The Bottom Line Upfront 💡

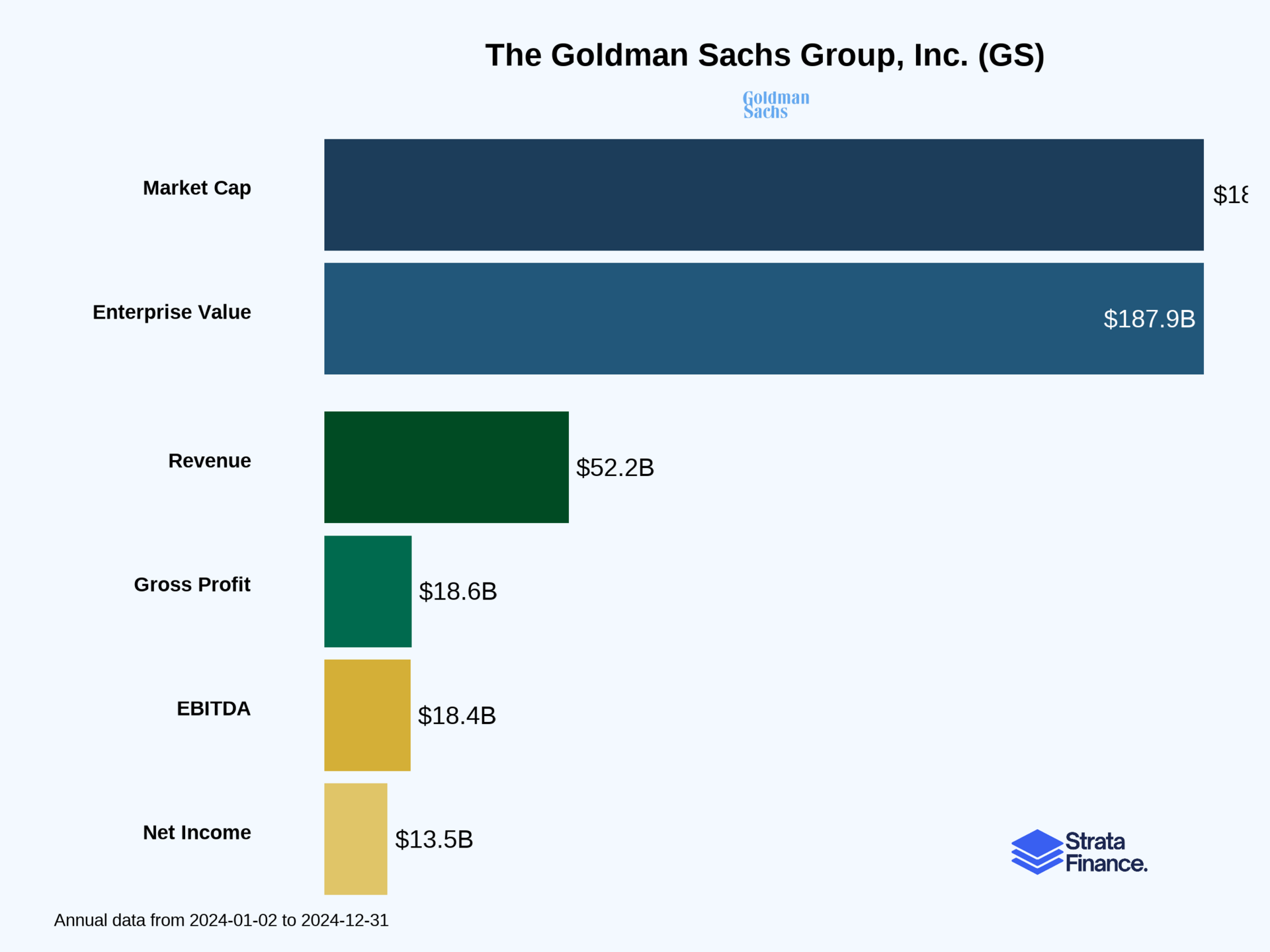

Goldman Sachs $GS ( ▲ 0.57% ) is Wall Street's premier investment bank, serving as the ultimate financial intermediary for billion-dollar deals, exotic securities trading, and wealth management for the ultra-wealthy. With $53.5 billion in revenue and $14.3 billion in net earnings in 2024, Goldman demonstrates strong financial performance across three main segments: Global Banking & Markets (65% of revenue), Asset & Wealth Management (30%), and Platform Solutions (5%). The company's competitive advantages include brand power, global reach, and integrated services, but it faces challenges from electronic trading disruption, fee compression, and regulatory pressure. Goldman represents a high-quality bet on the continued importance of sophisticated financial services, though investors must accept the inherent volatility of a business deeply tied to market cycles and regulatory changes.

