The Bottom Line Upfront 💡

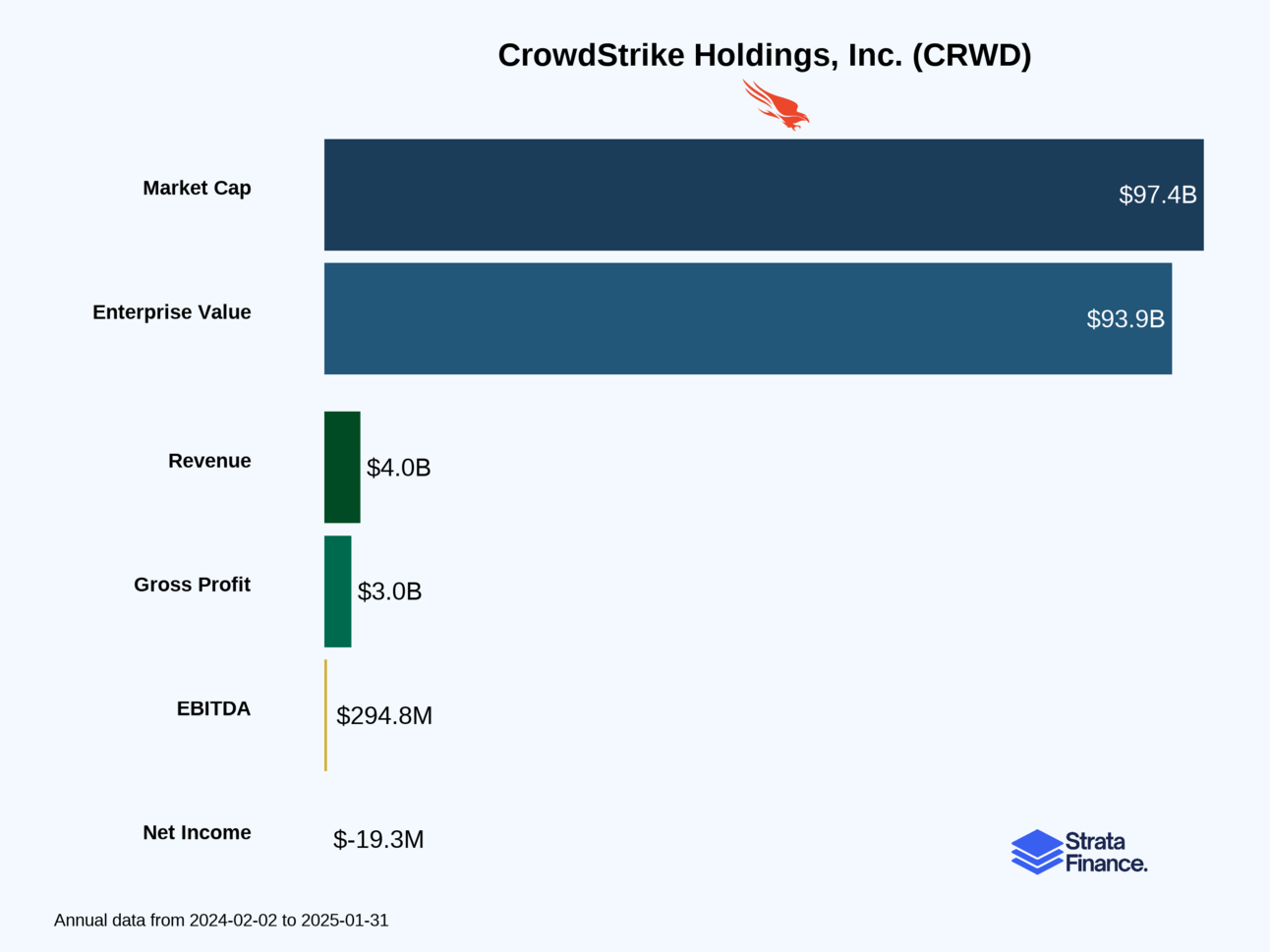

CrowdStrike $CRWD ( ▲ 4.86% ) has built one of the most impressive cybersecurity businesses in the world, protecting 74,000+ organizations with their AI-powered Falcon platform. With $3.95 billion in revenue (29% growth) and a fortress balance sheet of $4.3 billion in cash, they dominate the cloud-native security market through their innovative "single agent" approach that replaces multiple security tools.

