The Bottom Line Upfront 💡

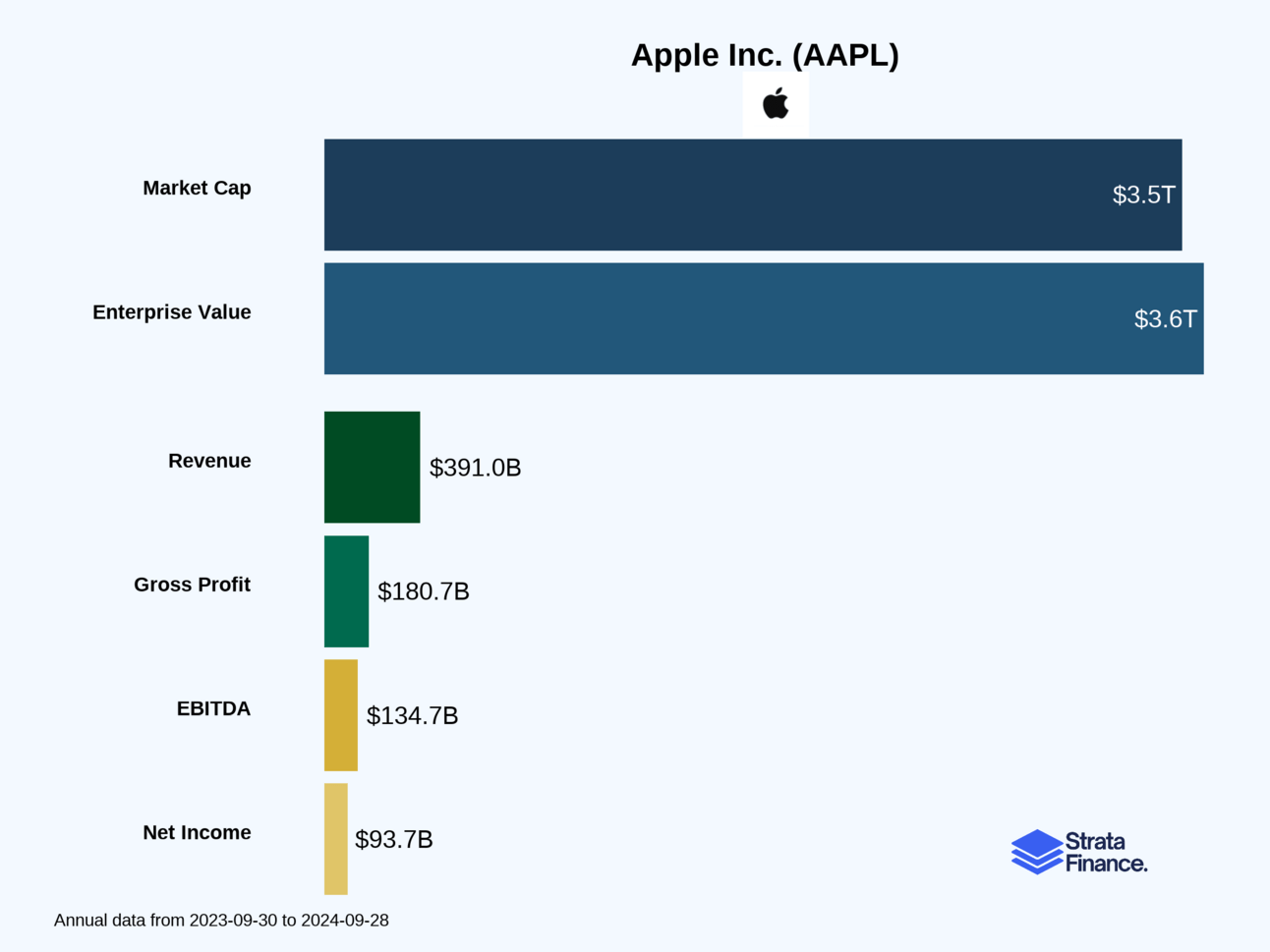

Apple Inc. $AAPL ( ▲ 0.8% ) remains one of the world's highest-quality businesses, generating $391B in revenue through its masterful ecosystem strategy. While iPhone sales ($201B) have plateaued and China revenue declined 8%, the company's Services division ($96B, +13% growth) continues driving profitability with 73.9% gross margins. Apple faces real challenges from regulatory pressure, Chinese competition, and market saturation, but maintains exceptional cash generation ($118B operating cash flow), pricing power (46.2% gross margins), and customer loyalty that competitors can't match.

Partnership

Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.

Strata Layers Chart

Layer 1: The Business Model 🏛️

Think of Apple as the ultimate "walled garden" company - but instead of keeping people out, they're keeping customers blissfully trapped inside with products so good you'll never want to leave. With 164,000 employees working from their spaceship-like headquarters in Cupertino, Apple has mastered the art of making technology feel like magic while charging premium prices for the privilege.

What They Actually Do 💼

Apple isn't just a phone company (though the iPhone generates over half their revenue at $201.2 billion ↗️). They're an ecosystem architect, designing everything from the silicon chips to the software to the services that run on top.

Here's how the money flows in:

Hardware Empire:

iPhone ($201.2B) - The golden goose that started it all

Mac ($30.0B ↗️) - Premium computers for creatives and professionals

iPad ($26.7B ↘️) - The tablet category they basically invented

Wearables & Accessories ($37.0B ↘️) - Apple Watch, AirPods, and other "one more thing" products

Services Kingdom:

Services ($96.2B ↗️) - The App Store, iCloud, Apple Music, and everything else that keeps the cash register ringing long after you buy the hardware

The Secret Sauce 🔮

Apple's business model is brilliantly simple: create products that work better together than apart. Buy an iPhone, and suddenly you "need" AirPods. Get AirPods, and wouldn't an Apple Watch be nice? Before you know it, you're paying for iCloud storage, Apple Music, and wondering how you lived without seamless handoff between devices.

