AI-written, human-approved. Read responsibly.

The Bottom Line Upfront

Delta Air Lines has successfully positioned itself as a premium carrier in the competitive airline industry, focusing on operational reliability and customer experience rather than competing solely on price. With a diversified revenue model that includes its lucrative SkyMiles program (particularly its $7.4B American Express partnership), cargo operations, and maintenance services, Delta has built a more resilient business than many competitors. The company’s strong balance sheet, investment-grade credit rating, and focus on premium products have created meaningful competitive advantages, though it remains vulnerable to fuel price volatility and economic downturns. For investors seeking exposure to air travel, Delta represents one of the higher-quality options in an inherently challenging industry.

Layer 1: The Business Model 🏛️

Flying People (and Stuff) Around the World ✈️

At its core, Delta Air Lines is in the business of moving people and cargo from point A to point B through the sky. In 2024, they flew over 200 million customers on up to 5,000 daily flights to more than 290 destinations across six continents. Think of Delta as operating a highway system in the sky, but instead of collecting tolls, they sell seats.

Delta’s business revolves around a hub-and-spoke network with two types of hubs:

Core hubs (Atlanta, Detroit, Minneapolis-St. Paul, Salt Lake City): These are Delta’s powerhouses with strong local passenger share and cost advantages

Coastal hubs (Boston, LA, NYC, Seattle): These serve large revenue markets and enable growth in premium products and international service

This hub system works like a funnel, collecting passengers from smaller markets and connecting them through central points to their final destinations. It’s like how Amazon uses fulfillment centers to efficiently distribute packages—except Delta’s packages are people who complain when you lose their luggage.

Beyond Just Flying: Delta’s Diversification Strategy 🧩

While flying people is the main gig, Delta has smartly expanded into complementary businesses:

SkyMiles Program 💳: This loyalty program is Delta’s golden goose. Members earn miles through flights and partner spending (especially with American Express) and redeem them for travel and other rewards. In 2024, about 10% of Delta’s passenger miles were from award travel—that’s roughly 30 million award tickets!

Cargo Operations 📦: Delta uses the belly space of passenger aircraft to transport freight, generating $822 million in 2024. Not huge, but a nice bonus from space that would otherwise go unused.

Maintenance Services 🔧: Delta TechOps provides maintenance not just for Delta’s fleet but for other airlines too. With agreements to service next-generation aircraft engines, this division is positioned for growth.

Delta Vacations 🏝️: This subsidiary packages vacation experiences for SkyMiles members, adding another revenue stream.

Monroe Energy ⛽: In a unique move, Delta owns and operates the Trainer oil refinery near Philadelphia. This helps them manage fuel cost volatility and ensure supply reliability. It’s like a restaurant buying a farm to control ingredient costs—unusual but potentially smart.

The Fleet: Delta’s Mobile Assets 🛫

Delta’s business relies on a diverse fleet of 1,292 aircraft (as of December 2024). They’re actively refreshing this fleet with new, more fuel-efficient planes that offer increased premium seating and cargo capacity. In 2024, they took delivery of 38 new aircraft, including A321neos, A220-300s, A330-900s, and A350-900s.

This fleet modernization serves multiple purposes: improving fuel efficiency, enhancing the customer experience with better cabins, and supporting environmental sustainability goals. It’s like upgrading from a gas-guzzling SUV to a hybrid—better for both your wallet and the environment.

Layer 2: Category Position 🏆

The Competitive Skies: Who’s Who in Aviation ✈️

The airline industry is notoriously competitive, and Delta faces different rivals across its markets:

Domestic Competition:

Legacy carriers: American Airlines and United Airlines (the “Big 3” along with Delta)

Mid-tier carriers: Alaska Airlines, JetBlue, Southwest

International Competition:

Foreign flag carriers (Lufthansa, British Airways, etc.)

Partner airlines (sometimes frenemies who both compete and cooperate)

Global alliances: Delta leads SkyTeam, competing against Star Alliance (United) and oneworld (American)

It’s like a global game of Risk, with airlines constantly battling for territory and forming alliances to strengthen their positions.

Delta’s Secret Sauce: Competitive Advantages 🥇

Delta has cultivated several key advantages that set it apart:

People and Culture 👥: Delta considers its 100,000+ employees its strongest advantage. The airline ranked as the world’s #11 Most Admired Company by FORTUNE in 2024 and #13 on Glassdoor’s Best Places to Work list. Their profit-sharing program ($1.4 billion in 2024) aligns employee interests with company success. Happy employees = happy customers.

