The Bottom Line Upfront 💡

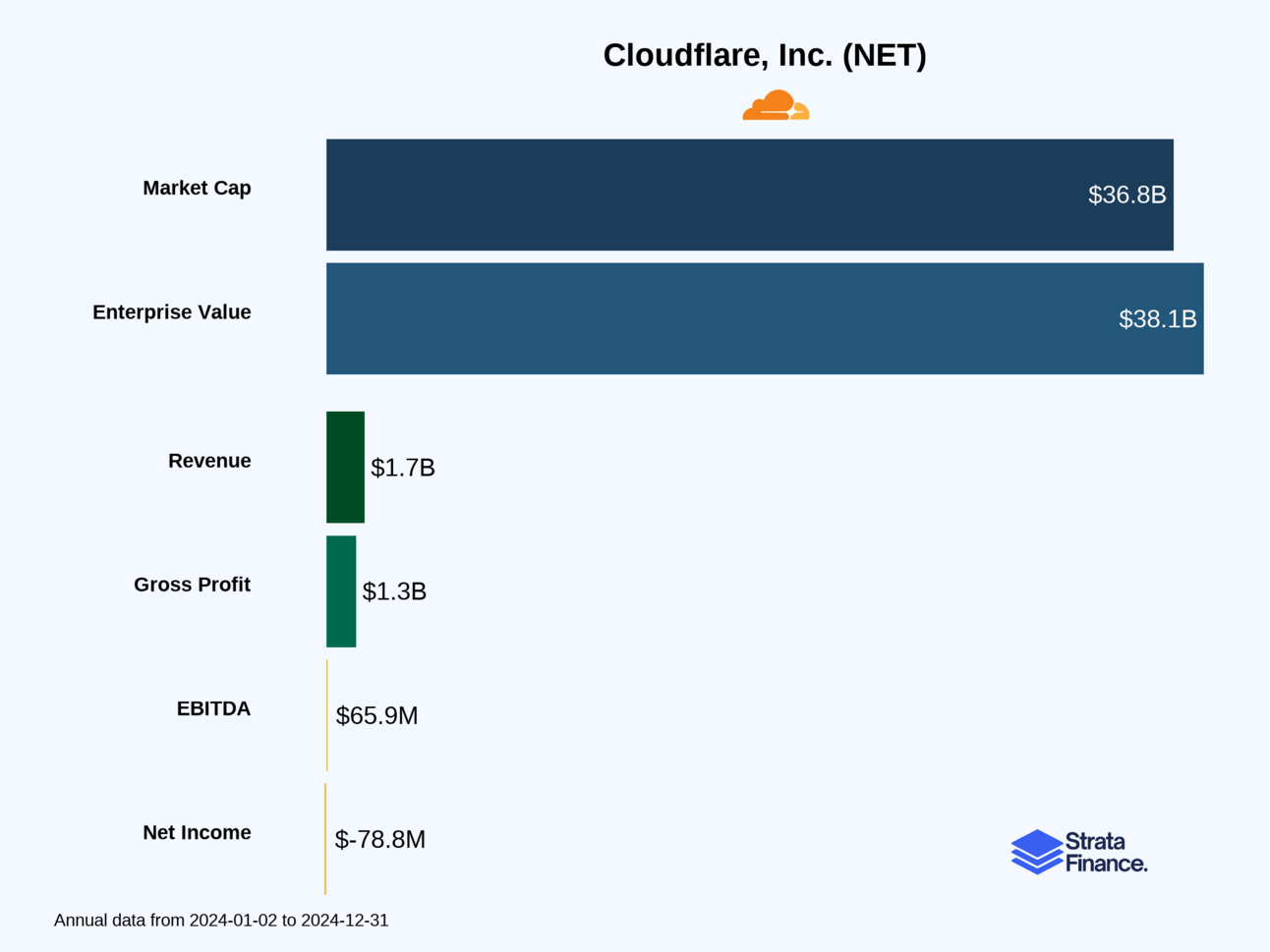

Cloudflare $NET ( ▲ 6.23% ) has built the internet's traffic management system, serving as the invisible layer that makes websites faster, safer, and more reliable. With 238,000 paying customers across 335+ cities globally, they've evolved from a simple content delivery network into a comprehensive "Connectivity Cloud" platform. The company generated $1.67 billion in revenue in 2024 (29% growth) and finally turned free cash flow positive at $167 million. Their bet is simple: as computing moves to the edge and AI demands low-latency processing, their global network becomes indispensable infrastructure. The bull case hinges on developer adoption of their serverless platform and continued enterprise security spending. The bear case worries about cloud giants like AWS and Microsoft leveraging their resources to compete aggressively. With improving unit economics but still GAAP losses, Cloudflare represents a calculated bet on the future of distributed computing.

Partnership

Quick, hard-hitting business news.

Morning Brew was built on a simple idea: business news doesn’t have to be boring.

Today, it’s the fastest-growing newsletter in the country with over 4.2 million readers—thanks to a format that makes staying informed both easy and enjoyable.

