The Bottom Line Upfront 💡

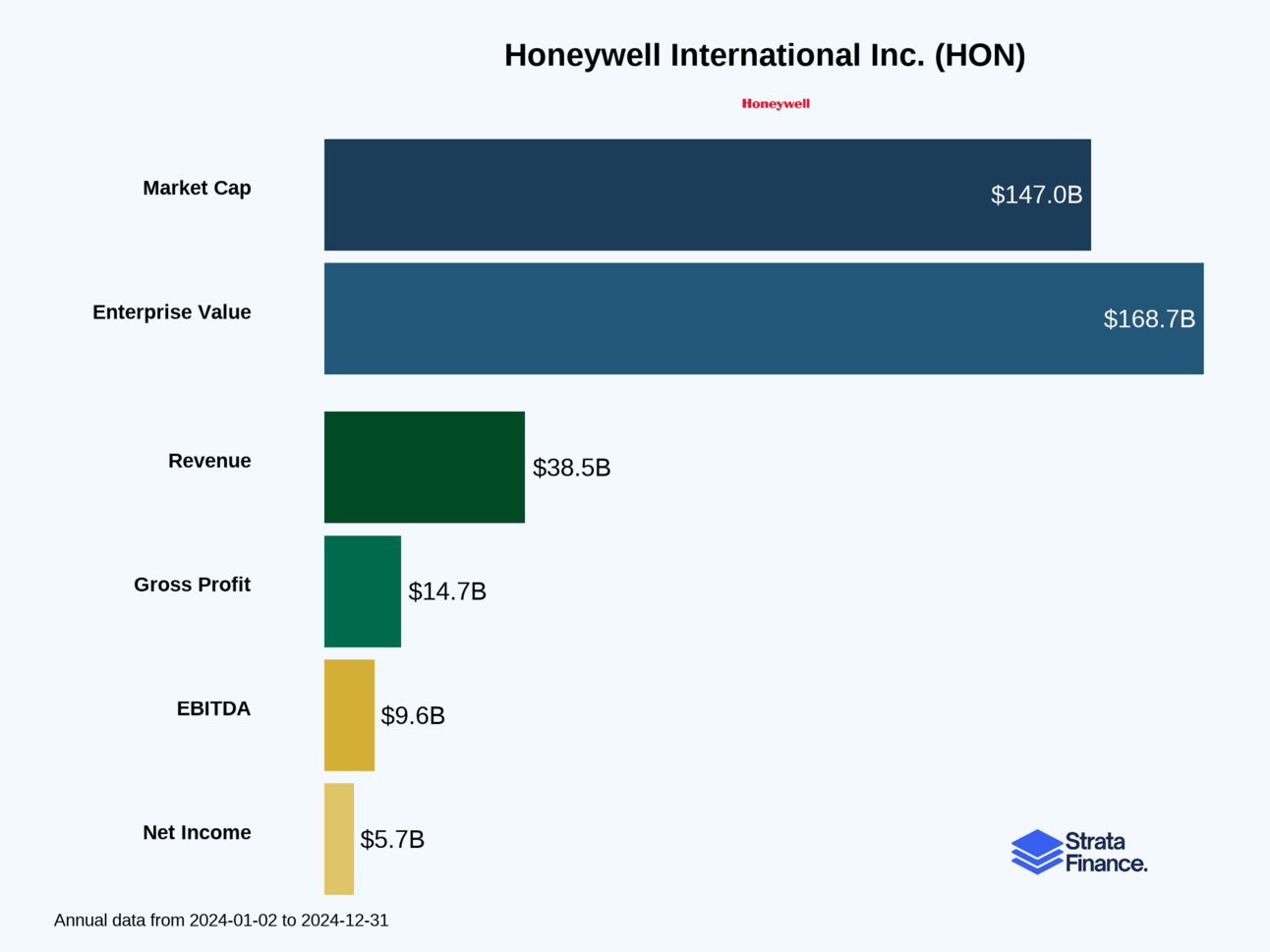

Honeywell International Inc. $HON ( ▲ 0.61% ) is the ultimate "behind-the-scenes" industrial giant that makes modern life work seamlessly - from keeping planes flying safely to automating factories and managing smart buildings. With $38.5B in 2024 revenue across four segments, the company is executing an ambitious plan to split into three independent companies by 2026, potentially unlocking significant shareholder value. The aerospace division ($15.5B revenue) is the crown jewel with its high-margin aftermarket business, while industrial automation faces cyclical headwinds. The separation strategy could create three focused companies better positioned to compete in aviation, automation, and advanced materials, but execution risk is real. For investors who believe in the transformation thesis, Honeywell offers exposure to three attractive long-term themes: aviation growth, industrial automation, and energy transition, backed by strong cash generation and a 15-year dividend growth track record.

