The Bottom Line Upfront 💡

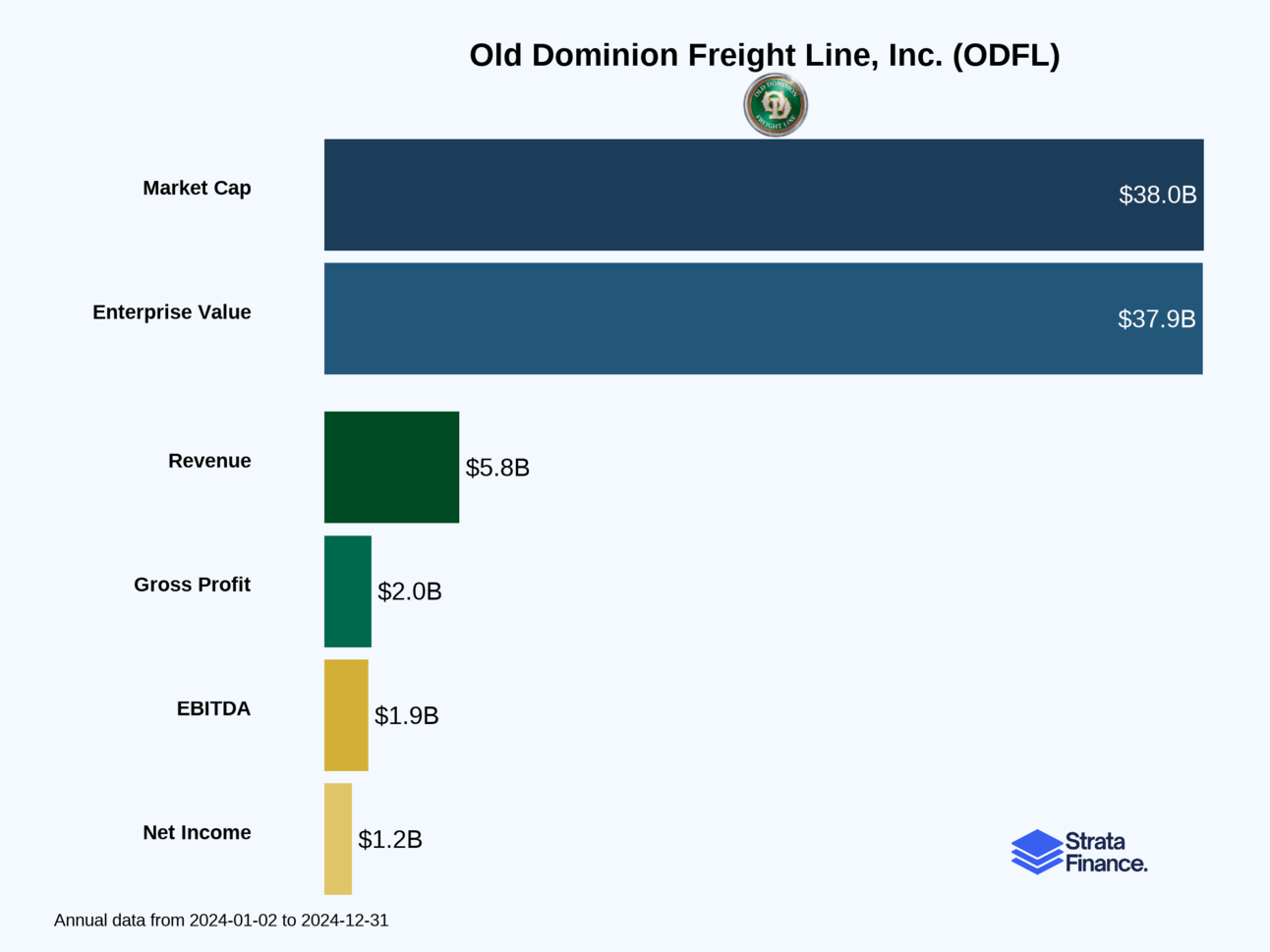

Old Dominion Freight Line $ODFL ( ▼ 3.14% ) has built something rare in trucking: a sustainable competitive advantage. With 99% on-time delivery, 0.1% cargo claims, and 10.1% driver turnover over 10 years, they've created a premium service moat in a commodity-like industry. Their integrated hub-and-spoke network spans 261 service centers, generating $5.8 billion in revenue primarily from less-than-truckload (LTL) shipping.

The 2024 reality check showed economic headwinds - volumes declined 2.8% and shipments dropped 1.4% - but ODFL maintained pricing discipline, increasing revenue per hundredweight by 2.4%. They returned $1.2 billion to shareholders through buybacks and dividends while investing $751 million in growth capex.