Operational Reliability ⏱️: Delta consistently ranks among the industry’s best performers in on-time arrivals and completion factor. In 2024, they were named the most on-time airline in North America by Cirium and the top airline by The Wall Street Journal for the fourth consecutive year. In an industry where delays cascade into customer nightmares, this reliability is gold.

Global Network 🌎: Delta’s extensive network, enhanced by partnerships with airlines like Aeroméxico, Air France-KLM, and Korean Air, provides comprehensive global coverage. These partnerships are like having friends with vacation homes all over the world—they extend Delta’s reach without the full cost of ownership.

Customer Loyalty ❤️: Delta has built strong customer loyalty through operational excellence and service quality. Their investments in airport improvements, lounges, and technology initiatives like Delta Sync have improved net promoter scores and increased customer loyalty. In the airline industry, where many customers view travel as a necessary evil, Delta has managed to build genuine brand affection.

Financial Foundation 💪: Over the past 15 years, Delta has transformed its business by investing in people, product, and reliability. In 2024, they regained investment grade rating from all three major rating agencies—a significant achievement for an airline.

Market Positioning: Premium with Purpose 🥂

Delta has strategically positioned itself as a premium carrier, focusing on service quality and reliability rather than competing solely on price. They’ve reduced reliance on price-sensitive customers by growing high-margin revenue streams:

Premium Products ↗️: Delta has seen record paid load factors in premium cabins, with premium yield growth significantly outpacing main cabin.

American Express Partnership ↗️: Generated $7.4 billion in 2024, with expectations to grow to $10 billion long-term.

Maintenance Services ↗️: Well-positioned for growth through agreements with jet engine manufacturers.

This premium positioning has helped Delta build a more resilient business model. While budget carriers fight over price-sensitive leisure travelers (the airline equivalent of coupon-clippers), Delta focuses on business travelers and premium leisure customers willing to pay more for a better experience.

