The Bottom Line Upfront 💡

HubSpot $HUBS ( ▲ 1.14% ) dominates mid-market CRM with a freemium model that's finally generating profits, but faces mounting AI competition from both enterprise giants and nimble startups. At current valuations, it's fairly priced with asymmetric upside if management successfully navigates the AI transition while expanding margins.

Sponsorship

Want to get the most out of ChatGPT?

ChatGPT is a superpower if you know how to use it correctly.

Discover how HubSpot's guide to AI can elevate both your productivity and creativity to get more things done.

Learn to automate tasks, enhance decision-making, and foster innovation with the power of AI.

Strata Layers Chart

Layer 1: The Business Model 🏛️

Think of HubSpot as the ultimate relationship counselor for businesses and their customers. Instead of forcing companies to juggle a dozen different software tools that don't talk to each other (like trying to coordinate a group text with people on different messaging apps), HubSpot provides one unified platform that handles everything from attracting customers to keeping them happy.

What They Actually Do: HubSpot operates a subscription-based software platform that helps mid-market businesses (2-2,000 employees) manage their entire customer lifecycle. Their platform consists of six main "Hubs":

Marketing Hub: Attracts customers through SEO, content, email campaigns

Sales Hub: Manages leads, tracks deals, automates follow-ups

Service Hub: Handles customer support and success

Operations Hub: Cleans and organizes customer data

Content Hub: Creates and manages websites and content

Commerce Hub: Processes payments and manages billing

The genius is in the integration - everything shares the same customer database, so your marketing team knows what sales promised, and customer service can see the full relationship history.

The Money Machine: 98% of their $3.1B revenue comes from subscriptions, with only 2% from professional services. They use a "freemium" model - give away basic tools for free, then convert users to paid plans as their needs grow. It's like offering free samples at Costco, except the samples are actually useful software tools.

Key Success Metrics:

Customer Count: 288,706 businesses (↗️ 16.4% growth)

Average Revenue Per Customer: $11,414 annually

Net Revenue Retention: 103.5% (existing customers spend more over time)

International Mix: 53% of customers, 48% of revenue

The Freemium Hook: Their strategy is brilliantly simple - start free, grow with you. Small businesses begin with free tools, then upgrade as they scale. It's like a gym membership that actually gets more valuable the more you use it.

Key Takeaway: HubSpot makes money by being the one-stop-shop for mid-market businesses who want integrated customer management without enterprise-level complexity.

Layer 2: Category Position 🏆

HubSpot operates in the crowded but lucrative world of customer relationship management (CRM) and marketing automation. Think of it as a three-way battle between enterprise giants, scrappy startups, and HubSpot sitting comfortably in the middle.

The Competition Landscape:

Enterprise Giants: Salesforce (the 800-pound gorilla), Microsoft, Adobe

Point Solutions: Specialized tools for email marketing, customer service, etc.

AI-Native Startups: New players building AI-first solutions from scratch

HubSpot's Sweet Spot: While Salesforce targets Fortune 500 companies with complex needs (and complex price tags), and basic tools serve small businesses, HubSpot owns the mid-market. They're the Goldilocks solution - not too simple, not too complex, but just right for growing businesses.

Competitive Advantages:

Unified Platform: One login, one interface, one customer view (competitors often require multiple integrations)

Freemium Model: Creates a massive funnel that's hard for competitors to match

Solutions Partner Network: 25% of customers come through partners who promote HubSpot

Thought Leadership: Their INBOUND conference attracts 13,000+ attendees and 550,000+ online viewers

Recent Challenges: The AI revolution is shaking things up. HubSpot acknowledges that competitors might innovate faster with AI, and they're racing to stay ahead with their "Breeze AI" platform. They've made three strategic AI acquisitions in 2025 alone.

Market Position: HubSpot has successfully carved out a defensible position in the mid-market, but they're feeling pressure from both directions - enterprise players moving down-market and AI startups moving up-market.

Key Takeaway: HubSpot dominates the mid-market CRM space but faces increasing AI-driven competition from both established players and nimble startups.

Layer 3: Show Me The Money! 📈

HubSpot's financials tell the story of a company that's finally figured out how to grow AND make money - a rare feat in the SaaS world.

