The Bottom Line Upfront 💡

Ford Motor Company $F ( ▲ 0.58% ) is essentially three companies in one: a profitable traditional automaker (Ford Blue), a dominant commercial vehicle powerhouse (Ford Pro), and a money-losing electric vehicle startup (Ford Model e). With $185 billion in revenue, Ford is asking investors to fund a massive transformation while hoping their traditional business stays strong enough to pay for it. Ford Pro is crushing it with $9 billion in profits, Ford Blue is solid but declining, and Ford Model e is burning $5+ billion annually trying to compete with Tesla. Success requires perfect execution across multiple complex initiatives – making this either a compelling value play or a cautionary tale about industrial disruption.

Partnership

Stay up-to-date with AI

The Rundown is the most trusted AI newsletter in the world, with 1,000,000+ readers and exclusive interviews with AI leaders like Mark Zuckerberg, Demis Hassibis, Mustafa Suleyman, and more.

Their expert research team spends all day learning what’s new in AI and talking with industry experts, then distills the most important developments into one free email every morning.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

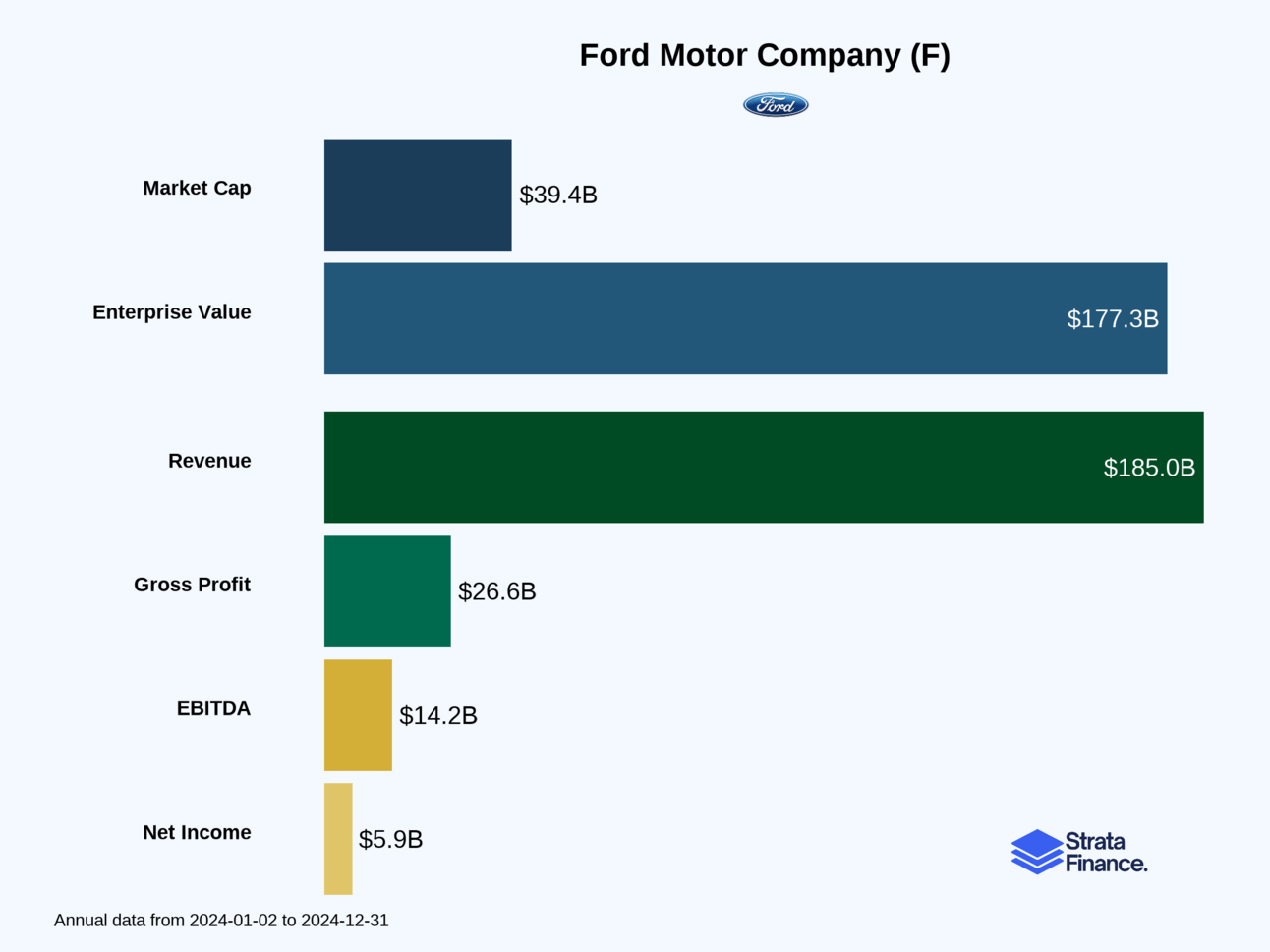

Strata Layers Chart

Layer 1: The Business Model 🏛️

Think of Ford as three different companies wearing a trench coat and pretending to be one. At its core, Ford is like that friend who's trying to reinvent themselves while still paying the bills with their old job – except the "old job" happens to be making some of America's most beloved trucks and the "reinvention" involves electric vehicles that are currently burning cash faster than a Tesla on Ludicrous mode.

