The Bottom Line Upfront 💡

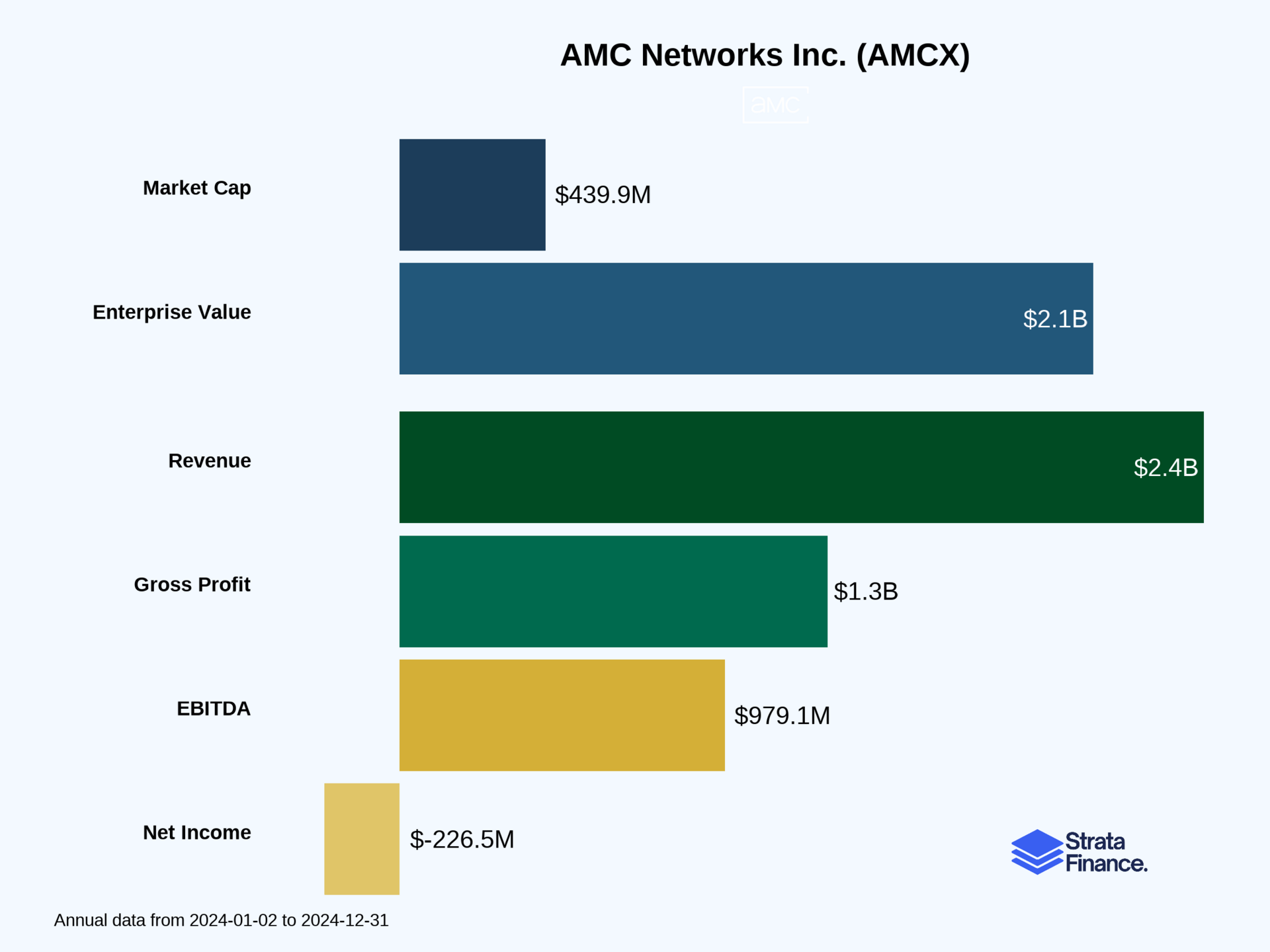

AMC Networks $AMCX ( ▼ 0.46% ) is a premium content creator caught in the brutal transition from traditional cable TV to streaming. While they've built quality niche streaming services like Shudder and own valuable content like The Walking Dead franchise, the company faces a perfect storm of declining linear TV revenues, massive debt ($3.2 billion vs. $329 million market cap), and fierce competition from streaming giants. Our DCF analysis suggests the stock is overvalued by 40-67%, trading at $7.58 versus a fair value of $2.50-$4.50. Despite some streaming subscriber growth (8.3% increase), the company posted negative operating margins in 2024 while fighting structural industry decline.

