite health trends

Operational Excellence: The $6.15B productivity investment will generate sustainable margin expansion and competitive advantages

International Growth: Emerging markets will drive volume growth as incomes rise and urbanization accelerates

Bear Case 🐻

Health Trend Acceleration: Consumer shift away from processed foods and sugary drinks accelerates faster than PEP can adapt their portfolio

Margin Compression: Commodity inflation and competitive pressure prevent meaningful margin expansion despite productivity investments

Geopolitical Risks: International exposure (44% of revenue) creates vulnerability to currency volatility, trade tensions, and regional instability

The Bottom Line: PEP is a mature, cash-generating machine facing the classic innovator's dilemma - how to transform their portfolio for health-conscious consumers while maintaining profitability from legacy products. Their diversification provides stability, but limits explosive growth potential. At current prices, you're paying for quality and consistency rather than growth excitement.

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.