The Bottom Line Upfront 💡

The Allstate Corporation $ALL ( ▼ 3.55% ) is America's second-largest personal auto insurer that's successfully navigating a challenging insurance landscape. After a tough 2023, the company roared back with $4.7 billion in net income in 2024, driven by successful rate increases and improved underwriting discipline. While the core insurance business faces headwinds from climate change and digital competitors like GEICO and Progressive, Allstate's strong brand recognition, growing Protection Services segment, and data-driven approach position it as a reliable, if unspectacular, investment. The company offers steady dividends and share buybacks for investors seeking stability over explosive growth, but faces long-term challenges from autonomous vehicles and intensifying price competition.

Partnership

Get access to the most exclusive offers for private market investors

Looking to invest in real estate, private credit, pre-IPO venture or crypto? AIR Insiders get exclusive offers and perks from leading private market investing tools and platforms, like:

Up to $250 free from Percent

50% off tax and retirement planning from Carry

$50 of free stock from Public

A free subscription to Worth Magazine

$1000 off an annual subscription to DealSheet

and offers from CapitalPad, Groundfloor, Fundrise, Mogul, and more.

Just sign up for our 2-week free trial to experience all the benefits of being an AIR Insider.

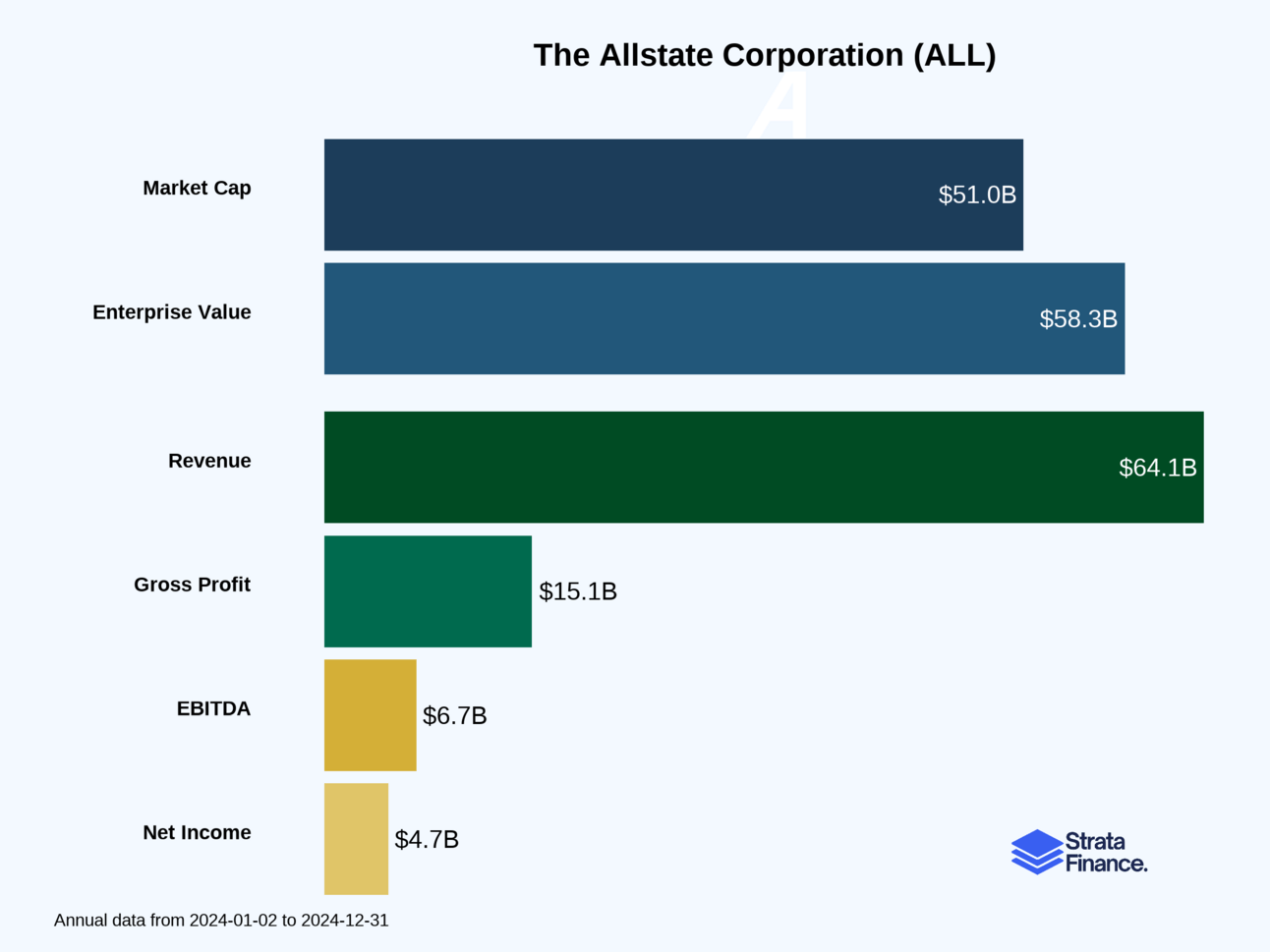

Strata Layers Chart

Layer 1: The Business Model 🏛️

What Does Allstate Actually Do? 🤔

Think of Allstate as the friend who's always got your back when life goes sideways. You know, the one who shows up with pizza when you're moving, except instead of pizza, they show up with money when your car gets totaled or your house catches fire. Founded in 1931 as a Sears subsidiary (yes, that Sears), Allstate has evolved into America's second-largest personal auto insurer with that iconic "You're in Good Hands" slogan that's been stuck in our heads for decades.

The business model is beautifully simple: customers pay premiums, Allstate pools that money, and when bad stuff happens, they pay out claims. The magic happens in the middle – using actuarial science (fancy math) to price policies so they collect more in premiums than they pay out in claims, while keeping enough customers happy to stick around.

The Four Pillars of Protection 🏗️

Allstate Protection (The Big Kahuna) This is where the real money lives, generating $53.9 billion in revenue ↗️ in 2024. It's your classic auto and homeowners insurance – the bread and butter that built the empire. Auto insurance alone brings in about $40 billion annually, making it the crown jewel. They've gotten clever here with telematics programs like Drivewise, which basically means they'll give you discounts for letting them spy on your driving habits. Drive like your grandmother? Get rewarded. Drive like you're in Fast & Furious? Pay more.

Protection Services (The New Kid) Revenue of $2.7 billion ↗️ in 2024 might seem small, but this is Allstate's growth darling. Think device insurance for your iPhone, identity theft protection, and roadside assistance. It's subscription-based recurring revenue – the holy grail of business models. They acquired SquareTrade to beef up this segment, and it's paying off as we all become increasingly dependent on our gadgets.

