The Bottom Line Upfront 💡

JPMorgan Chase $JPM ( ▲ 3.95% ) is America's banking behemoth – a $4.1 trillion financial empire that's basically the Swiss Army knife of finance. With four major business lines serving everyone from college students to Fortune 500 CEOs, JPM generates $94.1 billion in annual revenue through the classic banking playbook: borrow low, lend high, and collect fees on everything in between. Trading at a 40% profit margin with a 14.6% return on equity, they're the closest thing to a "sure thing" in banking. The bull case hinges on continued U.S. economic strength, successful tech investments, and the belief that scale still matters in finance. The bear case? Economic recession, fintech disruption, or regulatory backlash could derail the gravy train. Bottom line: JPM isn't sexy, but it's a cash-generating machine with multiple revenue streams, fortress-like financials, and Jamie Dimon at the helm. Sometimes boring is beautiful – especially when it pays a 2.9% dividend.

Partnership

Get access to the most exclusive offers for private market investors

Looking to invest in real estate, private credit, pre-IPO venture or crypto? AIR Insiders get exclusive offers and perks from leading private market investing tools and platforms, like:

Up to $250 free from Percent

50% off tax and retirement planning from Carry

$50 of free stock from Public

A free subscription to Worth Magazine

$1000 off an annual subscription to DealSheet

and offers from CapitalPad, Groundfloor, Fundrise, Mogul, and more.

Just sign up for our 2-week free trial to experience all the benefits of being an AIR Insider.

