The Bottom Line Upfront 💡

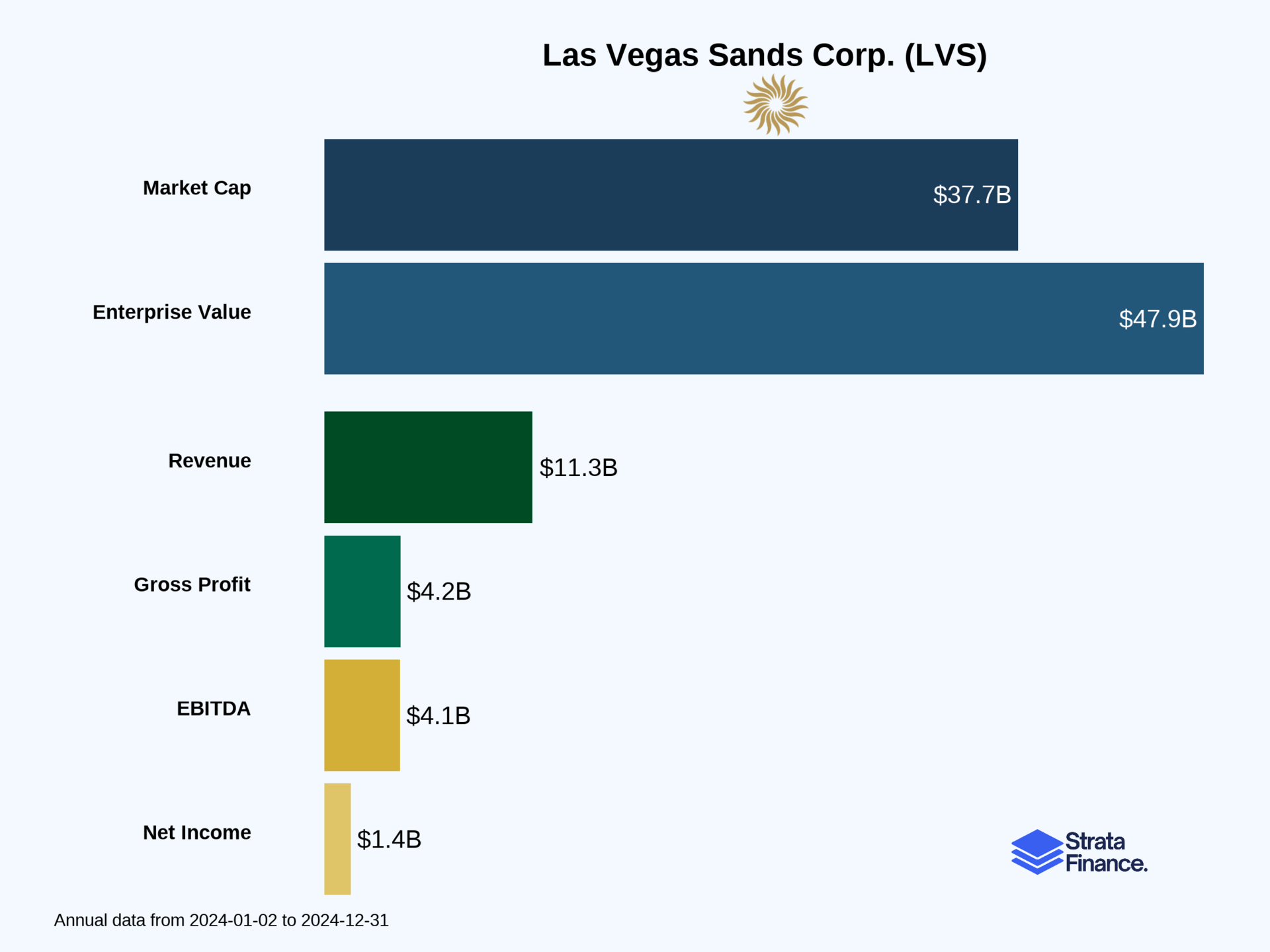

Las Vegas Sands Corp. $LVS ( ▲ 0.46% ) operates luxury integrated resorts in Asia's most exclusive gaming markets, but the stock appears significantly overvalued at current levels. Despite owning iconic properties like Marina Bay Sands and The Venetian Macao, our DCF analysis suggests fair value ranges from $4.80-$27.97 versus the current price of $53.07. The company carries $17.4 billion in net debt, faces massive required capital investments of $12+ billion, and depends heavily on Chinese regulatory stability for 63% of its revenue. While Asian demographic trends are compelling long-term, the risk-reward equation is broken at current valuations.

Sponsorship

Peak Rates on the Products You Need

Peak Bank was designed for those who want to bank boldly, providing a 100 percent digital platform that combines convenience and powerful money management tools. Our high-yield savings accounts offer rates as high as 4.35% APY* while remaining accessible and flexible, ensuring you stay in control at all times. Apply online to start your ascent.

Member FDIC

Strata Layers Chart

Layer 1: The Business Model 🏛️

What Does LVS Actually Do?

Think of Las Vegas Sands as the Disney World of gambling – but for adults with expense accounts and a taste for luxury shopping. They don't just run casinos; they've created what they call "Integrated Resorts," which are basically mini-cities designed to separate you from your money in the most entertaining way possible.

Here's the genius of their model: Instead of just hoping you'll gamble away your paycheck, they've built massive entertainment complexes that give you about 47 different ways to spend money. Want to gamble? Great! Need a hotel room? They've got 2,905 suites at The Venetian Macao alone. Hungry? How about restaurants from celebrity chefs. Want to shop? They own 2.7 million square feet of retail space featuring brands like Hermès and Louis Vuitton. Planning a corporate event? They've got 2.8 million square feet of convention space globally.