Each morning, Morning Brew delivers the day’s biggest stories—from Wall Street to Silicon Valley and beyond—in bite-sized reads packed with facts, not fluff, and just enough wit to keep things interesting.

Try the newsletter for free and see why busy professionals are ditching jargon-heavy, traditional business media for a smarter, faster way to stay in the loop.

Strata Layers Chart

Layer 1: The Business Model 🏛️

What Does Cloudflare Actually Do?

Imagine the internet as a massive highway system, and Cloudflare is like having the world's most sophisticated traffic management system, security checkpoints, and express lanes all rolled into one. When you visit a website, your request doesn't go directly to that company's servers—it first passes through Cloudflare's global network of 335+ cities, where they make everything faster, safer, and more reliable.

Cloudflare's mission sounds almost quaint in today's cynical tech world: "to help build a better Internet." But don't roll your eyes just yet—this isn't corporate fluff. They've built their entire business around solving a fundamental problem: as companies moved from physical hardware boxes to cloud services, the old way of stringing together different security and performance tools became obsolete. You can't exactly ship a hardware firewall to Amazon's cloud and ask them to plug it in for you.

The Three-Tier Money Machine 💰

Cloudflare operates what they call a "freemium" model with three distinct tiers:

Free Tier: Millions of users get basic services for nothing. This isn't charity—it's brilliant strategy. Free users provide massive scale that makes Cloudflare attractive to internet service providers (lowering costs), serve as a testing ground for new features, and act as a marketing funnel for paid services.

Pay-as-You-Go: Small and medium businesses sign up through the website for Pro ($25/month) and Business ($250/month) plans. Think of this as the "credit card and go" tier—no sales calls, no contracts, just instant access to enterprise-grade internet infrastructure.

Enterprise Contracts: The big money maker. Large companies sign 1-3 year contracts typically worth $100,000+ annually. These deals often include both base subscriptions and usage-based components, with some structured as "pool of funds" arrangements where customers commit to spend a certain amount across various Cloudflare services.

The Product Ecosystem 🛠️

Cloudflare has evolved from a simple content delivery network into a comprehensive platform with four main product categories:

Website & Application Services: The bread and butter—security tools like Web Application Firewall and DDoS protection, plus performance boosters like content delivery and load balancing.

SASE Platform: Think of this as "corporate networking in the cloud." It combines Zero Trust security (verifying every user and device) with network services that connect offices, data centers, and remote workers.

Developer Solutions: The growth engine. Cloudflare Workers lets developers run code directly on Cloudflare's network, plus storage, databases, and AI tools. This is where things get really interesting—they're not just protecting websites anymore, they're becoming a platform where applications actually run.

Consumer Products: The 1.1.1.1 DNS resolver and WARP VPN serve as both brand marketing and network intelligence gathering. Plus, they make the business offerings more powerful by adding scale.

Key Metrics That Matter 📊

Paying Customers: 237,714 as of December 2024 ↗️ (up 25% year-over-year). This is the core growth metric—more customers using the network creates a virtuous cycle.

Large Customers ($100K+ annually): 3,497 ↗️ (up from 2,756 in 2023). These are the customers that really move the revenue needle.

Dollar-Based Net Retention: 111% ↘️ (down from 115% in 2023, 122% in 2022). This measures how much existing customers expand their spending. The decline suggests some economic headwinds, but anything over 100% means customers are still growing their usage.

Network Scale: 335+ cities, 125+ countries, 13,000+ network interconnections. Bigger network = better performance = more attractive to customers.

Layer 2: Category Position 🏆

The Competitive Battlefield

Cloudflare positions itself as the leader in the emerging "Connectivity Cloud" category, but they face three distinct types of competitors:

Traditional Hardware Vendors: Companies like Cisco, F5, and Fortinet that built their businesses selling physical boxes. These guys are increasingly disadvantaged as workloads move to the cloud—you simply can't solve modern distributed computing problems with hardware sitting in one location. It's like trying to manage global traffic with a single stoplight.

Point Solution Cloud Vendors: Companies like Fastly (CDN), Zscaler (security), or Akamai (edge computing) that excel in specific areas but force customers to manage multiple vendors. Cloudflare's bet is that customers want one throat to choke rather than juggling five different dashboards.

Public Cloud Giants: AWS, Microsoft Azure, and Google Cloud all offer competing services. But Cloudflare argues they have a key advantage—independence. They don't compete with their customers like cloud providers do, and they help companies avoid vendor lock-in by working across all clouds.

Market Position Strengths 💪

Cloudflare's competitive moat comes from their unique network architecture. While competitors might be faster in specific regions or better at particular use cases, Cloudflare offers the rare combination of global reach, integrated services, and developer-friendly tools. Their "serverless" approach means customers don't need to worry about regions, scaling, or infrastructure management—the network handles it automatically.

The company serves 238,000 paying customers across 190+ countries with no single customer representing more than 10% of revenue.

