The Bottom Line Upfront 💡

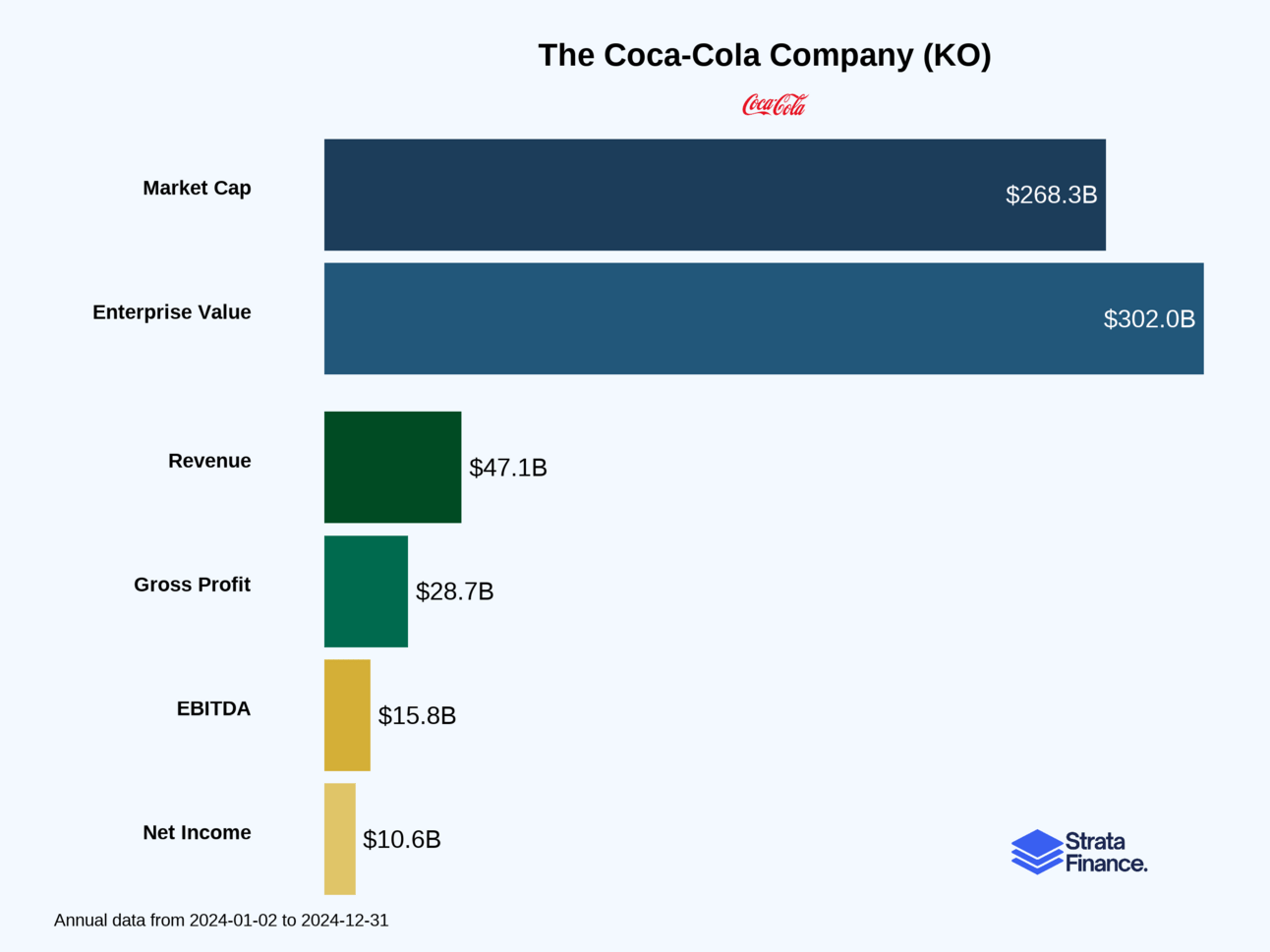

The Coca-Cola Company $KO ( ▲ 0.66% ) is the world's largest beverage company, operating as a sophisticated "beverage landlord" that owns iconic brands and secret formulas while partnering with bottlers for global distribution. With $47.1 billion in 2024 revenue and products reaching 2.2 billion of the world's daily beverage servings, Coca-Cola dominates through unmatched brand recognition and distribution networks spanning 200+ countries.