The really smart part? They sold all their Las Vegas properties in 2022 for $6.25 billion and went all-in on Asia. Why? Because while Americans might be tightening their belts, Asia's growing middle class is just getting started with their disposable income party.

The Money-Making Machine

LVS operates through a unique structure where they own 72.29% of Sands China Ltd. (SCL), which trades on the Hong Kong Stock Exchange. This isn't just corporate complexity for fun – it allows them to tap into Asian capital markets while maintaining control.

Their revenue streams break down like this:

Casino Operations (73% of revenue): The bread and butter, generating $8.3 billion ↗️ in 2024

Hotel Rooms (11%): $1.27 billion ↗️ from premium accommodations

Mall Operations (7%): $755 million from luxury retail leasing

Food & Beverage (5%): $607 million ↗️ from restaurants and dining

Convention/Other (3%): $359 million ↗️ from business events and entertainment

Key Properties & Brands

Macao Portfolio (through SCL ownership):

The Venetian Macao: The flagship with gondola rides and 952,000 sq ft of shopping

The Londoner Macao: Features replicas of Big Ben and Houses of Parliament (because nothing says "authentic London experience" like gambling in Macao)

The Parisian Macao: Complete with a half-scale Eiffel Tower, because why not?

The Plaza Macao & Four Seasons: Ultra-luxury positioning with 19 exclusive "Paiza Mansions"

Sands Macao: Their original property, the OG of Macao gaming

Singapore:

Marina Bay Sands: The iconic property with the infinity pool that's probably in half your Instagram feed

How They Measure Success

LVS tracks several key metrics that tell the real story:

Gaming Metrics:

Non-Rolling Chip Drop: $30.1 billion ↗️ in 2024 (this is the "mass market" – regular folks gambling)

Rolling Chip Volume: $51.0 billion ↗️ (the high-roller VIP action)

Win Percentages: They expect about 3.3% win rate on VIP play and 22.1% on mass market

Hotel Performance:

Occupancy Rates: 95.7% ↗️ in Macao, 94.8% ↘️ in Singapore

Average Daily Rate (ADR): $214 ↗️ in Macao, $826 ↗️ in Singapore (yes, $826 per night!)

