The Bottom Line Upfront 💡

Chubb Limited $CB ( ▼ 0.09% ) is a $247 billion global insurance giant operating across 54 countries, serving everyone from Fortune 500 companies to billionaire art collectors. With six distinct business segments generating $51.5 billion in annual premiums, Chubb has built a diversified empire spanning commercial insurance, high-net-worth personal lines, agricultural coverage, and life insurance. Their disciplined underwriting approach (86.6% combined ratio) and massive $150.7 billion investment portfolio ($5.9 billion in annual investment income) create a dual revenue engine that's proven resilient across market cycles. The company's strategic 85.5% stake in China's Huatai Group positions them perfectly for Asian growth, while their global reach and superior claims service maintain competitive advantages in an increasingly crowded market. However, investors must navigate inherent insurance industry volatility including catastrophe losses ($2.4 billion in 2024), interest rate sensitivity, and cyclical market dynamics that make this a quality play for those comfortable with the insurance sector's ups and downs.

Partnership

Get access to the most exclusive offers for private market investors

Looking to invest in real estate, private credit, pre-IPO venture or crypto? AIR Insiders get exclusive offers and perks from leading private market investing tools and platforms, like:

Up to $250 free from Percent

50% off tax and retirement planning from Carry

$50 of free stock from Public

A free subscription to Worth Magazine

$1000 off an annual subscription to DealSheet

and offers from CapitalPad, Groundfloor, Fundrise, Mogul, and more.

Just sign up for our 2-week free trial to experience all the benefits of being an AIR Insider.

