The Bottom Line Upfront 💡

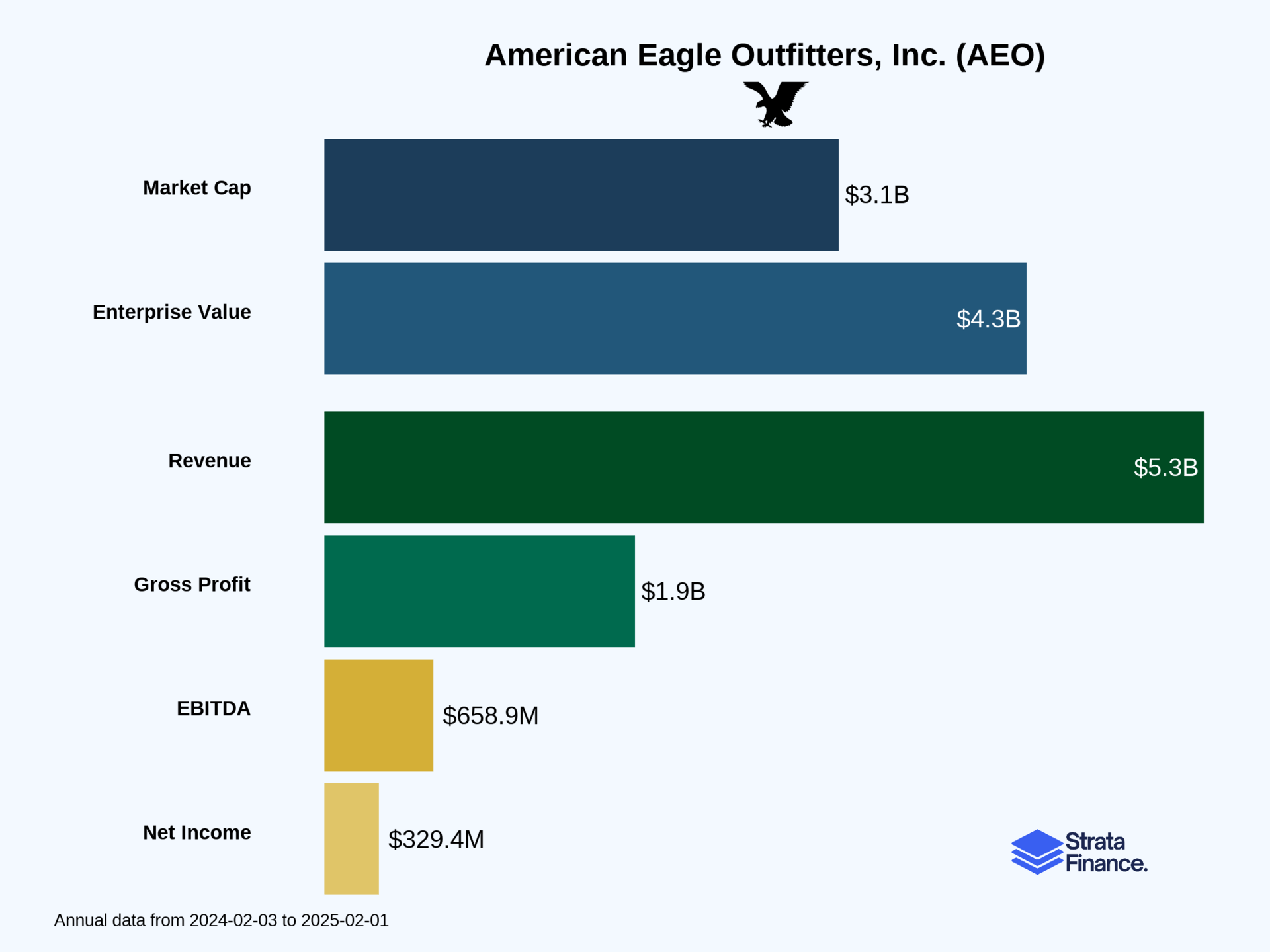

American Eagle Outfitters $AEO ( ▲ 0.56% ) has successfully transformed from a struggling teen mall brand into a $5.3B portfolio company, with its body-positive Aerie brand driving growth while the flagship American Eagle provides steady cash flow. However, at current prices around $25.50, investors are paying for perfection in a debt-heavy retail business where execution risks remain high.

Sponsorship

Learn Real Estate Investing from Wharton's Best Minds

In just 8 weeks, learn institutional-grade real estate analysis and modeling from Wharton faculty and seasoned investors.