Mall Operations:

Occupancy: 83.1% in Macao, 99.3% in Singapore

Base Rent per Square Foot: Varies by property, but they're essentially luxury mall landlords

The company's strategy focuses heavily on "mass market" gaming rather than VIP high-rollers. Why? Mass market players generate higher profit margins because they don't require as many comped services, and their spending is more predictable. Plus, the Chinese government has been cracking down on VIP gaming, so focusing on regular folks was prescient.

Layer 2: Category Position 🏆

The Competition Landscape

LVS operates in what's essentially a government-sanctioned oligopoly – and that's exactly how they like it. In Macao, there are only six gaming concessionaires total, making this less "free market competition" and more "exclusive club with very high membership fees."

Macao Competitors:

SJM Resorts: The local incumbent with deep government ties

Wynn Resorts: The luxury-focused American operator

Galaxy Casino: Strong local presence with solid mass market focus

MGM Grand Paradise: The MGM brand trying to make it in Asia

Melco Resorts: Another major player with multiple properties

Singapore: Even more exclusive – just two operators total. LVS competes only with Resorts World Sentosa (owned by Genting Singapore).

Market Position & Competitive Advantages

LVS has built several moats around their business:

Scale Advantage: Their properties are massive. The Venetian Macao alone has 503,000 square feet of gaming space.

Mass Market Leadership: They have the highest percentage of gaming revenue from mass tables and slots among Macao operators.

Brand Recognition: Marina Bay Sands has become synonymous with Singapore's skyline. In Macao, their interconnected European-themed properties (Venetian, Londoner, Parisian) create a critical mass that's hard to replicate.

Convention-Based Strategy: Their "convention-based marketing" is brilliant – attract business travelers during slow mid-week periods, then fill weekends with leisure travelers.

The Regulatory Moat

Here's what makes this business special (and risky): it's heavily regulated with limited licenses. LVS operates under a 10-year gaming concession in Macao (expires 2032) and a 30-year concession in Singapore. These aren't just business licenses – they're government-granted monopolies with specific investment requirements.

In Macao, LVS must invest at least $4.48 billion through 2032, with $4.17 billion in non-gaming projects. That's not optional spending – it's a regulatory requirement. But it also creates barriers to entry that would make even the most ambitious competitor think twice.

Layer 3: Show Me The Money! 📈

Revenue Breakdown: The Diversification Story

LVS has built what's essentially a luxury entertainment conglomerate, and their revenue mix shows it:

By Business Segment (2024):

Casino: $8.30 billion (73%) ↗️ +10.4%

Rooms: $1.27 billion (11%) ↗️ +5.8%

Mall: $755 million (7%) ↘️ -1.6%

Food & Beverage: $607 million (5%) ↗️ +3.9%

Convention/Other: $359 million (3%) ↗️ +21.7%

By Geography:

Macao: $7.07 billion (63%) ↗️ +8.4%

Singapore: $4.23 billion (37%) ↗️ +9.9%

Layer 4: Long-Term Valuation (DCF Model) 💰

Based on our discounted cash flow analysis, LVS appears significantly overvalued at current levels. Here's what the numbers tell us:

Current Market Price: $53.07 (as of 10.1.2025) Fair Value Range: $4.80 - $27.97

Yes, you read that right. Even in our optimistic scenario, the stock appears overvalued by 47-91%. Let's break down why.

Conservative Scenario: $4.80 Fair Value

Key Assumptions:

Revenue growth: 5.0% → 2.5% over 5 years (reflecting mature markets)

Operating margins: Gradual improvement to 22.0%

WACC: 10.7% (reflecting regulatory and geopolitical risks)

Terminal growth: 2.5%

The Problem: LVS carries $17.4 billion in net debt. That's not just a number on a balance sheet – it's a massive anchor dragging down equity value. Even with $1.6-1.9 billion in projected annual free cash flow, the debt burden severely limits shareholder returns.