Sponsorship

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Strata Layers Chart

Layer 1: The Business Model 🏛️

Think of AMC Networks as the cool, artsy cousin in the media family tree. While Disney and Netflix are throwing money around like confetti at a billionaire's birthday party, AMCX has carved out a niche as the boutique curator of premium content.

What They Actually Do

AMC Networks operates like a three-legged stool in the entertainment world:

🎬 Content Creation & Ownership: Through AMC Studios, they produce original programming that they actually own (revolutionary concept, right?). This isn't just "work for hire" – they create shows like The Walking Dead Universe and Anne Rice's vampire series, then monetize them across multiple platforms for years. It's like being both the chef and the restaurant owner.

📡 Distribution Networks: They run five national cable networks (AMC, We TV, BBC AMERICA, IFC, and SundanceTV) plus a growing portfolio of streaming services. Think of these as different themed restaurants under one corporate umbrella – AMC serves up prestige dramas, We TV focuses on unscripted reality for women (especially Black women), while Shudder is your go-to horror destination.

🌍 Global Reach: Through AMC Networks International, they distribute content to over 100 countries. It's like having franchise locations worldwide, but instead of burgers, they're serving up entertainment tailored to local tastes.

The Money Machine

AMCX generates revenue through three main streams:

Subscription Fees (60.8% of revenue): Cable companies and streaming platforms pay them per subscriber. It's like a gym membership model – they get paid whether you watch or not.

Advertising Revenue (27.9% of revenue): Traditional TV ads plus newer digital advertising opportunities. Though this bucket is shrinking ↘️ as viewers migrate to streaming.

Content Licensing (11.3% of revenue): They sell their shows to other platforms. When Netflix pays for The Walking Dead reruns, that's licensing revenue.

Key Metrics They Watch

Streaming Subscribers: 12.4 million across all services (↗️ 8.3% growth)

Linear Network Subscribers: AMC at 59.8 million (↘️ from 65.1 million)

Content Amortization: $889 million in 2024 (their biggest expense category)

Free Cash Flow: $331 million in 2024 (↗️ from $169 million)

Layer 2: Category Position 🏆

AMC Networks finds itself in the awkward middle child position of the media world – too big to be a scrappy startup, too small to compete with the streaming giants, but just specialized enough to survive.

The Competitive Landscape

The Giants: Disney, Netflix, Warner Bros. Discovery, and Amazon have essentially unlimited budgets and global scale. They're the Walmart of entertainment.

The Specialists: This is where AMCX lives, alongside companies like Lions Gate and smaller streaming services. They compete on quality and curation rather than quantity and scale.

The Declining Traditional Players: Paramount Global and others are struggling with the same cord-cutting challenges, but many lack AMCX's streaming pivot strategy.

Market Position Reality Check

AMCX has found success by not trying to be Netflix. Instead, they've built what they call "targeted streaming services" that serve as companions to (rather than competitors with) the major platforms. Shudder has become the destination for horror content, earning critical acclaim as "one of the best streaming services in the world" according to RogerEbert.com. That's like being the best sushi restaurant in town – you don't need to serve everything if you're the undisputed champion of your category.

Layer 3: Show Me The Money! 📈

Revenue Breakdown: The Good, The Bad, and The Ugly

Total Revenue: $2.42 billion in 2024 (↘️ 10.7% from $2.71 billion)

By Segment:

Domestic Operations: $2.11 billion (↘️ 8.8%)

International: $325 million (↘️ 19.6%)

The international decline was largely due to selling their 25/7 Media production business and losing a major UK distribution agreement.