They measure success through metrics like:

Gross margins (46.2% ↗️ - absolutely stellar for hardware)

Services growth (13% annually - the gift that keeps giving)

Ecosystem penetration (how many Apple products each customer owns)

How They Actually Make It All 🏭

Here's where it gets interesting: Apple designs almost everything but manufactures almost nothing. They're like the world's most demanding customer, creating detailed specifications for chips, screens, and components, then working with partners (mostly in Asia) to build everything to their exacting standards. It's outsourcing with obsessive quality control.

Layer 2: Category Position 🏆

The Competition Landscape 🥊

Smartphones: Apple battles Samsung for premium market supremacy while Chinese manufacturers like Xiaomi and Oppo chip away at the bottom. Apple's strategy? Let others fight over the scraps while they capture most of the industry's profits. In the US, iPhones hold over 50% market share, but globally it's more like 15-20% - turns out not everyone wants to pay $1,000+ for a phone.

Computers: The Mac competes in a Windows-dominated world, but Apple doesn't seem to care about market share here. They're content selling premium machines to creative professionals and loyal fans who value design over spreadsheet compatibility.

Tablets: iPad basically IS the tablet market for anything above bargain-basement pricing. They created the category and still dominate it, though growth has slowed as people hold onto tablets longer than phones.

Layer 3: Show Me The Money! 📈

Let's talk turkey - or should I say, let's talk apples? 🍎

Revenue Breakdown: The Geographic Story 🌍

Apple's revenue map tells a fascinating story:

Americas ($167B ↗️) - The home base remains strong

Europe ($101.3B ↗️) - Growing despite regulatory headaches

Greater China ($67B ↘️) - The concerning decline that has investors worried

Japan ($25B ↗️) - Steady as she goes

Rest of Asia Pacific ($30.7B ↗️) - Emerging markets showing promise

That China decline is the elephant in the room. An 8% drop in a market that size isn't just a rounding error - it's a $6 billion problem that reflects both local competition (hello, Huawei) and broader economic pressures.

The Product Portfolio Performance 📱

iPhone: The Cash Cow 🐮 At $201.2B, iPhone revenue stayed flat year-over-year. For most companies, flat would be disappointing. For Apple, it's impressive given the mature smartphone market. The real story is in the margins - they're still commanding premium prices while competitors race to the bottom.

Services: The Golden Child ✨ $96.2B ↗️ with 13% growth - this is what gets investors excited. Services carry gross margins of 73.9% compared to 37.2% for products. It's the difference between selling someone a car once versus charging them for gas, insurance, and maintenance forever.

Everything Else: Mixed Bag 🎒

The Margin Story 💰

Apple's gross margins of 46.2% ↗️ are frankly obscene in the best possible way. For context, most hardware companies would kill for 20% margins. Apple's secret? Brand power that lets them charge premium prices while achieving massive scale that drives down costs.

Layer 4: What Do We Have to Believe? 📚

Investing in Apple requires some big bets about the future. Let's break down what bulls and bears are thinking.

The Bull Case: Believers Gotta Believe 🚀

For Apple to justify its valuation and continue growing, you need to believe:

The ecosystem moat is unbreachable - Once you're in Apple's world, switching costs (both financial and emotional) keep you trapped forever.

Services growth continues - The $96B services business needs to keep growing at double digits.

They'll create the next big category - Apple Vision Pro might flop, but Apple's track record suggests they'll eventually nail spatial computing, AR glasses, or whatever comes next.

Premium positioning survives economic cycles - Even in recessions, enough people will pay up for Apple's quality and status.

China stabilizes - The $67B China business needs to stop shrinking. Whether through new products, local partnerships, or economic recovery, Apple needs to prove they can compete with local champions like Huawei.

The Bear Case: Skeptics Have Points Too 🐻

The pessimistic view requires believing:

Peak iPhone is real - Smartphone replacement cycles are lengthening, innovation is incremental, and competitors offer "good enough" alternatives at half the price.

Regulatory pressure breaks the ecosystem - The EU's Digital Markets Act and potential US antitrust action could force Apple to open up their walled garden, reducing App Store commissions and ecosystem lock-in.

Services growth hits a wall - There's only so much you can extract from each user. App Store growth slows, subscription fatigue sets in, and competitors offer better alternatives in music, video, and cloud services.

Innovation pipeline dries up - Apple hasn't created a major new product category since the Apple Watch in 2015. If Vision Pro fails and they can't find the next big thing, growth becomes much harder.

My Take: The Realistic View 🎯

Apple remains one of the highest-quality businesses in the world, but it's no longer the explosive growth story it once was. The company generates absurd amounts of cash ($118B in operating cash flow), has a loyal customer base, and maintains pricing power that most companies can only dream of.

The challenges are real though. China's decline is concerning, regulatory pressure is mounting, and the smartphone market is maturing. Apple needs to prove they can grow beyond the iPhone while maintaining their premium positioning.

The stock probably won't double overnight like it did in the 2010s, but it's hard to imagine a scenario where Apple becomes irrelevant. They've built something special - the question is whether "special" is enough when you're already the world's most valuable company.

Bottom line: Apple is a mature, high-quality business trading at a reasonable valuation for what it is. If you believe in the ecosystem moat and think they'll navigate current challenges, it's a solid long-term hold. If you think peak iPhone is here and regulatory pressure will crater their margins, there are probably better places for your money.

Just remember - betting against Apple has been a losing strategy for the past two decades. Sometimes the obvious choice is obvious for good reason. 🍎

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.