The Bottom Line Upfront 💡

Chipotle Mexican Grill $CMG ( ▲ 2.22% ) has built an exceptional fast-casual empire with premium pricing power and digital dominance, but the stock is significantly overvalued at current levels. This is a "great company, wait for a better price" situation where even our optimistic fair value sits 37% below today's trading price.

Sponsorship

Stop Planning. Start Building.

End of the year? Or time to start something new.

With beehiiv, this quiet stretch of time can become your biggest advantage. Their platform gives you all the tools you need to make real progress, real fast.

In just days (or even minutes) you can:

Build a fully-functioning website with the AI website builder

Launch a professional-looking newsletter

Earn money on autopilot with the beehiiv ad network

Host all of your content on one easy-to-use platform

If you’re looking to have a breakthrough year, beehiiv is the place to start. And to help motivate you even more, we’re giving you 30% off for three months with code BIG30.

Strata Layers Chart

Layer 1: The Business Model 🏛️

Think of Chipotle as the Tesla of burritos – they took something ordinary (Mexican food) and made it premium, sustainable, and tech-forward. Founded in 1993 in Denver, Chipotle operates on a beautifully simple concept: serve high-quality, customizable Mexican food fast, without the guilt.

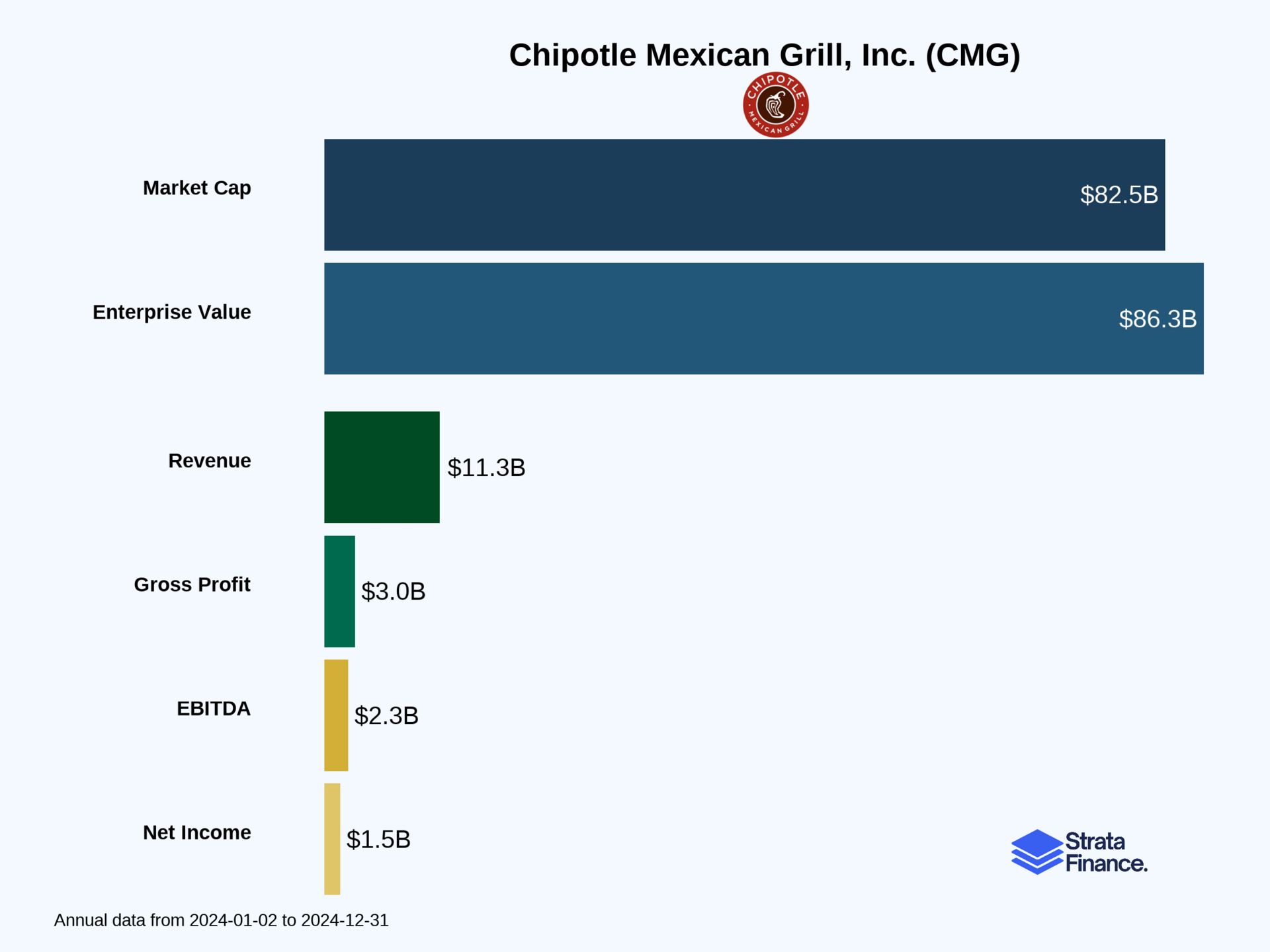

How They Make Money: It's refreshingly straightforward – they sell burritos, bowls, tacos, quesadillas, and salads directly to customers. No franchising headaches, no complex revenue streams. Just good food at premium prices. With 3,644 U.S. locations and 82 international spots, they generated $11.3 billion in revenue in 2024.

The "Food with Integrity" Differentiator: This isn't just marketing fluff. Chipotle built their entire brand around "Responsibly Raised®" meats (no antibiotics or growth hormones), organic produce when possible, and ingredients without artificial colors, flavors, or preservatives. They even publish sustainability reports and have a Food Safety Advisory Council. It's like Whole Foods met Taco Bell and had a very successful baby.

Key Success Metrics They Watch:

Comparable restaurant sales growth: 7.4% ↗️ in 2024 (this measures how existing stores are performing)

Digital sales mix: 35.1% of total sales (down slightly from 37.4% in 2023 ↘️ as dining normalized post-COVID)

Average restaurant sales: $3.2 million per location annually

