The Bottom Line Upfront 💡

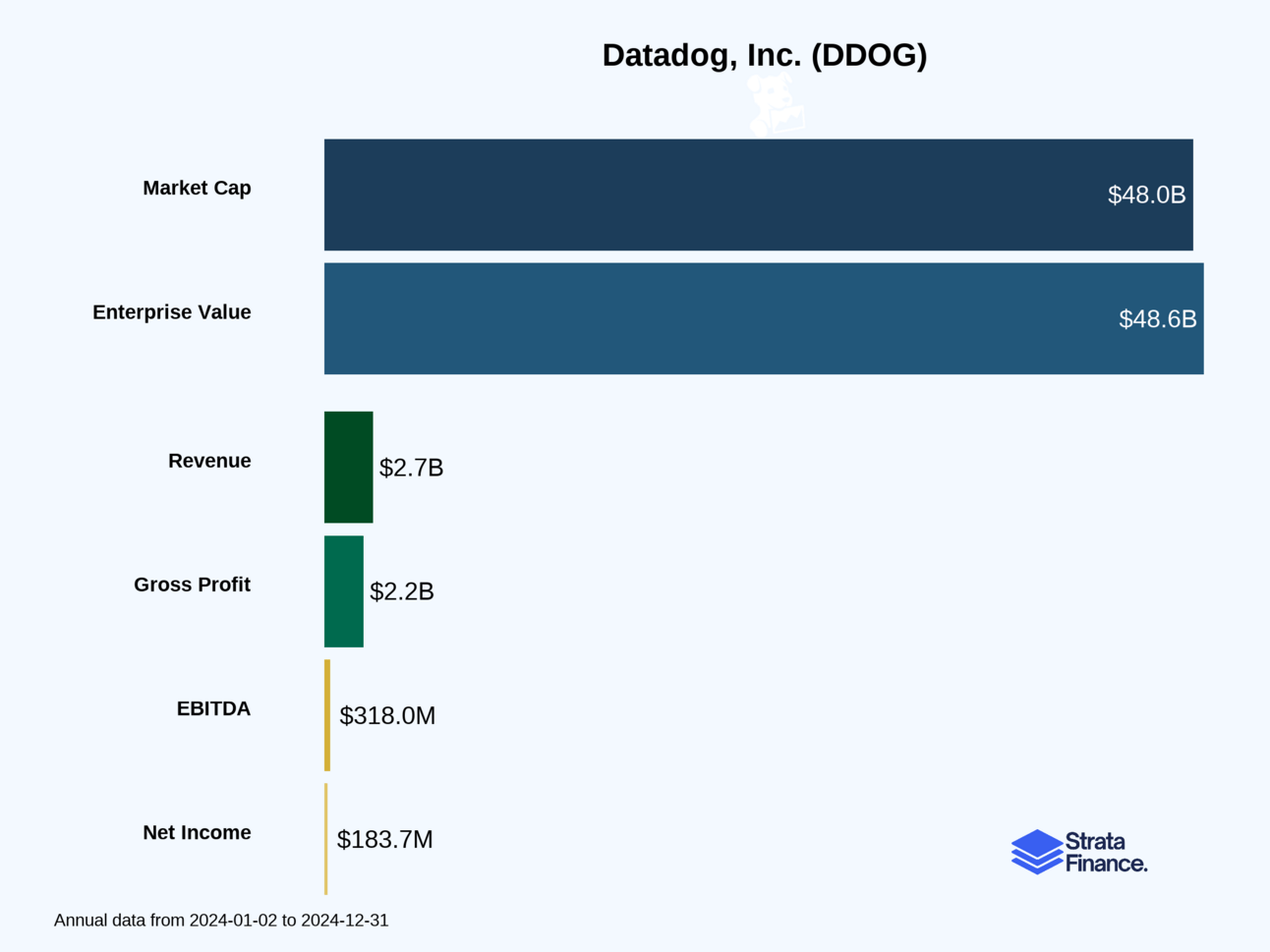

Datadog $DDOG ( ▲ 4.65% ) has built the gold standard for cloud monitoring and observability, turning the chaos of modern applications into actionable insights. With $2.68 billion in revenue growing 26% annually, 81% gross margins, and over 30,000 customers who keep spending more each year, this is a rare combination of growth and profitability. The company's unified platform approach creates real competitive advantages in an $81 billion market that's still in early innings. While competition is intensifying and valuation expectations are high, Datadog's strong fundamentals and massive growth runway make it a compelling way to play the continued digitization of business.

