The Bottom Line Upfront 💡

Boeing $BA ( ▲ 2.57% ) is one of only two companies on Earth capable of building large commercial aircraft, giving it immense strategic value in a global duopoly with Airbus. However, the aerospace giant is currently in crisis mode, burning through $12.1 billion in operating cash flow in 2024 while grappling with safety concerns, production issues, and massive cost overruns on defense programs. The company's recovery hinges on fixing quality problems, restoring regulatory confidence, and returning to profitability before competitors gain permanent market share advantages. It's a high-stakes turnaround story where success could deliver massive returns, but failure could mean prolonged financial distress for one of America's most important industrial companies.

Partnership

Ready to go beyond ChatGPT?

This free 5-day email course takes you all the way from basic AI prompts to building your own personal software. Whether you're already using ChatGPT or just starting with AI, this course is your gateway to learn advanced AI skills for peak performance.

Each day delivers practical, immediately applicable techniques straight to your inbox:

Day 1: Discover next-level AI capabilities for smarter, faster work

Day 2: Write prompts that deliver exactly what you need

Day 3: Build apps and tools with powerful Artifacts

Day 4: Create your own personalized AI assistant

Day 5: Develop working software without writing code

No technical skills required, no fluff. Just pure knowledge you can use right away. For free.

Strata Layers Chart

Layer 1: The Business Model 🏛️

Think of Boeing as the world's most expensive LEGO company – except instead of plastic bricks, they're assembling multi-million-dollar flying machines that need to work perfectly every single time. Founded in 1916 (yes, they're older than sliced bread), Boeing has evolved from a small Seattle startup into one of only two companies on Earth capable of building large commercial aircraft.

The Three-Ring Circus 🎪

Boeing operates like a three-ring circus, with each ring serving completely different audiences:

Ring 1: Commercial Airplanes (BCA) - The Crowd Pleaser ✈️ This is the Boeing most people know – the folks who build the planes you fly on vacation. They manufacture the 737 (think Southwest Airlines), the wide-body 777 and 787 Dreamliner (your international flights), and until recently, the massive 747 jumbo jet. In 2024, this segment generated $22.9 billion ↘️ (down from $33.9 billion in 2023), which tells you everything about Boeing's recent troubles.

The business model here is fascinating: Boeing doesn't just sell you a plane and walk away. They use "program accounting," which is essentially financial time travel. Instead of booking profit when each plane rolls off the assembly line, they estimate the total profit for an entire aircraft program (which might span 20+ years and thousands of planes) and spread that profit across all deliveries. It's like Netflix deciding how much money they'll make from a TV series before filming the first episode.

Ring 2: Defense, Space & Security (BDS) - The Government's Best Friend 🚁 This $23.9 billion segment builds the toys that keep nations safe and astronauts in space. Think fighter jets (F/A-18 Super Hornet), helicopters (those iconic Chinooks you see in war movies), tanker aircraft, satellites, and even spacecraft. The government is their sugar daddy here, with contracts that can last decades.

Defense contracts come in two flavors: cost-plus (where the government pays all costs plus a fee – basically a guaranteed profit margin) and fixed-price (where Boeing quotes a price and eats any cost overruns). Guess which one has been causing Boeing massive headaches lately? 🤦♂️

Ring 3: Global Services (BGS) - The Money Printer 🔧 This $20.0 billion ↗️ segment is the gift that keeps on giving. Once Boeing sells you a plane, they want to service it for the next 20-30 years. Think spare parts, maintenance, pilot training, and increasingly sophisticated data analytics. This is Boeing's highest-margin business because airlines need these services whether they like Boeing or not – you can't exactly take your 787 to the local mechanic.