Layer 3: Show Me The Money! 📈

Revenue Breakdown: Where Does the Cash Come From? 💵

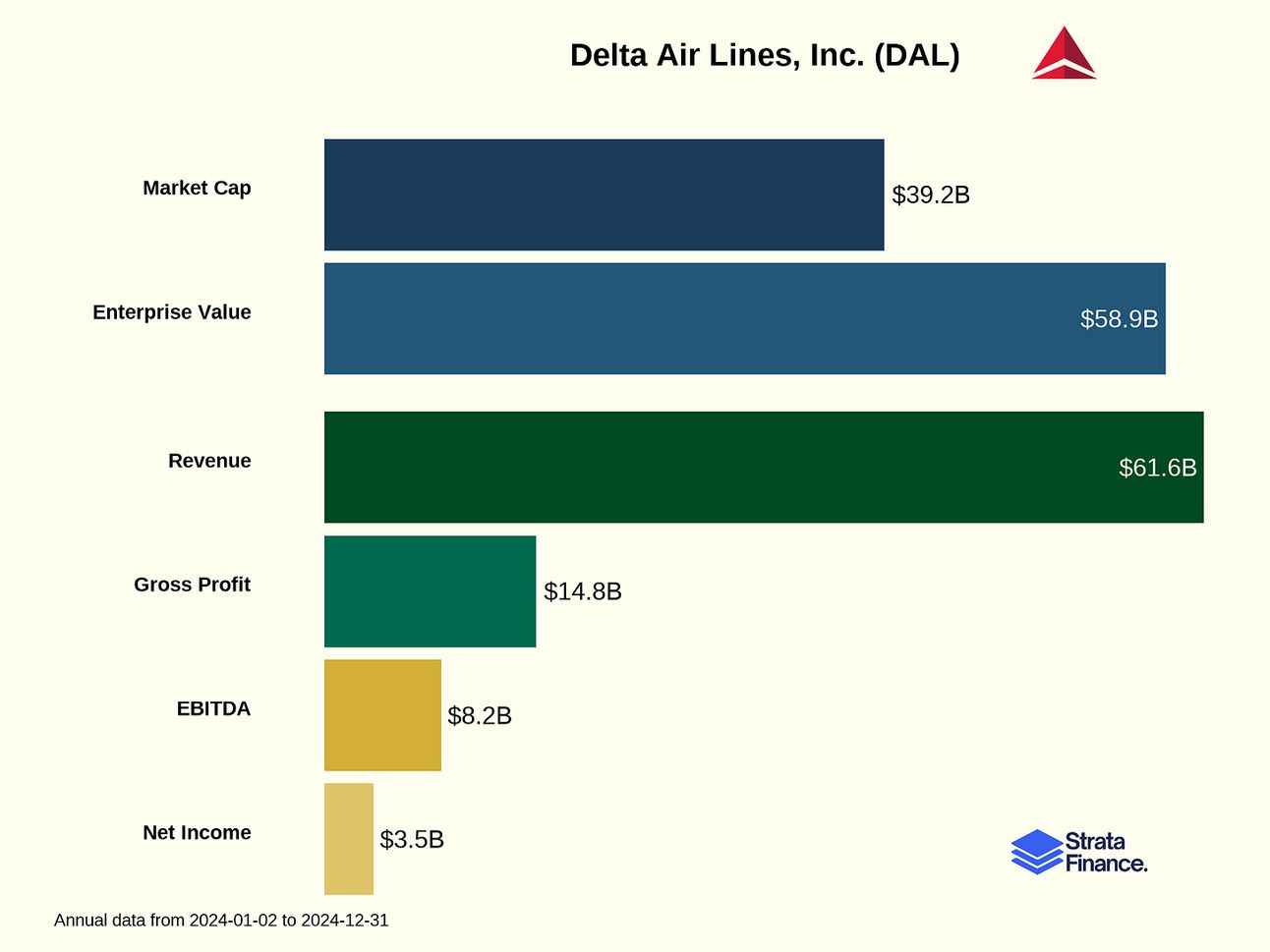

Delta’s 2024 operating revenue totaled $61.6 billion ↗️ (up 6% from 2023). Here’s how that breaks down:

Passenger Revenue: $50.9 billion (83% of total) ↗️

Main cabin tickets: $24.5 billion ↗️

Premium products: $20.6 billion ↗️ (growing faster than main cabin)

Loyalty travel awards: $3.8 billion ↗️

Travel-related services: $2.0 billion ↗️ (baggage fees, change fees, etc.)

Cargo: $822 million (1%) ↗️

Up 14% from 2023, a nice supplemental revenue stream

Other Revenue: $9.9 billion (16%) ↗️

Refinery operations: $4.6 billion ↗️

Loyalty program (non-flight): $3.3 billion ↗️

Ancillary businesses: $772 million ↘️

Miscellaneous: $1.2 billion ↗️ (lounge access, codeshare agreements, etc.)

Geographic Diversity: Flying Money Around the Globe 🌍

Delta’s passenger revenue is geographically diverse, providing some insulation from regional economic downturns:

Domestic: $35.2 billion (69%) ↗️

Atlantic: $9.1 billion (18%) ↗️

Latin America: $4.0 billion (8%) ↗️

Pacific: $2.5 billion (5%) ↗️ (22% growth in 2024, the strongest of any region)

The Pacific region’s strong growth (22%) came from improved demand for travel to South Korea and Japan, with capacity up 32%. It’s like Delta discovered a gold mine that had been temporarily closed during the pandemic.

The SkyMiles Money Machine 🏦

The SkyMiles program deserves special attention as a critical revenue driver. Total cash sales from marketing agreements related to the loyalty program were $7.4 billion in 2024 ↗️, an 8% increase from 2023.

The American Express partnership is particularly valuable, driven by co-brand card spend growth and new card acquisitions. This partnership is like having a money printer in Delta’s basement—it generates high-margin revenue that’s more stable than ticket sales.

Growth Drivers and Headwinds 🌪️

Growth Drivers:

Premium cabin demand ↗️

International travel recovery, especially in the Pacific ↗️

SkyMiles program and American Express partnership ↗️

Fleet modernization improving customer experience ↗️

Headwinds:

Operational disruptions (like the July 2024 CrowdStrike outage that cost $380 million) ↘️