The Three-Headed Beast 🐲

Ford Blue is the reliable breadwinner of the family, churning out gas-powered and hybrid vehicles that people actually want to buy. Think F-150s, Mustangs, and Lincoln luxury vehicles – the stuff that built Ford's reputation and still pays most of the bills. In 2024, this segment generated $101.9 billion in revenue ↗️ with a respectable $5.3 billion in EBIT, though that's down from $7.5 billion in 2023 ↘️. It's like the steady older sibling who went to business school and now supports the family while the younger siblings figure out their lives.

Ford Model e is the ambitious younger sibling who moved to Silicon Valley to "disrupt" things. This is Ford's electric vehicle division, responsible for the F-150 Lightning, Mustang Mach-E, and other battery-powered dreams. Unfortunately, it's also responsible for losing $5.1 billion in 2024 ↘️ on just $3.9 billion in revenue. That's a negative 131.8% EBIT margin, which is about as profitable as a lemonade stand that pays $2 for every cup it sells for $1.

Ford Pro is the overachiever who found their niche and is absolutely crushing it. This commercial vehicle division serves businesses, fleets, and government customers with everything from delivery vans to heavy-duty trucks. With $66.9 billion in revenue ↗️ and $9.0 billion in EBIT ↗️, it's sporting a healthy 13.5% margin. These are the vehicles that keep Amazon packages moving and construction sites running – unglamorous but essential.

The Money Machine 💰

Ford makes money the old-fashioned way: they build stuff and sell it for more than it costs to make. But like any good modern company, they've also got their fingers in the financing pie through Ford Credit, which generated $12.3 billion in revenue by helping people buy Ford vehicles. It's like being both the car dealer and the bank – a pretty sweet setup when it works.

The company measures success through metrics that would make any MBA proud:

Wholesale unit volumes (how many vehicles they ship to dealers)

EBIT margins by segment (how much profit each division squeezes out)

Market share (how much of the pie they're eating)

Adjusted free cash flow ($6.7 billion in 2024, which is real money you can actually spend)

The Global Empire 🌍

Ford operates like a multinational corporation should, with 375 facilities across 24 countries and 41 manufacturing plants. They've got about 171,000 employees worldwide, which is roughly the population of a mid-sized city all working to keep America (and the world) moving. The company sold approximately 4.47 million vehicles in 2024 through a network of about 9,000 dealerships globally ↘️.

Layer 2: Category Position 🏆

Ford is like that veteran boxer who's still throwing punches but facing younger, faster opponents who fight with completely different styles. In the traditional automotive world, they're a heavyweight. In the electric vehicle arena? They're learning that being good at making gas engines doesn't automatically make you good at making electric ones.

The Competition Landscape 🥊

Ford's main rivals include the usual suspects: General Motors (their eternal American rival), Stellantis (the European conglomerate that somehow owns Jeep, Ram, and Fiat), and Toyota (the efficiency masters from Japan). But the game has changed dramatically with the rise of Tesla, which has basically redefined what an automaker can be, and a parade of Chinese EV manufacturers who are eating everyone's lunch in the world's largest car market.

In the commercial vehicle space, Ford Pro is absolutely dominating. The F-Series has been America's best-selling truck for over four decades, and the Transit van family owns the commercial delivery market. This is Ford's fortress – their competitive moat filled with loyal fleet managers and mechanics who know these vehicles inside and out.

Market Share Reality Check 📊

Ford's position varies dramatically by segment and geography:

Strengths:

North American truck market leadership (F-Series is basically printing money)

Commercial vehicle dominance through Ford Pro

Strong brand recognition and dealer network

Challenges:

Electric vehicle market share is tiny compared to Tesla

Struggling in China (like most Western automakers)

European operations facing intense competition and regulatory pressure

The company's global wholesale volume has been relatively flat, hovering around 4 million vehicles annually. That's not growth, but it's not collapse either – it's the automotive equivalent of treading water while figuring out which direction to swim.

Layer 3: Show Me The Money! 📈

Ford's financial story is like a tale of three cities: one that's profitable, one that's promising, and one that's currently on fire (in a bad way).

Revenue Breakdown 💵

2024 Total Revenue: $185.0 billion ↗️

Ford Blue: $101.9 billion (55% of total) - The cash cow

Ford Pro: $66.9 billion (36% of total) - The growth engine

Ford Model e: $3.9 billion (2% of total) - The money pit

Ford Credit: $12.3 billion (7% of total) - The financing arm

The Profit Picture 📊

Here's where things get interesting (and by interesting, I mean concerning):

Ford Blue generated $5.3 billion in EBIT ↘️ on a 5.2% margin. That's down from $7.5 billion in 2023, showing that even the reliable division is feeling pressure from competition and new product launch costs.