The company is in the midst of a critical transformation from a traditional soda company to a "total beverage company," aggressively expanding into healthier categories like sports drinks, premium coffee, and plant-based beverages. While facing headwinds from health-conscious consumers and regulatory pressure on sugary drinks, Coca-Cola's financial strength (63 consecutive years of dividend increases), pricing power, and strategic portfolio diversification position it to navigate industry evolution. The key investment question is whether management can successfully transform their portfolio while maintaining profitability—a challenge that will define the company's next decade.

Partnership

Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.

Strata Layers Chart

Layer 1: The Business Model 🏛️

What Does Coca-Cola Actually Do?

Think of Coca-Cola as the world's most sophisticated beverage landlord. They don't just make drinks—they've built an empire where they own the secret recipes (the crown jewels) and rent them out to a global network of bottlers who do the heavy lifting of actually making and distributing the fizzy goodness we all know and love.

Here's how the magic works: Coca-Cola operates two main businesses that work together like a well-oiled machine:

The Concentrate Business (The Money Printer 💰)

This is where Coca-Cola makes its real money. They manufacture beverage concentrates—think of these as the "flavor essence" of your favorite drinks—and sell them to authorized bottling partners worldwide. These bottlers then add water, sweeteners, and carbonation to create the finished beverages. It's brilliant because Coca-Cola keeps control of the most valuable part (the secret formulas and brand) while outsourcing the capital-intensive, lower-margin work of bottling and distribution.

The Finished Product Business (The Heavy Lifter 🏋️)

This is where they directly manufacture and sell completed beverages. While this generates higher revenues, it comes with lower profit margins due to manufacturing, packaging, and distribution costs. Think of it as the difference between being a recipe creator versus running a restaurant—both make money, but one requires a lot more equipment and overhead.

The Brand Portfolio: More Than Just Coke

Coca-Cola has evolved far beyond its fizzy origins into what they call a "total beverage company." Their portfolio spans five main categories:

Water, Sports & Coffee: Dasani, Powerade, BODYARMOR, Costa coffee

Juice & Dairy: Simply, fairlife, innocent smoothies

Emerging Beverages: Energy drinks and other trendy stuff

Key Metrics That Matter

Coca-Cola tracks several metrics that tell the story of their business health:

Unit Case Volume

They sold 33.7 billion unit cases in 2024 ↗️ (up from 33.3 billion in 2023). A unit case equals 192 U.S. fluid ounces—basically 24 eight-ounce servings. This measures actual consumer demand.

Concentrate vs. Finished Product Split

85% of their volume comes from concentrate operations ↗️, which is great news since that's where the higher margins live.

Global Reach

Their products account for 2.2 billion of the estimated 65 billion beverage servings consumed worldwide every day. That's roughly 1 in every 30 beverages consumed globally bearing a Coca-Cola trademark—absolutely mind-blowing market penetration.

The Distribution Superpower

Here's what makes Coca-Cola truly special: they've built the most sophisticated beverage distribution system on the planet. They reach more than 200 countries and territories through a complex network of independent bottling partners, distributors, and direct relationships. It's like having a beverage highway system that can get a Coke to virtually any human on Earth.

Layer 2: Category Position 🏆

The Competitive Battlefield

The beverage industry is absolutely brutal—imagine a food fight, but with billion-dollar companies throwing marketing budgets instead of mashed potatoes. Coca-Cola faces competition from multiple directions:

The Classic Rivalry

PepsiCo remains the primary nemesis in many markets, creating the legendary "Cola Wars" that have driven decades of innovation and some truly memorable advertising campaigns.

The Established Giants

Nestlé (coffee and water), Keurig Dr Pepper (sodas and mixers), Danone (water and dairy), and Suntory (Asian beverages) all compete for shelf space and consumer wallets.

The Disruptors

Smaller companies are increasingly successful with "microbrands" sold directly to consumers through e-commerce, bypassing traditional distribution advantages. Red Bull basically created the energy drink category and still dominates it.

