The Bottom Line Upfront 💡

J.B. Hunt Transport Services $JBHT ( ▲ 1.38% ) is a $12+ billion transportation and logistics powerhouse that's evolved from a simple Arkansas trucking company into America's most diversified freight mover. With five distinct business segments spanning intermodal, dedicated contracts, brokerage, final mile delivery, and traditional trucking, they've built competitive moats in a notoriously commodity business. However, 2024 was a challenging year with revenue declining across all segments due to freight market weakness. The company's strong balance sheet, technology investments, and 90% customer retention rates in their dedicated business provide defensive characteristics, but they can't escape cyclical freight market dynamics. For investors, JBHT represents a quality company potentially trading at cyclical lows, but you need conviction about freight market recovery and their ability to execute on technology integration to justify the investment.

Partnership

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Strata Layers Chart

Layer 1: The Business Model 🏛️

Think of J.B. Hunt as the Swiss Army knife of American freight movement. While most trucking companies are like a single screwdriver, J.B. Hunt has built a multi-tool approach that can handle whatever logistics challenge you throw at it. Founded in 1961 in Arkansas (because where else would you start a trucking empire?), they've evolved from a simple trucking outfit into a $12+ billion transportation and logistics powerhouse.

What They Actually Do 🔧

J.B. Hunt operates five distinct business segments, each serving different slices of the massive freight transportation pie:

Intermodal (JBI) - The Crown Jewel 👑 This is their biggest moneymaker at $5.96 billion in 2024 revenue ↘️. Think of it as the best of both worlds: they use trains for the long, boring highway stretches (cheaper and more fuel-efficient) and trucks for the tricky first-mile pickup and last-mile delivery parts. They own 122,272 containers and chassis that are specially designed to work only with each other - like Apple products, but for freight. This creates what they call "operational competitive advantage," which is corporate speak for "good luck copying this setup."

Dedicated Contract Services (DCS) - The Steady Eddie 🤝 At $3.40 billion in revenue ↘️, DCS is like being the exclusive transportation department for big companies. Instead of Walmart or Home Depot managing their own truck fleets, they outsource the whole operation to J.B. Hunt under long-term contracts (averaging 5 years). It's a cost-plus model, meaning J.B. Hunt gets paid regardless of how busy the trucks are - pretty sweet deal when you can get it.

Integrated Capacity Solutions (ICS) - The Matchmaker 💕 This $1.14 billion segment ↘️ is essentially Uber for freight. When J.B. Hunt doesn't have the right truck in the right place, they tap into their network of 110,000 third-party carriers to get the job done. They also run the J.B. Hunt 360° platform, which is like a dating app that matches shippers with carriers.

Final Mile Services (FMS) - The Last Leg Hero 🏠 The $910 million FMS business ↘️ handles the trickiest part of e-commerce: getting that massive couch or refrigerator from a warehouse to your living room. With 98% of Americans living within 150 miles of an FMS location, they've built a network that can deliver and install big, bulky stuff nationwide.

Truckload (JBT) - The Traditional Play 🛣️ The smallest segment at $702 million ↘️, JBT is old-school trucking: pick up a full trailer at point A, drive it to point B. They mostly use independent contractors driving company-owned trailers.

Key Metrics That Matter 📊

J.B. Hunt tracks different metrics for each business, but here are the ones that really move the needle:

Revenue per load: How much they make per shipment (varies by segment)

Operating ratio: Operating expenses as a percentage of revenue (lower is better - theirs hit 93.1% in 2024 ↘️)

Equipment utilization: How efficiently they use their trucks and trailers

Customer retention: DCS boasts ~90% retention rates

Load volumes: Total shipments handled across all segments

The Money Machine 💰

J.B. Hunt makes money by being the middleman in America's freight movement, but they're a very sophisticated middleman. They own the trucks, containers, and technology platforms, then charge customers for moving their stuff efficiently. Revenue recognition follows the percentage-of-completion method - they book revenue as freight moves from pickup to delivery, providing steady cash flow.

Layer 2: Category Position 🏆

J.B. Hunt plays in what industry folks politely call a "highly fragmented and competitive" market, which is corporate speak for "there are thousands of trucking companies, and most of them are trying to undercut each other on price." But here's where J.B. Hunt gets interesting - they've managed to build moats in a commodity business.