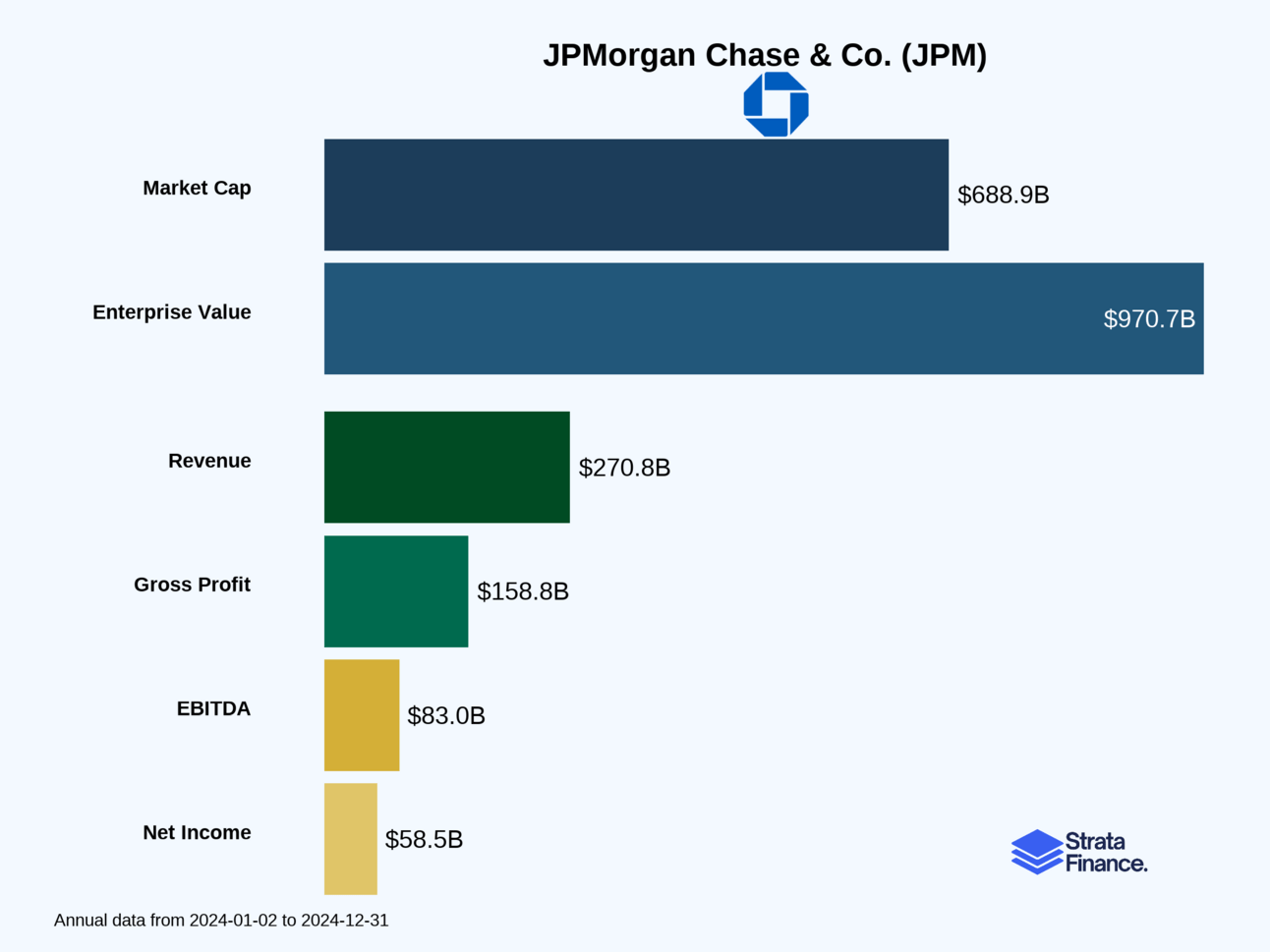

Strata Layers Chart

Layer 1: The Business Model 🏛️

Think of JPMorgan Chase as the Swiss Army knife of finance – they've got a tool for pretty much every financial need you can imagine. With roots stretching back to 1799 (yes, they're older than your great-great-great-grandmother's china), JPM has evolved into America's largest bank and a global financial powerhouse.

What They Actually Do 💰

JPM operates like a financial department store with four main "floors":

Consumer & Community Banking 🏠 - This is their bread and butter, serving 86 million customers (that's roughly 1 in 4 Americans!). They make money the old-fashioned way: borrowing money from depositors at low rates and lending it out at higher rates. Think checking accounts, mortgages, auto loans, and those Chase Sapphire credit cards that make you feel fancy at Starbucks. They also collect fees for various services – because banks love their fees almost as much as they love marble lobbies.

Corporate & Investment Banking 💼 - This is where the big boys play. They help massive corporations raise money, merge with other companies, and trade securities. It's like being a financial matchmaker for billion-dollar deals. Revenue comes from advisory fees (think of them as expensive consultants), underwriting fees for helping companies go public, and trading profits from their market-making operations.

Commercial Banking 🏢 - The middle child that serves mid-sized businesses. They provide loans, cash management, and other services to companies that are too big for your local credit union but not quite Goldman Sachs material.

Asset & Wealth Management 💎 - For people with more money than they know what to do with (lucky them). They manage investments for wealthy individuals and institutions, charging fees based on how much money they're managing. It's like being a financial babysitter for rich people's money.

Key Metrics They Watch 📊

Return on Equity (ROE): Currently at 14.6% ↗️ – This measures how efficiently they're using shareholders' money. Anything above 10% is solid for banks.

Net Interest Margin: 2.24% – The spread between what they pay for deposits and earn on loans. It's their profit margin on the basic banking business.

Efficiency Ratio: 62.4% – Lower is better. This means they spend about 62 cents to generate every dollar of revenue.

Common Equity Tier 1 Ratio: 14.0% – Their financial cushion. Regulators require at least 4.5%, so they're sitting pretty.

How They Deliver Value 🚀

JPM's secret sauce is their integrated platform. Unlike specialized firms that do one thing well, JPM can cross-sell services across all their divisions. Got a corporate client who needs a loan? Great, they can also help with their IPO, manage their employees' 401(k)s, and provide treasury services. It's like Amazon Prime for financial services.

They've also gone all-in on technology, spending over $12 billion annually (that's more than some countries' GDP) on digital transformation. Their mobile app serves 57 million users ↗️, making them a fintech company that happens to have a banking license.

Layer 2: Category Position 🏆

JPM sits on the iron throne of American banking, and they're not giving it up without a fight.

The Competition Landscape 🥊

In the heavyweight division of banking, JPM faces off against:

Bank of America: The scrappy challenger with a massive retail presence

Wells Fargo: The wounded giant still recovering from scandal fallout

Citigroup: The global player with international reach but domestic struggles

Goldman Sachs: The investment banking aristocrat trying to break into consumer banking

JPM consistently ranks #1 in total assets ($4.1 trillion – that's larger than Germany's GDP) and market cap. They're like the Yankees of banking: everyone either loves them or loves to hate them, but you can't ignore their dominance.