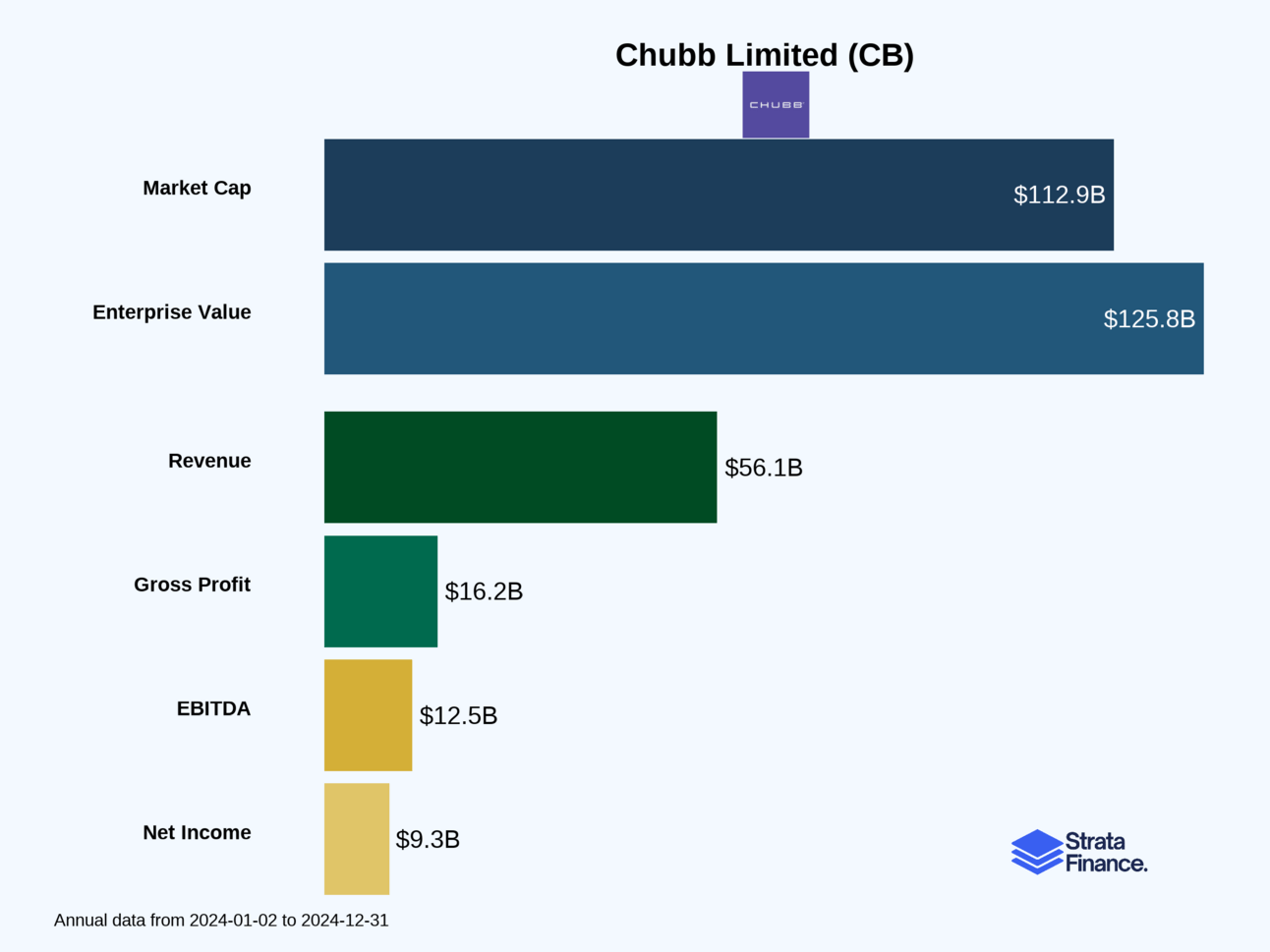

Strata Layers Chart

Layer 1: The Business Model 🏛️

What Does Chubb Actually Do?

Think of Chubb as the world's most sophisticated insurance department store, but instead of selling clothes, they're selling peace of mind to everyone from billionaires worried about their art collections to farmers concerned about hailstorms destroying their crops.

At its core, Chubb operates on the classic insurance model: collect premiums today, invest that money, and pay claims when bad things happen. But here's where it gets interesting – they've built this into a $247 billion empire spanning 54 countries with the kind of global reach that would make Amazon jealous.

The Six-Ring Circus 🎪

Chubb runs six distinct business segments, each with its own personality:

1. North America Commercial P&C (40% of premiums) 💼

This is the bread and butter – insuring businesses from corner delis to Fortune 500 companies. Whether you need basic property coverage or want to insure against the risk of your CEO getting kidnapped (yes, that's a real thing), they've got you covered.

2. North America Personal P&C (12% of premiums) 🏖️

The "rich people problems" division. These folks insure $50 million Hamptons estates, vintage Ferrari collections, and Picasso paintings. When your homeowner's insurance needs exceed what GEICO can handle, you call Chubb.

3. Agricultural Insurance (5% of premiums) 🚜

Through Rain and Hail Insurance, they protect farmers against everything from drought to hailstorms. It's like crop insurance meets sophisticated risk modeling – because apparently, even corn needs insurance these days.

4. Overseas General Insurance (27% of premiums) 🌍

Their international expansion vehicle, now supercharged by their 85.5% stake in China's Huatai Group. This gives them serious presence in the world's second-largest insurance market.

5. Global Reinsurance (3% of premiums) 🔄

Insurance for insurance companies. When other insurers want to reduce their exposure to massive losses, they buy reinsurance from Chubb. It's like being the insurance industry's insurance company.

6. Life Insurance (13% of premiums) ❤️

Primarily focused on Asia and Latin America, offering everything from traditional life insurance to accident coverage. Think of it as their growth engine in emerging markets.

How They Make Money (The Magic Formula) 💰

Chubb's revenue model is beautifully simple but requires serious execution:

Premium Collection: They collected $51.5 billion in net premiums in 2024

Investment Income: That $150.7 billion investment portfolio generated $5.9 billion in income

Underwriting Discipline: Their combined ratio of 86.6% means they're collecting more in premiums than they pay in claims and expenses

Key Success Metrics 📊

The metrics that matter most for Chubb:

Combined Ratio: 86.6% (anything under 100% is profitable underwriting)

Return on Equity: Strong but varies with market conditions

Book Value Growth: $64 billion in shareholders' equity

Premium Growth: 8.7% growth in net premiums written

Investment Yield: 4.5% on average invested assets

Layer 2: Category Position 🏆

The Insurance Heavyweight Division

Chubb operates in the big leagues of global insurance, competing against titans like AIG, Travelers, and Berkshire Hathaway's insurance operations. But here's what makes them special – they're one of the few truly global, diversified insurance companies with the scale to compete everywhere from Manhattan penthouses to Chinese factories.

Competitive Advantages That Actually Matter

Global Reach with Local Expertise

While many insurers talk about being global, Chubb actually delivers. Their 43,000 employees across 54 countries aren't just for show – they provide the local knowledge needed to underwrite complex international risks.

Underwriting Discipline

In an industry where competitors often chase market share by cutting prices, Chubb maintains strict standards. Their current accident year combined ratio of 83.1% (excluding catastrophes) proves this discipline pays off.

Superior Claims Service

This might sound boring, but in insurance, claims service is everything. When your $100 million factory burns down, you want the insurer that answers the phone and cuts checks quickly.

Financial Strength

With A.M. Best and S&P ratings that make other insurers jealous, customers and brokers prefer working with Chubb because they know the company will be around to pay claims decades from now.