Competitive pressure in domestic markets ↘️

Fuel price volatility (though lower in 2024) ↗️

Economic sensitivity (airlines are cyclical businesses) ↘️

Layer 4: Cash Rules Everything Around Me 💰

Profitability: Making Money in a Tough Business ✅

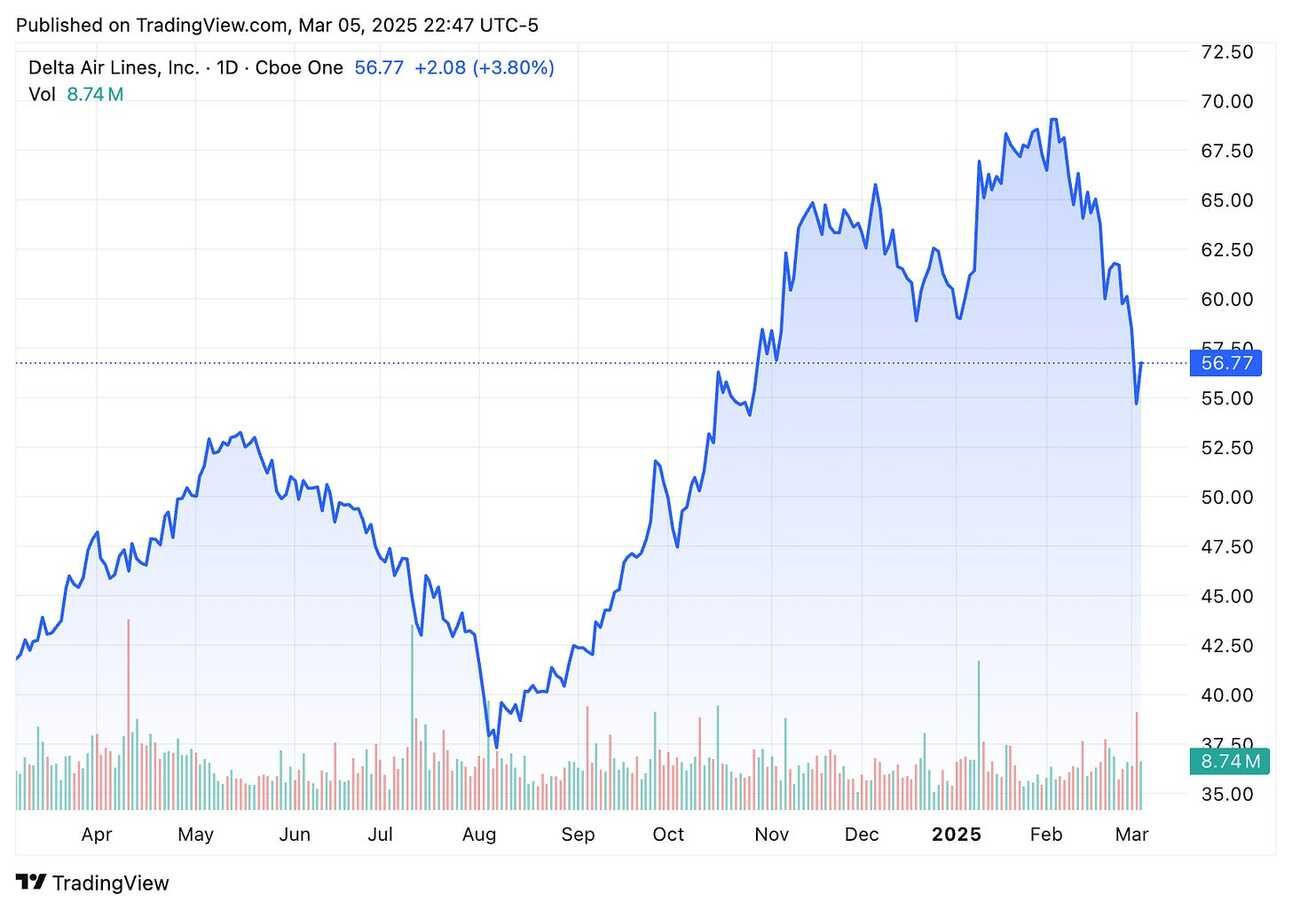

Delta delivered strong financial results in 2024, with operating income of $6.0 billion ↗️, up $474 million from 2023. That’s an operating margin of 9.7% ↗️—solid for an airline, an industry where margins are typically thinner than economy class legroom.

Net income was $3.5 billion ↘️, down from $4.6 billion in 2023, primarily due to non-operating factors like mark-to-market losses on investments compared to gains in the previous year.

Cost Structure: Where Does the Money Go? 💸

Delta’s major expense categories in 2024:

Labor: $16.2 billion (29% of expenses) ↗️

Up 11% from 2023 due to wage increases and higher staffing levels

Includes $1.4 billion in profit sharing (Delta shares success with employees)

Fuel: $10.6 billion (19%) ↘️

Down 5% from 2023 due to 12% lower fuel prices, partially offset by 5% higher consumption

Average price per gallon: $2.57 ↘️ (down from $2.82 in 2023)

Ancillary Businesses and Refinery: $5.4 billion (10%) ↗️

Up 30% primarily related to higher refinery sales to third parties

Other Operating Costs: $23.4 billion (42%) ↗️

Includes contracted services, landing fees, maintenance, depreciation, etc.