The bull case centers on their service premium sustainability, market share gains through industry consolidation, and massive operating leverage when volumes recover. The bear case worries about prolonged economic weakness, margin compression from desperate competitors, and the cyclical nature of freight demand.

The verdict: ODFL is a premium operator trading at premium valuations. They'll likely emerge stronger from any downturn, but the ride will be bumpy. Success depends on believing their operational excellence and "OD Family" culture can continue taking market share in a consolidating industry.

Sponsor

What Top Execs Read Before the Market Opens

The Daily Upside was founded by investment professionals to arm decision-makers with market intelligence that goes deeper than headlines. No filler. Just concise, trusted insights on business trends, deal flow, and economic shifts—read by leaders at top firms across finance, tech, and beyond.

Strata Layers Chart

Layer 1: The Business Model 🏛️

What Does ODFL Actually Do?

Think of Old Dominion Freight Line as the postal service for businesses, but instead of letters, they're moving pallets of industrial goods across America. Founded in 1934 (yes, they've been trucking since before your grandparents were born), ODFL operates in what's called the "less-than-truckload" or LTL market.

Here's the key difference that makes LTL special: Instead of renting an entire truck to move one company's stuff (like hiring a moving van), LTL carriers pick up smaller shipments from multiple businesses and play an elaborate game of freight Tetris, combining them efficiently onto trucks heading in the same direction. It's like carpooling, but for cargo.

The Magic of the Hub-and-Spoke Network 🕸️

ODFL operates 261 service centers across the continental US (they own 239 of them - because apparently they don't like paying rent). Each center works like a mini airport:

Daytime: Local trucks fan out for pickup and delivery in their territory

Nighttime: All freight gets sorted and loaded onto long-haul trucks heading to other service centers

Next Morning: Freight arrives at destination centers for local delivery

This network effect is their secret sauce. The more freight flowing through the system, the more efficient everything becomes.

How They Make Money 💰

ODFL generated $5.8 billion in revenue in 2024, with over 98% coming from LTL shipments. Their pricing is based on three factors:

Weight - Heavier stuff costs more (shocking, we know)

Commodity type - Light, bulky items (think furniture) cost more per pound than dense, heavy items (think metal parts)

Distance - Longer trips cost more

They also tack on fuel surcharges (indexed to Department of Energy diesel prices) and various accessorial charges for special handling.

Key Metrics That Matter 📊

ODFL obsesses over density - getting more shipments and tonnage through their existing infrastructure. Think of it like a restaurant trying to turn tables faster. Key metrics include:

LTL Revenue per Hundredweight: $32.05 in 2024 ↗️ (up from $31.31 in 2023)

Shipments per Day: 47,288 in 2024 ↘️ (down from 48,317 in 2023)

Operating Ratio: 73.4% in 2024 ↘️ (worse than 72.0% in 2023) - this measures operating expenses as a percentage of revenue; lower is better

The "OD Family" Culture 👨👩👧👦

Here's where ODFL gets interesting. In an industry notorious for high turnover and labor issues, they've built what they call the "OD Family" culture. Their driver turnover rate is just 10.1% over 10 years - in trucking, that's like finding a unicorn. Over 24% of their drivers have achieved one million safe driving miles, and they run their own driver training program that has produced 3,700+ active drivers (34% of their workforce).

This isn't just feel-good corporate speak - it's a massive competitive advantage in an industry where finding and keeping good drivers is brutally difficult.

Layer 2: Category Position 🏆

The LTL Landscape

The LTL industry is a $46.9 billion market that's highly consolidated. The top 5 carriers control 57% of the market, and the top 10 control 82%. ODFL sits comfortably among these industry leaders, having grown primarily through organic expansion rather than acquisitions (they're the anti-roll-up strategy).

What Makes ODFL Special

While competitors often grow through buying other companies and stitching together fragmented networks, ODFL has built a single, integrated system. The result? 99% on-time service with a 0.1% cargo claims ratio in 2024. These numbers would make Amazon jealous.

Their competitive advantages include:

Service Quality: Those 99% on-time numbers aren't an accident

Network Density: More freight = better efficiency = lower costs

Union-Free Operations: Gives them flexibility competitors often lack

Technology Integration: Proprietary systems optimize everything from routing to customer service

The Competition Battlefield ⚔️

ODFL doesn't just compete with other LTL carriers. They're fighting a multi-front war:

Other LTL carriers for core business

Truckload carriers for larger shipments

Third-party logistics providers who decide which carrier to use

The industry continues to consolidate as customers demand providers who can offer both regional and national service. This trend plays to ODFL's strengths - their integrated network and comprehensive service offerings position them well to steal market share from smaller, regional competitors.

