The Bottom Line Upfront 💡

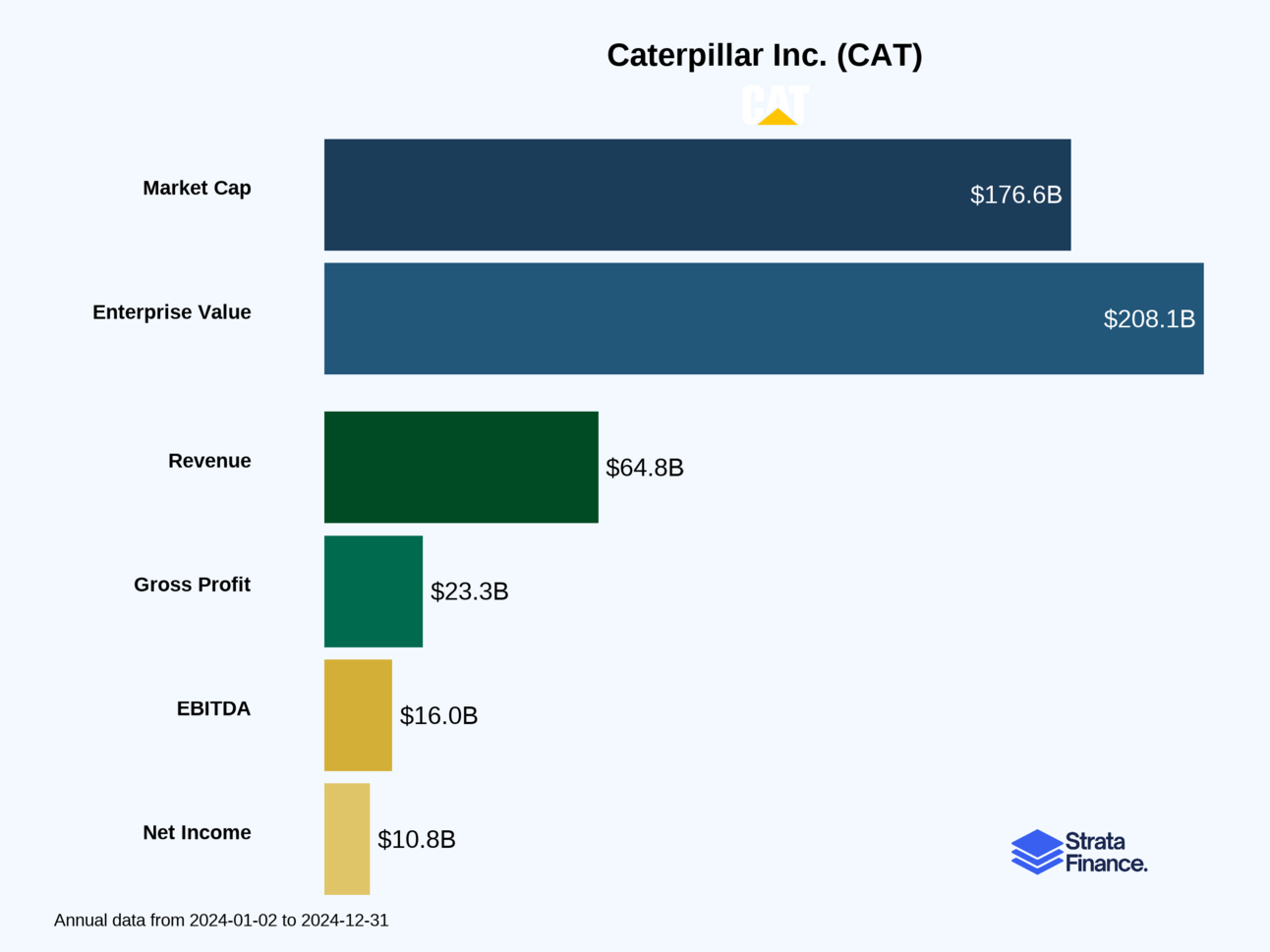

Caterpillar Inc. $CAT ( ▲ 7.06% ) is the world's leading manufacturer of construction and mining equipment, with nearly 100 years of market dominance built on massive yellow machines and an unmatched global dealer network. Despite facing revenue headwinds in 2024 ($64.8B, down 3%), the company maintains strong profitability (20.2% operating margin) and is well-positioned to capitalize on long-term infrastructure and energy transition trends. However, investors must navigate cyclical industry dynamics, intensifying Chinese competition, and technology disruption risks. This is a quality business trading at fair valuations, suitable for patient investors who believe in global infrastructure development and can stomach cyclical volatility.

Partnership

1440: Your Weekly Business Cheat Sheet

Expand your business and finance knowledge with 1440. Get clear, conversational breakdowns of the key concepts in business and finance—no paywalls, no spin. Every Thursday, 1440 delivers deep dives, interactive charts, and rapid market rundowns trusted by 100k+ professionals.

Strata Layers Chart

Layer 1: The Business Model 🏛️

Think of Caterpillar as the company that makes the machines that build everything else. If you've ever seen a construction site, mining operation, or power plant, chances are there's a big yellow machine with "CAT" on the side doing the heavy lifting. Founded in 1925 (yes, they're 100 years old!), Caterpillar has evolved from a simple tractor company into the world's leading manufacturer of construction and mining equipment, engines, and industrial gas turbines.

What They Actually Do 🔧

Caterpillar operates like a well-oiled machine (pun intended) across four main business segments:

Construction Industries ($25.5B in 2024 ↘️) - This is the bread and butter. They make everything from compact excavators that can fit in your backyard to massive wheel loaders that could probably move your entire house. Think of all those yellow machines you see at construction sites - bulldozers, excavators, motor graders, asphalt pavers. If it's yellow and moves dirt, CAT probably makes it. They've even got different product lines for different markets - fancy high-tech machines for developed countries and more basic (but reliable) SEM brand equipment for price-sensitive developing markets.

