The Bottom Line Upfront 💡

Berkshire Hathaway $BRK.B ( ▼ 0.49% ) isn't just a company – it's Warren Buffett's masterpiece of American capitalism. With $649 billion in market cap and 392,400 employees, Berkshire operates as the world's most successful business collector, owning everything from GEICO insurance to BNSF Railway to See's Candies. The genius lies in their hands-off approach: buy excellent businesses, provide financial backing, then let management do what they do best.

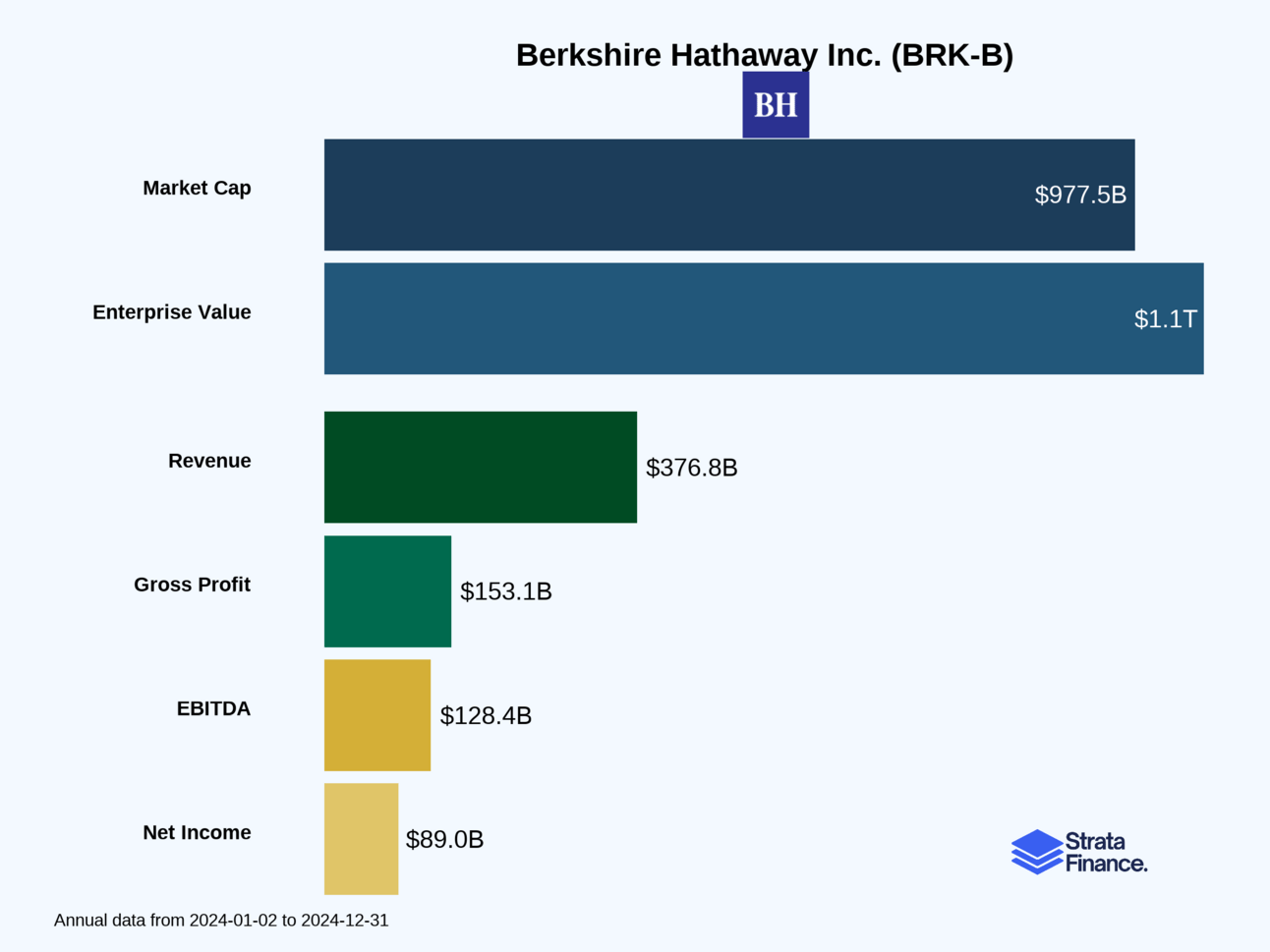

The company generated $377 billion in revenue across four pillars: insurance (the "float" money machine), railroads (moving America's freight), utilities (powering the future), and a diverse collection of manufacturing and retail businesses. With $318 billion in cash and an AA+ credit rating, they're essentially a sovereign wealth fund disguised as a corporation.