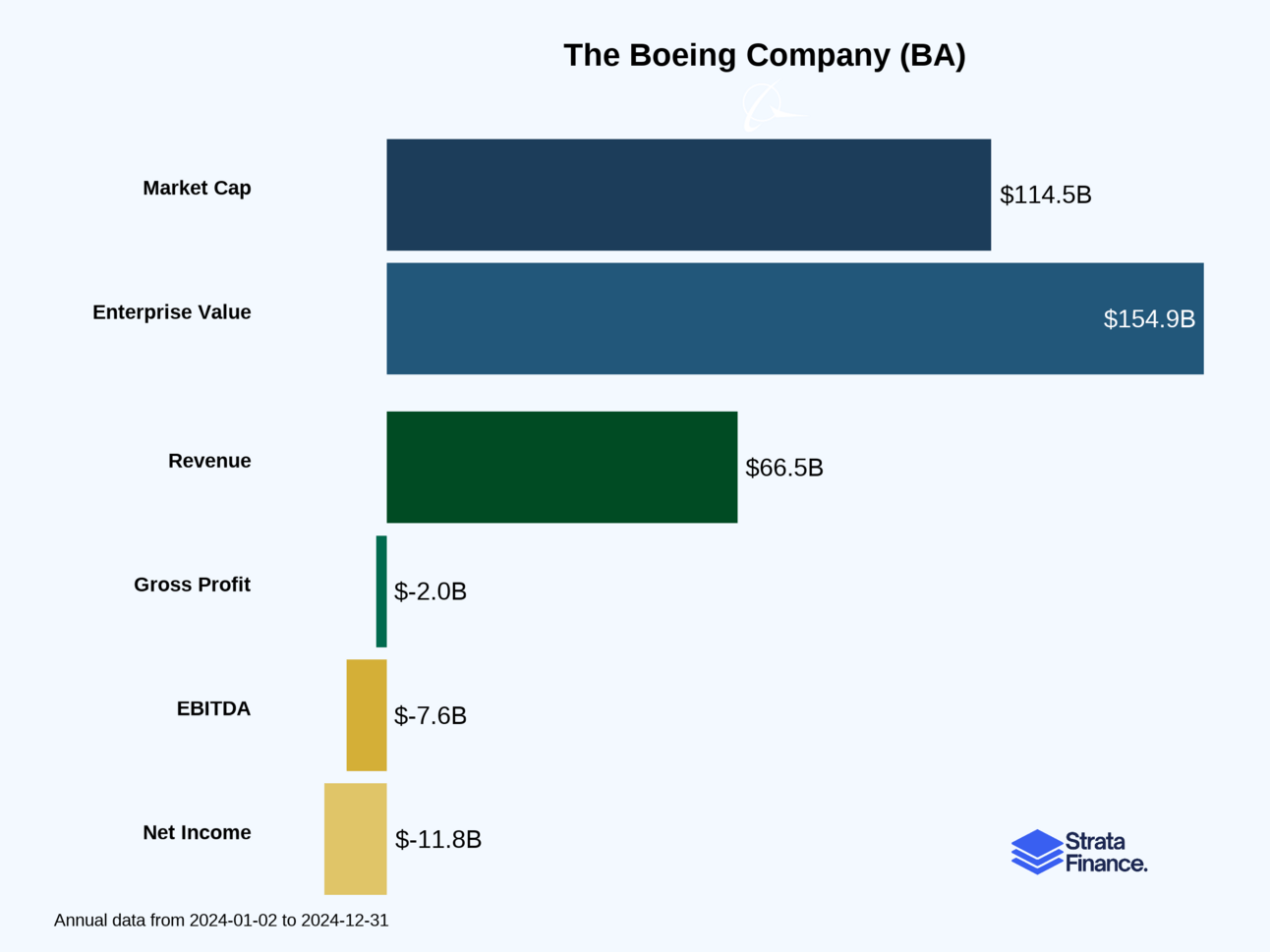

Key Metrics That Matter 📊

Boeing obsesses over several metrics that tell the story of their business:

Aircraft Deliveries: In 2024, they delivered just 348 aircraft ↘️ compared to 528 in 2023. That's like a car factory cutting production in half.

Backlog: They have $521.3 billion in future orders, with $435.2 billion in commercial aircraft alone. That's roughly 14 years of work at current production rates.

Production Rates: Currently building 38 737s per month (the FAA won't let them go higher until they fix quality issues).

Cash Flow: This is the big one. In 2024, Boeing burned through $12.1 billion in operating cash ↘️, forcing them to raise $24.3 billion in new capital.

The Production Puzzle 🧩

Boeing's manufacturing strategy is like conducting a global orchestra where every musician is in a different time zone. They don't build entire planes in one factory – instead, major suppliers like Spirit AeroSystems (which Boeing is acquiring) build large sections, then ship them to Boeing for final assembly. It's efficient when it works, but creates quality control nightmares when suppliers mess up.

Layer 2: Category Position 🏆

The Ultimate Duopoly 👥

In commercial aviation, there are essentially two players that matter: Boeing and Europe's Airbus. Together, they control about 99% of the market for large commercial aircraft (100+ seats). It's like Coke vs. Pepsi, except each "can" costs $100+ million and takes years to deliver.

This isn't a friendly competition – it's industrial warfare fought with spreadsheets, engineering prowess, and political influence. Airlines typically standardize on one manufacturer's aircraft to minimize training and maintenance costs, so winning a major carrier's business can mean decades of follow-on orders.

The Scorecard 📈

Boeing's Strengths:

Deep relationships with airlines worldwide (80% of their commercial backlog is international)

Complete product line from narrow-body to wide-body aircraft

Integrated services offering through BGS

Home field advantage in the massive U.S. market

Recent Challenges:

The 737 MAX crisis (2018-2019 crashes, 20-month grounding) fundamentally damaged Boeing's safety reputation

January 2024 Alaska Airlines door plug incident reignited safety concerns

Airbus has been gaining market share, particularly with their A320 family outselling the 737 MAX

Defense: A Different Game 🎯

In defense and space, Boeing faces a more fragmented field with Lockheed Martin, Raytheon, Northrop Grumman, and others. The game here is about long-term relationships, technological capability, and political connections. Boeing's advantage is their breadth – they can bid on everything from fighter jets to satellites to presidential aircraft.