Partnership

Get access to the most exclusive offers for private market investors

Looking to invest in real estate, private credit, pre-IPO venture or crypto? AIR Insiders get exclusive offers and perks from leading private market investing tools and platforms, like:

Up to $250 free from Percent

50% off tax and retirement planning from Carry

$50 of free stock from Public

A free subscription to Worth Magazine

$1000 off an annual subscription to DealSheet

and offers from CapitalPad, Groundfloor, Fundrise, Mogul, and more.

Just sign up for our 2-week free trial to experience all the benefits of being an AIR Insider.

Strata Layers Chart

Layer 1: The Business Model 🏛️

Think of Honeywell as the ultimate "behind-the-scenes" company. You know that feeling when you walk into a modern office building and everything just works - the lights adjust automatically, the temperature is perfect, the elevators arrive quickly, and the security system recognizes your badge? That's probably Honeywell making your life better without you even knowing it.

Founded way back in 1906 (yes, they're older than sliced bread), Honeywell has evolved from a simple heating controls company into what they call an "integrated operating company." Translation: they make the invisible infrastructure of modern life actually function. Their tagline might as well be "We make stuff work so you don't have to think about it."

The Four Pillars of Honeywell's Empire 🏗️

Aerospace Technologies ($15.5B in 2024 ↗️) - The Crown Jewel. This is where Honeywell really shines. They're essentially the nervous system of the aviation industry. When you're cruising at 35,000 feet, there's a good chance Honeywell technology is keeping you alive and comfortable. They make:

Auxiliary power units (those little engines that keep planes running on the ground)

Avionics systems (the fancy computers that help pilots navigate)

Environmental control systems (keeping you from freezing or suffocating)

Aircraft wheels and brakes (kind of important for landing)

The beautiful part? Once their systems are installed on an aircraft, they provide maintenance and parts for the plane's entire 20-30 year lifespan. It's like being the only mechanic in town for a very expensive, very complicated machine.

Industrial Automation ($10.1B in 2024 ↘️) - The Factory Whisperer. This segment helps factories and industrial facilities run smarter. They provide the sensors, control systems, and software that monitor everything from oil refineries to pharmaceutical plants. Think of them as the company that teaches robots how to behave in factories. They also help warehouses move packages efficiently (hello, Amazon fulfillment centers).

Building Automation ($6.5B in 2024 ↗️) - The Smart Building Guru. Remember that perfectly functioning office building we mentioned? This is the division responsible. They provide fire safety systems, security solutions, energy management, and HVAC controls. Recent acquisitions have strengthened their position in smart locks and access control, because apparently, even doors need to be smart now.

Energy and Sustainability Solutions ($6.4B in 2024 ↗️) - The Green Transition Bet. This is Honeywell's hedge on the energy transition. Their UOP business provides technology for refining (including sustainable aviation fuels), while Advanced Materials makes everything from high-performance fibers for body armor to environmentally friendly refrigerants. They're helping old energy companies go green while serving new green energy markets.

Key Success Metrics to Watch 📊

Honeywell tracks several critical metrics that tell the story of their business health:

Backlog: Currently sitting at $35.3B ↗️ (up from $31.8B in 2023). This is like having a massive order book that provides visibility into future revenue.

Organic Growth: They obsess over growth that comes from existing operations rather than acquisitions.

Operating Cash Flow: Generated $6.1B in 2024 ↗️, showing they're not just profitable on paper but actually generating real cash.

Segment Profit Margins: Each division is measured on profitability, with Aerospace leading the pack at 25.8% margins.

The Secret Sauce: Honeywell Accelerator & Forge 🚀

Their "Honeywell Accelerator" is basically their playbook for running businesses efficiently - think of it as McDonald's operations manual but for industrial companies. Meanwhile, "Honeywell Forge" is their IoT platform that connects physical products to software analytics, allowing customers to predict when things will break before they actually do. It's like having a crystal ball for industrial equipment.

Layer 2: Category Position 🏆

Honeywell doesn't compete on price - they compete on being the most reliable option when failure isn't acceptable. When you're 35,000 feet in the air or running a nuclear power plant, "good enough" isn't good enough.

Aerospace: Flying High in a Duopoly-Adjacent Market ✈️

In aerospace, Honeywell battles giants like RTX Corporation (formerly Raytheon), Safran, and L3 Harris. But here's the thing - this isn't a commodity business. Once an airline chooses Honeywell's auxiliary power units for their fleet, switching costs are enormous. The certification process alone can take years and cost millions.

Honeywell has carved out dominant positions in specific niches. Their auxiliary power units are found on most commercial aircraft, and their avionics systems are considered among the most advanced in the industry. The commercial aviation recovery post-COVID has been a major tailwind, with flight hours increasing ↗️ and airlines investing in new, more efficient aircraft.

Industrial Automation: The Smart Factory Arms Race 🤖

Here, they face stiff competition from Emerson Electric, Rockwell Automation, and Siemens. But Honeywell differentiates itself through cybersecurity expertise - increasingly critical as factories become more connected and vulnerable to cyber attacks. They're also benefiting from the "reshoring" trend as companies bring manufacturing back to North America and need automation to compete with lower-cost overseas production.