Layer 3: Show Me The Money! 📈

Revenue Breakdown

2024 Revenue: $5.8 billion ↘️ (down 0.9% from 2023's $5.9 billion)

The revenue mix is beautifully simple:

98%+ from LTL shipments ($5.76 billion)

Remainder from value-added services like container drayage, truckload brokerage, and supply chain consulting

Geographic and Customer Mix

95%+ of revenue comes from US operations

Largest customer: 5.3% of revenue (nice diversification)

Top 20 customers: 31.1% of revenue

No single customer exceeds 6% of revenue

This diversification is gold in the trucking world - they're not dependent on any single customer or region.

The 2024 Reality Check 📉

Let's be honest: 2024 was tough. The numbers tell the story:

LTL tons: 9.0 million ↘️ (down 2.8% from 9.3 million)

LTL shipments: 12.0 million ↘️ (down 1.4% from 12.2 million)

Revenue per hundredweight: $32.05 ↗️ (up 2.4% - the silver lining)

The volume decline reflects broader economic softness, but ODFL maintained pricing discipline. They'd rather have fewer shipments at good prices than chase volume at bad margins.

Cost Structure Deep Dive 💸

Major expense categories (as % of revenue):

Salaries, wages & benefits: 46.2% ($2.69 billion)

Operating supplies & expenses: 10.9% ($635 million) - mostly fuel

Depreciation: 5.9% ($345 million)

General supplies & expenses: 3.0% ($177 million)

The good news? Operating supplies and expenses (mainly fuel) dropped 11.6% year-over-year as diesel prices fell. The bad news? Labor costs as a percentage of revenue increased due to the volume decline - classic operating leverage working in reverse.

Seasonality Patterns 📅

Like most transportation companies, ODFL sees seasonal patterns:

Q1 & Q4: Typically weaker (winter weather, holidays)

Q2 & Q3: Stronger performance (peak shipping season)

Weather events can significantly impact operations - hurricanes, floods, and severe winter weather all hurt performance by reducing demand and increasing costs.

Capital Allocation Strategy 💰

ODFL returned serious cash to shareholders in 2024:

Share repurchases: $967 million

Dividends: $224 million

Remaining buyback authorization: $2.26 billion

They also invested $751 million in capital expenditures (about 13% of revenue), focusing on:

Service center facilities: $373 million

Tractors: $219 million

Trailers: $104 million

Technology: $28 million

Layer 4: What Do We Have to Believe? 📚

The Bull Case 🐂

For ODFL to be a great long-term investment, you need to believe:

The Service Premium is Sustainable: ODFL's 99% on-time performance and 0.1% claims ratio command premium pricing. As long as customers value reliability over rock-bottom prices, ODFL wins.

Market Share Gains Continue: Industry consolidation should benefit the strongest players. ODFL's integrated network and service quality position them to steal business from weaker competitors.

Economic Recovery Drives Operating Leverage: When volumes return, ODFL's fixed costs get spread across more revenue, dramatically improving margins. Their operating ratio could improve significantly.

The "OD Family" Culture Remains Intact: Their low driver turnover and strong culture are massive competitive advantages in a labor-intensive industry.

Technology Investments Pay Off: Continued investment in routing optimization, customer service systems, and operational technology should maintain their efficiency edge.

The Bear Case 🐻

The risks that could derail the investment:

Prolonged Economic Weakness: If industrial production stays soft, volume declines could persist. ODFL's high fixed costs mean operating leverage works both ways.

Margin Compression: Competitors might sacrifice margins to maintain volume, forcing ODFL to choose between market share and profitability.

Labor Cost Inflation: If driver wages spike industry-wide, ODFL's labor advantage could erode. Their union-free status helps, but they still compete for the same driver pool.

Technology Disruption: Autonomous trucking, while still years away, could eventually commoditize the industry. ODFL's service advantage might matter less if robots are driving.

Customer Concentration Risk: While diversified today, losing a major customer or seeing consolidation among their customer base could hurt.

Fuel Price Volatility: While they have fuel surcharges, there's always timing lag and customer resistance during rapid price increases.

The Bottom Line Assessment 🎯

ODFL is a high-quality operator in a tough industry. They've built something special with their integrated network, service culture, and operational excellence. The 2024 results show they can maintain pricing discipline even when volumes decline - that's the mark of a company with real competitive advantages.

However, they're not immune to economic cycles. The LTL business is inherently tied to industrial production and economic activity. When the economy sneezes, freight companies catch a cold.

The key question: Are you betting on ODFL's operational excellence and market share gains, or are you worried about prolonged economic weakness and margin pressure?

At current levels, you're paying for a premium company with premium execution. Whether that premium is justified depends on your view of the economic cycle and ODFL's ability to continue taking market share from competitors.

Our take: ODFL has built a moat in a commodity-like industry through superior service and operational efficiency. That's impressive and rare. But like all cyclical businesses, timing matters. The company will likely emerge stronger from any downturn, but the ride might be bumpy.

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.