Recent Competitive Dynamics 🥊

The competitive landscape is intensifying as major cloud providers expand their edge computing offerings. AWS launched CloudFront Functions, Microsoft pushed Azure Front Door, and Google enhanced their Cloud CDN. However, Cloudflare continues to differentiate through developer experience and their expanding AI capabilities.

Their recent acquisition of Kivera for $28 million added cloud security and compliance technology, showing they're still actively building their competitive position. The company's focus on AI workloads—deploying GPUs across their global network—positions them for the next wave of distributed computing.

Layer 3: Show Me The Money! 📈

Revenue Breakdown: The Numbers Game

Total Revenue: $1.67 billion in 2024 ↗️ (29% growth year-over-year). For context, this puts them in the same league as established enterprise software companies, though still dwarfed by cloud giants like AWS ($90+ billion) or Microsoft Azure ($60+ billion).

Geographic Mix:

United States: $849.5M (51% of revenue)

Europe/Middle East/Africa: $466.5M (28%)

Asia Pacific: $223.2M (13%)

Other: $130.4M (8%)

The international diversification is impressive and growing—49% of revenue comes from outside the US, providing both growth opportunities and currency hedging.

Customer Channel Split:

Direct customers: 80% of revenue ($1.33B)

Channel partners: 20% of revenue ($337M) ↗️

The channel partner growth (from 13% in 2022 to 20% in 2024) shows they're successfully scaling through resellers and managed service providers.

Customer Economics: The Unit Economics Story 📊

The customer acquisition and expansion story is where things get interesting:

Customer Growth: Paying customers grew 25% in 2024, but the real money is in the large customer segment. Companies spending $100K+ annually grew from 2,042 in 2022 to 3,497 in 2024—a 71% increase over two years.

Net Retention Challenges: The dollar-based net retention rate declined from 122% in 2022 to 111% in 2024 ↘️. While still healthy (anything over 100% means existing customers are spending more), this decline reflects macroeconomic pressures affecting customer expansion decisions.

Customer Concentration: No single customer represents more than 10% of revenue, which is both good (diversified risk) and challenging (no massive whale customers to drive growth).

Layer 4: What Do We Have to Believe? 📚

The Bull Case: Betting on the Edge 🚀

Belief #1: The Internet is Moving to the Edge. Cloudflare's entire thesis rests on the idea that computing is moving from centralized data centers to distributed edge locations. If you believe 5G, autonomous vehicles, and AI applications will require sub-millisecond response times, Cloudflare's global network becomes incredibly valuable.

Belief #2: Developers Will Choose Simplicity. The developer platform (Cloudflare Workers) could be transformational. Instead of managing complex cloud infrastructure, developers can deploy code globally with a few lines of configuration.

Belief #3: Security Becomes Everyone's Problem. As cyber threats increase and regulations tighten, every company needs enterprise-grade security. Cloudflare's integrated approach becomes more attractive than managing multiple point solutions.

Belief #4: Scale Creates Unbreakable Moats. The more traffic that flows through Cloudflare's network, the better their threat intelligence, the more attractive they become to ISPs (lowering costs), and the harder it becomes for competitors to match their global reach. This network effect could create a winner-take-most dynamic.

The Bear Case: Reality Check Time 🐻

Risk #1: The Cloud Giants Wake Up. AWS, Microsoft, and Google have virtually unlimited resources and existing customer relationships.

Risk #2: The Developer Platform Flops. Cloudflare Workers is cool technology, but developers are notoriously fickle.

Risk #3: Economic Headwinds Persist. The declining net retention rate and lengthening sales cycles suggest customers are tightening belts.

Risk #4: Commoditization of Core Services. CDN and basic security services are becoming commoditized. If Cloudflare can't successfully move up the value chain to more sophisticated services, they could face margin pressure and slower growth.

The Verdict: A Calculated Bet on the Future 🎯

Cloudflare is essentially a bet on how the internet will evolve over the next decade. They've built impressive technology and achieved a strong market position, but they're still in the "invest for growth" phase with significant execution risk ahead.

What Makes This Interesting:

Massive addressable market (every internet-connected business is a potential customer)

Strong competitive moats through network effects and scale

Proven ability to expand within existing customers

Clear path to profitability with improving unit economics

What Keeps Me Up at Night:

Intense competition from well-funded giants

Dependence on continued technology shifts (edge computing, AI)

Execution risk on the developer platform strategy

Macroeconomic sensitivity affecting customer expansion

Bottom Line: Cloudflare has built something genuinely valuable—a global network that makes the internet work better. Whether that translates to investment returns depends on their ability to stay ahead of competition and successfully expand beyond their core networking services into the broader developer platform market. It's not a sure thing, but for investors who believe in the edge computing thesis and Cloudflare's execution ability, the potential upside is substantial.

The company sits at the intersection of several powerful trends: cloud migration, cybersecurity, AI workloads, and developer productivity. If even half of their strategic bets pay off, this could be a very rewarding investment. Just don't bet the farm—this is still a growth story with meaningful execution risk.

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.