Ford Pro is the star performer with $9.0 billion in EBIT ↗️ and a stellar 13.5% margin. Commercial customers apparently don't mind paying for quality, and Ford has built a moat around this business that competitors struggle to cross.

Ford Model e lost $5.1 billion ↘️, which is actually worse than the $4.7 billion loss in 2023. The segment is hemorrhaging money due to pricing pressure (everyone's racing to the bottom on EV prices) and the high costs of building out electric vehicle capabilities.

Cost Structure Reality 💸

Ford's biggest expenses are exactly what you'd expect from a manufacturer:

Material costs (steel, aluminum, batteries, chips – all the stuff that goes into cars)

Labor costs (171,000 employees don't work for free)

Manufacturing overhead (keeping 41 plants running isn't cheap)

R&D spending (about $8.0 billion in 2024, because standing still means falling behind)

The company spent $8.6 billion on capital expenditures in 2024 ↗️, much of it going toward electric vehicle production capabilities. That's a lot of money to spend on something that's currently losing money, but sometimes you have to spend money to make money (eventually).

Geographic Mix 🌎

Ford's revenue is heavily concentrated in North America, which generated about 68% of total revenue in 2024. This geographic concentration is both a strength (they dominate their home market) and a vulnerability (they're dependent on North American economic health and consumer preferences).

Seasonality and Cyclicality 📅

The automotive business is naturally cyclical – people buy fewer cars during recessions and more during good times. Ford also experiences seasonal patterns, with production typically higher in the first half of the year to meet spring and summer demand. The company has to constantly balance inventory levels, dealer stock, and production schedules like a complex juggling act.

Layer 4: What Do We Have to Believe? 📚

Investing in Ford requires believing in a transformation story while the company continues to generate cash from its traditional business. It's like betting on a caterpillar that's halfway through becoming a butterfly – except the caterpillar is still pretty good at being a caterpillar.

The Bull Case 🐂

For Ford to succeed, you need to believe:

The EV transition will eventually make sense financially. Ford Model e is currently burning $5+ billion annually, but bulls believe this is necessary investment spending that will pay off as EV adoption accelerates and costs come down. The company has already shown it can build compelling electric vehicles (F-150 Lightning, Mustang Mach-E) – now it just needs to make them profitably.

Ford Pro is a sustainable competitive advantage. Commercial customers are stickier than retail customers, and Ford has built deep relationships with fleet managers over decades. As these fleets electrify, Ford is positioned to capture that transition with vehicles and services tailored to business needs.

The traditional business can fund the transition. Ford Blue continues to generate billions in cash flow from vehicles people actually want to buy. This gives Ford time to figure out the electric vehicle puzzle without going bankrupt in the process.

Management can execute the transformation. CEO Jim Farley has been making tough decisions, including canceling unprofitable EV programs and focusing resources on winnable battles. The company's willingness to adjust course based on market realities is encouraging.

The Bear Case 🐻

The skeptics worry about:

The EV losses are unsustainable. Losing $5+ billion annually on electric vehicles while facing intense competition from Tesla and Chinese manufacturers is a recipe for disaster. If EV adoption stalls or Ford can't achieve profitability, the company could be stuck funding a money-losing division indefinitely.

Traditional business is under pressure. Ford Blue's EBIT fell from $7.5 billion to $5.3 billion in 2024 ↘️, showing that even the profitable segments face headwinds. If the traditional business weakens while EVs continue losing money, Ford could find itself in serious trouble.

Competition is intensifying everywhere. Tesla continues to dominate EVs, Chinese manufacturers are expanding globally, and traditional competitors aren't standing still. Ford risks being squeezed from all sides without a clear competitive advantage.

Execution risk is enormous. Transforming a 120-year-old manufacturing company into a technology-forward mobility provider is incredibly difficult. Many companies have tried similar transformations and failed spectacularly.

The Bottom Line 📝

Ford is essentially asking investors to fund a massive transformation while hoping the traditional business remains strong enough to pay for it. The company has real strengths – particularly in commercial vehicles and North American trucks – but also faces existential challenges in the shift to electric vehicles.

The good news? Ford isn't betting everything on one strategy. The segmented approach allows them to optimize each business differently, potentially providing more flexibility than competitors with more integrated approaches. Ford Pro's success shows the company can adapt and win in new market conditions.

The concerning news? The EV transition is proving more expensive and difficult than anyone anticipated, and Ford is burning through billions while trying to figure it out. Success requires perfect execution across multiple complex initiatives while maintaining profitability in traditional businesses facing their own challenges.

For investors, Ford represents a classic value-versus-growth dilemma wrapped in a transformation story. You're buying a profitable traditional automaker that's trying to become something else entirely. Whether that transformation succeeds may determine if Ford thrives in the next century or becomes a cautionary tale about the perils of industrial disruption.

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.