The Competition Landscape 🥊

The trucking industry has more players than a high school marching band, but only a handful can compete nationally across all service types like J.B. Hunt. Their main rivals include:

CH Robinson Worldwide: The freight brokerage giant

Knight-Swift Transportation: Another large trucking conglomerate

Old Dominion Freight Line: The LTL (less-than-truckload) specialist

XPO Inc: Logistics and transportation services

But here's the thing - J.B. Hunt doesn't really have a direct competitor that matches their exact mix of services. Most companies excel in one area (like Old Dominion in LTL or CH Robinson in brokerage), while J.B. Hunt offers the full spectrum.

Competitive Advantages 🛡️

Scale and Network Effects: With 33,646 employees and operations across North America, J.B. Hunt has the scale to serve Fortune 500 customers that smaller competitors simply can't handle.

Technology Integration: The J.B. Hunt 360° platform isn't just marketing fluff - it processed $396 million in marketplace revenue in 2024. This creates switching costs for customers who get used to the visibility and integration.

Intermodal Expertise: Their partnership with BNSF Railway (dating back to 1989) and other Class I railroads gives them unique capabilities in combining rail and truck transport. Those specially designed containers that only work with their chassis? That's not an accident - it's a competitive moat.

Customer Stickiness: When you're handling someone's entire dedicated fleet operation under a 5-year contract, they're not switching providers on a whim. DCS's 90% customer retention rate proves this works.

Market Position Reality Check 📈

J.B. Hunt is definitely a big fish, but the transportation pond is enormous. Their top 10 customers represent about 35% of revenue, with one customer alone accounting for 11%. This shows both the strength of their enterprise relationships and the concentration risk they face.

The company's integrated approach - being able to offer intermodal, dedicated, brokerage, and final mile services - is their key differentiator. Pure-play competitors might beat them in one specific area, but few can match the breadth of services under one roof.

Layer 3: Show Me The Money! 📈

Let's talk turkey about J.B. Hunt's financials, because 2024 was... well, let's just say it wasn't their victory lap year.