However, the July 19, 2024, global outage was a watershed moment that disrupted millions of systems worldwide, triggering lawsuits, regulatory scrutiny, and competitive challenges. While their fundamentals remain strong—95% subscription revenue, 75% gross margins, and 112% net retention—growth has decelerated (ARR growth slowed from 34% to 23%), and profitability turned negative.

The investment thesis hinges on whether CrowdStrike can rebuild customer trust while maintaining their technological edge in an increasingly competitive market. Their platform consolidation strategy and AI-powered intelligence remain compelling, but execution risk is elevated as they navigate the aftermath of their most significant operational failure.

Partnership

Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI

Strata Layers Chart

Layer 1: The Business Model 🏛️

What Does CrowdStrike Actually Do? 🤔

Imagine if your computer had a super-smart bodyguard that never sleeps, never takes breaks, and gets smarter every time it encounters a new threat. That's essentially what CrowdStrike does, but for entire organizations with thousands of computers, servers, and devices.

CrowdStrike is the cybersecurity equivalent of having the world's best security team protecting every device in your company simultaneously. They've built what they call the "Falcon platform" - a cloud-based security system that watches over 74,000+ organizations worldwide, analyzing trillions of security events every week to stop cyber attacks before they happen.

The Magic Behind the Curtain ✨

Here's where it gets clever: Instead of installing bulky, resource-hogging security software on every device (the old way), CrowdStrike deploys one tiny, lightweight "agent" that barely uses any system resources. Think of it like having a highly trained security guard who weighs two pounds instead of 200 pounds but is infinitely more effective.

This lightweight agent continuously monitors what's happening on each device and streams that data to CrowdStrike's "Security Cloud" - a massive AI-powered brain that analyzes patterns across their entire customer base. When the AI spots something suspicious on one customer's network, it instantly shares that intelligence with all other customers. It's like having a neighborhood watch program, but for the entire internet.

How They Make Money 💰

CrowdStrike operates on a subscription model (think Netflix, but for cybersecurity):

Subscription Revenue: 95% of their business ($3.76 billion in fiscal 2025) ↗️

Professional Services: 5% of their business ($192 million) - incident response, forensics, consulting

Their "land-and-expand" strategy is particularly clever. They typically start small with a customer, prove their value, then expand by:

Adding more devices (endpoints) to monitor

Selling additional security modules (they have 29 different ones!)

Expanding to new departments or subsidiaries

Key Success Metrics 📊

CrowdStrike tracks several important metrics that tell us how healthy their business is:

Annual Recurring Revenue (ARR): $4.24 billion ↗️ (23% growth)

This is their most important metric - it shows predictable, recurring income

Dollar-Based Net Retention Rate: 112% ↘️ (down from 119%)

This means existing customers spend 12% more each year on average

The decline is concerning but still above 100% (which is good)

Customer Count: 74,000+ organizations worldwide

Ranges from small businesses to Fortune 500 companies and government agencies

The Platform Approach 🏗️

CrowdStrike offers 29 different security modules through their Falcon platform, covering:

Endpoint Security: Protecting computers, phones, servers

Cloud Security: Securing cloud-based applications and data

Identity Protection: Making sure users are who they say they are

Data Protection: Keeping sensitive information safe

Threat Intelligence: Understanding what the bad guys are up to

The beauty is that customers can start with one module and easily add others without installing new software - it's all delivered through that same lightweight agent.

Layer 2: Category Position 🏆

The Cybersecurity Battlefield ⚔️

CrowdStrike operates in the massive and growing cybersecurity market, but they've carved out a particularly strong position in what's called "endpoint security" - protecting individual devices like computers and servers.

The cybersecurity world is basically divided into the old guard and the new guard:

The Old Guard (CrowdStrike's main competition):

Legacy antivirus companies like Symantec trying to modernize their decades-old software

Traditional security vendors like McAfee bolting cloud features onto on-premise products

Network security companies like Palo Alto Networks expanding into endpoint protection

The New Guard:

Cloud-native security companies like CrowdStrike

Specialized vendors like SentinelOne focus on specific security niches

Market Position Reality Check 📈

CrowdStrike has established itself as a leader in the cloud-native security space, but they're not without competition. Their main advantages come from:

Government Validation: 25 of 50 U.S. states have standardized on CrowdStrike

Enterprise Adoption: Trusted by some of the world's largest companies

Technology Leadership: Consistently rated highly by industry analysts

However, the July 19, 2024 incident (more on this later) created some competitive challenges, as rivals like Microsoft have used the outage to question CrowdStrike's reliability.