Delta’s unit cost performance remained stable, with total operating cost per available seat mile (CASM) of 19.30 cents (flat compared to 2023). Non-fuel unit costs (CASM-Ex) increased 2.8% to 13.54 cents ↗️.

Balance Sheet: Getting Financially Fit 💪

Delta has prioritized strengthening its balance sheet and reducing debt:

Made $4.0 billion in debt payments in 2024, including $1.1 billion in early repayments ↘️

Regained investment grade rating from all three major rating agencies in 2024 ↗️

Ended 2024 with $6.1 billion in liquidity ↘️ (cash, cash equivalents, and available credit)

Generated $8.0 billion from operating activities ↗️ and $3.4 billion in free cash flow ↗️

This debt reduction strategy is like paying off your credit cards ahead of schedule—it reduces interest expenses and gives you more financial flexibility for the future.

Capital Allocation: Investing in the Future ✈️

Delta’s capital expenditures were $5.1 billion in 2024 ↘️ (slightly down from $5.3 billion in 2023), primarily for:

Aircraft purchases and fleet modifications

Airport construction projects (like the LaGuardia terminal)

Technology enhancements

The company also resumed dividend payments, with $321 million paid to shareholders in 2024 ↗️.

Delta’s capital allocation strategy balances reinvestment in the business, debt reduction, and shareholder returns—a more balanced approach than many airlines that historically prioritized growth at all costs.

Layer 6: What Do We Have to Believe? 📚

The Bull Case: Blue Skies Ahead ☀️

For the bull case on Delta to play out, you need to believe:

Premium Strategy Will Continue to Work: Delta’s focus on premium products will keep attracting less price-sensitive customers willing to pay for quality. This isn’t just about fancy seats—it’s about reliability, service, and the overall experience.

SkyMiles Will Keep Printing Money: The loyalty program, especially the American Express partnership, will continue growing toward that $10 billion long-term target. This high-margin revenue stream is less cyclical than ticket sales.

International Expansion Will Pay Off: Investments in partnerships and routes, especially in the Pacific region, will drive profitable growth as global travel demand increases.

Fleet Modernization Will Deliver: The ongoing fleet renewal will improve fuel efficiency, reduce maintenance costs, and enhance customer experience, supporting both revenue growth and margin improvement.

Balance Sheet Strength Creates Opportunities: The restored investment grade rating and continued debt reduction will provide flexibility to weather downturns and invest in growth.

The Bear Case: Turbulence Ahead 🌩️

Key risks that could ground Delta’s performance:

Fuel Price Volatility: With fuel representing 19% of operating expenses, significant increases could pressure margins despite hedging strategies and refinery ownership. Oil prices are notoriously unpredictable.

Economic Sensitivity: Airlines are cyclical businesses, and an economic downturn could reduce travel demand, particularly in premium cabins where Delta has focused its growth strategy.

Competitive Pressures: The airline industry never stays rational for long. If competitors aggressively add capacity or cut prices, Delta’s yields could suffer.

Operational Disruptions: As demonstrated by the July 2024 CrowdStrike outage ($380 million impact), technological or operational disruptions can have significant financial consequences.

Environmental Regulations: Increasing regulations and the transition to sustainable aviation fuel (SAF) could raise costs, as SAF currently costs significantly more than conventional jet fuel.

Milestones to Monitor 📊

Keep an eye on these key indicators:

Premium Cabin Load Factors and Yields: Are customers still willing to pay up for premium experiences?

American Express Partnership Revenue: Is this critical revenue stream continuing to grow?

Debt Reduction Progress: Is Delta continuing to strengthen its balance sheet?

Operational Performance Metrics: Is Delta maintaining its industry-leading reliability?

Capacity Discipline: Is the industry adding seats in a rational way, or returning to the bad old days of growth at any cost?

The Final Word: Is Delta Ready for Takeoff? 🚀

Delta has transformed itself from a traditional airline into a more diversified travel company with multiple revenue streams and a focus on premium experiences. The company’s strong operational performance, customer loyalty, and financial discipline position it well compared to peers.

While the airline industry remains inherently challenging (Warren Buffett once joked that investors would have been better off if someone had shot down the Wright brothers’ plane), Delta has built a business model designed to weather turbulence better than most.

For investors, Delta represents one of the higher-quality options in the airline space. It’s not without risks—no airline is—but its premium positioning, diversified revenue streams, and strong management team give it advantages that many competitors lack.

If you believe in the long-term growth of global air travel and want exposure to the sector, Delta offers a relatively stable flight path in an industry known for choppy air. Just remember to fasten your seatbelt during earnings season—even the best airlines experience occasional turbulence.

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.