Revenue Breakdown - The Good, Bad, and Ugly 💸

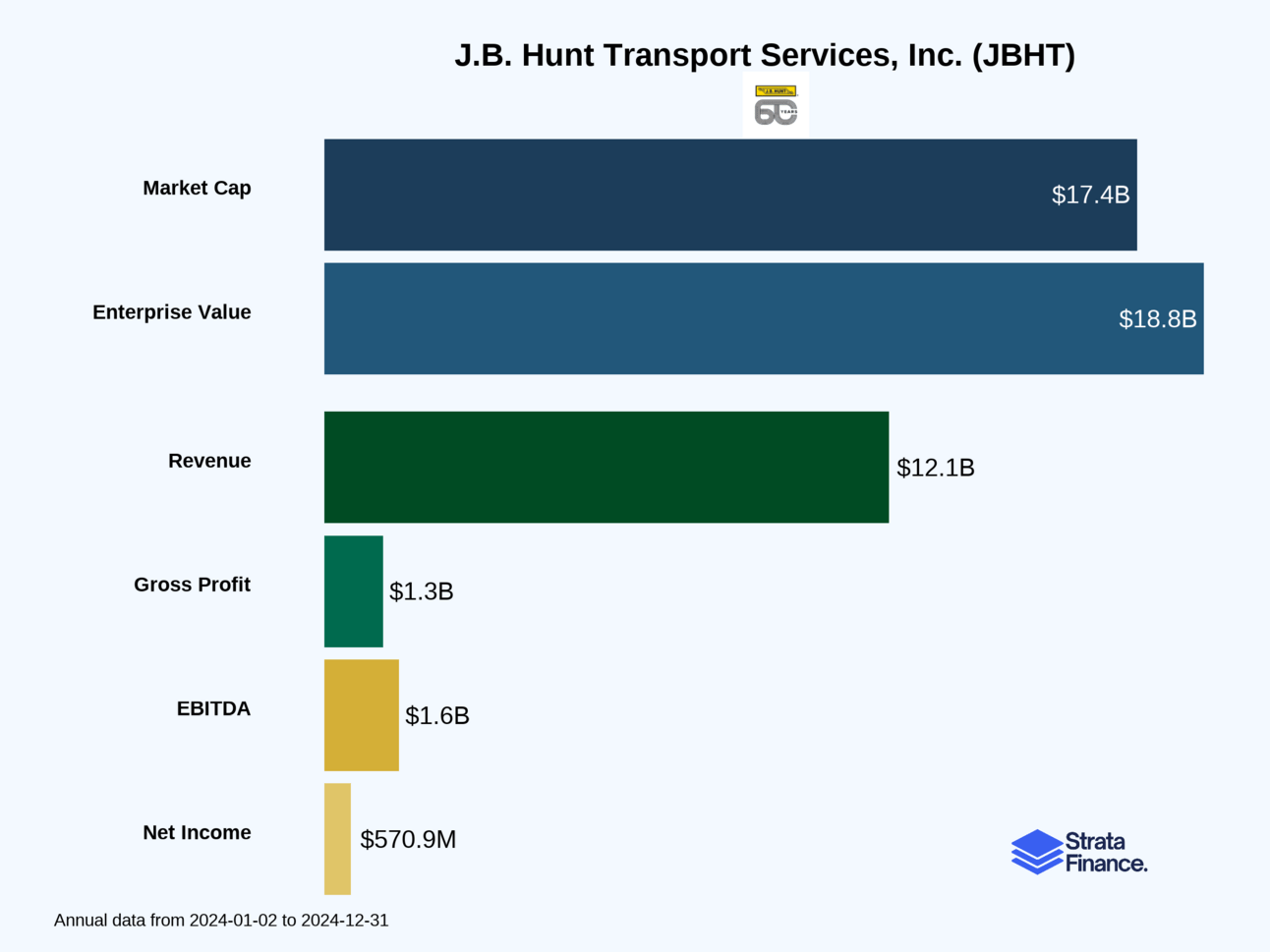

Total Revenue: $12.09 billion in 2024 ↘️ (down from $12.83 billion in 2023)

Every single segment saw revenue decline in 2024 - that's not a typo, that's a freight recession:

Intermodal (JBI): $5.96B ↘️ (49% of total revenue)

Dedicated (DCS): $3.40B ↘️ (28% of total revenue)

Brokerage (ICS): $1.14B ↘️ (9% of total revenue)

Final Mile (FMS): $910M ↘️ (8% of total revenue)

Truckload (JBT): $702M ↘️ (6% of total revenue)

The Margin Story - Ouch 😬

Operating margins compressed to 6.9% in 2024 ↘️ from 7.7% in 2023. In the trucking world, margins are everything, and J.B. Hunt's operating ratio (expenses as % of revenue) worsened to 93.1% from 92.3%. That might not sound like much, but in a $12 billion business, every tenth of a percentage point matters.

Where the Money Goes:

Purchased Transportation: 44.5% of revenue (paying railroads and third-party carriers)

Salaries & Benefits: 26.7% of revenue (those 33,646 employees don't work for free)

Depreciation: 6.3% of revenue (trucks and containers wear out)

Fuel: 5.4% of revenue (diesel ain't cheap)

Segment Performance Deep Dive 🔍

Intermodal (JBI) - The segment that pays the bills saw revenue per load drop 6% ↘️ to $2,849, even though they moved 2% more loads ↗️. This is classic freight market weakness - more volume but lower prices.

Dedicated (DCS) - Revenue per truck per week fell 2% ↘️ to $5,075, showing that even their stickiest business wasn't immune to market pressures.

Brokerage (ICS) - This was the real problem child, with an operating loss of $56 million ↘️ (worse than 2023's $44 million loss). The BNSF Logistics acquisition integration costs didn't help, including $26 million in asset impairments.

Final Mile (FMS) - Actually improved its operating income to $60 million ↗️ from $47 million, showing that the last-mile delivery business has some resilience.