Layer 3: Show Me The Money! 📈

Revenue Breakdown: Where the Cash Flows

Coca-Cola generated $47.1 billion in revenue in 2024 ↗️ (up 3% from $45.8 billion in 2023). Here's how it breaks down:

By Geography:

North America: $18.6 billion (39.6% of total) - The cash cow market

Europe, Middle East & Africa: $7.4 billion (15.8%)

Latin America: $6.5 billion (13.7%)

Bottling Investments: $6.2 billion (13.2%)

Asia Pacific: $5.1 billion (10.8%)

Global Ventures: $3.1 billion (6.7%)

By Business Type:

Concentrate Operations: 59% of revenue (the high-margin stuff)

Finished Product Operations: 41% of revenue (higher revenue, lower margins)

The Margin Story

Gross Margin

61.1% in 2024 ↗️ (up from 59.5% in 2023) - This improvement shows pricing power and operational efficiency.

Operating Margin

21.2% in 2024 ↘️ (down from 24.7% in 2023) - The decline was largely due to one-time charges and higher commodity costs.

Volume and Pricing Dynamics

The company achieved 1% unit case volume growth ↗️ while implementing favorable pricing initiatives across most markets. This is the holy grail of consumer goods—growing both volume and price simultaneously shows real brand strength.

Geographic Volume Performance:

Latin America: +3% ↗️ (led by Brazil and Mexico)

Asia Pacific: +1% ↗️ (despite challenges in China)

North America: Flat (mature market dynamics)

Europe, Middle East & Africa: Flat (economic headwinds)

The Big Financial Moves

Major Charges in 2024:

These might look scary, but they're largely accounting adjustments rather than cash going out the door. The fairlife charge actually reflects the brand's success—they're paying more because it's performing better than expected.

Layer 4: What Do We Have to Believe? 📚

The Bull Case: Why Coca-Cola Could Crush It 🚀

Global Beverage Demand Growth

As emerging markets develop and populations grow, total beverage consumption should increase. Coca-Cola is perfectly positioned to capture this growth with their unmatched distribution network.

Portfolio Transformation Success

The company's aggressive expansion into healthier categories (sports drinks, premium coffee, plant-based beverages) could offset declining soda consumption. If they can successfully transfer their distribution advantages to these new categories, the growth potential is enormous.

Pricing Power Persistence

Their ability to raise prices while maintaining volume in 2024 suggests strong brand loyalty. If this continues, they can offset inflation and drive margin expansion.

Operational Efficiency

The ongoing refranchising strategy (selling bottling operations to focus on higher-margin concentrate business) could significantly improve returns on capital.

Emerging Market Penetration

There are still billions of people who don't regularly consume Coca-Cola products. As these markets develop, the volume growth potential is massive.

The Bear Case: Why This Could Go Flat 📉

The Health Trend Is Real

Younger consumers are increasingly avoiding sugary drinks, and this trend shows no signs of reversing. If Coca-Cola can't successfully pivot to healthier options, their core business could face permanent decline.

Competition Is Intensifying

New brands with direct-to-consumer models and health-focused positioning are gaining market share. Traditional distribution advantages matter less in an e-commerce world.

Regulatory Pressure

Governments worldwide are implementing sugar taxes, marketing restrictions, and other regulations that could significantly impact profitability.

Currency and Economic Headwinds

With 84% of volume coming from international markets, currency fluctuations and economic instability in key markets pose ongoing risks.

Execution Risk on New Categories

The company has made massive bets on categories like sports drinks (BodyArmor) and premium coffee (Costa). If these don't deliver expected returns, it could be very expensive.

The Bottom Line Assessment

Coca-Cola is a company in transition, and that creates both opportunity and risk. They have unmatched global reach, incredible brand strength, and are generating massive cash flows. However, they're also fighting against long-term demographic and health trends that threaten their core business.

The key question for investors is whether management can successfully transform the company's portfolio while maintaining the profitability of their traditional business. Their recent moves suggest they understand the challenge and are making the right investments, but execution will be everything.

The company isn't going anywhere—they'll still be selling beverages in 2050. The question is whether they'll be selling the same old Coke to a shrinking market or successfully riding the wave of global beverage evolution. Based on their financial resources, strategic moves, and management track record, they've got a fighting chance to pull off the transformation.

Just remember: even giants can stumble, and the beverage industry moves faster than it used to. Keep an eye on those volume trends and new category performance—they'll tell you whether the transformation is working or if it's time to switch to water. 💧

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.