Layer 3: Show Me The Money! 📈

Revenue Breakdown 💵

Total Revenue: $3.95 billion (29% growth) ↗️

By Type:

Subscription Revenue: $3.76 billion (95% of total, 31% growth) ↗️

Professional Services: $192 million (5% of total, 4% growth) ↗️

By Geography:

United States: $2.68 billion (68% of revenue)

Europe/Middle East/Africa: $619 million (16% of revenue)

Asia Pacific: $402 million (10% of revenue)

Other: $249 million (6% of revenue)

The Land-and-Expand Magic 🪄

CrowdStrike's business model is beautifully designed around customer expansion:

Dollar-Based Net Retention Rate: 112% ↘️

This means existing customers are spending 12% more year-over-year

The decline from 119% is worth watching - could indicate market saturation or competitive pressure

Annual Recurring Revenue Growth: 23% ↗️

Added $806.7 million in net new ARR during fiscal 2025

Slower than the previous year's 34% growth ↘️

The July 19 Impact 💥

The July 19, 2024 incident had real financial consequences:

$60.1 million in direct expenses (net of insurance)

Ongoing legal and professional service costs

Likely contributed to slower growth rates

Layer 4: What Do We Have to Believe? 📚

The Bull Case 🐂

For CrowdStrike to be a great long-term investment, you need to believe:

The Cybersecurity Market Will Keep Growing: With increasing digitization and sophisticated threats, demand for advanced security should continue expanding. The shift to cloud and remote work creates more attack surfaces to protect.

Platform Consolidation is Inevitable: Organizations are tired of managing dozens of security tools. CrowdStrike's unified platform approach should win as companies seek simplicity and better integration.

AI-Powered Security is the Future: Their cloud-scale AI approach, analyzing trillions of events weekly, should provide sustainable competitive advantages that traditional vendors can't match.

They Can Recover from July 19: The incident was a significant setback, but if they can rebuild customer confidence and demonstrate improved reliability, their fundamental advantages remain intact.

International Expansion Will Accelerate: With 68% of revenue still from the U.S., there's significant room for global growth as cybersecurity becomes a worldwide priority.

The Land-and-Expand Model Will Continue: Even with some slowdown, their ability to grow within existing accounts should drive long-term revenue growth.

The Bear Case 🐻

The investment could struggle if:

Trust Never Fully Recovers: The July 19 incident was a massive global disruption. If customers lose confidence in CrowdStrike's reliability, competitors could gain significant market share.

Growth Rates Continue Declining: ARR growth slowed from 34% to 23%, and net retention dropped from 119% to 112%. If these trends continue, the high valuation becomes harder to justify.

Legal and Regulatory Backlash: The July 19 incident has triggered multiple lawsuits and regulatory scrutiny. Significant penalties or restrictions could impact operations and profitability.

Market Saturation: As they penetrate deeper into their addressable market, finding new customers and expansion opportunities becomes increasingly difficult.

Economic Downturn Impact: In a recession, cybersecurity might be seen as a cost center to cut rather than a necessity to maintain.

My Take: A Resilient Business Facing a Critical Test 🎯

CrowdStrike has built an impressive business with strong fundamentals:

Dominant market position in a growing industry

Excellent gross margins and cash generation

Platform approach that creates customer stickiness

Strong balance sheet to weather challenges

However, the July 19 incident was a wake-up call that even the best technology companies can face existential challenges. The key question is whether this was a one-time operational failure or a sign of deeper issues.

What I'm Watching:

Customer retention and new customer acquisition trends

Recovery in growth metrics (ARR growth, net retention)

Resolution of legal challenges and regulatory scrutiny

Competitive response and market share trends

Bottom Line: CrowdStrike remains a high-quality business in a great market, but investors need to believe the company can rebuild trust and maintain its competitive advantages. The strong balance sheet provides time to execute this recovery, but the execution risk is real.

The cybersecurity market isn't going anywhere, and CrowdStrike's platform approach still makes sense. But like any investment in a growth stock, you're betting on management's ability to navigate challenges and continue innovating. The July 19 incident was a significant test of that thesis.

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.