The Bottom Line Upfront 💡

GE Aerospace $GE ( ▲ 4.78% ) has completed one of the most successful corporate transformations in modern business history. After spinning off healthcare and energy divisions, the company now operates as a focused aerospace powerhouse with a compelling "razor and blade" business model: sell jet engines at low margins, then generate decades of high-margin recurring revenue from maintenance and services.

Key Investment Highlights:

70% services revenue creates predictable, recurring cash flows

45,000 commercial engines in service provide expanding installed base

LEAP engine dominance in the crucial narrowbody market

$171.6 billion backlog ensures years of future revenue

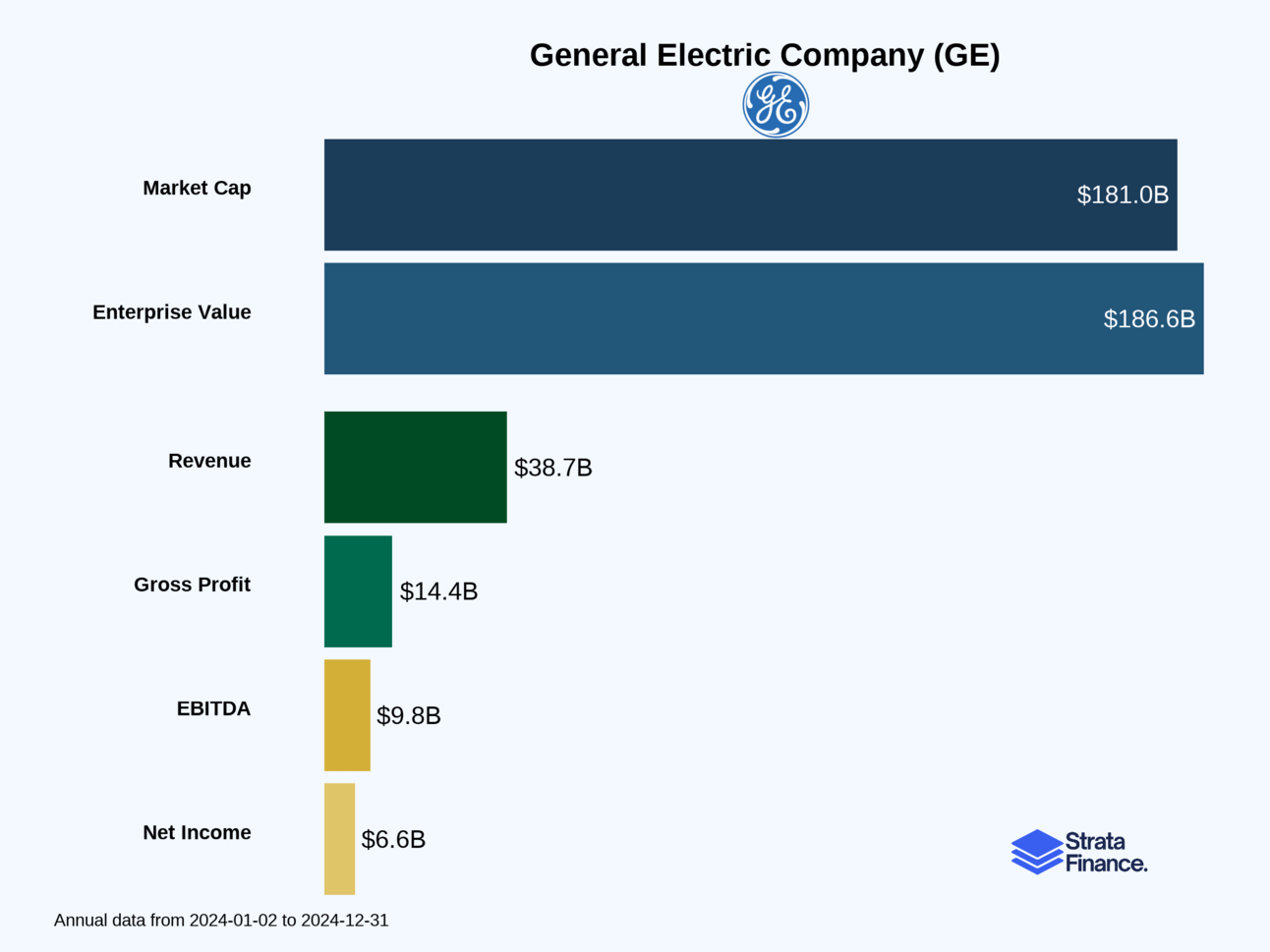

Strong financials: $38.7B revenue, $6.7B net income, $6.1B free cash flow

Partnership

Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.