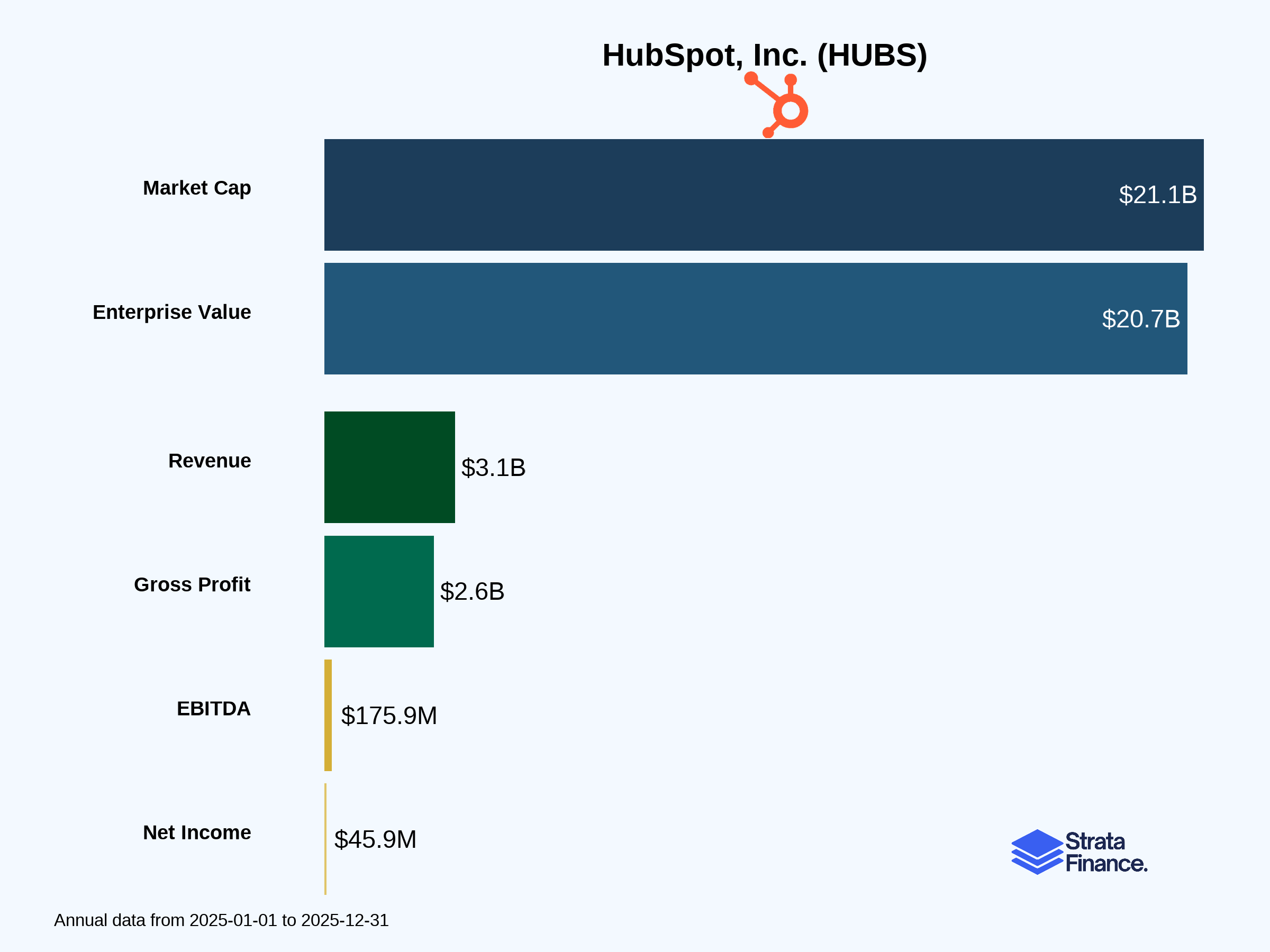

Revenue Breakdown:

Total Revenue: $3.13B (↗️ 19% growth)

Subscription Revenue: $3.06B (98% of total)

Professional Services: $67M (2% of total)

Geographic Split: 52% Americas, 32% Europe, 8% Asia Pacific

The Profitability Turnaround: After years of burning cash for growth, HubSpot achieved a major milestone in 2025:

Net Income: $45.9M (vs. $4.6M in 2024) ↗️

Operating Margin: 0.2% (finally positive!)

