The Bottom Line Upfront 💡

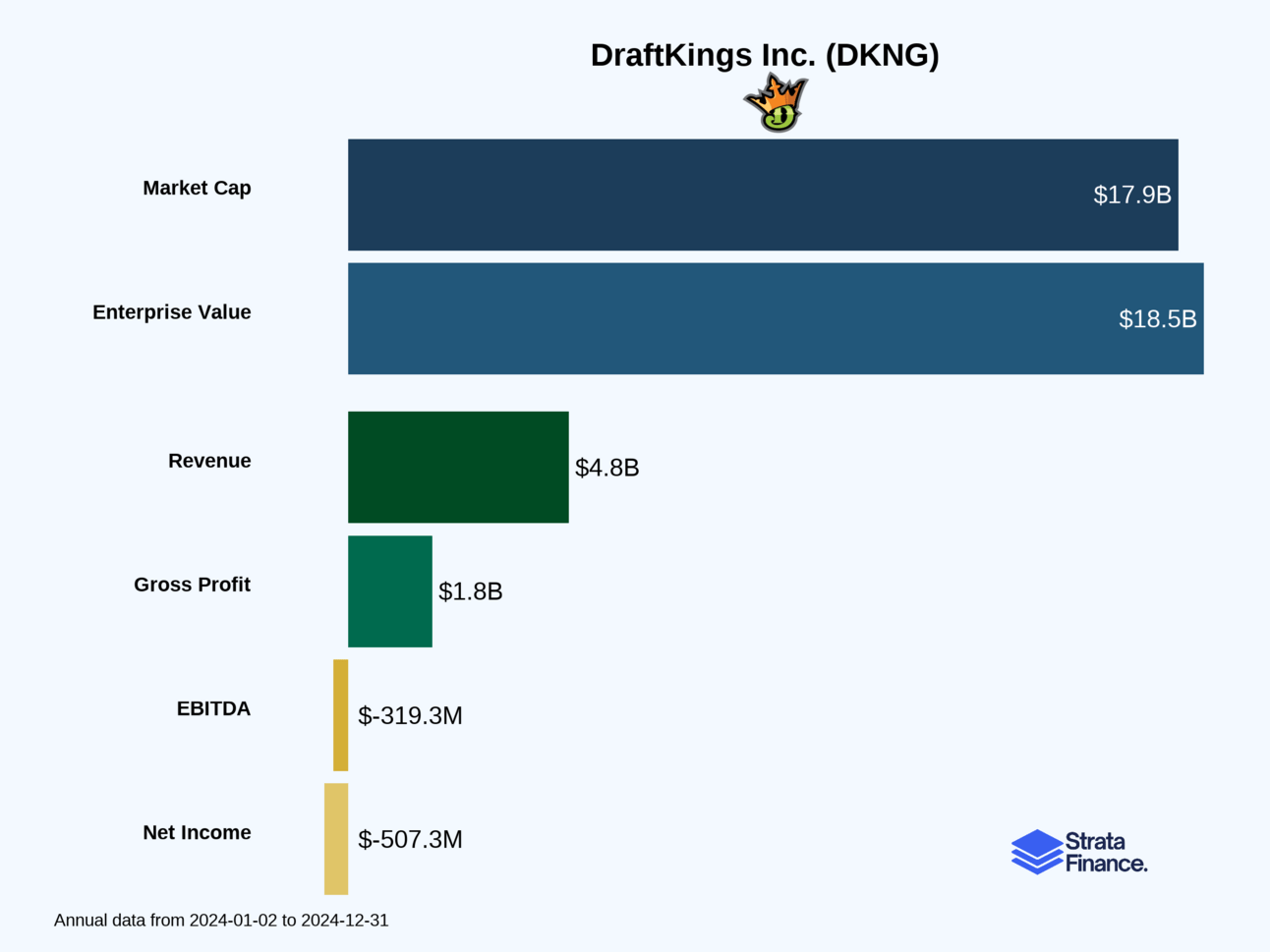

DraftKings Inc. $DKNG ( ▲ 4.31% ) is America's digital casino that never closes - a mobile-first gaming platform combining sports betting, online casino games, fantasy sports, and lottery services. With $4.77 billion in 2024 revenue (up 30%) and 3.7 million monthly paying customers, they're locked in a duopoly battle with FanDuel for dominance in the rapidly expanding U.S. online gaming market. The company finally achieved positive Adjusted EBITDA of $181 million in 2024, marking a crucial milestone in their evolution from cash-burning growth story to sustainable business. However, they're still posting net losses over $500 million annually while fighting an expensive customer acquisition war. This is a high-risk, high-reward bet on the continued legalization of online gambling across America - if you believe sports betting will become as mainstream as lottery tickets and DraftKings can maintain market leadership, the upside is enormous. But regulatory backlash or permanent promotional warfare could wipe out shareholders faster than a bad parlay bet.