Strata Layers Chart

Layer 1: The Business Model 🏛️

What Does GE Aerospace Actually Do?

Think of GE Aerospace as the ultimate "razor and blade" business, but instead of selling you a $5 razor and $50 worth of blades, they're selling airlines $20 million engines and then charging them for decades of maintenance, parts, and services. It's basically the industrial equivalent of your gym membership – once you're in, you're paying for life.

After one of the most dramatic corporate makeovers in business history, GE has transformed from a sprawling conglomerate that made everything from light bulbs to MRI machines into a laser-focused aerospace powerhouse. They spun off GE HealthCare in 2023 and GE Vernova (energy) in 2024, leaving behind a company that does one thing exceptionally well: building and maintaining the engines that power the world's aircraft.

The Money-Making Machine:

70% of revenue comes from aftermarket services (the "blades") ↗️

30% from equipment sales (the "razors")

45,000 commercial engines and 25,000 military engines in their installed base

Service contracts that can last 10-25 years with predictable, recurring payments

Two Main Business Divisions

Commercial Engines & Services (70% of revenue) 🛫

This is where the magic happens. They design, build, and service jet engines for commercial airlines, business jets, and other civilian aircraft. The crown jewel here is the LEAP engine, produced through their 50-50 joint venture with Safran called CFM International. The LEAP is rapidly becoming the industry standard for narrowbody aircraft – think of it as the iPhone of jet engines.

Defense & Propulsion Technologies (25% of revenue) 🚁

This division serves military customers with everything from fighter jet engines (F-16s, F-18s) to helicopter powerplants (Apache helicopters) and advanced propulsion systems. It's split between Defense & Systems and Propulsion & Additive Technologies, covering both the big military contracts and specialized components.

Key Metrics to Watch

Installed Base Growth: More engines in service = more recurring revenue Shop Visit Volume: Internal shop visits grew 3% in 2024 ↗️ LEAP Engine Deliveries: 1,407 delivered in 2024 (down from 1,570 due to supply chain issues) ↘️ Remaining Performance Obligation (RPO): $171.6 billion backlog ↗️ (up 11%) Services Revenue Growth: The golden metric – services revenue hit $24.8 billion in 2024 ↗️

The FLIGHT DECK Operating Model

GE Aerospace operates under their proprietary "FLIGHT DECK" lean operating system, which prioritizes:

Safety (because nobody wants their engine falling off)

Quality (see above)

Delivery (airlines hate delays)

Cost (margins matter)

This isn't just corporate buzzword bingo – it's how they bridge strategy to actual results across their global operations spanning 134 facilities in 46 countries.

Layer 2: Category Position 🏆

The Aerospace Engine Oligopoly

The commercial aircraft engine market is essentially a three-horse race between titans, and GE Aerospace is firmly in the lead pack. Think of it like the smartphone market, but with much higher barriers to entry and contracts that last decades instead of years.

The Big Three:

GE Aerospace/CFM International (through Safran partnership)

Rolls-Royce (British engineering at its finest)

Pratt & Whitney (RTX Corporation subsidiary)

Market Dynamics: It's All About Platform Wins

Unlike consumer products where you can switch brands easily, aircraft engines are typically exclusive to specific aircraft models. Win the Boeing 737 MAX engine contract? Congratulations, you just locked in decades of revenue from one of the world's most popular aircraft. Lose it? Well, better luck next time in 20 years when they design a new plane.

GE's Winning Positions:

LEAP engines power both Boeing 737 MAX and Airbus A320neo families

Strong military positions across F-16, F-18, Apache helicopters, and more

Supply Chain: The Great Equalizer

Here's where things get interesting (and challenging). The entire aerospace industry is currently supply-constrained, which sounds bad but actually benefits established players like GE. When everyone's struggling to get parts and materials, scale and supplier relationships become competitive moats.