Partnership

Get access to the most exclusive offers for private market investors

Looking to invest in real estate, private credit, pre-IPO venture or crypto? AIR Insiders get exclusive offers and perks from leading private market investing tools and platforms, like:

Up to $250 free from Percent

50% off tax and retirement planning from Carry

$50 of free stock from Public

A free subscription to Worth Magazine

$1000 off an annual subscription to DealSheet

and offers from CapitalPad, Groundfloor, Fundrise, Mogul, and more.

Just sign up for our 2-week free trial to experience all the benefits of being an AIR Insider.

Strata Layers Chart

Layer 1: The Business Model 🏛️

Think of Goldman Sachs as the ultimate financial middleman - but instead of selling used cars, they're dealing in billion-dollar mergers, trading exotic securities, and managing the wealth of the world's richest people. Founded in 1869 (yes, they're older than the telephone), Goldman has evolved from a humble commercial paper business into one of Wall Street's most prestigious and profitable institutions.

What They Actually Do 💼

Goldman operates like a three-ring circus of finance, with each ring serving different but interconnected purposes:

Ring 1: Global Banking & Markets (The Big Kahuna) This is where Goldman makes most of its money ($34.9 billion in 2024 ↗️). Think of this as their "classic Goldman" business - the stuff that made them famous and feared on Wall Street:

Investment Banking: They're the guys companies call when they want to merge, acquire, or raise money. Need to sell your company for $50 billion? Goldman will find you a buyer and charge you a hefty fee for the privilege. They're consistently ranked among the top global firms for this work.

Market Making: This is where Goldman acts like a sophisticated pawn shop for financial instruments. They buy and sell everything from stocks to bonds to complex derivatives, making money on the spread between what they pay and what they sell for. It's like being the house in a casino, except the chips are Treasury bonds and the players are pension funds.

Trading & Sales: They maintain a global army of traders and salespeople who execute transactions for clients across all major asset classes. Their Marquee platform is like Amazon for institutional investors - providing market data, analytics, and trade execution all in one place.

Ring 2: Asset & Wealth Management (The Growth Engine) This segment ($16.1 billion in 2024 ↗️) is where Goldman manages money for everyone from sovereign wealth funds to ultra-rich individuals:

Asset Management: They run mutual funds, hedge funds, private equity funds, and other investment vehicles. Think BlackRock, but with more attitude and higher fees.

Wealth Management: Private banking for people who have more money than small countries. If you need to ask about the minimum account size, you probably can't afford it.

Alternative Investments: Private equity, real estate, infrastructure - basically anything that isn't a plain vanilla stock or bond.

Ring 3: Platform Solutions (The Experiment) This is Goldman's attempt to be more like a regular bank ($2.4 billion in 2024 →). It includes:

Consumer Banking: Credit cards (like the Apple Card) and deposits through their Marcus platform. However, they're actively retreating from this space after discovering that consumer banking is harder than it looks.

Transaction Banking: Corporate cash management and payment services - basically being the plumbing for other businesses' financial operations.

How They Make Money 💰

Goldman's revenue model is beautifully diversified (which is finance-speak for "they have multiple ways to extract money from the financial system"):

Fees: Investment banking advisory fees, underwriting fees, management fees from funds

Spreads: The difference between what they buy and sell securities for

Interest: Like any bank, they make money lending at higher rates than they borrow

Performance Fees: When their funds do well, they get a cut of the profits

Key Metrics They Watch 📊

Goldman obsesses over several key performance indicators:

Return on Equity (ROE): 12.7% in 2024 ↗️ (up from 7.5% in 2023). This measures how efficiently they're using shareholder money.

Efficiency Ratio: Total expenses divided by net revenue - lower is better

Book Value per Share: What each share would be worth if they liquidated everything

Tier 1 Capital Ratio: A regulatory measure of financial strength (they had 16.8% in 2024)

Layer 2: Category Position 🏆

Goldman Sachs sits at the apex of the investment banking food chain, but that doesn't mean they're unchallenged. The financial services industry is like a giant game of musical chairs, and the music never stops.

The Competition Landscape 🥊

Goldman faces different competitors across their various businesses:

Investment Banking Rivals:

Morgan Stanley: Their closest pure-play competitor, especially in wealth management

JPMorgan Chase: The 800-pound gorilla with a massive commercial banking base

Bank of America: Strong in both investment banking and wealth management

Citigroup: Global reach but less focused

Market Making Competition:

Citadel Securities: The electronic trading powerhouse that's eating everyone's lunch

Virtu Financial: Another electronic market maker with lower costs

Traditional banks: All the big banks have trading operations

Asset Management Battles:

Market Position Strengths 💪

Goldman's competitive advantages are real but not unassailable:

Brand Power: The Goldman name still opens doors and commands premium fees

Global Network: Offices in 40+ countries with deep local relationships

Integrated Platform: Can offer everything from M&A advice to financing to risk management

Talent Magnet: Still attracts top-tier talent (average Management Committee tenure: 24 years)

Technology: Significant investments in platforms like Marquee

Layer 3: Show Me The Money! 📈

Let's dive into Goldman's financial engine and see what makes this money machine tick. Spoiler alert: they made a lot more money in 2024 than 2023, which is always nice when you're a shareholder.