Optimistic Scenario: $27.97 Fair Value

Key Assumptions:

Revenue growth: 8.0% → 4.0% over 5 years (assuming strong Asian recovery)

Higher free cash flow margins through operational efficiency

WACC: 9.2% (lower risk premium)

Terminal growth: 3.0%

Still Overvalued: Even assuming everything goes right – strong Asian economic growth, successful completion of expansion projects, no regulatory setbacks – the stock trades at a 47% premium to fair value.

Sensitivity Analysis

The valuation is highly sensitive to key assumptions:

WACC Sensitivity (Optimistic Scenario):

8.5% WACC: $32.50 fair value

9.0% WACC: $29.80 fair value

10.0% WACC: $24.90 fair value

11.0% WACC: $20.90 fair value

Terminal Growth Sensitivity:

2.0% growth: $24.50 fair value

3.0% growth: $29.40 fair value

4.0% growth: $35.60 fair value

What's Driving the Disconnect?

The Debt Problem: $17.4 billion in net debt represents 48% of enterprise value. This isn't growth debt funding expansion – much of it stems from pandemic-era borrowing and ongoing capital requirements.

Regulatory Concentration Risk: 63% of revenue comes from Macao, where they operate under a concession that expires in 2032. Any regulatory changes or geopolitical tensions with China create massive risk.

Capital Intensity: The business requires constant reinvestment. They're spending $8 billion on Singapore expansion alone, plus $4.48 billion in required Macao investments through 2032.

The math is pretty clear here. Both conservative and optimistic scenarios suggest significant overvaluation. The market appears to be pricing in perfect execution of expansion plans, no regulatory setbacks, and sustained high growth rates that seem unrealistic given the mature nature of their core markets.

Layer 5: What Do We Have to Believe? 📚

The Bull Case: Betting on Asian Growth 🐂

To justify buying LVS at current prices, you need to believe several things will go exactly right:

Asia's Middle Class Explosion: The core thesis is that Asia's growing middle class will drive sustained demand for luxury entertainment and gaming.

Macao Remains the "Las Vegas of Asia": Despite geopolitical tensions, you have to believe China will continue allowing its citizens to gamble in Macao while restricting it everywhere else.

$12+ Billion in Expansion Projects Pay Off: Between the $8 billion Singapore expansion and $4.48 billion in required Macao investments, LVS is betting big on future demand.

Mass Market Gaming Continues Growing: Their shift from VIP to mass market gaming was smart, but you need sustained growth in middle-class gambling to drive revenue increases.

Regulatory Stability: The Macao concession expires in 2032. You're betting it gets renewed on favorable terms and that Singapore maintains its two-operator duopoly.

The Bear Case: House of Cards 🐻

The bear case is unfortunately, quite compelling:

Debt Burden is Crushing: $17.4 billion in net debt against $1.6 billion in free cash flow means they're essentially a leveraged bet on Asian gaming growth.

Geopolitical Time Bomb: 63% of revenue depends on Chinese citizens being allowed to gamble in Macao.

Mature Market Dynamics: Both Macao and Singapore are mature gaming markets with limited room for expansion.

Regulatory Overhang: Gaming concessions are government privileges, not rights.

Capital Intensity Never Ends: This isn't a software business that scales beautifully.

Structural Headwinds: VIP gaming (historically high-margin) faces continued pressure from Chinese anti-corruption efforts.

The Verdict: Proceed with Extreme Caution ⚠️

LVS operates fantastic properties and has built impressive competitive moats in attractive markets. The management team is experienced, and the long-term demographic trends in Asia are compelling.

But here's the problem: the stock price already reflects all of that optimism and then some. At current valuations, you're not just betting on Asian growth – you're betting on perfect execution of massive expansion projects, no regulatory setbacks, sustained high growth rates, and successful debt management.

Better Opportunities Exist: If you want exposure to Asian growth, there are probably better ways to play it than a highly leveraged gaming company with massive regulatory and geopolitical risks.

The house always wins in gambling, but that doesn't mean the house's stock is always a good bet. Right now, LVS appears to be priced for perfection in an imperfect world.

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.