The Bottom Line Upfront 💡

Nexstar Media Group $NXST ( ▼ 1.98% ) is America's largest local TV broadcaster, operating 201 stations across 116 markets and reaching 70% of US households. Trading at ~$196 per share, the company appears significantly undervalued with a fair value estimate of $492 per share (151% upside potential). Despite industry headwinds from cord-cutting and streaming competition, Nexstar generates exceptional cash flows with 20%+ free cash flow margins, driven by a dual revenue model: stable distribution fees from cable companies (54% of revenue) and advertising revenue including lucrative political cycles (45% of revenue). The investment thesis centers on whether this cash cow can generate sufficient returns while managing $6.96 billion in debt and transitioning to digital platforms. At current valuations, investors are essentially paid a 20%+ cash yield to bet that local TV doesn't disappear overnight - a contrarian play with compelling risk-adjusted returns for patient value investors.

Sponsorship

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Strata Layers Chart

Layer 1: The Business Model 🏛️

Layer 1: The Business Model 🏛️

Think of Nexstar Media Group as the Walmart of local television - they've built an empire by being everywhere at once and leveraging massive scale. With 201 TV stations across 116 markets, they're basically the landlord of America's living rooms, collecting rent from both the cable companies that carry their signals and the advertisers who want to reach their audiences.

The Money Machine 💰

Nexstar operates a beautifully simple two-sided marketplace:

Side 1: Distribution Revenue (54% of total) ↗️ Cable and satellite companies pay Nexstar monthly fees based on their subscriber counts to carry local TV signals. It's like a subscription service, but instead of Netflix charging you $15/month, Comcast pays Nexstar a few dollars per subscriber per month for the right to include their local news and network programming. These contracts typically last 3-5 years with built-in annual price increases - it's recurring revenue that would make a SaaS CEO jealous.

Side 2: Advertising Revenue (45% of total) Local businesses, national brands, and politicians pay to run commercials during programming. The beauty here is that Nexstar gets paid twice for the same content - once by distributors to carry it, and again by advertisers to interrupt it with commercials. It's like owning a highway and charging both the drivers to use it AND the billboard companies to advertise alongside it.

The Portfolio Empire 🏢

Local TV Stations: The crown jewels - 201 stations affiliated with major networks (CBS, FOX, NBC, ABC, The CW). These are the local news powerhouses that people actually trust, employing 6,000 journalists who won 494 awards in 2024 alone.

The CW Network: Nexstar owns 77.1% of America's fifth-largest broadcast network. Think of it as their national platform - they've been transforming it from a money-losing teen drama network into a sports-focused, profitable operation.

NewsNation: Their 24/7 cable news network positioning itself as the "unbiased" alternative to Fox News and CNN. It's like being the Switzerland of cable news.

Digital Assets: 138 websites and 229 mobile apps that collectively attract 103 million monthly users ↗️. Not bad for a "traditional" media company.

Key Success Metrics 📊

Stations reaching 70% of US TV households (including partners)

Distribution revenue growth of 7.4% ↗️ in 2024

Political advertising cycles - they made bank in 2024 with 20.3% of ad revenue from political campaigns

Free cash flow margin of ~20% - this business prints money when managed well

Layer 2: Category Position 🏆

Layer 2: Category Position 🏆

Nexstar isn't just playing in the local TV sandbox - they've basically bought the entire playground. They're the largest local TV broadcaster in America, and it's not even close.

The Competition Landscape 🥊

Direct Competitors:

Gray Television, TEGNA, Sinclair Broadcast Group - all significantly smaller

Nexstar is roughly 2-3x larger than its nearest competitor in terms of station count and revenue

The Real Competition: The existential threat isn't other TV companies - it's the entire digital ecosystem. Netflix, YouTube, TikTok, and streaming services are stealing eyeballs, while Google and Meta are vacuuming up advertising dollars. It's like being the best horse-and-buggy manufacturer when cars are being invented.

Market Position Strengths 💪

Scale Advantages: Being the biggest affiliate group for each major network gives them serious negotiating power. When you control 70% of TV households, networks need you more than you need them.

Local News Moat: While anyone can stream content, producing quality local news requires boots on the ground, relationships with sources, and significant infrastructure investment. It's hard to disrupt.

Political Advertising Goldmine: Every two years, politicians need to reach voters, and local TV remains the most effective way to do it. Nexstar's geographic footprint covers most competitive political markets.