Revenue Breakdown: The Big Picture 💵

Goldman generated $53.5 billion in total net revenue in 2024 ↗️ (up from $46.3 billion in 2023). Here's how that breaks down:

By Business Segment:

Global Banking & Markets: $34.9 billion (65% of total) ↗️

Asset & Wealth Management: $16.1 billion (30% of total) ↗️

Platform Solutions: $2.4 billion (5% of total) →

By Geography:

Americas: $34.4 billion (64%) - mostly U.S. operations

EMEA: $12.3 billion (23%) - Europe, Middle East, Africa

Asia: $6.8 billion (13%) - including their growing India operations

Global Banking & Markets: The Cash Cow 🐮

This segment is Goldman's bread and butter, and 2024 was a good year:

Investment Banking Fees: The classic Goldman business of advising on deals and underwriting securities.

Market Making: This is where Goldman acts as the middleman in financial markets. This includes FICC (Fixed Income, Currency & Commodities) and traditional stocks and derivatives.

Asset & Wealth Management: The Growth Story 📊

This segment grew nicely to $16.1 billion ↗️ and represents Goldman's future:

Management Fees: The steady, predictable income from managing other people's money. These are typically calculated as a percentage of assets under management.

Incentive Fees: Performance-based fees when their funds beat benchmarks - these can be lumpy but very profitable.

Private Banking: Lending to wealthy clients and earning interest spreads.

Investment Gains: Returns from Goldman's own investments in funds and companies.

Platform Solutions: The Question Mark ❓

At $2.4 billion, this is Goldman's smallest and most uncertain segment:

Consumer Platforms: Credit cards (mainly Apple Card) and Marcus deposits. They're actively exiting much of this business.

Transaction Banking: Corporate cash management services - this is where they're focusing their efforts.

Layer 4: What Do We Have to Believe? 📚

After digging through Goldman's business model, competitive position, and financials, let's get to the heart of the investment question: Is this a company you want to own a piece of?

The Bull Case: Why Goldman Could Soar 🚀

Belief #1: The Smart Money Always Needs Smart Advisors Goldman's core investment banking and advisory business isn't going anywhere. Companies will always need help with mergers, acquisitions, and raising capital.

Belief #2: Asset Management is the Golden Goose This is the segment that could drive Goldman's future growth. With $16.1 billion in revenue ↗️ and growing, asset management provides more predictable, fee-based income compared to the volatile trading business.

Belief #3: Technology Investments Will Pay Off Goldman has invested heavily in technology platforms like Marquee and digital capabilities. If these investments help them serve clients more efficiently and capture market share from slower-moving competitors, the returns could be substantial.

Belief #4: Regulatory Environment Stabilizes Much of Goldman's underperformance in recent years has been due to post-2008 regulatory changes.

Belief #5: They've Learned from Consumer Banking Mistakes Goldman's retreat from consumer banking, while embarrassing, shows management discipline.

The Bear Case: Why Goldman Could Struggle 📉

Risk #1: The Trading Business is Under Siege Electronic trading platforms and algorithmic trading are squeezing margins in Goldman's traditional market-making business. If this trend accelerates, a major source of Goldman's profits could continue to erode.

Risk #2: Fee Compression is Relentless Clients are demanding lower fees across all financial services. From investment banking to asset management, Goldman faces constant pressure to reduce prices while maintaining service quality.

Risk #3: Regulatory Risks Never Go Away Goldman operates in a heavily regulated industry where rules can change quickly. New regulations could limit their activities, increase costs, or force business model changes.

Risk #4: Talent Wars are Expensive Goldman's success depends on attracting and retaining top talent, but compensation costs are enormous ($16.7 billion in 2024).

Risk #5: Economic Cycles Hit Hard Goldman's business is highly cyclical. During economic downturns, M&A activity drops, trading volumes decline, and asset values fall.

Risk #6: Fintech Disruption Accelerates Newer, more agile competitors with better technology could continue to chip away at Goldman's market share.

My Take: A High-Quality Business in a Tough Industry 🎯

Goldman Sachs is undeniably a high-quality financial services firm with strong competitive positions in several attractive markets. However, this is not a business for the faint of heart. Goldman operates in an industry where:

Regulations can change overnight

Technology disruption is constant

Talent costs are astronomical

Results can swing wildly based on market conditions

The investment thesis boils down to this: If you believe that sophisticated financial services will always be in demand, that Goldman's brand and capabilities provide sustainable competitive advantages, and that their pivot toward more stable asset management revenues will succeed, then Goldman could be a solid long-term investment.

But if you think electronic trading will continue to commoditize their core businesses, that regulatory pressure will intensify, or that fintech disruption will accelerate, then you might want to look elsewhere.

The 2024 results suggest they're adapting successfully, but in this business, past performance definitely doesn't guarantee future results. Invest accordingly. 📊

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.