Gross Margin: 84% (consistently strong)

Customer Economics:

Average Revenue Per Customer: $11,414 (↗️ slight increase)

Net Revenue Retention: 103.5% (customers spend more over time)

Customer Growth: 16.4% year-over-year ↗️

Where The Money Goes: HubSpot spends like a growth company:

Sales & Marketing: $1.38B (44% of revenue) - customer acquisition is expensive

R&D: $906M (29% of revenue) - heavy investment in AI and platform development

General & Administrative: $326M (10% of revenue)

International Opportunity: With 53% of customers outside the US generating 48% of revenue, there's clear room for international expansion and revenue optimization.

The Cash Generation Story: Operating cash flow of $761M shows the business is finally generating serious cash, enabling the $500M share buyback program they completed in 2025.

Key Takeaway: HubSpot has successfully transitioned from growth-at-all-costs to profitable growth, with strong unit economics and improving margins.

Layer 4: Long-Term Valuation (DCF Model) 💰

The Verdict: Fairly Valued to Slightly Undervalued

Scenario | Fair Value | vs Current Price (~$244) |

|---|---|---|

Conservative | $250 | +2.5% |

Optimistic | $525 | +115% |

Key Valuation Drivers:

Operating Margin Expansion: Success depends on growing from ~0.2% to 10-15% over 5 years

Revenue Growth Sustainability: Maintaining 15-20% growth while improving profitability

AI Investment Payoff: Whether Breeze AI and recent acquisitions drive competitive advantage

The Investment Call: At current prices around $244, HubSpot appears fairly valued under conservative assumptions. The stock offers asymmetric upside if management successfully executes their margin expansion plan while maintaining growth momentum.

Layer 5: What Do We Have to Believe? 📚

Bull Case 🚀

Mid-Market Dominance: HubSpot can maintain and expand their leadership in the underserved mid-market segment as more businesses digitize

AI Advantage: Their Breeze AI platform and recent acquisitions (Frame AI, Dashworks, XFunnel) create sustainable competitive moats

International Expansion: With 53% of customers outside the US, there's massive room for geographic growth and revenue optimization

Margin Expansion: The company can successfully transition from growth-at-all-costs to profitable growth without sacrificing market position

Bear Case 🐻

Competitive Pressure: Salesforce moves down-market or AI-native startups disrupt with better, cheaper solutions

Economic Sensitivity: Mid-market customers cut software spending during economic downturns

Execution Risk: High customer acquisition costs and the need for continued innovation strain profitability

Valuation Risk: Growth expectations are largely priced in, leaving little room for disappointment

The Bottom Line: HubSpot has successfully built a dominant position in mid-market CRM with improving unit economics and a clear path to profitability. However, the AI revolution creates both opportunity and risk - their success depends on staying ahead of the innovation curve while expanding margins. At current valuations, the stock offers reasonable upside for investors who believe in management's execution ability.

What to Watch 👀

Key Metrics to Monitor:

Net Revenue Retention: Watch for any decline below 100% - it signals customer health issues

Operating Margin: Track progress toward 10%+ margins over the next 2-3 years

Customer Growth Rate: If it drops below 10%, growth story may be maturing

International Revenue Mix: Should trend toward 55%+ of total revenue

Upcoming Catalysts:

AI Product Launches: Success of Breeze AI features and integration of recent acquisitions

International Expansion: New market entries and localization efforts

Enterprise Push: Any moves up-market toward larger customers

Competitive Threats:

Salesforce's Mid-Market Push: Watch for aggressive pricing or feature matching

Microsoft Integration: Deeper CRM integration with Office 365 ecosystem

AI Startup Disruption: New players with AI-first architectures gaining traction

Red Flags:

Customer acquisition costs rising faster than revenue per customer

Churn rates increasing or net revenue retention declining

Major competitive losses or pricing pressure in core markets

The bottom line? HubSpot is a well-executed SaaS business at a reasonable valuation, but success depends on navigating the AI transition while maintaining their mid-market dominance. Perfect for investors who believe in the power of integrated platforms over point solutions! 🎯

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.