Recent Wins and Challenges 📈📉

Wins:

Successfully renewed major network affiliation agreements with CBS and NBC

Transformed The CW from a money-loser to a profitable sports-focused network

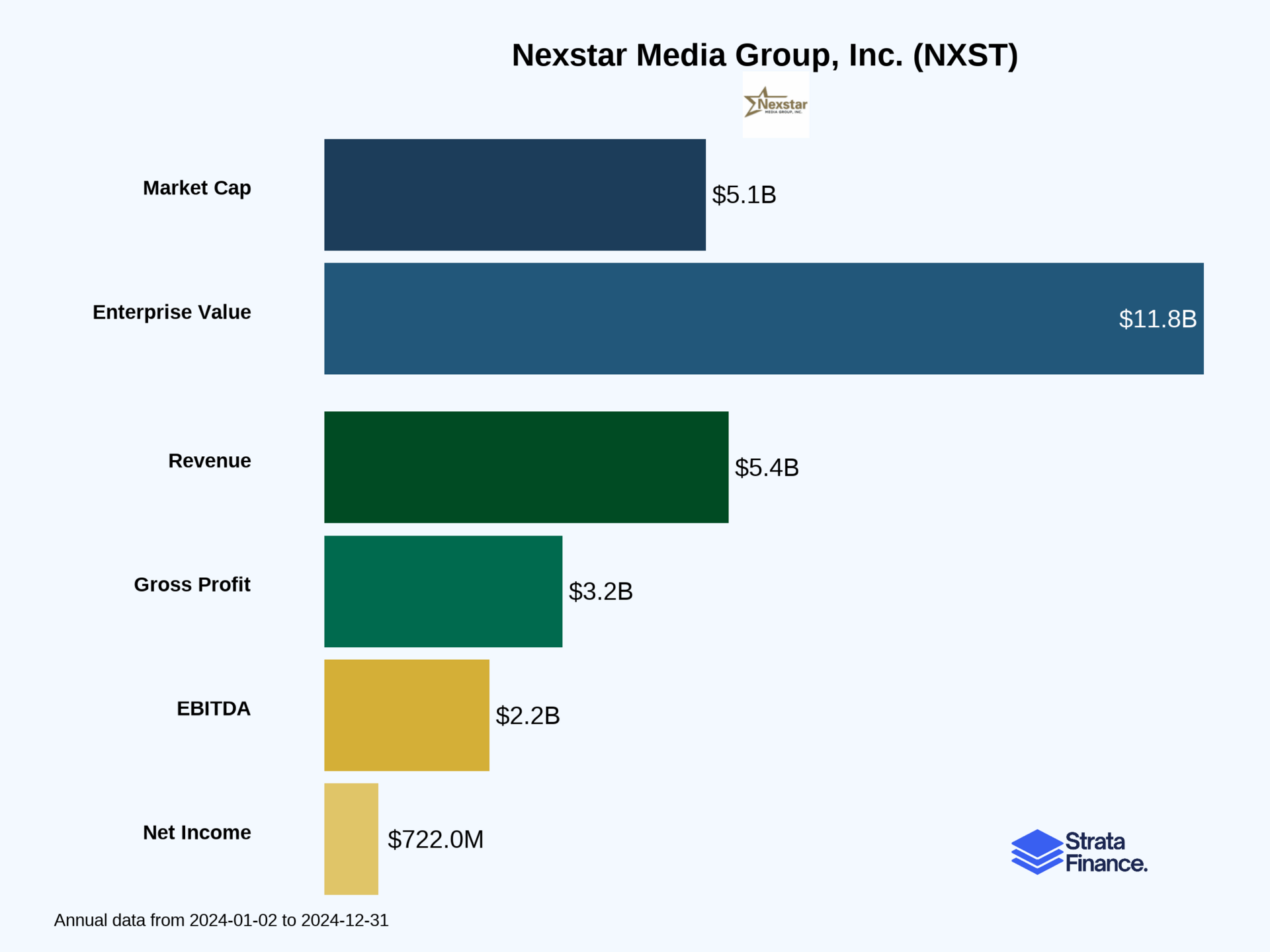

Achieved record $5.4 billion revenue ↗️ in 2024

Challenges:

Cord-cutting continues to pressure subscriber counts

Competition from digital platforms for advertising dollars

High debt burden of $6.96 billion needs attention

Layer 3: Show Me The Money! 📈

Layer 3: Show Me The Money! 📈

Revenue Breakdown: The Two-Engine Airplane ✈️

Distribution Revenue: $2.93 billion (54.1%) ↗️ This is the steady, predictable engine. Cable companies pay based on subscriber counts, and while cord-cutting is real, it's happening slowly. Plus, Nexstar negotiates annual price increases that often offset subscriber losses. It's like having a rent-stabilized apartment in Manhattan - the rent keeps going up even if the neighborhood changes.