The bull case rests on betting that America's economy will continue growing and that Berkshire's decentralized culture survives Warren Buffett's eventual departure. The bear case worries about succession, regulatory challenges, and what to do with all that cash. Either way, you're buying a piece of American business history that's proven remarkably durable across multiple economic cycles.

Partnership

Tailored HR Software Recommendations for Your Organization

Choosing HR software can be overwhelming—with over 1,000+ tools on the market, it’s easy to spend days and still feel unsure.

That’s why thousands of HR teams rely on SSR’s HR software advisors. Instead of spending hundreds of hours on research and demos, you’ll get free 1:1 help from an HR software expert who understands your requirements and provides 2–3 tailored recommendations based on your unique needs.

Whether you're looking for an HRIS, ATS, or Payroll solution, we help you cut through the noise and make confident decisions—fast.

Why HR teams trust SSR HR Advisors:

✅ 100% free for HR teams

✅ Get 2-3 Tailored solutions from 1,000+ options

✅ 1:1 expert guidance from HR advisors

✅ Trusted by 15,000+ companies

From MIT to the Indianapolis Colts, smart HR teams trust SSR to find the right software—without the stress.

Strata Layers Chart

Layer 1: The Business Model 🏛️

Think of Berkshire Hathaway as the world's most successful business collector. Warren Buffett didn't just build a company – he built a machine that buys excellent businesses and lets them do what they do best while providing them with a financial fortress that would make Fort Knox jealous.

What They Actually Do 💼

Berkshire operates like a holding company on steroids, owning a mind-boggling collection of businesses across virtually every industry you can imagine. With 392,400 employees worldwide, they're essentially running a small country's worth of economic activity from their modest headquarters in Omaha, Nebraska.

The genius of their model lies in what they don't do: micromanage. Each subsidiary operates with unusual independence, keeping their own cultures and management teams while benefiting from Berkshire's massive financial backing. It's like having the world's most patient and wealthy parent who gives you money but doesn't tell you how to run your life.

The Four Pillars of Power 🏗️

1. Insurance: The Money Machine 💰 This is where the magic happens. Berkshire's insurance companies (GEICO, various reinsurance operations) collect premiums upfront and pay claims later. That gap creates "float" – essentially free money to invest. With $171 billion in float as of 2024, they're sitting on more investable cash than most countries' GDP.

GEICO alone wrote $42.9 billion in premiums ↗️ in 2024, making it America's third-largest auto insurer with 12.3% market share. But here's the kicker: they actually made money on underwriting ($11.4 billion in pre-tax profits ↗️), which is like a casino that wins on both the house edge AND the side bets.

2. BNSF Railroad: Moving America 🚂 Burlington Northern Santa Fe operates over 32,500 route miles of track across 28 states. Think of it as owning the interstate highway system, but for trains. They moved 9.6 million cars/units ↗️ in 2024, generating $23.4 billion in revenue. When America needs to move stuff – and America always needs to move stuff – BNSF gets paid.

3. Berkshire Hathaway Energy: Powering the Future ⚡ BHE isn't just any utility company – they're the utility company that actually cares about the future. With $35.4 billion invested in renewable energy projects, they've reduced greenhouse gas emissions by 38% since 2005. They generated $26.3 billion in revenue ↗️ in 2024 while serving millions of customers across multiple states.

4. Everything Else: The Beautiful Chaos 🎪 From Duracell batteries to See's Candies, from NetJets private planes to Nebraska Furniture Mart, Berkshire owns businesses that touch virtually every aspect of American life. Manufacturing brought in $77.1 billion ↗️, while service and retailing added $138.7 billion (though that was down ↘️ from 2023).

Key Success Metrics 📊

Berkshire measures success differently than most companies:

Float growth: More float = more investment capital

Underwriting profitability: Making money on insurance before investing premiums

Return on equity: How efficiently they use shareholder money

Book value per share: The accounting value of the business

Cash generation: Free cash flow across all businesses

The company's combined statutory surplus of $310 billion provides a financial cushion that would make other companies weep with envy.

Layer 2: Category Position 🏆

Here's where things get weird: Berkshire doesn't really have competitors because nobody else is crazy enough (or smart enough) to try this business model at this scale.

The Conglomerate Graveyard 🪦

Most conglomerates have gone the way of the dodo. GE broke itself apart, ITT split up decades ago, and even activist investors usually demand companies focus on "core competencies." But Berkshire thrives precisely because they don't try to create synergies or integrate businesses. They're the anti-conglomerate conglomerate.

Segment-by-Segment Domination 💪

Insurance: GEICO competes with State Farm, Progressive, and Allstate, but with a crucial advantage – they don't need to make money on underwriting to survive. This lets them price more rationally during market cycles. Their reinsurance operations compete globally with companies like Munich Re and Swiss Re, but Berkshire's AA+ credit rating means they can write risks others can't touch.