Transaction growth: 5.3% ↗️ (more customers coming through the door)

Average check: 2.1% ↗️ (customers spending more per visit)

The Chipotlane Innovation: Here's where it gets clever – they've created drive-through lanes specifically for digital orders called "Chipotlanes." It's like having a VIP lane for their app users. 257 of their 304 new restaurants in 2024 included these, and they plan for 80%+ of new locations to have them.

Key Takeaway: Chipotle has mastered the art of charging premium prices for fast food by positioning themselves as the ethical, high-quality option in a sea of processed competitors.

Layer 2: Category Position 🏆

Chipotle sits comfortably at the top of the fast-casual Mexican food pyramid, but they're not just competing with other burrito joints – they're battling everyone from McDonald's to local taco shops for your lunch dollar.

The Competitive Landscape: Direct competitors include Qdoba, Moe's Southwest Grill, and newer entrants like Sweetgreen (different cuisine, same fast-casual model). But Chipotle's real competition is broader – they're fighting Chick-fil-A, Panera, and even meal delivery services for the "quick but quality" dining occasion.

Market Position Strengths:

Brand Power: Chipotle has achieved something rare – they're both a meme and a premium brand. Gen Z loves them, millennials grew up with them, and even boomers respect the quality

Digital Leadership: While competitors scrambled to build apps during COVID, Chipotle was already there with a sophisticated loyalty program (Chipotle Rewards) and seamless ordering

Scale Advantages: With 3,600+ U.S. locations, they have massive purchasing power and can invest in technology that smaller competitors can't match

Recent Competitive Wins:

Successfully raised prices 2.9% in 2024 while still growing traffic ↗️ (pricing power = strong brand)

Digital sales remain robust at 35% of total revenue

Opening 300+ new locations annually while maintaining quality

The Challenges: Labor costs are rising faster than a soufflé in a hot oven, especially in California where minimum wage increases hit hard. Competition for prime real estate is fierce, and newer concepts keep popping up with fresh takes on fast-casual dining.

Key Takeaway: Chipotle has built an economic moat through brand strength and operational scale that keeps competitors at bay, but they can't rest on their guac-covered laurels.

Layer 3: Show Me The Money! 📈

Let's dig into the financial burrito and see what's inside each layer.

