The Bottom Line Upfront 🎯

Ares is like the cool kid's table of the investment world - they manage money for big institutions and wealthy folks, but do it with a twist. With $418.8B under management (↗️19% YoY), they're crushing it in alternative investments like private credit, real estate, and private equity. Think of them as the sophisticated friend who knows where all the good investment opportunities are hiding.

Layer 1: The Business Model 🏢

What They Do: Ares is basically a super-sophisticated investment manager that handles other people's money - but not your average Joe's savings account. They manage complex investment strategies across four main areas:

Credit Group ($284.8B AUM) 💳

Real Assets Group ($65.4B AUM) 🏢

Private Equity Group ($39.1B AUM) 💼

Secondaries Group ($24.7B AUM) 🔄

Key Metrics They Care About:

Assets Under Management (AUM): $418.8B ↗️19% YoY

Fee-Paying AUM: $262.4B ↗️13% YoY

Capital Raised: $74.5B in 2023 across 125 vehicles

Perpetual Capital: 95% of management fees (this is like having subscribers instead of one-time customers)

Layer 2: Category Position 🏆

The Competition:

Blackstone (the 800-pound gorilla)

KKR (the OG private equity firm)

Apollo (the other credit specialist)

Market Position: Ares has carved out a sweet spot in credit investments, where they're actually the biggest kid on the block. They're like the straight-A student who's also surprisingly cool - they've built their reputation on being really good at analyzing risk while still finding ways to make money.

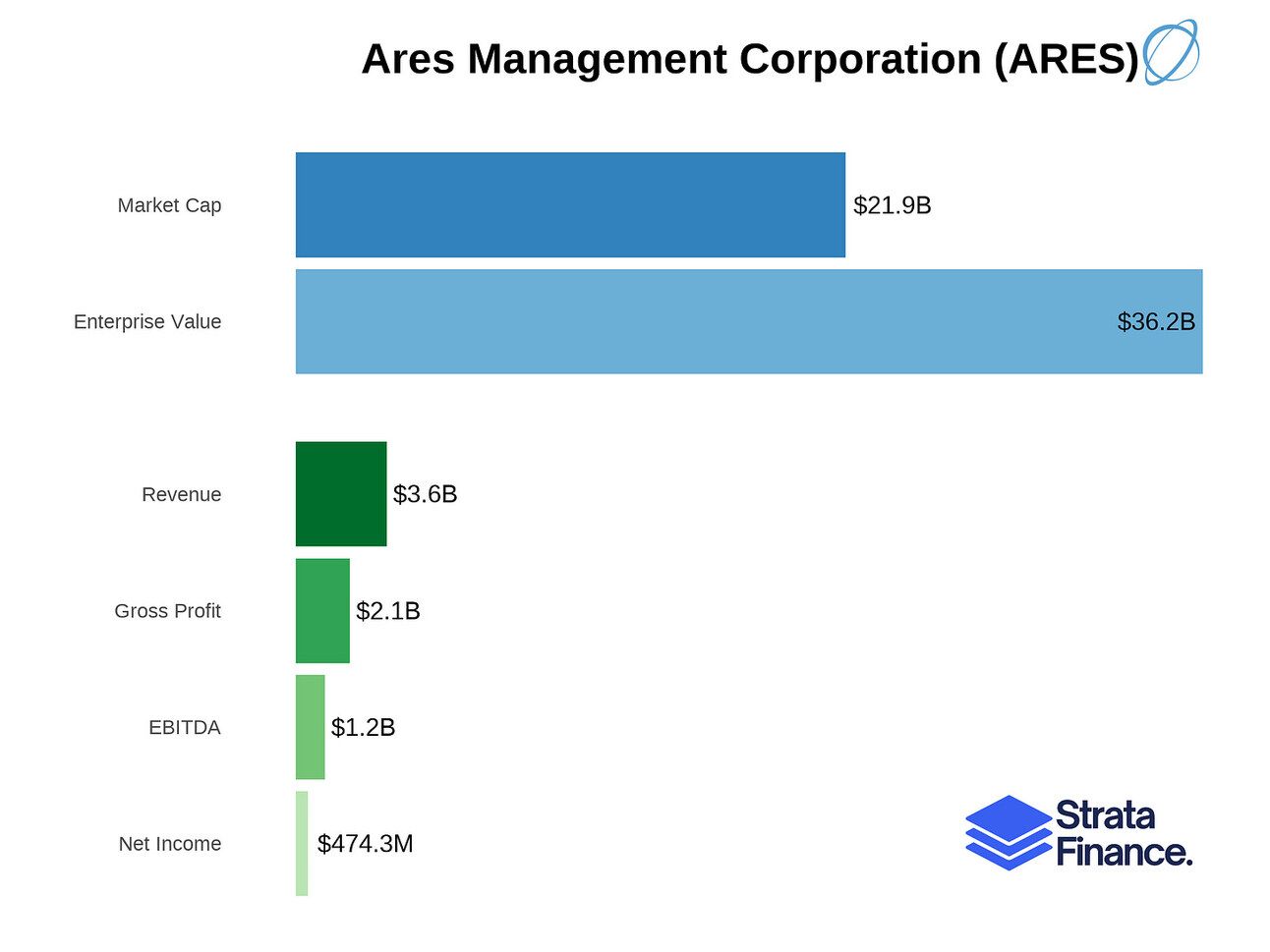

Layer 3: The Top Line 📈

Revenue Breakdown:

Credit Group: $1.75B (largest contributor)

Real Assets: $389.4M

Private Equity: $230.3M

Secondaries: $174.9M

Who's Buying:

Institutional investors (pension funds, sovereign wealth funds)

Insurance companies

Wealthy individuals

Other investment managers

Growth Trajectory:

New capital raised: $74.5B ↗️

New institutional investors: 300 added in 2023

Capital deployed: $68.1B ↘️ (slightly down from the previous year)

Layer 4: Cash is King 👑

Profitability:

Net income: $474.3M ↗️

Operating margins are healthy across all segments

Credit Group leads with $1.26B in operating income

Cost Structure:

Largest expense: Compensation (it's a people business!)

Heavy investment in technology and infrastructure

Global office network (35+ offices in 15+ countries)

Layer 6: By Your Powers Combined 💪

Scale Economics ✅

Larger AUM means better deals and more negotiating power

Switching Costs ✅

Once institutions invest, it's hard to move billions around

Network Effects ✅

More money = better deals = more money (virtuous cycle)

Process Power ✅

Their credit analysis process is their secret sauce

Cornered Resource ❌

Talent can (and does) move between firms

Brand ✅

Strong institutional reputation, especially in credit

Counter-Positioning ❌

Business model similar to other alternative asset managers

Layer 7: Story Time 📖

The Bull Case:

Growing AUM in a secular growth industry

High percentage of locked-up, recurring revenue

Strong position in private credit as banks retreat

Diversified business model across asset classes

The Bear Case:

Dependent on market conditions for performance

Highly competitive industry

Interest rate sensitivity

Regulatory risks

What We Need to Believe:

Private markets continue to grow

Institutions keep allocating to alternatives

Ares can maintain its edge in credit markets

They can keep attracting and retaining top talent

Think of Ares as the Netflix of money management - they've built a subscription-like business model (perpetual capital) in an industry that traditionally wasn't subscription-based, and they're really good at what they do. The question is whether they can keep the hit shows (returns) coming!

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.