Railroad: BNSF's main rival is Union Pacific in the western U.S., but railroads are essentially regional monopolies. You can't exactly build a competing railroad network in 2024. The real competition comes from trucking, but trains are roughly 3-4 times more fuel-efficient for long-haul freight.

Utilities: BHE operates in regulated markets where competition is limited but returns are capped. Their competitive advantage comes from financial strength – they can invest in infrastructure projects that smaller utilities can't afford.

Manufacturing & Retail: Each business faces industry-specific competition, but they all benefit from Berkshire's permanent capital and long-term thinking. When competitors are worried about quarterly earnings, Berkshire's businesses can focus on building market share and customer relationships.

Layer 3: Show Me The Money! 📈

Berkshire's revenue streams are like a diversified investment portfolio, but instead of stocks and bonds, they own entire businesses.

Revenue Breakdown: The Beautiful Mess 💰

Service & Retailing: $138.7 billion (37% of total) This includes Pilot Travel Centers, McLane distribution, auto dealerships, and various retail operations. The decline ↘️ from $144.3 billion in 2023 was primarily due to lower fuel prices at Pilot.

Manufacturing: $77.1 billion (21% of total) Industrial products ($35.8 billion), building products ($26.5 billion), and consumer products ($14.9 billion). The growth ↗️ was driven by higher demand for aerospace products at Precision Castparts and improved performance across several businesses.

Insurance: $105.1 billion (28% of total) This includes both premiums earned ($88.3 billion) and investment income ($16.8 billion). The growth ↗️ reflects strong performance across all insurance segments.

Utilities: $26.3 billion (7% of total) Steady growth ↗️ from regulated operations and renewable energy investments.

Railroad: $23.5 billion (6% of total) Slight decline ↘️ due to lower average revenue per car/unit, though freight volumes increased.

Geographic Spread 🌍

Berkshire is overwhelmingly a North American story:

United States: ~86-87% of revenues

Europe: Significant operations through various subsidiaries

Asia-Pacific: Growing presence, especially in reinsurance

Canada: Railroad and other operations

Layer 4: What Do We Have to Believe? 📚

The Bull Case: Betting on American Capitalism 🐂

Belief #1: The Buffett Magic Transfers You have to believe that Greg Abel and the next generation of leaders can maintain Berkshire's culture and capital allocation discipline. The decentralized structure should help, but losing Buffett's investment acumen is like losing Michael Jordan from the Bulls.

Belief #2: Size Becomes an Advantage, Not a Burden With $318 billion in cash and a $649 billion market cap, Berkshire needs massive opportunities to move the needle. But their size also means they can make investments and acquisitions that nobody else can handle.

Belief #3: The Insurance Float Machine Keeps Humming The insurance operations need to continue generating profitable float while avoiding major catastrophes. Climate change makes this increasingly challenging, but Berkshire's financial strength provides a crucial buffer.

Belief #4: American Infrastructure Needs Berkshire BNSF and BHE benefit from America's aging infrastructure and the need for massive investments in transportation and energy. Government spending on infrastructure could be a major tailwind.

The Bear Case: When Giants Fall 🐻

Risk #1: The Succession Question What happens when Warren Buffett is no longer involved? Even with succession plans, losing the world's most famous investor creates uncertainty about future capital allocation.

Risk #2: Regulatory and Legal Challenges PacifiCorp's wildfire liabilities could balloon beyond current estimates. Utility regulation could become more restrictive. Insurance regulations could limit profitability.

Risk #3: Economic Sensitivity Despite diversification, Berkshire is ultimately tied to economic growth. A prolonged recession would hurt railroad volumes, insurance demand, manufacturing sales, and retail spending.

Risk #4: The Cash Problem Having $318 billion in cash sounds great until you realize it's earning minimal returns. If Berkshire can't find attractive investments, shareholders might prefer dividends or buybacks.

The Verdict: A Unique American Institution 🇺🇸

Berkshire Hathaway isn't just a stock – it's a piece of American business history that happens to trade on the NYSE. The company has survived and thrived through multiple economic cycles by sticking to simple principles: buy good businesses, treat people fairly, and maintain financial strength above all else.

The succession question looms large, but the business model has proven remarkably durable. With operations touching virtually every aspect of the American economy, Berkshire is essentially a bet on the long-term prosperity of the United States.

For investors, the question isn't whether Berkshire is a good business (it obviously is), but whether you can stomach the volatility that comes with a $649 billion market cap and whether you believe the next generation can maintain the magic that Buffett created.

At current levels, you're buying a collection of excellent businesses at a reasonable price, managed by people who think in decades rather than quarters. In a world of quarterly earnings obsession and activist investors, that might be the rarest commodity of all.

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.