Defense Market: Different Game, Same Dominance

The defense market operates under completely different rules – think long development cycles, government funding, and platforms that stay in service for 30+ years. GE has built fortress-like positions across multiple military aircraft:

F110 engines power F-16 Fighting Falcons

F414 engines power F/A-18 Super Hornets

T700 engines power Apache and Black Hawk helicopters

Recently won a $1.1 billion contract for T700 engines through 2029 ↗️

Layer 3: Show Me The Money! 📈

Revenue Breakdown: The 70-30 Split That Matters

Total Revenue: $38.7 billion (up 9% from 2023) ↗️

By Business Type:

Equipment Sales: $10.3 billion (27%)

Services Revenue: $24.8 billion (64%) ↗️

Insurance Revenue: $3.6 billion (9%) - legacy run-off operations

By Segment:

Commercial Engines & Services: $26.9 billion (70%) ↗️

Defense & Propulsion Technologies: $9.5 billion (25%) ↗️

Corporate & Other: $2.3 billion (includes insurance operations)

Geographic Revenue: A Global Business

U.S. Revenue: $17.3 billion (45%) International Revenue: $21.4 billion (55%) ↗️

International Breakdown:

Europe: $7.8 billion (20%)

China Region: $3.6 billion (9%)

Middle East & Africa: $3.7 billion (10%)

Asia (ex-China): $3.6 billion (9%)

Americas: $2.6 billion (7%)

The international revenue mix shows GE's global reach, though it also creates exposure to geopolitical tensions and currency fluctuations.

The Beautiful Economics of Services

Here's where GE Aerospace's business model really shines. Within Commercial Engines & Services:

Services represent 74% of segment revenue ($19.8 billion)

Equipment represents 26% of segment revenue ($7.1 billion)

Services margins are significantly higher than equipment margins

This creates a flywheel effect: sell engines at low margins to win platforms, then generate high-margin recurring revenue for decades. It's like Netflix, but for jet engines.

Layer 4: What Do We Have to Believe? 📚

The Bull Case: Betting on the Skies 🚀

For GE Aerospace to be a winning investment, you need to believe:

Air travel demand will continue growing globally - Emerging markets, growing middle class, and pent-up travel demand support this thesis. The company serves 120 countries, positioning it well for global growth.

The LEAP engine transition will drive massive services growth - As LEAP engines accumulate flight hours, they'll start requiring major shop visits, creating a services revenue bonanza. With 1,407 LEAP engines delivered in 2024 alone, this wave is building.

Supply chain constraints will eventually resolve - Current production bottlenecks are limiting growth, but GE's investments in manufacturing capacity and supplier partnerships should pay off as constraints ease.

Sustainable aviation technology will create new opportunities - The RISE program and other green initiatives position GE as a leader in the industry's environmental transition. Airlines face increasing pressure to reduce emissions, and GE's technology could be the solution.

Defense spending will remain robust - Geopolitical tensions and military modernization programs support continued defense revenue growth. The recent $1.1 billion T700 contract win demonstrates this trend.

The "razor and blade" model will compound - With 45,000 commercial engines in service and growing, the installed base creates an expanding foundation for recurring revenue.

The Bear Case: Turbulence Ahead ⛈️

The risks that could derail the investment:

Economic recession crushing air travel - Airlines are cyclical businesses. A severe recession could slash flying activity, hurting both equipment orders and services revenue. The COVID-19 pandemic showed how quickly aviation can collapse.

Supply chain problems persist longer than expected - If material shortages and production constraints continue, GE could lose market share to competitors who solve these issues faster.

Competition intensifies in key markets - Rolls-Royce and Pratt & Whitney aren't sitting still. New engine technologies or aggressive pricing could erode GE's market position.

Geopolitical tensions disrupt international business - With 55% of revenue from international markets, trade wars, sanctions, or conflicts could significantly impact operations.

Environmental regulations create unexpected costs - While GE is investing in green technology, new regulations could require expensive retrofits or accelerate the retirement of existing engines.

Defense budget cuts - Political changes could reduce military spending, impacting the 25% of revenue from defense operations.

The Verdict: A Transformed Giant with Compelling Economics 🎯

GE Aerospace represents one of the most successful corporate transformations in recent memory. By shedding the complexity of a sprawling conglomerate and focusing on what it does best, the company has created a more predictable, higher-quality business model.

For investors who believe in the long-term growth of global aviation and GE's ability to maintain its technology leadership, this looks like a compelling opportunity. The transformation from "General Electric" to "GE Aerospace" has created a focused, profitable business with predictable cash flows and significant competitive advantages.

Just remember: you're not just buying an engine company – you're buying into the future of flight itself. And after more than a century of aviation innovation, GE Aerospace seems well-positioned to keep lifting people up and bringing them home safely for decades to come. ✈️

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.