Partnership

Stay up-to-date with AI

The Rundown is the most trusted AI newsletter in the world, with 1,000,000+ readers and exclusive interviews with AI leaders like Mark Zuckerberg, Demis Hassibis, Mustafa Suleyman, and more.

Their expert research team spends all day learning what’s new in AI and talking with industry experts, then distills the most important developments into one free email every morning.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

Strata Layers Chart

Layer 1: The Business Model 🏛️

What Does Datadog Actually Do?

Imagine you're running a massive restaurant chain with locations worldwide. You need to know everything that's happening in real-time: which kitchens are running hot, which servers are slow, which locations are getting slammed with orders, and whether your payment systems are working properly. Now multiply that complexity by about 1,000x and you've got modern cloud computing.

That's where Datadog comes in. They're essentially the "mission control center" for companies running applications in the cloud. Their platform monitors everything from servers and databases to user experiences and security threats, turning what would otherwise be chaos into actionable insights.

The Core Business: Observability as a Service

Datadog operates a Software-as-a-Service (SaaS) platform that does three main things:

Collects data from every part of a company's technology stack (servers, applications, networks, user interactions)

Correlates and analyzes that data in real-time using AI and machine learning

Presents insights through dashboards, alerts, and automated responses

Think of it like having a really smart friend who watches all your technology 24/7 and immediately tells you when something's wrong, why it's wrong, and how to fix it.

The "Land and Expand" Money Machine 💰

Datadog's business model is beautifully simple and sticky:

Land: They make it incredibly easy for customers to get started. You can literally deploy their platform and start seeing value within minutes. No army of consultants required.

Expand: Once customers see the value, they naturally want more. They start with infrastructure monitoring, then add application performance monitoring, then log management, then security monitoring... you get the picture.

This shows up in their metrics:

83% of customers use multiple products ↗️

50% use more than four products ↗️ (up from 47% last year)

26% use more than six products ↗️ (up from 22% last year)

Revenue Model: Usage-Based Pricing

Customers typically pay based on:

Number of hosts (servers) being monitored

Volume of data being processed and stored

Additional features like custom metrics, synthetic monitoring, etc.

Contracts are usually annual or multi-year, providing predictable recurring revenue. When customers' infrastructure grows, Datadog's revenue grows automatically - it's like having a business that scales with your customers' success.

Layer 2: Category Position 🏆

The Competitive Landscape: It's Complicated

Datadog's competitive situation is unique because their unified platform competes across multiple traditional categories. It's like they're playing chess while everyone else is playing checkers.

Traditional Infrastructure Monitoring: IBM, Microsoft, SolarWinds

These are the old guard, built for on-premise data centers

Datadog's cloud-native approach gives them a significant advantage

This is where the real battle is fought

Datadog differentiates by integrating APM with infrastructure and logs

Datadog was first to combine logs with metrics and traces

Their "three pillars of observability" integration is a key differentiator

Cloud Provider Tools: AWS CloudWatch, Azure Monitor, Google Cloud Operations

These are "good enough" for basic monitoring

Datadog wins with multi-cloud support and advanced features

Datadog's Competitive Advantages

First-Mover in Unified Observability: They were first to combine metrics, traces, and logs in one platform

Cloud-Native Architecture: Built for modern, dynamic environments from day one

Integration Ecosystem: 850+ out-of-the-box integrations (that's just showing off at this point)

Ease of Use: Deploy in minutes, not months

Scale: Processing trillions of events per hour (yes, trillions with a T)

Market Position: David Among Goliaths

While Datadog faces competition from much larger companies, they've carved out a strong position by being the best at what they do. Their $2.68 billion in revenue ↗️ might seem small compared to Microsoft or IBM, but in the observability space, they're a major player with significant mindshare among developers and DevOps teams.