Advertising Revenue: $2.42 billion (44.7%) The more volatile but potentially lucrative engine. This includes:

Local advertising (more stable, sold by local sales teams)

National advertising (more cyclical, now sold in-house for better margins)

Political advertising (the golden goose every two years)

The Political Advertising Bonanza 🗳️

Here's where it gets interesting: In 2024, political advertising represented 20.3% of total ad revenue. That's roughly $490 million just from politicians trying to convince people to vote for them. This creates a predictable two-year cycle where even-numbered years (election years) are significantly more profitable than odd years.

Layer 4: Long-Term Valuation (DCF Model) 💰

The DCF Deep Dive 🔍

Based on our discounted cash flow analysis, Nexstar appears to be significantly undervalued at its current level of around $196 per share (as of November 11, 2025).

Fair Value Range:

Conservative Scenario: $364 per share (85% upside)

Optimistic Scenario: $721 per share (268% upside)

Base Case Estimate: ~$492 per share (151% upside)

Key Valuation Drivers 🎯

What's Working in Nexstar's Favor:

Exceptional Cash Generation: Free cash flow margins around 20% are impressive for any business

Debt Reduction Capability: Generated $1.25 billion in operating cash flow in 2024

Predictable Revenue Streams: Distribution contracts provide stable base with built-in escalators

The Discount Factors:

High Debt Burden: $6.96 billion in net debt creates financial risk

Industry Headwinds: Cord-cutting and streaming competition

Cyclical Nature: Political advertising creates earnings volatility

Why the Market is Skeptical 🤔

The current low valuation suggests investors are pricing in significant secular decline. They're essentially betting that cord-cutting will accelerate and advertising will migrate entirely to digital platforms. While these are real risks, the market may be overly pessimistic about Nexstar's ability to adapt and maintain cash generation.

Layer 5: What Do We Have to Believe? 📚

The Bull Case: Local TV Isn't Dead Yet 🚀

Core Beliefs for Success:

Local News Remains Irreplaceable: People still want to know about local weather, traffic, crime, and politics. No algorithm can replace boots-on-the-ground journalism.

Political Advertising Stays on TV: Politicians will continue spending billions on local TV because it's still the most effective way to reach voters, especially older ones who actually vote.

Debt Reduction Execution: With $1.25 billion in annual operating cash flow, Nexstar can meaningfully reduce its $6.96 billion debt burden over the next 3-5 years.

Digital Transformation Success: The company's 103 million monthly digital users provide a foundation for new revenue streams and audience monetization.

The CW Turnaround: Converting the network from a money-loser to a profitable sports-focused platform creates additional value.

The Bear Case: Disruption is Real 📉

Critical Risks and Challenges:

Accelerating Cord-Cutting: If cable/satellite subscriber losses accelerate beyond current trends, distribution revenue could face significant pressure.

Debt Refinancing Risk: With $6.96 billion in debt and rising interest rates, refinancing costs could significantly impact cash flows.

Regulatory Pressure: Government could impose restrictions on media consolidation or ownership rules that limit growth opportunities.

Generational Shift: Younger audiences increasingly get news and entertainment from social media and streaming platforms, potentially making local TV irrelevant over time.

The Verdict: A Contrarian Play with Real Merit 🎯

Nexstar represents a classic value trap vs. value opportunity debate. The company generates enormous cash flows from assets that many consider obsolete, but those cash flows remain remarkably resilient.

The Investment Thesis: At current valuations, you're essentially getting paid a 20%+ cash yield to bet that local TV doesn't disappear overnight. Even if the business slowly declines, the combination of strong cash generation, debt reduction, and potential digital upside could generate attractive returns.

The Risk: You're betting against the tide of technological change in an industry that's clearly in secular decline. If cord-cutting accelerates or advertising migration happens faster than expected, even the attractive current valuation might not provide adequate downside protection.

Bottom Line: Nexstar isn't a growth story - it's a cash cow in a declining industry with smart management trying to milk every dollar while transitioning to digital. For investors comfortable with cyclical, cash-generative businesses trading at deep discounts, it's worth serious consideration. Just don't expect it to be the next Netflix.

The key question isn't whether traditional TV will eventually decline - it's whether Nexstar can generate enough cash along the way to reward patient investors. At current prices, the odds look surprisingly favorable. 📺💰

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.