Revenue Stream Deep Dive

Subscription Revenue ($1.47 billion, ↘️ 5.7%):

The Bright Spot: Streaming revenue grew 6.6% ↗️ thanks to subscriber growth and price increases

The Dark Cloud: Traditional affiliate revenue dropped 13.2% ↘️ as cable subscribers flee faster than passengers on the Titanic

Customer Behavior: People are trading $100+ cable bills for $5-15 streaming subscriptions

Advertising Revenue ($677 million, ↘️ 5.5%):

Linear TV ratings continue declining as viewers migrate to streaming

The entertainment advertising market remains soft (translation: companies aren't spending)

Content Licensing ($273 million, ↘️ 37.4%):

This is the most volatile revenue stream, depending on when shows are delivered

2023 benefited from delivering remaining episodes of "Silo" (an AMC Studios production for Apple TV+)

Layer 4: Long-Term Valuation (DCF Model) 💰

Buckle up, because this is where things get spicy. Our DCF analysis reveals a company trading at what might charitably be called "optimistic" levels.

The Valuation Reality Check

Current Stock Price: $7.58 (as of 11.4.2025)

DCF Fair Value Estimate: $2.50 - $4.50

Implied Downside: 40-67% ↘️

Key Assumptions Driving Our Analysis

The Conservative Scenario (Fair Value: ~$2.50):

Revenue continues declining 3-5% annually as cord-cutting accelerates

Free cash flow margins compress to 5-7% due to competitive pressures

Terminal growth rate of 2.5% (reflecting mature, declining industry)

WACC of 11% (reflecting high debt burden and business risk)

The Optimistic Scenario (Fair Value: ~$4.50):

Revenue decline moderates to 0.5-3% annually

FCF margins expand to 8-13% through operational improvements

Terminal growth rate of 2% with WACC of 9.5%

The Debt Elephant in the Room 🐘

Here's the kicker that makes this valuation exercise particularly sobering: AMCX carries $3.2 billion in net debt against a market cap of only $329 million. That's like having a $320,000 mortgage on a $33,000 house. The math gets ugly fast.

In our conservative scenario, the enterprise value doesn't even cover the debt burden, resulting in negative equity value. Even FMP's DCF model spits out a $0.00 fair value estimate, which is Wall Street's polite way of saying "bankruptcy risk."

Layer 5: What Do We Have to Believe? 📚

The Bull Case: Streaming Phoenix Rising 🔥

What Bulls Need to Believe:

The Streaming Transition Works: AMCX successfully pivots from declining linear TV to growing streaming services. Their 8.3% subscriber growth ↗️ continues accelerating, and they capture enough market share in their niches to offset linear losses.

Content is King: Their owned content library (Walking Dead, Anne Rice properties, etc.) becomes increasingly valuable as streaming platforms compete for differentiated programming. Think of it as owning prime real estate in a growing neighborhood.

Debt Becomes Manageable: Free cash flow generation of $331 million continues or improves, allowing them to pay down the $3.2 billion debt burden over time. They avoid refinancing disasters and maintain access to capital markets.

Bull Case Probability: Low to Medium.

The Bear Case: Traditional Media Death Spiral 💀

What Bears Believe:

Debt Becomes Unsustainable: With $3.2 billion in debt and declining cash flows, refinancing becomes increasingly expensive or impossible. Bankruptcy or distressed sale becomes likely.

Bear Case Probability: Medium to High.

Our Assessment: A Melting Ice Cube 🧊

AMCX feels like a melting ice cube – it might not disappear entirely, but it's definitely getting smaller. The company has some genuine assets (quality content, loyal niche audiences, decent free cash flow generation), but they're fighting powerful structural forces.

The Reality Check: Even if management executes perfectly, they're swimming against a strong current. The traditional TV business is in secular decline, and while streaming offers hope, the competition is fierce and well-funded.

The Debt Problem: This is the real killer. At current debt levels, AMCX needs everything to go right just to survive, let alone thrive. There's little margin for error.

Bottom Line: Sometimes the best investment decision is knowing what not to buy. AMCX, despite its quality content and niche market positions, appears to be one of those situations where the risks significantly outweigh the potential rewards.

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.