Cash Flow and Capital Allocation 💰

Despite the revenue decline, J.B. Hunt generated $1.48 billion in operating cash flow ↘️ (down from $1.74 billion). They spent $674 million on new equipment and returned $689 million to shareholders through dividends ($175M) and share buybacks ($514M).

The company maintains a strong balance sheet with $47 million in cash and $1.5 billion in available credit. They've got $500 million in debt maturing in 2025, but management seems confident they can handle it.

Layer 4: What Do We Have to Believe? 📚

Alright, let's cut to the chase. J.B. Hunt is a solid company that had a rough 2024, but the question for investors is whether this is a temporary freight recession or something more structural. Here's what you need to believe for each scenario:

The Bull Case - Why J.B. Hunt Could Crush It 🐂

Belief #1: Freight Markets Are Cyclical, Not Broken You have to believe that 2024's weakness was a cyclical downturn, not a permanent shift. Historically, freight markets swing between oversupply (like now) and tight capacity. When the cycle turns, companies with scale and efficiency advantages like J.B. Hunt tend to outperform.

Belief #2: Technology Creates Sustainable Advantages The J.B. Hunt 360° platform isn't just a fancy website - it's becoming the nervous system that connects all their services. If customers get hooked on the visibility and integration, switching costs increase dramatically. Think of it like getting locked into the Apple ecosystem, but for freight.

Belief #3: Intermodal Is the Future Rail transport is roughly 3-4x more fuel-efficient than trucking. As sustainability becomes more important and fuel costs remain volatile, intermodal should gain market share. J.B. Hunt's 30+ year partnership with BNSF and their specialized equipment give them a huge head start.

Belief #4: E-commerce Drives Final Mile Demand The growth of online shopping, especially for big and bulky items, should continue driving demand for FMS services. Their network of 98% population coverage within 150 miles is hard to replicate.

Belief #5: Outsourcing Trend Continues More companies are realizing that managing transportation isn't their core competency. The DCS model of outsourcing entire fleet operations should continue growing, especially given their 90% retention rate.

The Bear Case - What Could Go Wrong 🐻

Risk #1: Structural Overcapacity What if there are simply too many trucks and not enough freight? The industry added capacity during the pandemic boom, and that excess might take years to work off. J.B. Hunt's margins could stay compressed longer than expected.

Risk #2: Customer Concentration With one customer representing 11% of revenue and the top 10 accounting for 35%, J.B. Hunt is vulnerable to major customer losses. If a big customer decides to bring transportation in-house or switches providers, it would hurt.

Risk #3: Technology Disruption Autonomous trucking is still years away from widespread adoption, but when it arrives, it could dramatically change the economics of transportation. Companies with large driver workforces (like J.B. Hunt's 22,573 drivers) could face disruption.

Risk #4: Regulatory Changes New environmental regulations, hours-of-service rules, or other government mandates could increase costs faster than J.B. Hunt can pass them through to customers.

Risk #5: Economic Recession Freight demand is closely tied to economic activity. A significant recession would hit volumes hard across all segments, and J.B. Hunt's high fixed costs would amplify the impact on margins.

The Verdict - My Take 🎯

J.B. Hunt is a well-managed company in a cyclical industry that's currently in a down cycle. Their diversified business model, technology investments, and long-term customer relationships provide some defensive characteristics, but they can't completely escape freight market dynamics.

The company's strong balance sheet and consistent dividend growth (they just raised it to $0.44/quarter) suggest management is confident in the long-term outlook. The aggressive share buybacks in 2024 ($514 million) indicate they believe the stock is undervalued.

For investors, the key question is timing. If you believe freight markets will recover and J.B. Hunt's competitive advantages will drive market share gains, the current weakness could be a buying opportunity. But if you think structural changes are reducing freight demand or increasing competition permanently, there might be better places to park your money.

The company's 60+ year track record and evolution from a simple trucking company to an integrated logistics provider suggest they know how to adapt. But past performance doesn't guarantee future results, especially in an industry as competitive and cyclical as transportation.

Bottom line: J.B. Hunt is a quality company trading at what might be cyclical lows, but you need to have conviction about freight market recovery and their ability to execute on their technology and service integration strategy. It's not a slam dunk, but it's not a disaster either - just a solid business navigating choppy waters. 🌊

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.