Building Automation: The Smart Building Revolution 🏢

Against Johnson Controls, Schneider Electric, and Siemens, Honeywell's strength lies in their integrated approach. Instead of buying fire safety from one vendor, HVAC from another, and security from a third, customers can get everything from Honeywell in one coordinated system. The recent $4.9B acquisition of Carrier's access solutions business significantly strengthened their smart building credentials.

Energy Transition: Riding the Green Wave 🌱

In the energy space, they compete with specialty chemical companies like Arkema and Chemours. Their UOP business has a particularly strong position in refining technology - many of the world's refineries use Honeywell catalysts and processes. As the energy transition accelerates, they're well-positioned to help traditional energy companies adapt while serving new green markets.

Layer 3: Show Me The Money! 📈

Revenue Breakdown: A Well-Diversified Money Machine 💰

Honeywell's 2024 revenue of $38.5B ↗️ (up 5% from 2023) comes from a beautifully diversified portfolio:

By Segment:

Aerospace Technologies: $15.5B (40% of total) ↗️ 13%

Industrial Automation: $10.1B (26% of total) ↘️ 7%

Building Automation: $6.5B (17% of total) ↗️ 8%

Energy & Sustainability: $6.4B (17% of total) ↗️ 3%

By Geography:

United States: $21.8B (57%)

Europe: $8.8B (23%)

Other International: $7.9B (20%)

By Product vs. Service:

Products: $26.3B (68%)

Services: $12.2B (32%)

The Aerospace Cash Cow 🐮

Aerospace is the star performer, and for good reason. The segment has two distinct revenue streams:

Original Equipment (OE): $2.2B - Selling new systems to aircraft manufacturers

Aftermarket: $7.1B - The real goldmine, providing parts and services over the aircraft's lifetime

Defense and Space: $6.1B - Government contracts with steady, predictable revenue

The aftermarket business is particularly attractive because it's higher-margin and more predictable. Once Honeywell's systems are on a plane, they're essentially guaranteed decades of service revenue. It's like selling someone a printer and then being their only source of ink cartridges for 30 years.

Layer 4: What Do We Have to Believe? 📚

The Bull Case: Three Companies Are Better Than One 🐂

The Separation Strategy Will Unlock Value Honeywell's plan to split into three independent companies (Aerospace, Automation, and Advanced Materials) could be a masterstroke. Each business would be able to:

Focus on their specific markets without cross-subsidizing weaker divisions

Make targeted acquisitions without worrying about portfolio balance

Optimize capital allocation for their unique business cycles

Attract investors who want pure-play exposure to specific themes

Aerospace Aftermarket Dominance The aerospace aftermarket business is a beautiful thing - high margins, predictable revenue, and growing flight hours globally. As the commercial aviation industry continues recovering and expanding, this cash cow should keep producing.

Automation Megatrend The push toward industrial automation isn't going away. Companies need to automate to remain competitive, especially as labor costs rise and cybersecurity becomes critical. Honeywell's software capabilities give them an edge in this transition.

Energy Transition Positioning While others debate the energy transition, Honeywell is positioned to profit from it. They help traditional energy companies go greener while serving new renewable markets. It's like being Switzerland in an energy war.

The Bear Case: Complexity and Cyclicality 🐻

Execution Risk on Separation Breaking up a 118-year-old company is incredibly complex. There are IT systems to separate, shared services to duplicate, and cultures to maintain. The process could be disruptive and expensive, potentially destroying value instead of creating it.

Industrial Cyclicality Industrial Automation's 7% decline ↘️ in 2024 reminds us that these businesses are cyclical. When the economy slows, companies delay automation investments. The warehouse automation slowdown shows how quickly demand can evaporate.

Aerospace Concentration Risk While aerospace is their crown jewel, it's also a concentrated bet. Any major disruption to commercial aviation (pandemic, anyone?) hits them hard. The Boeing 737 MAX crisis showed how aircraft manufacturer problems become Honeywell problems.

Competition from Tech Giants As industrial systems become more software-driven, Honeywell faces potential competition from tech giants like Microsoft, Amazon, and Google who have deeper software expertise and bigger R&D budgets.

The Verdict: A Solid Industrial Play with Transformation Upside 🎯

Honeywell is fundamentally a well-run industrial company with strong market positions in attractive niches. The planned separation is ambitious and could unlock significant value if executed well. However, investors need to believe that:

The separation will be executed smoothly without major disruptions

Each resulting company will be stronger independently than as part of the conglomerate

The aerospace aftermarket will continue growing as global aviation expands

Industrial automation demand will recover from the current cyclical downturn

They can maintain their technological edge against both traditional competitors and new tech entrants

For investors who believe in these premises, Honeywell offers exposure to three attractive long-term themes: aviation growth, industrial automation, and energy transition. The company's strong cash generation, dividend growth track record (15 increases in 14 years!), and experienced management team provide some downside protection.

Just remember: you're not just buying Honeywell today - you're buying a bet on what three separate companies might become tomorrow. That's either exciting or terrifying, depending on your risk tolerance. 🎢

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.