You’ll gain:

Insider insights on how top firms like Blackstone and KKR evaluate deals

Exclusive invites to recruiting and networking events

Direct access to Wharton faculty and a certificate that signals credibility

Join a thriving community of 5,000+ graduates for ongoing career development, networking, and deal flow.

Use code SAVE300 at checkout to save $300 on tuition.

Program starts February 9.

Strata Layers Chart

Layer 1: The Business Model 🏛️

Remember when American Eagle was just that store in the mall where teenagers bought jeans that were somehow both too tight and too baggy at the same time? Well, AEO has evolved into something much more sophisticated – though they still sell plenty of jeans.

What They Actually Do

AEO operates like a fashion portfolio manager, running four distinct brands that target different customer segments and price points:

American Eagle (829 stores): The flagship brand that's your reliable friend – casual, comfortable clothes that won't break the bank or go out of style next week. Think jeans, hoodies, and that perfect t-shirt you'll wear until it falls apart.

Aerie (318 stores): The breakout star that's basically the anti-Victoria's Secret. They sell intimates, activewear, and swimwear with a "no photoshop, all bodies are beautiful" message that Gen Z absolutely loves. This is where the real growth magic happens.

Todd Snyder (19 stores): The sophisticated older brother – premium menswear for guys who want to look put-together without trying too hard. Think $200 sweaters instead of $20 ones.

Unsubscribed (6 stores): The hipster cousin focused on sustainable, slow fashion. Each store is unique and emphasizes local makers and natural fibers.

The Money Machine

AEO makes money the old-fashioned way: they design clothes, have them manufactured (mostly in Asia), and sell them through their stores and websites. But here's where it gets interesting – they've built what they call an "omni-channel" experience that's actually pretty slick:

Buy online, pick up in store

Return anything anywhere

Ship from stores when distribution centers are out of stock

Digital presence in 90 countries (not bad for a company that started in Pittsburgh!)

Key Success Metrics They Watch

Comparable sales growth: Did existing stores sell more this year than last year?

Digital penetration: How much of their business comes from online vs. in-store

Gross margin: Are they making more money per item sold?

Inventory turnover: How quickly they sell through their stuff (crucial in fashion)

Key Takeaway: AEO has transformed from a single teen brand into a multi-brand portfolio company with sophisticated digital capabilities, but they still live and die by their ability to predict what people want to wear.

Layer 2: Category Position 🏆

The specialty retail apparel game is brutal. It's like musical chairs, but the music never stops and new players keep joining while others get eliminated. AEO has managed to not only survive but actually thrive by picking their battles wisely.

The Competition Landscape

AEO squares off against a mixed bag of competitors:

Direct rivals: Abercrombie & Fitch (who's had quite the comeback), Urban Outfitters, and The Gap

Fast fashion: H&M, Zara, and Forever 21 (though Forever 21 has had some... issues)

Activewear giants: Lululemon and Athleta in the Aerie space

Department stores: Macy's, Nordstrom, and others fighting for the same wallet share

Where AEO Wins

The company's secret sauce has been reading the cultural room better than most. While Abercrombie was still trying to be exclusive and Victoria's Secret was doubling down on supermodel fantasy, AEO pivoted to inclusivity and authenticity. Aerie's #AerieREAL campaign (no photoshop, diverse body types) hit at exactly the right cultural moment and has been driving serious growth.

Their omni-channel game is also legitimately strong. Many retailers talk about seamless online-offline integration, but AEO actually delivers it. You can return online purchases to any store, which sounds simple but requires serious operational sophistication.

Recent Market Moves

AEO has been playing defense and offense simultaneously. They've been closing underperforming American Eagle stores (down 22 locations in fiscal 2024) while aggressively expanding Aerie (up 8 locations). They also made the smart decision to exit challenging international markets like Japan and Hong Kong rather than throwing good money after bad.

Key Takeaway: AEO has successfully repositioned itself as the inclusive, authentic alternative in a market where many competitors are still figuring out what Gen Z actually wants.

Layer 3: Show Me The Money! 📈

Let's talk dollars and cents, because at the end of the day, cultural relevance doesn't pay the bills if you can't convert it into profit.

Revenue Breakdown

AEO's $5.33 billion in revenue breaks down like this:

American Eagle: $3.39B (63.5% of total) ↗️ 1% growth

Aerie: $1.74B (32.6% of total) ↗️ 4% growth

Other brands: $244M (4.6% of total) ↘️ 50% decline (mostly due to Quiet Platforms restructuring)

The story here is clear: Aerie is the growth engine, American Eagle is the steady cash cow, and the smaller brands are still finding their footing.