Market Position Reality Check

In commercial insurance, Chubb is a top-tier player but not the biggest. They compete through specialization rather than scale, focusing on complex risks that require sophisticated underwriting. In high-net-worth personal lines, they're among the market leaders alongside AIG Private Client Group.

The Huatai Group acquisition was a game-changer for their Asian presence, instantly making them a major player in China's massive insurance market. This wasn't just buying market share – it was buying local expertise and distribution that would take decades to build organically.

Layer 3: Show Me The Money! 📈

Revenue Breakdown: The Global Money Machine

Geographic Mix 🌎

North America: 64% (still the cash cow)

Asia: 19% (the growth engine, boosted by Huatai)

Europe: 11% (steady and profitable)

Latin America: 6% (emerging opportunities)

Segment Performance 💼

North America Commercial: $20.0 billion (40% of total premiums)

Overseas General: $13.4 billion (27% of total premiums)

Life Insurance: $6.3 billion (13% of total premiums)

North America Personal: $6.2 billion (12% of total premiums)

The Investment Income Goldmine 💎

Here's what many people miss about insurance companies – they're essentially massive investment funds that happen to sell insurance. Chubb's $150.7 billion investment portfolio generated $5.9 billion in net investment income in 2024, representing a 4.5% yield.

This investment income is crucial because it provides a steady revenue stream that doesn't depend on underwriting performance. Even in years with heavy catastrophe losses, that investment income keeps flowing.

Cost Structure: Where the Money Goes 💸

Claims and Benefits: $30.7 billion (the biggest expense, obviously)

Policy Acquisition Costs: $9.1 billion (commissions to agents and brokers)

Administrative Expenses: $4.4 billion (keeping the lights on globally)

Interest Expense: $741 million (cost of debt financing)

Layer 4: What Do We Have to Believe? 📚

The Bull Case: Why Chubb Could Crush It 🚀

Belief #1: Global Insurance Demand Will Keep Growing

As emerging markets develop and wealth increases globally, demand for sophisticated insurance products should expand. Chubb's global platform positions them perfectly to capture this growth.

Belief #2: Underwriting Discipline Creates Long-Term Value

While competitors chase market share with aggressive pricing, Chubb's disciplined approach should generate superior returns over full market cycles. Their 86.6% combined ratio suggests this strategy is working.

Belief #3: The Huatai Investment Will Pay Off Big

China's insurance market is massive and growing. If Chubb can successfully integrate Huatai and capture market share growth, this could be transformational for long-term returns.

Belief #4: Climate Change = More Insurance Demand

Counterintuitively, increasing natural disasters could benefit Chubb by driving demand for sophisticated risk management and higher insurance penetration rates.

Belief #5: Technology Will Improve Efficiency

Digital transformation initiatives should reduce costs and improve customer experience, expanding margins over time.

The Bear Case: What Could Go Wrong 😰

Risk #1: Catastrophe Losses Could Spiral

Climate change might increase catastrophe frequency and severity faster than Chubb can adjust pricing. The $1.5 billion California wildfire loss shows how quickly things can turn ugly.

Risk #2: Interest Rates Could Hurt Investment Income

With $150.7 billion invested primarily in fixed-income securities, falling interest rates would pressure investment income, a crucial profit driver.

Risk #3: Competition Could Intensify

New entrants, including tech companies and alternative capital sources, could disrupt traditional insurance models and pressure margins.

Risk #4: Regulatory Headaches

Operating in 54 countries means dealing with 54 different regulatory environments. Changes in regulations could impact profitability or growth opportunities.

Risk #5: The Huatai Bet Could Backfire

If China's economy slows significantly or regulatory changes limit foreign insurance companies, the massive Huatai investment might not deliver expected returns.

The Bottom Line Assessment 🎯

Chubb is a high-quality insurance company with global reach, underwriting discipline, and strong financial metrics. Their diversified business model provides stability, while their Asian expansion offers growth potential.

However, this isn't a "set it and forget it" investment. Insurance is a cyclical business subject to catastrophe losses, interest rate sensitivity, and competitive pressures. The company's premium valuation (it typically trades at a premium to book value) reflects its quality but also means expectations are high.

For investors who understand insurance fundamentals and believe in long-term global growth, Chubb offers exposure to a well-managed, diversified insurance platform. Just don't expect it to be boring – between hurricanes, wildfires, and global economic volatility, there's always something happening in the insurance world.

The key question isn't whether Chubb is a good insurance company (it clearly is), but whether you're comfortable with the inherent volatility and cyclicality that comes with owning any insurance stock, even a high-quality one like this.

Enjoy Strata? Check out my friends

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.