Allstate Health and Benefits (The Steady Eddie) Bringing in $1.9 billion ↗️ in 2024, this segment focuses on employer-sponsored benefits like supplemental health insurance and disability coverage. It's not flashy, but it's stable recurring revenue that diversifies their risk beyond property damage.

Corporate and Other (The Miscellaneous Drawer) Every company has one – the segment where they put everything that doesn't fit elsewhere, plus their investment income operations.

Key Metrics That Matter 📊

Combined Ratio: This is the insurance industry's report card. Under 100% means they're making money on underwriting (collecting more premiums than paying claims). Allstate's auto insurance hit 96.8% in 2024 – that's solid profitability.

Premiums Written: $60.4 billion ↗️ in 2024, up from $54.6 billion in 2023. This measures how much new business they're writing.

Investment Portfolio: $73.3 billion in invested assets generating steady income. Insurance companies are essentially investment firms that happen to sell insurance – they invest your premiums until they need to pay claims.

Market Share: About 13% in auto insurance (second place behind State Farm) and they're the fourth-largest homeowners insurer. Not bad for a company that started selling insurance out of Sears catalogs.

Layer 2: Category Position 🏆

The Gladiator Arena of Insurance ⚔️

The personal insurance market is like a never-ending price war where everyone's trying to convince you they're the cheapest while secretly hoping you never file a claim. Allstate sits in the interesting position of being big enough to matter but not so big they can get complacent.

The Competition Lineup:

State Farm: The 800-pound gorilla with about 18% market share

Progressive: The scrappy digital-first challenger that's been eating everyone's lunch

GEICO: Berkshire Hathaway's gecko-powered marketing machine

Liberty Mutual: The "Liberty Biberty" folks (yes, that's their actual campaign)

Allstate's Competitive Advantages 💪

Brand Recognition: "You're in Good Hands" isn't just a slogan – it's cultural DNA. This brand equity translates to pricing power and customer loyalty that digital-only competitors struggle to match.

Agent Network: While competitors go direct-to-consumer, Allstate maintains a hybrid model with both exclusive and independent agents. It costs more, but provides personal service that many customers value, especially for complex products like homeowners insurance.

Data and Telematics: Their Drivewise program has millions of enrolled customers providing real driving data. This isn't just about discounts – it's about better risk assessment and pricing.

The Challenges 😰

The GEICO/Progressive Problem: These direct-to-consumer players have lower costs and can offer cheaper rates. They've been steadily gaining market share by appealing to price-sensitive customers.

Climate Change Reality: Homeowners insurance is getting hammered by increasingly severe weather. Allstate has had to pull back from some high-risk markets, which limits growth opportunities.