Revenue Breakdown:

Food & Beverage: $11.2B (99.4% of total revenue)

Delivery Service Fees: $66.5M (0.6% of total)

Geographic Split: Overwhelmingly U.S.-focused with minimal international exposure

The Growth Story: Revenue jumped 14.6% ↗️ in 2024, driven by:

New Restaurant Growth: 304 new locations (8.9% unit growth)

Same-Store Sales: 7.4% ↗️ growth from existing locations

Pricing Power: 2.9% menu price increases that customers actually accepted

Customer Behavior Insights:

Digital customers tend to spend more and visit more frequently

The loyalty program creates sticky customers who order ahead

Lunch remains the dominant daypart, but dinner is growing

Catering and group orders provide higher-margin opportunities

Cost Structure Reality Check:

Food, Beverage & Packaging: 29.8% of revenue (↗️ from 29.5% due to generous portions and ingredient inflation)

Labor: 24.7% of revenue (flat despite wage pressures thanks to sales leverage)

Occupancy: 5.0% of revenue (↘️ slightly due to sales growth)

Other Operating Costs: 13.9% of revenue (↘️ from 14.5% due to efficiency gains)

Margin Trends: Operating margin expanded to 16.9%, showing they can grow profitably even with cost pressures. The secret sauce? Scale economies and pricing power.

Cash Generation Machine: $2.1 billion in operating cash flow ↗️ funds expansion, share buybacks ($1.0B in 2024), and keeps the balance sheet fortress-strong with $2.2B in cash and investments.

Key Takeaway: Chipotle has cracked the code on profitable growth – they're expanding rapidly while maintaining healthy margins and generating massive cash flows.

Layer 4: Long-Term Valuation (DCF Model) 💰

The Verdict: Significantly Overvalued 🚨

Scenario | Fair Value | vs Current Price (~$40.34 as of 1.13.2026) |

|---|---|---|

Conservative | $13.95 | -65.4% |

Optimistic | $25.49 | -36.8% |

Key Valuation Assumptions:

Growth Trajectory: Even assuming 12.9% initial revenue growth declining to 7.7% over 5 years, the math doesn't work at current prices

Margin Expansion: Optimistic scenario assumes operating margins reach 18.8% (vs current 16.9%), which may be challenging given labor cost pressures

Terminal Value: Using 2.5-3.5% long-term growth rates typical for mature restaurant chains

The Reality Check: The market is pricing in perfection. Current valuation implies Chipotle will execute flawlessly on international expansion, maintain premium pricing power indefinitely, and achieve margin expansion that may be difficult given industry dynamics.

Investment Recommendation: WAIT FOR A BETTER ENTRY POINT - Great company, wrong price.

Layer 5: What Do We Have to Believe? 📚

Bull Case 🚀

International Goldmine: The 3 licensed restaurants in the Middle East are just the beginning of a massive global expansion that could double or triple the addressable market

Digital Dominance: The loyalty program and app ecosystem create a data-driven competitive advantage that drives higher margins and customer lifetime value

Premium Brand Durability: Chipotle's "Food with Integrity" positioning allows them to maintain pricing power even during economic downturns as health-conscious consumers prioritize quality

Bear Case 🐻

Labor Cost Tsunami: Rising minimum wages (especially in key markets like California) could crush margins faster than you can say "extra guac"

Growth Saturation: With 3,600+ U.S. locations, prime real estate is getting scarce and new units may cannibalize existing stores

Economic Sensitivity: At $12+ per meal, Chipotle becomes a luxury during recessions when consumers trade down to cheaper alternatives

The Bottom Line: Chipotle is undeniably a high-quality business with strong fundamentals, loyal customers, and smart management. However, the current stock price assumes everything goes perfectly for years to come. Even minor execution hiccups could lead to significant downside. This is a "great company, wait for a better price" situation.

What to Watch 👀

Critical Metrics to Monitor:

Same-store sales growth: If this drops below 3-4%, it signals market saturation or competitive pressure

Digital sales mix: Watch for continued decline below 30% as it indicates weakening customer engagement

Labor costs as % of revenue: Any increase above 25% suggests margin pressure is winning

Upcoming Catalysts:

International expansion results: Success in the Middle East could unlock massive growth potential

New restaurant format tests: Watch for innovations beyond traditional Chipotle locations

Menu innovation: Limited-time offerings and new proteins could drive traffic and check growth

Competitive Threats to Track:

New fast-casual concepts gaining traction in key markets

Labor union organizing efforts that could increase costs

Food safety incidents at Chipotle or competitors that could shift consumer sentiment

Economic Indicators:

Consumer spending on dining out: Chipotle is discretionary spending that gets cut during tough times

Commodity price inflation: Avocado and protein costs directly impact margins

The key is patience – Chipotle will likely remain a great business, but great businesses can be terrible investments at the wrong price. Wait for Mr. Market to serve up a more reasonable valuation! 🌯📉

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.