The Margin Story

Here's where things get interesting. AEO's gross margin improved to 39.2% from 38.5% last year ↗️, which is actually pretty impressive in an inflationary environment. This improvement came from:

Better merchandise margins (they're getting better at pricing)

Operational efficiency gains from their profit improvement program

Less promotional activity (always a good sign)

Operating margin nearly doubled to 8.0% from 4.2% ↗️, though that's partly because they had massive restructuring charges last year that didn't repeat.

Cost Structure Reality Check

AEO's biggest expense categories:

Cost of sales: $3.24B (60.8% of revenue) - includes merchandise, store rent, distribution

SG&A expenses: $1.43B (26.9% of revenue) - corporate overhead, store labor, marketing

Depreciation: $212M (4.0% of revenue) - all those store fixtures and IT systems

Seasonal Patterns

Like most retailers, AEO is heavily seasonal. Q3 (back-to-school) and Q4 (holidays) are make-or-break quarters. This means they need to nail their inventory planning twice a year or face painful markdowns.

Geographic Mix

About 84% of revenue comes from the U.S., with the rest from Canada, Mexico, and international licensing. They're not trying to be a global empire – they're focusing on markets where they can actually win.

Key Takeaway: AEO is successfully growing its higher-margin Aerie business while maintaining profitability in its core American Eagle brand, with improving operational efficiency driving margin expansion.

Layer 4: Long-Term Valuation (DCF Model) 💰

The Verdict: Overvalued at current levels

Scenario | Fair Value | vs Current Price (~$25.50) |

|---|---|---|

Conservative | Negative | Significant downside risk |

Optimistic | $18.85 | -26% downside |

What's Behind These Numbers

The DCF analysis reveals some uncomfortable truths:

Debt burden: AEO carries $1.76B in net debt, which significantly weighs on equity value

Cash flow volatility: Free cash flow has ranged from $146M to $406M in recent years

Retail headwinds: The sector faces structural challenges from e-commerce disruption

Key Assumptions

Revenue growth of ~2% annually (modest but realistic for mature retail)

Operating margins gradually improving from 8.0% to 8.5-10.0% (depending on scenario)

Terminal growth rate of 2.5-3.5% (reflecting retail industry maturity)

Investment Recommendation: HOLD/WEAK BUY - Wait for a better entry point around $19-20

Layer 5: What Do We Have to Believe? 📚

Bull Case 🚀

Aerie becomes a $3B+ brand: The body-positive messaging and inclusive sizing continue to resonate, driving market share gains in intimates and activewear

Digital transformation pays off: Omni-channel investments drive higher margins and customer loyalty, while international expansion through licensing provides low-risk growth

Operational excellence: The profit improvement program delivers sustained margin expansion through better inventory management and cost control

Bear Case 🐻

Fashion relevance fades: Gen Z moves on to new brands, and AEO struggles to stay culturally relevant (see: what happened to many 2000s mall brands)

Debt burden becomes problematic: High debt limits financial flexibility during economic downturns or when major investments are needed

Mall retail decline: Physical store traffic continues falling, and the shift to pure e-commerce accelerates faster than AEO can adapt

The Bottom Line: AEO has successfully reinvented itself for the Instagram generation, but the retail apparel business remains inherently risky. The Aerie growth story is compelling, but the current stock price seems to assume everything goes perfectly. Smart investors might want to wait for a better entry point or a clearer path to debt reduction.

What to Watch 👀

Critical Metrics to Monitor:

Aerie comparable sales growth: If this drops below 3-5%, the growth story is in trouble

American Eagle store productivity: Watch for accelerating store closures or declining sales per square foot

Debt-to-EBITDA ratio: Needs to trend toward 2x or lower for financial health

Digital penetration rates: Should continue growing as a percentage of total sales

Gross margin trends: Any sustained decline below 38% would signal pricing pressure

Upcoming Catalysts:

Back-to-school and holiday seasons (Q3/Q4 2025) will test demand strength

Store remodeling program results (90-100 stores planned for 2025)

International licensing expansion progress

Potential debt refinancing or reduction initiatives

Competitive Threats to Track:

Lululemon's continued expansion into Aerie's activewear territory

New direct-to-consumer brands targeting Gen Z

Amazon's private label apparel growth

Any signs of Abercrombie & Fitch momentum continuing

The bottom line? AEO has built something genuinely impressive with Aerie and maintained relevance with American Eagle, but at current prices, you're paying for perfection in a business where perfection is rare. Patience might be rewarded here. 🛍️

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.