The $81 billion total addressable market gives them plenty of room to grow, especially as more companies migrate to the cloud and adopt modern application architectures.

Layer 3: Show Me The Money! 📈

Revenue Breakdown: The Numbers Don't Lie

Total Revenue (2024): $2.68 billion ↗️ (+26% YoY) Geographic Split: 70% North America, 30% International Customer Concentration: Beautifully diversified - no single customer dominates

The Beautiful Business Model in Action

Gross Margin: 81% (consistent year-over-year) This is software economics at their finest. Once built, the platform can serve additional customers with minimal incremental costs.

Revenue Growth: 26% in 2024 ↗️, 27% in 2023 Solid, consistent growth that's sustainable and profitable.

Customer Economics: The Magic of Expansion

The real beauty is in how customers grow their spending:

Dollar-based net retention: High-110% ↗️

Customer growth: 30,000 total ↗️ (up from 27,300)

High-value customers: 3,610 paying $100K+ annually ↗️

Cost Structure: Investing for Growth

R&D Spending: $1.15 billion (43% of revenue) They're not messing around with innovation. This level of R&D investment shows they're serious about staying ahead.

Sales & Marketing: $757 million (28% of revenue) Reasonable for a growth company, and the efficiency is improving.

Profitability Inflection: $184 million net income ↗️ This is huge - they've proven they can grow AND be profitable.

Layer 4: What Do We Have to Believe? 📚

The Bull Case: Why Datadog Could Be a Home Run 🚀

Belief #1: Cloud Migration is Still Early Despite all the talk about "digital transformation," most companies are still in the early stages of moving to the cloud. As they migrate more workloads, they'll need more observability.

Belief #2: Applications Keep Getting More Complex Microservices, containers, serverless, AI/ML - modern applications are incredibly complex. This complexity creates more demand for Datadog's unified monitoring approach.

Belief #3: The Platform Effect is Real As customers adopt more Datadog products, switching costs increase dramatically. It's much easier to add another Datadog product than to rip out their entire monitoring stack.

Belief #4: International Expansion Has Legs With only 30% of revenue from outside North America, there's huge opportunity as international markets accelerate cloud adoption.

Belief #5: AI Creates New Opportunities Their new LLM Observability product shows they can extend their platform to emerging technologies. As AI adoption grows, so does the need to monitor AI applications.

The Bear Case: What Could Go Wrong 🐻

Risk #1: Economic Downturn Hits IT Spending In a recession, companies might delay cloud migrations or reduce monitoring spend. Datadog's growth could slow significantly.

Risk #2: Cloud Providers Get Serious About Monitoring AWS, Microsoft, and Google have deep pockets. If they decide to make monitoring a priority, they could bundle it cheaply with their cloud services.

Risk #3: Competition Intensifies New Relic, Dynatrace, and others aren't standing still. If they successfully copy Datadog's unified approach, the competitive advantage could erode.

Risk #4: Customer Concentration Risk While diversified today, if a few large customers reduce spending or churn, it could meaningfully impact growth.

Risk #5: Valuation Expectations At current levels, the stock likely prices in continued strong execution. Any stumble could lead to significant multiple compression.

The Verdict: A High-Quality Growth Story 🎯

Datadog has built something special: a profitable, growing, cash-generating business in a large and expanding market. Their unified platform approach creates real customer value and meaningful competitive advantages.

The financials are impressive - 26% revenue growth with 81% gross margins and positive net income. The customer metrics show strong retention and expansion. The balance sheet is fortress-like with over $4 billion in liquidity.

Bottom Line: Datadog is a high-quality business with strong fundamentals and significant growth opportunities. Whether it's a good investment depends on the price you pay and your tolerance for growth stock volatility. But if you're looking for a way to play the continued digitization of business, this dog has some serious bite. 🐕

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.