Digital Transformation Lag: While they're catching up, Allstate was slower to embrace digital-first customer experiences compared to some competitors.

Layer 3: Show Me The Money! 📈

Revenue Breakdown: Where the Cash Flows 💰

Allstate Protection: $53.9 billion ↗️ (92% of total revenue) This is the mothership. Auto insurance dominates with roughly $40 billion, while homeowners brings in the rest. The growth here comes from rate increases (they've been pushing through price hikes to maintain profitability) and modest customer growth.

Protection Services: $2.7 billion ↗️ (5% of total revenue) The fastest-growing segment, benefiting from our collective addiction to expensive gadgets that need protection. This is subscription-based revenue, which means it's predictable and recurring – investors love this stuff.

Health and Benefits: $1.9 billion ↗️ (3% of total revenue) Steady growth in employer-sponsored benefits. Not exciting, but reliable.

The Economics of Insurance 🧮

Here's the beautiful thing about insurance: customers pay upfront, and you might not have to pay claims for months or years. This creates "float" – free money to invest. Allstate's $73.3 billion investment portfolio generates about $3.1 billion in annual investment income, which is essentially bonus profit on top of underwriting gains.

Cost Structure Reality Check:

Claims and benefits: $41.0 billion ↘️ (good news – down from $42.1 billion in 2023)

Operating expenses: $9.3 billion ↗️ (includes agent commissions, marketing, and overhead)

Margin Trends: The Profitability Picture 📊

2024 was a comeback story. After losing $188 million in 2023, Allstate roared back with $4.7 billion ↗️ in net income. This turnaround came from:

Successful rate increases in auto insurance

Better catastrophe loss experience (fewer major storms)

Improved underwriting discipline

The combined ratio improvement in auto insurance (96.8% vs. higher levels in previous years) shows they're getting pricing right again.

Seasonality and Cyclicality 🌪️

Insurance has natural patterns:

Q1: Typically lower catastrophe losses (winter is boring for insurance)

Q2-Q3: Hurricane and severe weather season can spike claims

Q4: Usually better, but winter storms can cause issues

Auto insurance is relatively stable year-round, but homeowners insurance can be lumpy due to weather events.

Layer 4: What Do We Have to Believe? 📚

The Bull Case: Why Allstate Could Crush It 🚀

Belief #1: Brand Moats Still Matter In an increasingly commoditized world, Allstate's brand recognition and customer loyalty provide sustainable competitive advantages. People trust the "Good Hands" brand, and that trust translates to pricing power.

Belief #2: Data Wins the Long Game Their telematics programs and data analytics capabilities will enable better risk selection and pricing over time. As they get smarter about who to insure and at what price, profitability should improve.

Belief #3: Protection Services is the Future The $2.7 billion Protection Services segment is just getting started. As our lives become more digital, the need for comprehensive protection beyond traditional insurance will explode. Allstate is well-positioned to capture this growth.

Belief #4: Climate Adaptation Creates Opportunities While climate change creates challenges, it also creates opportunities for companies with superior risk management. Allstate's investments in catastrophe modeling and selective underwriting could provide competitive advantages as weaker competitors struggle.

The Bear Case: What Could Go Wrong 😱

Risk #1: The Race to the Bottom If price competition intensifies, Allstate's higher cost structure (due to agents and brand investments) could become a liability. GEICO and Progressive have shown that customers will switch for lower prices.

Risk #2: Climate Change Acceleration If severe weather events become more frequent and severe than expected, even sophisticated risk management might not be enough. The entire homeowners insurance model could become unsustainable in some regions.

Risk #3: Autonomous Vehicles Self-driving cars could eventually reduce accident rates dramatically, shrinking the auto insurance market. While this is likely decades away, it's a long-term existential threat.

Risk #4: Regulatory Pressure Insurance is heavily regulated, and political pressure to keep rates low could limit Allstate's ability to price for profitability, especially in catastrophe-prone areas.

The Verdict: A Solid, If Unspectacular, Business 🎯

Allstate is like that reliable friend who's not the most exciting person at the party but will definitely help you move and never flake on plans. The business model is proven, the brand is strong, and they're adapting to modern challenges reasonably well.

The 2024 turnaround shows management can navigate difficult periods and return to profitability. The Protection Services growth story provides upside potential, while the core insurance business offers stability and cash generation.

However, this isn't a high-growth tech stock. It's a mature insurance company in a competitive industry facing long-term structural challenges. The investment case depends on believing that brand strength, operational excellence, and smart capital allocation can overcome these headwinds.

For investors seeking steady dividends, share buybacks, and modest growth with a company that's been around for nearly a century, Allstate fits the bill. Just don't expect it to be the most thrilling ride in your portfolio – but sometimes boring and profitable is exactly what you need.

AI-written, human-approved

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.