However, newer players like SpaceX have disrupted the cozy aerospace establishment with reusable rockets and aggressive pricing. Boeing's space business, while historically strong, now looks expensive and slow compared to Elon Musk's operation.

Layer 3: Show Me The Money! 📈

Revenue Breakdown: The Good, The Bad, and The Ugly 💰

2024 Revenue by Segment:

Commercial Airplanes: $22.9B (34%) ↘️

Defense, Space & Security: $23.9B (36%) ↘️

Global Services: $20.0B (30%) ↗️

The revenue mix tells a story of a company in transition. Commercial aircraft, traditionally Boeing's crown jewel, saw revenue crater by $11 billion due to production issues and the Alaska Airlines incident. Meanwhile, Global Services grew steadily – proving that the "razor and blade" model works in aerospace too.

Geographic Spread: A Global Giant 🌍

Boeing generates 54.4% of revenue domestically and 45.6% internationally, with Asia being their largest international market. This global footprint is both a strength (diversified revenue) and a vulnerability (trade tensions, particularly with China, can hurt badly).

The Margin Story: Ouch 😬

Here's where things get painful:

Operating Margin 2024: -16.1% ↘️ (vs. -1.0% in 2023)

Net Loss: $11.8 billion ↘️ (vs. $2.2 billion loss in 2023)

Boeing isn't just losing money – they're hemorrhaging it. The company recorded massive charges on defense programs ($5.0 billion) and commercial aircraft programs ($4.1 billion), particularly the troubled 777X.

Cash Flow: The Lifeblood 🩸

Operating cash flow of -$12.1 billion in 2024 forced Boeing to raise capital through:

$10 billion in new bonds

$24.3 billion equity offering (one of the largest in corporate history)

This wasn't a choice – it was survival. Boeing needed cash to fund operations during production shutdowns and labor strikes.

Layer 4: What Do We Have to Believe? 📚

The Bull Case: Phoenix Rising 🔥

For Boeing to succeed, you need to believe:

Quality Issues Are Fixable: Boeing can implement effective quality controls and regain FAA approval for production increases. The company has submitted comprehensive safety plans and is investing heavily in workforce training and process improvements.

The Duopoly Endures: No new entrants will successfully challenge the Boeing-Airbus duopoly in large commercial aircraft. The barriers to entry (capital requirements, certification complexity, supply chain) remain insurmountable.

Air Travel Growth Continues: Boeing forecasts 3.2% annual fleet growth over 20 years, requiring 43,975 new aircraft. If this materializes, both Boeing and Airbus will be busy for decades.

Defense Spending Remains Strong: Geopolitical tensions support continued defense investment, and Boeing's broad portfolio positions them well for next-generation programs.

Services Growth Accelerates: The installed base of Boeing aircraft continues growing, and airlines increasingly outsource maintenance and operations to manufacturers.

The Bear Case: Turbulence Ahead ⛈️

The risks that could derail Boeing:

Another Safety Incident: Boeing's reputation hangs by a thread. Another major incident could trigger massive order cancellations and regulatory action that might be impossible to recover from.

Airbus Dominance: If Airbus continues gaining market share while Boeing struggles with production, the competitive balance could shift permanently. Airlines might standardize on Airbus to avoid Boeing's quality issues.

Defense Program Disasters: Fixed-price development contracts have already cost Boeing $5+ billion. More overruns could cripple the defense business and drain cash needed for commercial recovery.

Financial Distress: With massive debt and ongoing losses, Boeing might be forced into financial restructuring that dilutes shareholders or constrains investment in new programs.

Regulatory Strangulation: The FAA might impose restrictions so severe that Boeing can't operate profitably, or international regulators might reject Boeing aircraft certification.

The Verdict: A Wounded Giant 🏥

Boeing remains one of only two companies capable of building large commercial aircraft – a position of immense strategic value. The company has survived world wars, economic crashes, and previous crises. Their technology, customer relationships, and manufacturing scale represent genuine competitive advantages.

However, Boeing is currently in the intensive care unit of corporate America. The company faces an unprecedented combination of safety concerns, regulatory scrutiny, financial pressure, and competitive threats. Recovery is possible, but it requires flawless execution over multiple years while competitors don't stand still.

The investment thesis boils down to this: Are you willing to bet that one of America's most important industrial companies can fix its quality problems, restore regulatory confidence, and return to profitability before running out of money or losing too much market share?

It's a high-stakes gamble with potentially massive rewards for those who get the timing right – but also the potential for significant losses if the recovery falters. Boeing isn't going away, but the path back to prosperity is neither certain nor quick.

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.