Resource Industries ($12.4B in 2024 ↘️) - This is where things get really big. We're talking about mining trucks that can haul 400 tons (that's like 200 cars!), electric rope shovels that can move a house-sized scoop of earth, and draglines so massive they have to be assembled on-site. These machines are so expensive and long-lasting that customers often keep them for decades, creating a beautiful recurring revenue stream from parts and service.

Energy & Transportation ($28.9B in 2024 ↗️) - The most diverse segment, covering everything from ship engines to locomotive power to the generators keeping data centers humming. This division has been on fire lately thanks to the AI boom - all those ChatGPT queries need power, and CAT makes the generators that provide it. They're also big in oil & gas, industrial applications, and marine engines.

Financial Products ($4.1B in 2024 ↗️) - Here's where CAT gets clever. Through Cat Financial, they don't just sell you a $500,000 excavator - they'll finance it for you too. This removes a major barrier to purchase and creates steady interest income. It's like being both the car dealer AND the bank.

The Secret Sauce: The Dealer Network 🌐

Here's what makes CAT special: their global network of 152 independent dealers serving 187 countries. These aren't just sales outlets - they're local partners who sell, service, and support CAT equipment for decades. When you buy a CAT machine, you're not just buying equipment, you're buying into a relationship. Need parts at 2 AM because your excavator broke down? Your local CAT dealer has your back. This creates incredible customer stickiness - switching equipment brands often means switching dealer relationships, which customers hate doing.

Key Metrics to Watch 📊

Order Backlog: Currently sitting at $30.0B ↗️ (up from $27.5B), giving visibility into future revenue

Dealer Inventory Changes: Machine dealer inventory dropped $700M in 2024, indicating softer demand

Services Revenue Growth: Expected to grow across all segments in 2025 - this is the high-margin recurring stuff

Operating Margin: 20.2% in 2024, showing strong profitability despite revenue decline

Layer 2: Category Position 🏆

Caterpillar is basically the 800-pound gorilla in most of its markets, but that doesn't mean life is easy. The competitive landscape varies dramatically by geography and product category, creating a complex chess game of market positioning.