Market Share Wins 🎯

Investment Banking: Consistently top 3 globally for fees, often #1

Credit Cards: One of the largest portfolios in the industry

Branch Network: 4,700+ locations (though who needs branches anymore?)

Digital Banking: Their app is downloaded more than most games

Recent Competitive Moves 🎮

JPM has been playing chess while others play checkers. They've launched digital-only banks in international markets, invested heavily in AI and machine learning, and made strategic acquisitions to fill capability gaps. While fintech startups nip at their heels, JPM's response has been: "Cute. Watch this." They have the resources to out-innovate most challengers and the regulatory expertise that takes decades to build.

Layer 3: Show Me The Money! 📈

Let's talk turkey – or in this case, let's talk about $94.1 billion in annual revenue ↗️ (up 2.4%).

Revenue Breakdown by Segment 🍰

Corporate & Investment Bank: $38.7B (41% of total) – The volatile but profitable crown jewel

Consumer & Community Banking: $26.3B (28% of total) – Steady Eddie that pays the bills

Commercial Banking: $22.5B (24% of total) – The reliable middle child

Asset & Wealth Management: $10.9B (12% of total) – Small but growing with sticky revenues

How They Make Their Money 💸

Net Interest Income: The classic banking play – borrow low, lend high, pocket the difference. With $1.1 trillion in average loan balances, even small margins add up fast.

Fee Income: From investment banking advisory fees to credit card interchange fees to wealth management fees. Banks have more fee categories than a budget airline.

Trading Revenue: Making money on market movements and providing liquidity. It's like being the house in Vegas, but with more regulations and better suits.

Customer Demographics 👥

Their customer base spans from college students with their first checking account to Fortune 500 CEOs. The consumer business serves everyone from millennials drowning in student debt to boomers planning retirement. The institutional side serves everyone from small municipalities to sovereign wealth funds.

Layer 4: What Do We Have to Believe? 📚

The Bull Case 🐂

For JPM to be a winner, you need to believe:

The U.S. economy remains resilient – Banks are leveraged plays on economic growth. If America keeps humming along, JPM benefits from loan growth, lower credit losses, and increased business activity.

Their technology investments pay off – That $12B+ annual tech spend needs to translate into competitive advantages, cost savings, and new revenue streams. So far, so good.

Scale still matters in banking – Despite fintech disruption, JPM's size, regulatory expertise, and integrated platform provide sustainable competitive advantages.

Interest rates stay elevated – Higher rates mean fatter net interest margins. JPM's fortress balance sheet positions them well in a higher-rate environment.

Wealth management growth continues – As baby boomers age and wealth concentrates, demand for sophisticated financial services should grow.

The Bear Case 🐻

The risks that could derail the JPM train:

Economic recession – Banks are cyclical. A severe downturn would mean loan losses, reduced business activity, and potential dividend cuts.

Fintech disruption accelerates – If tech companies successfully unbundle banking services, JPM's integrated model could become a liability rather than an asset.

Regulatory backlash – Politicians love to bash big banks. New regulations could limit profitability, force business model changes, or break up the company.

Credit cycle turns – We're in a relatively benign credit environment. When it turns (and it always does), loan losses could spike.

Interest rates collapse – If we return to zero rates, net interest margins get crushed, and the core banking business becomes much less profitable.

The Bottom Line 📝

JPMorgan Chase is the closest thing to a "sure thing" in banking, which is like being the tallest building in a town prone to earthquakes – impressive, but not without risk. They've built an incredible franchise with multiple revenue streams, strong management (Jamie Dimon is basically the Warren Buffett of banking), and a fortress balance sheet.

The company trades on the belief that big, diversified, well-managed banks will continue to play a central role in the global financial system. They've survived every crisis, adapted to every regulatory change, and consistently generated strong returns for shareholders.

Is it exciting? Not particularly – unless you find quarterly earnings calls thrilling. Is it a solid business with predictable cash flows and reasonable growth prospects? Absolutely. Sometimes boring is beautiful, especially when it comes with a 2.9% dividend yield and consistent share buybacks.

JPM isn't going to 10x overnight, but it's also not going to zero. In a world of meme stocks and crypto volatility, sometimes you just want to own a piece of the financial system's backbone. And if that backbone happens to generate $37.7 billion in annual profits ↗️, well, that's not too shabby.

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.