Partnership

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Strata Layers Chart

Layer 1: The Business Model 🏛️

Think of DraftKings as the digital casino that never closes, combined with a fantasy sports league commissioner and a lottery ticket runner all rolled into one slick mobile app. Their mission? "To make life more exciting by responsibly creating the world's favorite real-money games and betting experiences." Translation: they want to be your one-stop shop for putting money where your mouth is when it comes to sports.

What They Actually Do 💰

DraftKings operates like a sophisticated digital entertainment platform with four main revenue engines:

Sportsbook (61% of revenue) - This is their bread and butter. Users place bets on sports events at odds set by DraftKings. Think of it like being the house in Vegas, but instead of slot machines, they're taking action on whether the Patriots will cover the spread. In 2024, they processed a staggering $48.1 billion ↗️ in total betting handle (that's every dollar wagered) and kept about 6.0% ↗️ as their cut after paying out winners.

iGaming/Online Casino (32% of revenue) - Digital versions of classic casino games like blackjack, roulette, and slots. Unlike sports betting where outcomes can be unpredictable, casino games have built-in mathematical advantages that make revenue more predictable. It's like owning a piece of every slot machine in Vegas, but without the overhead of feeding people free drinks.

Daily Fantasy Sports (part of "Other" revenue) - Their original claim to fame. Users draft fantasy teams and compete against each other for prize money. DraftKings takes a cut of the entry fees, essentially acting like the tournament organizer who gets paid regardless of who wins.

Digital Lottery Courier - Through their 2024 acquisition of Jackpocket, they now help people buy official state lottery tickets through their app, earning service fees and commissions. It's like having a really efficient friend who runs to the corner store to buy your Powerball tickets.

Key Success Metrics 📊

DraftKings obsesses over a few critical numbers:

Monthly Unique Payers (MUPs): 3.7 million ↗️ in 2024 (up 39% from 2023). These are people who actually spend money, not just tire-kickers.

Average Revenue Per MUP (ARPMUP): $106 ↘️ in 2024 (down from $113 in 2023, but this decline was mainly due to lower-spending lottery customers from the Jackpocket acquisition).

Sportsbook Net Revenue Margin: 6.0% ↗️, showing they're getting better at setting odds and managing risk.

The Technology Edge 🔧

Their secret sauce is a highly scalable technology platform that can be deployed in new states with minimal additional investment. They've built sophisticated data science and machine learning systems that:

Personalize user experiences (showing you the bets you're most likely to make)

Optimize marketing spend (finding the cheapest ways to acquire profitable customers)

Manage risk (making sure they don't get wiped out by a few lucky bettors)

The platform is designed to handle the complex, state-by-state regulatory requirements that make this industry a compliance nightmare. They maintain separate user fund accounts as required by law and have built systems that can adapt to different jurisdictional rules.

Layer 2: Category Position 🏆

DraftKings operates in the rapidly expanding U.S. online gaming market, where they've established themselves as one of the "Big Two" alongside FanDuel. It's essentially a duopoly with some smaller players nipping at their heels.

The Competitive Landscape 🥊

The Main Rival: FanDuel is their primary competitor and arguably has a slight edge in market share in many states. The two companies are locked in an expensive arms race for customers, throwing around promotional offers like confetti at a New Year's party.

The Traditional Casino Crowd: BetMGM, Caesars, and other established casino operators are trying to translate their brick-and-mortar expertise to the digital world. They have deep pockets and regulatory relationships, but often lack the technology sophistication.

The Upstarts: Smaller players like PointsBet and Barstool Sportsbook (now owned by Penn Entertainment) are trying to carve out niches, often by targeting specific demographics or offering unique betting products.

Market Position Strengths 💪

DraftKings has several competitive advantages:

First-mover advantage: They were among the first to launch in many newly legal states

Multi-product ecosystem: Users can seamlessly move between sports betting, casino games, and fantasy sports

Technology leadership: Their data science capabilities are genuinely impressive

Scale benefits: Their size allows them to negotiate better deals with payment processors and content providers

Current Market Dynamics 📈

As of December 2024, 39 U.S. states plus D.C. and Puerto Rico have legalized some form of sports betting, with 33 allowing online betting. DraftKings operates in 26 of the 32 live online markets. The iGaming opportunity is even more nascent, with only 7 states currently legal - representing massive untapped potential.

The industry is still in its land-grab phase, with companies prioritizing market share over profitability. This has led to intense promotional wars where operators offer generous sign-up bonuses to attract new customers. It's expensive, but necessary to build market position before the industry matures.