The Competition Lineup 🥊

Global Heavyweights: Komatsu (Japan's answer to CAT), Deere & Company (the green machines), Volvo Construction Equipment, and Hitachi Construction Machinery. These guys compete head-to-head with CAT in most major markets.

Regional Challengers: Here's where it gets interesting. Chinese manufacturers like Sany Heavy Industry, XCMG, and LiuGong are becoming serious players, especially in their home market and other developing countries. They're not just cheap knockoffs anymore - they're getting sophisticated and aggressive about global expansion.

Specialized Players: In specific niches, CAT faces focused competitors like Liebherr in mining, Epiroc in underground mining, and Siemens Energy in power generation.

Market Position Reality Check 📈

CAT maintains leadership positions in most categories, but the competitive dynamics are shifting. In North America and Europe, CAT's dealer network and brand strength keep them on top. But in China (the world's largest construction equipment market), local players dominate. This geographic split is crucial - CAT can't just rely on home field advantage anymore.

The company's competitive moats are real but under pressure:

Dealer Network: Still the strongest advantage, but requires constant investment

Scale & R&D: $2.1B in R&D spending in 2024 helps maintain technological leadership

Financial Services: Cat Financial makes it easier to buy CAT equipment vs. competitors

Brand Trust: When you're moving millions of tons of material, reliability matters

Layer 3: Show Me The Money! 📈

Let's dive into the financial engine that powers this yellow machine empire. CAT's revenue story for 2024 is one of resilience in challenging times, with some segments thriving while others face headwinds.

Revenue Breakdown: The Big Picture 💰

Total Revenue: $64.8B in 2024 ↘️ (down 3% from $67.1B in 2023)

The revenue decline tells an interesting story. Lower sales volume was the main culprit, but CAT managed to partially offset this with favorable pricing - basically, they sold fewer machines but charged more for them. Smart move in a tough market.

Segment Performance: Winners and Losers 🎯

Energy & Transportation: The Star Performer 📈

$28.9B (45% of total revenue) ↗️

Growth driven by power generation demand, especially data centers

Oil & gas holding steady, industrial applications struggling

This segment is riding the AI wave - every ChatGPT query needs power!

Construction Industries: Feeling the Pressure 📉

$25.5B (39% of total revenue) ↘️

Down 7% due to softer construction demand and reduced dealer inventory building

North America and EAME (Europe/Africa/Middle East) particularly weak

Still the largest segment, but facing cyclical headwinds

Resource Industries: Mining the Challenges ⛏️

$12.4B (19% of total revenue) ↘️

Down 9% as mining companies show capital discipline

High commodity prices support demand, but customers are cautious about new investments

Long equipment lifecycles mean lumpy demand patterns

Financial Products: The Steady Eddie 🏦

$4.1B (6% of total revenue) ↗️

Up 7% thanks to higher interest rates and growing loan portfolio

This is the gift that keeps giving - steady, recurring revenue

Geographic Revenue: Where the Money Comes From 🌍

North America: $34.4B (53% of total) ↘️ - Still the biggest market but showing weakness EAME: $12.3B (19% of total) ↘️ - European construction slowdown hurting results

Asia/Pacific: $11.4B (18% of total) ↘️ - China weakness offsetting strength elsewhere Latin America: $6.7B (10% of total) ↗️ - The bright spot with modest growth

Customer Behavior: What's Driving Demand 👥

The order backlog of $30.0B ↗️ provides good visibility, but there's a catch - about $8.0B won't be filled until after 2025. This suggests customers are placing orders but asking for later delivery, possibly due to financing constraints or project delays.

Dealer inventory changes tell another story. Machine dealer inventory dropped $700M in 2024, compared to a $700M increase in 2023. This suggests dealers are being cautious about stocking up, which could indicate softer end-user demand or uncertainty about the economic outlook.

Layer 4: What Do We Have to Believe? 📚

Alright, let's cut to the chase. If you're thinking about investing in CAT, here's what you need to believe - and what could go wrong.

The Bull Case: Why CAT Could Crush It 🚀

Believe This: The world needs massive infrastructure investment, and CAT is perfectly positioned to benefit.

The bull case rests on several key pillars:

Infrastructure Supercycle: Developing countries need roads, bridges, airports, and cities. The U.S. Infrastructure Investment and Jobs Act alone represents hundreds of billions in spending. When governments spend on infrastructure, CAT wins.

Energy Transition Goldmine: Yes, the shift away from fossil fuels challenges some CAT markets, but it also creates massive opportunities. Wind farms need construction equipment. Solar installations require earthmoving. Grid modernization needs power generation equipment. The energy transition isn't just about what we're moving away from - it's about what we're building toward.

Data Center Boom: Every AI query, every Netflix stream, every Zoom call needs power. Data centers are proliferating globally, and they need reliable backup power. CAT's generator business is riding this wave hard.

Services Goldmine: With millions of CAT machines worldwide, the installed base creates a recurring revenue stream that's less cyclical than new equipment sales. Think of it like the razor blade model - sell the razor (machine) once, sell blades (parts and service) forever.

Technology Leadership: CAT's massive R&D spending ($2.1B annually) is developing autonomous machines, electric equipment, and digital solutions that could revolutionize construction and mining. First-mover advantage in these areas could be huge.

Financial Flexibility: With $6.9B in cash and strong credit facilities, CAT can weather downturns and invest in growth opportunities while competitors struggle.

The Bear Case: What Could Go Wrong 🐻

Fear This: Chinese competition, economic cycles, and technological disruption could derail the CAT story.

The bear case has some serious teeth:

Cyclical Reality: Construction and mining are notoriously cyclical industries. When economies slow, infrastructure spending gets cut, mining companies defer equipment purchases, and CAT's revenues can fall off a cliff. The 2008-2009 financial crisis saw CAT's revenues drop by over 30%.

Technology Disruption Risk: What if CAT bets wrong on electrification? What if autonomous technology develops differently than expected? What if new entrants (think Tesla for construction equipment) disrupt the industry? Technology transitions create both opportunities and existential risks.

Margin Pressure: As competition intensifies, especially from lower-cost manufacturers, CAT may face pressure to cut prices. Their premium pricing strategy works when customers value quality and service, but price competition could compress margins.

Geographic Concentration Risk: CAT is heavily dependent on North American markets (53% of revenue). Economic weakness in the U.S. or trade tensions could disproportionately impact results.

Regulatory Headwinds: Emissions standards are getting tighter globally. Environmental regulations could force expensive technology investments or limit market access for traditional diesel equipment.

The Verdict: A Quality Business in a Tough Spot 🎯

Here's my take: CAT is a high-quality business with real competitive advantages, but it's facing some serious headwinds. The company has survived and thrived for nearly 100 years by adapting to changing markets and technologies. Their dealer network, financial strength, and technology investments position them well for the long term.

However, this isn't a growth story - it's a cyclical value play with some growth options. You're betting that:

Global infrastructure needs will drive long-term demand

CAT can successfully navigate the technology transition

The company's competitive advantages will withstand increasing competition

Management can maintain margins while investing in the future

The stock isn't cheap, and the near-term outlook is challenging. But if you believe in the long-term infrastructure and energy transition themes, and you can stomach the cyclical volatility, CAT could be a solid addition to a diversified portfolio.

Just remember: this is a company that makes big, expensive machines for cyclical industries. When times are good, they're really good. When times are bad... well, let's just say you'll want to have a strong stomach and a long-term perspective.

Bottom Line: CAT is like that reliable friend who's been through everything with you. They're not the most exciting company in the world, but when you need something heavy moved or a hole dug, they're the ones you call. The question is whether that's enough in a rapidly changing world. 🤔

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.