Layer 3: Show Me The Money! 📈

Revenue Breakdown 💵

DraftKings generated $4.77 billion ↗️ in revenue in 2024 (up 30% from 2023), with a clear concentration in their core gaming products:

By Product Line:

Sportsbook: $2.90 billion (61% of total)

iGaming: $1.51 billion (32% of total)

Other (DFS, lottery, media): $357 million (7% of total)

By Geography:

United States: $4.65 billion (97% of total)

International: $119 million (3% of total)

The U.S. focus makes sense given the regulatory complexity of expanding internationally and the massive domestic opportunity still being unlocked.

Customer Behavior & Seasonality 📅

DraftKings experiences significant seasonality, with Q4 typically being their strongest quarter due to the overlap of NFL and NBA seasons. Football is king in American sports betting, and when the NFL is in full swing, the money flows.

The company has been successful at cross-selling customers between products. Someone might start with fantasy football, then try sports betting, and eventually play some online casino games. This multi-product engagement increases customer lifetime value and makes users stickier.

The Economics of Growth 📊

Here's where things get interesting (and expensive). DraftKings is still in investment mode, prioritizing growth over profitability:

Major Cost Categories (2024):

Cost of Revenue: $2.95 billion (62% of revenue) - includes gaming taxes, payment processing, and promotional costs

Sales & Marketing: $1.26 billion (27% of revenue) - customer acquisition is expensive!

Product & Technology: $397 million (8% of revenue) - building and maintaining their platform

General & Administrative: $764 million (16% of revenue) - running the business

The good news? They achieved positive Adjusted EBITDA of $181 million ↗️ in 2024, compared to negative $151 million in 2023. This suggests their revenue growth is finally starting to outpace their spending growth.

Margin Trends 📉📈

DraftKings' gross margins (revenue minus direct costs) have been under pressure due to:

High promotional spending to acquire customers in competitive markets

Increasing gaming tax rates in some states (Illinois raised their online sportsbook tax rate in July 2024)

Mix shift toward newer, less mature markets where they spend more on marketing

However, their Sportsbook Net Revenue Margin improved to 6.0% ↗️ in 2024 from 5.6% in 2023, showing they're getting better at setting odds and managing risk.

Layer 5: What Do We Have to Believe? 📚

The Bull Case 🐂

Belief #1: The U.S. online gaming market will continue expanding rapidly Currently, only 33 states allow online sports betting and just 7 allow iGaming. If DraftKings is right that this will eventually be legal in most states, the addressable market could triple or quadruple from current levels.

Belief #2: They can achieve sustainable competitive advantages Their technology platform, brand recognition, and multi-product ecosystem need to create lasting moats that prevent competitors from stealing market share as the industry matures.

Belief #3: Customer acquisition costs will normalize Right now, companies are spending unsustainable amounts to acquire customers. Bulls believe this promotional arms race will eventually calm down, allowing DraftKings to maintain their user base while dramatically reducing marketing spend.

Belief #4: Cross-selling will drive higher lifetime value The theory is that customers who use multiple products (sports betting + casino + fantasy) will be more valuable and less likely to churn than single-product users.

The Bear Case 🐻

Risk #1: Regulatory backlash Politicians love to grandstand about gambling, and there's always risk of increased taxes, restrictive regulations, or outright bans. Some states have already imposed punitive tax rates that make operations barely profitable.

Risk #2: Permanent promotional warfare What if customer acquisition costs never normalize? If companies have to keep offering generous bonuses forever to prevent churn, the unit economics might never work.

Risk #3: Market saturation The most enthusiastic sports bettors have probably already signed up. Future growth might require converting casual fans who bet less frequently and generate lower lifetime value.

Risk #4: Competitive pressure Traditional casino companies have deep pockets and regulatory relationships. Tech giants like Amazon or Google could theoretically enter the space. FanDuel isn't going anywhere.

Risk #5: Problem gambling concerns Increased scrutiny around gambling addiction could lead to mandatory spending limits, cooling-off periods, or other restrictions that hurt revenue growth.

The Bottom Line Assessment 🎯

DraftKings is essentially a bet on the continued legalization and normalization of online gambling in America. They've built a strong position in a rapidly growing market, but they're still burning cash to maintain that position.

The company finally achieved positive Adjusted EBITDA in 2024, which is a meaningful milestone. However, they're still posting net losses of over $500 million annually, so this isn't for investors who need immediate profitability.

The business model is fundamentally sound - they're essentially taking a small percentage of a massive and growing pool of money that Americans want to bet on sports. The question is whether they can maintain their market position as competition intensifies and whether the regulatory environment remains favorable.

For investors, this is a high-risk, high-reward play on the future of American entertainment. If you believe that sports betting will become as mainstream as buying a lottery ticket, and that DraftKings can maintain their leadership position, the upside could be enormous. But if the regulatory winds shift or competition proves more brutal than expected, shareholders could get wiped out faster than a bad parlay bet.

The company's 2024 performance suggests they're moving in the right direction, but they're still in the "prove it" phase of their evolution from growth-at-all-costs startup to sustainable business. Buckle up - it's going to be a wild ride! 🎢

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.